-

U.S. dairy exports on record pace through first half of 2021

By USDEC Staff August 5, 2021- Tweet

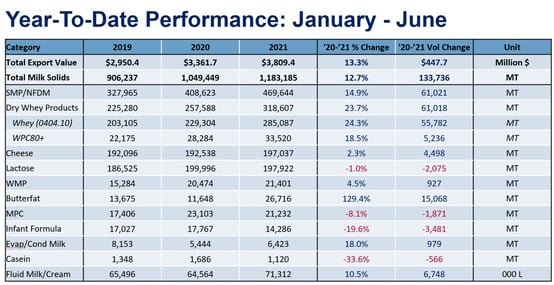

Through June, U.S. dairy exports in 2021 are up 13% in both volume and value compared to 2020.

June export figures align with many of the trends we’ve seen throughout the first six months of 2021: dairy ingredients drove the majority of June’s growth in volume and higher commodity prices pushed value up at an even faster pace.

Total dairy export volume on a milk solids equivalent basis picked up 6% and total export value grew 15% to $670 million. Whey exports grew the most with an additional 6,973 metric tons (MT) shipped out compared to June 2020, a gain of 16% driven by demand from China. Non-fat dry milk/skim milk powder (NFDM/SMP) wasn’t far behind, growing 5,579 MT, a gain of 7%, thanks to recovering demand in Mexico. Cheese exports faltered in the face of strong year-over-year comparisons, declining by 5,031 MT (-13%).

Detailed data and charts can be found here.

For this month’s write-up, we’re going to focus less on June’s data and more on the key dynamics we’ve seen in the first half of 2021 in each of the United States’ major products and how we see these themes playing out in the back half of the year.

NFDM/SMP

-3.jpg?width=554&name=Chart2%20(3)-3.jpg)

Starting with our largest export product, NFDM/SMP, the primary dynamic affecting U.S. export performance remains the congestion at port, particularly in California. Exporters repeatedly dealt with container ships canceling or rolling bookings, lack of equipment, and narrow windows to get the product to port, all of which weighed on U.S. exports to the Asia-Pacific, but particularly NFDM/SMP to Southeast Asia (SEA).

To be clear, delayed product still moved – NFDM/SMP shipments to Southeast Asia are up 1% (+1,133 MT) through the first half of the year – but we believe that plenty of product that has been booked for export has not left U.S.’ shores yet. Additionally, delays outside of the control of U.S. exporters have hampered the U.S.’ ability to maintain market share in the region as European suppliers have been aggressive in pushing greater volumes to the region (+25,257 MT through May).

With logistics congestion slowing U.S. export growth to Southeast Asia, the recovery in demand out of Mexico has been particularly welcome. Total NFDM/SMP exports to Mexico were up 25% year-to-date (+33,288 MT) and were even ahead of 2019 volumes through June. While we attribute some of the strength in Mexico’s demand to drought that is affecting local milk production, the overall gain in imports is still a positive signal for recovering consumer demand within the country.

What does this mean for the rest of 2021?

Well, all signs point to port congestion remaining a headache for U.S. exporters through at least the end of the year. While those delays will act as a headwind and dampen U.S. exports to the Asia-Pacific compared to what they would be without port delays, we still expect strong growth overall in NFDM/SMP exports in the second half.

As mentioned earlier, plenty of milk powder has already been sold to overseas buyers is sitting in a warehouse waiting to be shipped. That product will move – even if it ships two months later than it was supposed to. Additionally, the U.S. milk production outlook in the back half of the year continues to look incredibly robust, which will result in plenty of available supply for export. Finally, U.S. domestic demand for NFDM is expected to remain weak with so much raw milk available; this will also push greater volumes into the export market.

Overall, while there remain plenty of watchouts to this optimistic forecast – the most significant being COVID-19 outbreaks in Southeast Asia – the U.S. should be well placed to grow its NFDM/SMP in the second half of 2021 given limited milk production growth out of Europe and New Zealand’s additional milk fixated on satisfying Chinese demand.

Whey

The story for whey in the first half of the year has been all about demand. Total U.S. whey exports in June grew 16% (+6,973 MT) over June of last year. High-value protein continues to show strong growth as well with WPC80+ June exports up 43% (+1,899 MT) over June of last year.

.jpg?width=554&name=Chart3%20(4).jpg)

This story of steady expansion has characterized the first half of the year. US whey exports are up 24% year-to—date (+66,670 MT) over the same period last year which puts the U.S. on pace to have yet another record year in whey exports.

At the risk of sounding like a broken record, China is fueling the growth. In June, US whey exports to China were up 39% (+7,513 MT) and are up 75% (+66,670 MT) through the first half of this year. As we’ve said many times before, whey for feed has been the key driver for Chinese sweet whey and whey permeate imports as the pork industry consolidates into more commercial operations and continues to rebuild its pig herd following the devastation of African Swine Fever (ASF). The approval for permeate to be used in food has undoubtedly helped as well, but the market remains small at this point. On the high-value side, China’s push to increase its domestic infant formula manufacturing has increased WPC80 demand.

What does this mean for the rest of 2021?

As we look to the second half, the seemingly insatiable demand we saw over the last year has more recently been put into question with the collapse of pork prices in China pinching pig farmers’ margins and signaling to the industry to curb expansion. This seems to have already impacted whey demand as U.S. dry whey prices have fallen from their peak and industry contacts confirm Chinese purchasing has slowed.

