-

Tariffs as High as 45% Inflict Risk on Chinese Food Companies, Pain on U.S. Dairy Farmers

By USDEC May 9, 2019- Tweet

Chinese importers want to mitigate supply-chain risk by adding more U.S. dairy products, but tariffs make that strategy too expensive.

SHANGHAI -- If Chinese food companies can import more whey protein, cheese, milk powder and other dairy products from the United States they lessen their reliance on China's dominant dairy supplier, New Zealand, while increasing food security for a population of 1.4 billion.

But Chinese tariffs make U.S. dairy products too expensive for importers like Zongshang Liu, vice president of Shanghai Milkground Food Tech Co., the second largest processed cheese manufacturer in China.

Zongshang Liu of Shanghai Milkground Food Tech Co., left, with daughter Verna Liu, the company's research and development manager. USDEC photo by Mark O'Keefe.

U.S. dairy products are assessed tariffs as high as 45%. This tax on imported goods, which varies from product to product, is at least 25% higher than it is for goods from other countries. This reduces the ability of U.S. dairy companies to compete and Chinese companies to manage their risk.

"We do not want to be monopolized by New Zealand," said Liu.

As the global economy awaits the results of high-level, high-anxiety trade talks between the United States and China this week, Liu's business decisions illustrate the negative dynamic tariffs can create, creating lose-lose scenarios for both the U.S. dairy industry and Chinese food companies.

Tariffs can undercut relationships the U.S. dairy industry has been building for years on behalf of its member companies. If tariffs are lifted through trade talks, the potential still exists for win-win partnerships benefitting China, U.S. dairy farmers and a U.S. dairy industry that supports nearly 3 million U.S. jobs.

“If the price is competitive and U.S. suppliers meet our specifications, we are very willing to choose the United States," explained Liu at his Shanghai office. "We want to diversify our investments. We want to reduce our risks.”

Previously booming exports to China nosedive after tariffs

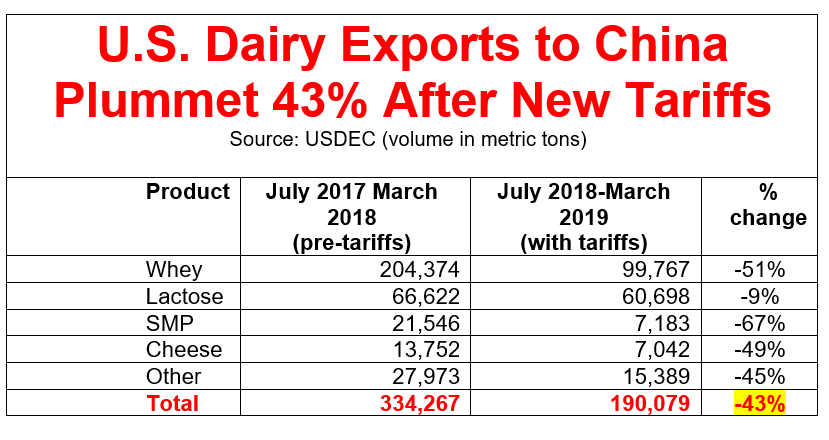

China has been on a dairy spending spree this year with imports growing by 13% in the first quarter compared to the same period a year ago, according to data reported in Global Trade Atlas. But the United States has been left out of the China expansion. Since the first new tariffs went into effect in July 2018, U.S. dairy volume to China has fallen 43%.

Looking ahead, lost sales in China are predicted to cost U.S. dairy farmers $12.2 billion by 2023 if the current retaliatory tariffs remain in place, according to a study commissioned last year by USDEC and conducted by Informa Agribusiness Consulting.

President Trump said on Twitter Sunday that he will increase tariffs on China this week. According to a notice published in the Federal Register on Thursday, tariffs on $200 billion worth of Chinese imports will go from 10% to 25%, effective Friday.

For 10 months, China has been paying Tariffs to the USA of 25% on 50 Billion Dollars of High Tech, and 10% on 200 Billion Dollars of other goods. These payments are partially responsible for our great economic results. The 10% will go up to 25% on Friday. 325 Billions Dollars....

— Donald J. Trump (@realDonaldTrump) May 5, 2019If China retaliates with tariffs higher than their current level, the potential long-term damage to one of the U.S. dairy industry's most important export market increases.

