-

Tariffs Won't Slow U.S. Dairy's Pursuit of Ambitious Export Goal (video)

By Tom Vilsack September 26, 2018- Tweet

The world needs U.S. dairy and we need the world to export more of our abundant milk, award-winning products and high-quality ingredients.

When we unveiled our "Next 5%" goal last year to increase U.S. Dairy exports, we could not have anticipated retaliatory tariffs on U.S. dairy products in two of our most important markets, China and Mexico.

But that's what has happened. I want to address the tariffs and our plans moving forward.

VIDEO BELOW: Secretary Vilsack discusses Mexican and Chinese tariffs.

VIDEO ABOVE: Click arrow, lower left.

Tension rising with China

On Monday, China retaliated to escalating tariffs by the Trump administration with new tariffs of its own on $60 billion of U.S. exports, including certain dairy products. China canceled planned talks with the U.S. and issued a 71-page white paper stating, "China does not want a trade war, but it is not afraid of one and will fight one if necessary."

Unfortunately, I see no end in sight for this escalating trade tension between economic superpowers.

This could have long-range negative effects on the U.S. dairy industry because China is a vital growth market, a key to our future plans. In 2017, we sold $577 million in dairy products there, an increase of 49 percent over the previous year. With 1.4 billion mouths to feed, the long-range upside for U.S. Dairy in China is huge. We project it's only a matter of time before China becomes the world's largest cheese importer.

But if tariffs against U.S. dairy products remain in place, they will tilt the playing field to our competitors' advantage.

More hope for Mexico

Mexico is also crucial to our future success. It's our No. 1 market, where we sold $1.2 billion in dairy products and ingredients last year.

Despite a preliminary handshake agreement in August between the U.S. and Mexico, we don't have a modernized North American Free Trade Agreement yet. Negotiations between the U.S. and Canada continue, with Canada's unfair protectionism of its dairy industry a major issue.

I am more hopeful about tariffs lifting in Mexico than China. If our government ends its steel and aluminum tariffs on Mexico, this may ultimately lead to Mexico's elimination of retaliatory tariffs of our exports.

But nothing is certain.

Dairy exports impact broader economy

Why should anyone outside our industry care? This is an important question to answer as policymakers focus on trade like no time in recent history. We have a strong economic argument to make.

Ongoing tariffs would not only hurt dairy, but the larger agriculture sector and the broader U.S. economy.

Dairy supports 2.9 million jobs nationally, creates $64 billion in tax revenue and is increasingly dependent on exports for future growth.

What's more, increasing exports spark economic expansion. Consider our exports to Mexico. Every $1 of U.S. dairy exports to our neighbors south of the border generates $2.50 of economic activity here in the United States, more than double our bang for the buck.

(Get information quantifying dairy's economic impact in your state at GotDairyJobs.org.)Questions on tariffs and The Next 5%

These trade policy challenges raise understandable questions about The Next 5%, our farmer-funded, supplier-supported goal to increase U.S. dairy exports.

Those questions include:

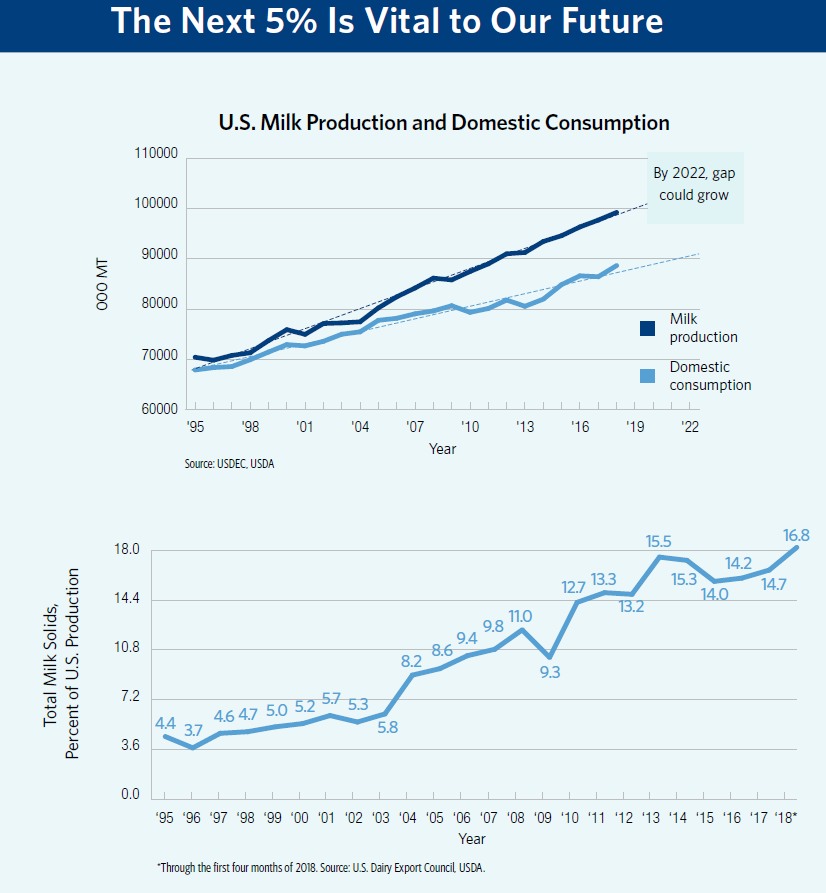

- Is it still realistic to think we can grow export volume from roughly 15 percent of U.S. milk solids to 20 percent over the next three to five years?

