-

Seventh straight month of growth for U.S. dairy exports

By USDEC Staff October 5, 2021- Tweet

Solid growth in a diverse mix of destinations and products kept U.S. exports on a positive trajectory despite continued port congestion.

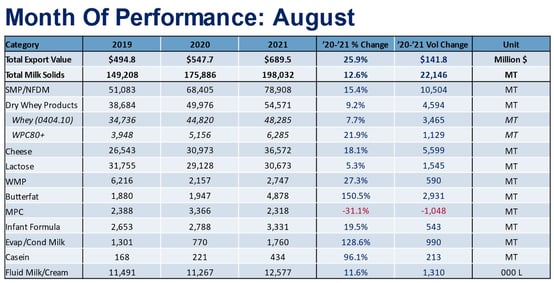

Export volume in milk solids equivalent grew by 13% in August compared to the same month a year ago, thanks to gains in every major product category. The largest gains were recorded by nonfat dry milk/skim milk powder (NFDM/SMP). Export value increased at twice the rate of volume (+26%), supported by a boom in cheese (+18%) and high-value whey (+22%) exports alongside a tighter global price environment.

More data and graphs from August's trade data can be found here.

Before we move into our analysis, we want to highlight our new and improved Data Hub for analyzing U.S. dairy export data. This interactive tool allows users to examine U.S. dairy exports by major product and region. The Data Hub also contains data on the major dairy importers, global prices and milk production of the major exporters. (Click on image below)

Without further ado, here are our main takeaways from August’s trade data:

Continued strength in cheese exports, particularly to Latin America – Stephen Cain

Historically, U.S. cheese exports tend to decline seasonally in the back half of the year. On average, exports in the second half have been 12% lower than in the first six months. However, the strong July and August numbers in 2021 have bucked that trend, with both months growing considerably.

Cheese exports in August increased 18% over the same period last year. Mexico was a crucial source of growth (as we’ll discuss below), but it was the rest of Latin America that impressed, growing 57% (+2,370 MT) year-over-year.

Chile and Colombia were the two leaders in South America, up 172% (+1,025 MT) and 68% (+177 MT). Exports to Central America and the Caribbean were up in nearly all markets but especially Panama (+89%, +387 MT), Honduras (+48%, +223 MT), Guatemala (+84%, +310 MT) and El Salvador (+142%, +136 MT). In general, the growth throughout Latin America has been supported by continued economic recovery as vaccine rates increase, economies reopen and demand rebounds for cheese.

Beyond the demand picture, port congestion continues to impact U.S. dairy exports. However, as most of the cheese leaving the U.S. destined for Latin America leaves the country via our land border with Mexico or through the Gulf, exporters are able to avoid the West Coast congestion. This ability has been a major advantage in circumventing congestion and has likely contributed to increased exports to the region. We will be watching closely as to whether this trend will continue in the coming months as logistics delays are not confined to California but are actively impacting Gulf ports as well.

U.S. price competitiveness has also likely been a factor in driving increased cheese exports. U.S. cheese prices have been sitting at a discount to New Zealand and the EU for much of the year. In the two months leading up to August, the U.S. was at a 22% discount to New Zealand and a 10% discount to the EU.

U.S. cheese exports for the rest of the year are anticipated to remain strong. Global demand for cheese is growing faster than normal with year-to-date global cheese trade up 6% (compared to the average annual growth rate of 3%). This global uptick in demand paired with U.S. product availability puts the U.S. in a strong position to see robust growth in cheese exports through the end of the year.

Mexico’s recovery powered August’s growth – William Loux

Focusing more specifically on our southern neighbor, exports to Mexico (+11,903 MT in milk solids equivalent) grew by more than twice the volume of any other market. However, while cheese powered the growth to the rest of Latin America, it was NFDM/SMP that was the primary engine for export growth to Mexico.

-Oct-05-2021-07-04-48-46-PM.jpg?width=1108&name=Chart5%20(2)-Oct-05-2021-07-04-48-46-PM.jpg)

Powder volumes to our southern neighbor increased by more than 40% compared to a year ago (+9,488 MT). Reportedly, economic difficulties and high feed costs limited the availability of local milk production in Mexico despite official statistics showing steady growth between 2 and 2.5%. Whether local milk is short or not, U.S. export figures suggest the market inside of Mexico is much tighter than it was a year ago. Prices are higher (in both dollar and peso terms), but, even so, import volumes of NFDM/SMP have consistently exceeded prior-year levels nearly every month this year.