China depends on dairy imports

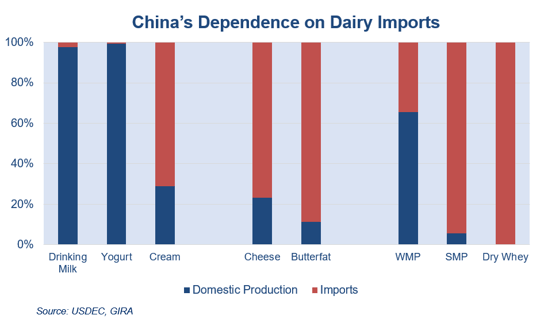

China is not dairy self-sufficient and needs the United States and other countries to feed a growing population that can't get enough dairy.

U.S. Dairy Export Council Executive Vice President Marc Beck made this point when he spoke last month at an annual conference in Beijing held by the China Chamber of Commerce for Import and Export of Foodstuffs, Native Produce and Animal (CFNA).

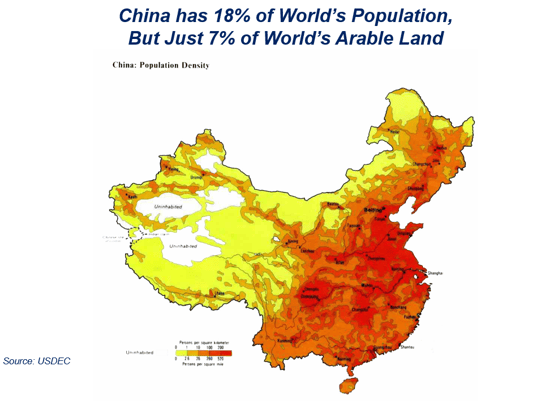

“China is facing a mismatch between its resources and the market,” Beck told the CFNA, which has nearly 7,000 member companies devoted to agriculture, including 1,500 in the dairy sector alone.

Beck said environmental constraints, poor farm margins and consolidation will limit China's domestic milk production growth while dairy consumption continues to steadily rise.

China has 18% of the world’s population, but just 7% of the globe's arable land. This creates significant land and water constraints. Water scarcity is an issue. As a result, China must rely on imports to meet its food needs, including dairy.

Expect even more Chinese demand for dairy imports

Beck told CFNA that China’s dependence on dairy imports is projected to increase from about 32% today to nearly 35% by 2023.

“We provide food security and nutritional benefits to millions of consumers in China and around the world,” Beck told Chinese agricultural leaders.

USDEC Executive Vice President Marc Beck discussed global dairy market trends at a dairy conference in Beijing last month.

USDEC Executive Vice President Marc Beck discussed global dairy market trends at a dairy conference in Beijing last month.

“Whether our products end up as ingredients in child nutrition formulas manufactured by Chinese companies, or in new emerging products that address the unique nutritional needs of China’s growing senior population, we are aware and proud of the fact that we are not just selling stuff."

Chinese food executive: 'We don't want to be monopolized'

New Zealand is the dominant dairy supplier to China and that makes Jian Lu of Want Want Group, a bustling Chinese food and beverage conglomerate, uneasy. Lu is the Vice Managing Director of Want Want Group, which operates 34 production bases and 131 plants in China.

Lu said he imports 90% of the milk powder he needs for a wide range of food products but can’t buy from the United States until U.S companies can again compete on price.

Jian Lu oversees 131 food processing plants for Want Want Group. He wants multiple dairy suppliers to reduce his risk. USDEC photo by Mark O'Keefe.

Jian Lu oversees 131 food processing plants for Want Want Group. He wants multiple dairy suppliers to reduce his risk. USDEC photo by Mark O'Keefe.

“We don’t want to be monopolized,” said Lu, sitting in his office at corporate headquarters in Shanghai. “We want to reduce that risk. Years ago, we started to look for other suppliers beyond New Zealand. We knew we needed another source in the Northern Hemisphere."

Lu said he was "very grateful" for information the U.S. Dairy Export Council provided, making the case that the United States' abundance of milk and China's need for much more is a win-win proposition.