- Are we still moving forward on The Next 5% investments, particularly in China, where the trade policy disagreements have the potential to drag on for some time?

- With so many U.S. dairy farmers financially struggling at a time when most of the U.S. economy is thriving, is this the time to expand overseas?

My answers, in order, are: Yes, Yes and Yes.

We must increase exports to keep our farmers in business and our factories humming. As the chart below illustrates, we can't rely on our domestic market alone. The gap between what we produce will get wider and wider, adversely affecting our industry.

Increasing exports help fill the gap.

Growing global demand

The first half of 2018 was the most successful half-year in the history of U.S. dairy exports. U.S. dairy exports of milk powders, cheese, butterfat, whey and lactose topped 1.14 million tons, a record high and up 20 percent from the prior year.

Exports were equivalent to 16.8 percent of milk solids produced during the period. We have established momentum.

Looking ahead, we forecast the world will need an additional 1.3 million metric tons of dairy products to meet global demand growth over the next three to five years.

With generous help from our farmer-funders through the checkoff program, we believe U.S. suppliers can increase cheese exports by 200,000 tons and dairy ingredient exports by 450,000 tons.

This is how we get to The Next 5%.

The cost of new tariffs

There is no doubt that the new tariffs have been a significant setback.

An Informa Agribusiness analysis commissioned by USDEC predicted Chinese tariffs on U.S. dairy products will cost U.S. dairy farmers $12.2 billion by 2023 if they remain in place. Read more here.

Those estimates were made before China upped the ante with this week's new tariffs.

It would be easy to shrink back at this moment, or at least take a breather. But the world needs U.S. dairy and we need the world to expand our industry and increase milk prices for our farmers.

Checkoff funding propels us

Recent investments in establishing The Next 5% have been made possible with increased support from our parent organization, Dairy Management Inc., along with state and regional dairy organizations funded by the dairy checkoff. We are grateful for this support.

Our opinion at USDEC is that our efforts in pursuit of The Next 5% now become even more important. We must continue to aggressively tell the U.S. dairy industry story.

Our mantra for 2018 and 2019 is "more, new and better" in all of our markets, including China and Mexico.

I can guarantee that we know how important our work is to make sure our dairy producers and processors have a brighter and better future.

Tom Vilsack is president and CEO of the U.S. Dairy Export Council. He is a former U.S. Secretary of Agriculture and a governor of Iowa.

Learn more:

- What Dairy Farmers Need to Know About Increasing Exports to "The Next 5%"

- Dairy Famers Face Uncertain Future with New Tariffs (podcast + video)

- (VIDE0) 650 Million Reasons for U.S. Dairy's Long-Term Investment in Southeast Asia

- U.S. Dairy Demonstrates Commitment to Southeast Asia with Singapore Innovation Partnership

Subscribe to the U.S. Dairy Exporter Blog

The U.S. Dairy Export Council fosters collaborative industry partnerships with processors, trading companies and others to enhance global demand for U.S. dairy products and ingredients. USDEC is primarily supported by Dairy Management Inc. through the dairy farmer checkoff. How to republish this post.

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (67)

- Africa (6)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (20)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (9)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farmer leaders (1)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Future trends (1)

- Geographical Indications (GIs) (10)

- Global Marketing (86)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (271)

- Member Services (17)

- Mexico (41)

- Middle East (9)

- Middle East & North Africa (3)

- Middle East/North Africa (9)

- Milk (4)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (19)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (329)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (26)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- April 2015 (11)

- December 2015 (11)

- March 2014 (10)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- January 2026 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- April 2024 (2)

- June 2024 (2)

- July 2024 (2)

- November 2024 (2)

- December 2024 (2)

- February 2025 (2)

- June 2025 (2)

- July 2025 (2)

- September 2025 (2)

- November 2025 (2)

- December 2025 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- May 2024 (1)

- August 2024 (1)

- September 2024 (1)

- October 2024 (1)

- January 2025 (1)

- March 2025 (1)

- April 2025 (1)

- May 2025 (1)

- August 2025 (1)

- February 2026 (1)

- USDEC (183)

- USDEC Staff (167)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Nick Gardner (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Krysta Harden, USDEC President and CEO (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Becky Nyman (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Erica Louder (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

.png)