Even more positive, the demand expansion was not limited to milk powders either. Exports of whey products jumped 68% (+1,559 MT) with growth of 60% or more in all whey codes (WPC, WPC80+, dry whey and modified whey). Although smaller volumes compared to ingredients, cheese was no laggard either (+9%, +777 MT).

With improved vaccination rates, a recovering economy and (maybe) lackluster domestic milk production, Mexico is returning to pre-pandemic import levels. On an annualized basis, Mexico is only 6% behind pre-pandemic demand in NFDM/SMP (compared to a low ebb of down 22%) and 9% in cheese (compared to a low ebb of down 16%). We expect this positive trend to continue even if import volumes are not quite up to 2019 totals by year end.

And it’s a good thing that Mexico’s demand has improved, because…

Port data showed minimal improvement in West Coast congestion

While exports to the Asia-Pacific markets benefited from a very slight improvement at West Coast ports in August, it’s hard to be overly enthused about it.

Looking at data from the major California ports (Los Angeles, Long Beach and Oakland), exporters (of all products, not just dairy) managed to secure passage for a few more loaded outbound containers in August (+9% compared to July).

However, filled containers loaded onto outbound vessels still lagged prior-year levels significantly (down 12%), despite plenty of demand for space aboard a ship. Indeed, consistent with July’s woes, 70% of outbound containers from California’s major ports lacked cargo.

-Oct-05-2021-05-43-07-94-PM.jpg?width=554&name=Chart3%20(2)-Oct-05-2021-05-43-07-94-PM.jpg)

The Pacific Northwest wasn’t much better with 57% of outbounds leaving Seattle-Tacoma empty – the second-highest percentage of empties and second-lowest amount of filled cargo exported since at least 2015 (when the data series begins); the record lows were just one month prior in July 2021.

So, while slightly more cargo moved in August out of the West Coast, shipping congestion remains an important storyline when assessing U.S. dairy exports. Effectively, the West Coast’s biggest export was air despite U.S. dairy and other exporters working tirelessly to find space aboard container vessels.

Looking ahead, with the holiday import rush already upon us, delays, high freight rates and difficulties securing cargo space will persist at least into the new year. So far, U.S. dairy companies have managed to grow exports despite the challenges, but it is worth pondering what our export figures would have been without these challenges.

Learn more about global dairy markets:-

Cheese and whey drive U.S. dairy exports to 6th straight month of growth

-

U.S. dairy exports on record pace through first half of 2021

-

Dairy exports show few signs of slowing in May

-

U.S. dairy exports maintain momentum in April

Subscribe to the U.S. Dairy Exporter Blog

The U.S. Dairy Export Council fosters collaborative industry partnerships with processors, trading companies and others to enhance global demand for U.S. dairy products and ingredients. USDEC is primarily supported by Dairy Management Inc. through the dairy farmer checkoff. How to republish this post.

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (67)

- Africa (6)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (20)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (9)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farmer leaders (1)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Future trends (1)

- Geographical Indications (GIs) (10)

- Global Marketing (86)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (271)

- Member Services (17)

- Mexico (41)

- Middle East (9)

- Middle East & North Africa (3)

- Middle East/North Africa (9)

- Milk (4)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (19)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (329)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (26)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- April 2015 (11)

- December 2015 (11)

- March 2014 (10)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- January 2026 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- April 2024 (2)

- June 2024 (2)

- July 2024 (2)

- November 2024 (2)

- December 2024 (2)

- February 2025 (2)

- June 2025 (2)

- July 2025 (2)

- September 2025 (2)

- November 2025 (2)

- December 2025 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- May 2024 (1)

- August 2024 (1)

- September 2024 (1)

- October 2024 (1)

- January 2025 (1)

- March 2025 (1)

- April 2025 (1)

- May 2025 (1)

- August 2025 (1)

- February 2026 (1)

- USDEC (183)

- USDEC Staff (167)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Nick Gardner (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Krysta Harden, USDEC President and CEO (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Becky Nyman (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Erica Louder (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

.png)