But the tariffs are forcing Want Want to look elsewhere, most likely the European Union, to mitigate its risk. He said once Want Want finds that secondary supplier it will be difficult, though not impossible, for other countries. In other words, the window of opportunity is now. The window may be closed later.

Want Want Group's iconic symbol greets visitors at corporate headquarters in Shanghai. The company has more than 55,000 employees in China. USDEC photo by Mark O'Keefe.

Want Want Group's iconic symbol greets visitors at corporate headquarters in Shanghai. The company has more than 55,000 employees in China. USDEC photo by Mark O'Keefe.

“We need large volumes of milk powder," Lu explained. "We need to guarantee we have a reliable and consistent source for that milk powder. We need WMP but we also need SMP. Working together we can broaden our relationship beyond buyer and seller to develop products together.”

As the largest single-country producer of whey proteins, cheese, NDM/SMP and lactose, and with a large and growing milk shed, the United States is well-positioned to meet China's growing dairy demand while reducing its risk on a dominant foreign supplier—if the U.S. can compete on price.

“China needs supply chain diversification and security. I’m here to tell you that the U.S. can provide all that,” Beck said in Beijing. “The United States accounts for about 18% of world trade—we are a significant dairy supplier. We can be an important part of your supply chain. We are eager to collaborate.”

Trade talks crucial to U.S. dairy industry

Whether the U.S. dairy industry can form collaborative partnerships like this in China hinges on trade policy between the two governments.

“U.S. dairy farmers and exporters cannot overstate how important it is for the U.S. and China trade talks to stay on course until an agreement can be reached," said USDEC President and CEO Tom Vilsack.

Much is at stake, not only for the U.S. dairy industry but the nearly 3 million U.S. jobs it supports.

Exports are a key to a more prosperous dairy future. Consider:

- Ninety-five percent of the world's population lives outside the United States.

- The milk from nearly one in six tankers leaving American farms ends up in dairy products sold overseas.

- The industry has set an ambitious goal of increasing that to one in five tankers.

China is the big prize.

If the high tariffs on U.S. dairy are lifted, U.S. suppliers can regain price competitiveness and market share. If the tariffs remain or escalate, U.S. dairy will struggle to compete on a tilted playing field in the world's largest country.

Mark O'Keefe is vice president of editorial services at the U.S. Dairy Export Council. Interviews with Chinese importers occurred in Shanghai.Learn more:

- (12 Photos) U.S. Ambassador Sends Goodwill Message to China's Food Industry at Conference, USDEC Reception

- Tariffs Won't Slow U.S. Dairy's Pursuit of Ambitious Export Goal (video)

- Prediction: China will Become the World's Big Cheese

- U.S.-China Dairy Partnership Launched to Meet Future Demand for Nutritious Products (VIDEO)

- USDEC Goes to China to Expand Dairy Trade

Subscribe to the U.S. Dairy Exporter Blog

The U.S. Dairy Export Council fosters collaborative industry partnerships with processors, trading companies and others to enhance global demand for U.S. dairy products and ingredients. USDEC is primarily supported by Dairy Management Inc. through the dairy farmer checkoff. How to republish this post.

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (67)

- Africa (6)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (20)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (9)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farmer leaders (1)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Future trends (1)

- Geographical Indications (GIs) (10)

- Global Marketing (86)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (271)

- Member Services (17)

- Mexico (41)

- Middle East (9)

- Middle East & North Africa (3)

- Middle East/North Africa (9)

- Milk (4)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (19)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (329)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (26)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- April 2015 (11)

- December 2015 (11)

- March 2014 (10)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- January 2026 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- April 2024 (2)

- June 2024 (2)

- July 2024 (2)

- November 2024 (2)

- December 2024 (2)

- February 2025 (2)

- June 2025 (2)

- July 2025 (2)

- September 2025 (2)

- November 2025 (2)

- December 2025 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- May 2024 (1)

- August 2024 (1)

- September 2024 (1)

- October 2024 (1)

- January 2025 (1)

- March 2025 (1)

- April 2025 (1)

- May 2025 (1)

- August 2025 (1)

- February 2026 (1)

- USDEC (183)

- USDEC Staff (167)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Nick Gardner (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Krysta Harden, USDEC President and CEO (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Becky Nyman (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Erica Louder (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

.png)