Still before we get too pessimistic, that decline in price fails to tell the full story. More recent outbreaks of ASF in China created a frenzy among producers as they sent hogs to market in an attempt to avoid any outbreaks on their operations, which then fueled that price collapse with a glut of supply. The price free-fall has subsided in recent weeks, but prices remain in line with pre-ASF levels. If we remain at these price levels, we are unlikely to see the level of feverish whey demand continue through the back half of this year. However, if prices begin to tick back up, we may see renewed demand growth as pork production margins become more conducive for expansion.

Additionally, while it sometimes seems like it, the whey market is not only about China, particularly when we talk about higher protein whey products. US whey exports to countries other than China showed solid growth through June in face of historically high global prices. U.S. exports to SEA and Korea have also experienced growth with SEA expanding by 2% (1,181 MT) and Korea’s WPC80+ demand surging by 77% (+4,276). Overall, demand is expected to be strong globally for whey in the back half of the year, and while there is risk of a slight pullback from China, we still expect whey exports to be at, or more likely above, where they were in 2020 through the end of year.

Cheese

Compared to the relatively steady growth of NFDM/SMP and whey, U.S. cheese exports have been on a rollercoaster. U.S. cheese exports went from a 10% year-over-year decline in January to a 51% spike in April to a 13% decline in June, with other monthly results somewhere in between. Still, U.S. cheese sales managed positive growth through the first six months and rose a respectable 2.3% to 197,036 MT compared to the previous year.

-2.jpg?width=554&name=Chart4%20(3)-2.jpg)

While many factors are responsible, two stand above the rest:

First, there has been wild fluctuation in year-over-year comparisons. In 2020, cheese export volumes swung from multi-year lows in April to multi-year highs in June as a result of extreme price swings. For instance, June 2020 cheese exports were higher than at any point last year. However, that cheese was exported at $650/MT cheaper than June 2021. Essentially, matching 2020 volumes at current prices was an exceedingly difficult feat.

Second, the stop-start nature of foodservice reopenings around the world as the race between vaccines and variants continues to slog on has resulted in export volumes varying significantly from month to month.

They are not the only factors – economic growth, U.S. shipping issues and other influences continue to affect cheese demand and exports as well – but they are the main drivers.

We’ve seen that translate to major swings in purchasing, with Japan and South Korea being two of the best examples. Through the first four months of 2021, U.S. cheese exports to Japan were up 32% and sales to South Korea were up 29%. Through the first six months, after factoring in May-June numbers, U.S. cheese sales to Japan were up 2% and volume to South Korea was lagging the first six months of 2020 by 5%. A rollercoaster indeed.

What does this mean for the rest of 2021?

On the optimistic side, U.S. cheese prices (while still exhibiting some volatility) remain favorable compared to major competitors, incentivizing international customers to look to the U.S. for cheese. Additionally, U.S. cheese supply should remain plentiful with new capacity and plenty of milk production growth, particularly in the Midwest, expected through 2021. And while nations are tightening foodservice restrictions in the face of the Delta variant, few of the major cheese buyers have so far returned to complete lockdown status.

Still, if you read the half-year reports from major dairy and food suppliers this year, you will see one word repeated frequently: “uncertainty.” For the rest of the year, much of U.S. cheese export performance will depend on pandemic progress.

Overall, we anticipate favorable pricing, good demand and plenty of supply available for export which should result in growth in the second half of the year, but don’t expect the rollercoaster to be over. Third quarter U.S. cheese exports were strong in 2020 and set a challenging bar, while 2020 cheese export volumes in the fourth quarter were some of the worst in years.

To make sense of this uncertainty, be sure to stay tuned for future trade data updates out of USDEC.

Learn more about global dairy markets:-

Dairy exports show few signs of slowing in May

-

U.S. dairy exports maintain momentum in April

-

U.S. dairy exports hit all-time record in March

Subscribe to the U.S. Dairy Exporter Blog

The U.S. Dairy Export Council fosters collaborative industry partnerships with processors, trading companies and others to enhance global demand for U.S. dairy products and ingredients. USDEC is primarily supported by Dairy Management Inc. through the dairy farmer checkoff. How to republish this post.

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (67)

- Africa (6)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (20)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (9)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farmer leaders (1)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Future trends (1)

- Geographical Indications (GIs) (10)

- Global Marketing (86)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (271)

- Member Services (17)

- Mexico (41)

- Middle East (9)

- Middle East & North Africa (3)

- Middle East/North Africa (9)

- Milk (4)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (19)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (329)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (26)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- April 2015 (11)

- December 2015 (11)

- March 2014 (10)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- January 2026 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- April 2024 (2)

- June 2024 (2)

- July 2024 (2)

- November 2024 (2)

- December 2024 (2)

- February 2025 (2)

- June 2025 (2)

- July 2025 (2)

- September 2025 (2)

- November 2025 (2)

- December 2025 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- May 2024 (1)

- August 2024 (1)

- September 2024 (1)

- October 2024 (1)

- January 2025 (1)

- March 2025 (1)

- April 2025 (1)

- May 2025 (1)

- August 2025 (1)

- February 2026 (1)

- USDEC (183)

- USDEC Staff (167)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Nick Gardner (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Krysta Harden, USDEC President and CEO (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Becky Nyman (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Erica Louder (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

.png)