-

Dairy exports show few signs of slowing in May

By USDEC Staff July 2, 2021- Tweet

Ingredients drive U.S. dairy exports to a near-record month.

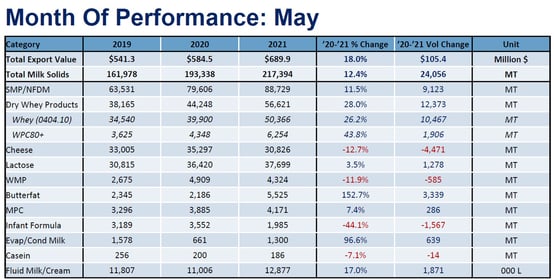

While record cheese exports pushed U.S. exports to record heights daily in April, it was ingredients that drove May volumes to nearly that same record level – with May as the second highest month for most dairy exports shipped in a single month on a daily basis. Compared to May last year, U.S. Dairy export volume in milk solids equivalent grew 13%, with the total value of those shipments 18% higher.

Overall, a surge in non-fat dry milk/skim milk powder (NFDM/SMP) to Mexico and the Middle East/North Africa (MENA) and the continued demand for whey in China were the primary drivers of ingredient export growth. Port issues continued to frustrate U.S. dairy exporters in May, but as we have seen the past few months, U.S. exporters are finding ways to manage the delays at port and address rising freight and trucking rates.

More detailed data and charts can be found here.

Beyond that topline, here are our three main takeaways from the May export data:

NFDM/SMP exports soar

U.S. NFDM/SMP exports jumped 12% (+9,566 MT) to 88,729 MT in May. That’s the most NFDM/SMP the United States has ever shipped in a single month, topping the 86,532 MT exported in March of this year.

Strong global demand and favorable U.S. pricing continue to support U.S. sales. As a result, U.S. NFDM/SMP exports were up 17% to 388,209 MT, well above record annual pace through the first five months.

May gains came in most major markets.

U.S. NFDM/SMP shipments to Mexico grew 28% (+6,752 MT) vs. May 2020. Mexican NFDM/SMP purchasing has ticked up every month since January. Better-than-expected economic growth this year is a significant driver, but drought is likely playing a role as well. Around two-thirds of Mexico is facing drought conditions, and forecasts are calling for the situation to worsen in the coming weeks, causing widespread water shortages and crop damage.

May U.S. NFDM/SMP exports to the MENA region jumped 161% (+5,994 MT), led by Algeria (+3,993 MT). Similarly, sales to China doubled (+2,973 MT). Favorable U.S. pricing and efforts in both regions to diversify supply supported U.S. trade.

U.S. sales to Southeast Asia fell 11%. Gains to Vietnam, Malaysia, Thailand, and Singapore weren’t enough to offset a sharp decline to Indonesia (-46%) and a 14% drop to the Philippines.

Given global demand, U.S. production and stocks, favorable pricing, and the ongoing U.S. shipping backlog, there is strong reason for optimism for continued NFDM/SMP success in the coming months. On top of this, even after the record month, indications are we have more booked product waiting for a ship).

Cheese volumes step back after record April

Of the major export products, cheese was the only U.S. dairy export to take a step back in May. Total volume was down 13% (-4,471 MT). Shipments to Asia-Pacific saw the sharpest pullback. Exports to Korea and Japan fell by 36% each (-3,403 MT and -1,949 MT, respectively), and volumes to Australia dropped by 51% (-1,317 MT). Mexico bucked the trend with a 14% increase in imports (+1,023 MT).

However, before we sound any alarm bells over reduced international demand in Asia, it is worth comparing the market conditions in May 2020 and May 2021. May 2020 came right after historically low cheese prices in April (falling as low as $1/lb.) as the COVID-19 pandemic and foodservice closures hammered U.S. domestic cheese demand. This meant that there was plenty of available cheese for export at very competitive prices in May last year. You can see this in the contrasting export prices as the average unit value of cheese exported in May 2020 was almost 30 cents per pound cheaper than in May 2021. The sharp deterioration of the Mexican peso negated much of the price decline in the U.S., so it was primarily Asia-Pacific customers who bought more U.S. cheese last year.

Contrast last year’s experience with this May: The U.S. economy is opening up rather than shutting down. While U.S. supply was booming this year thanks to new capacity, demand grew alongside it as foodservice establishments replenished pipelines for waves of customers, which also kept prices supported. On top of that, the port issues likely delayed some booked export orders in May.

Yet, today, cheese is more readily available. Supply is still booming and domestic demand has backed off as foodservice pipelines have finished refilling and retail demand slows. With global demand for cheese accelerating as many countries reopen, we remain optimistic that this combination of factors should result in increased U.S. cheese exports in the coming months.

WPC80+ demand growth

U.S. total whey exports in May were up 28% (+12,373 MT) over May of last year. A key driver of the growth has been higher value products. WPC80+ exports were up 44% (+1,906 MT) over May 2020 and up 73% over 2019. During May of last year, gyms were closed, travel was limited, and many consumers were eschewing fitness for comfort foods, leading to a decrease in WPC80+ demand. So it comes as no surprise that as the world reopens and consumers seek healthier products after a sedentary 2020, demand is returning. Equally encouraging is the growth over more “normal” 2019 levels, which illustrates an increased global appetite for WPC80+.

The diversity in the growth of U.S. WPC80+ markets is particularly encouraging as no single market was driving the growth. Exports to China expanded by 342 MT, the United Kingdom by 335 MT, South Korea by 315 MT, and Brazil by 240 MT. Turkey grew from 0 MT in May 2020 to 194 MT. Canada, Japan, Vietnam, and Mexico all grew by more than 100 MT. Of the major markets, only India pulled back, which resulted from non-tariff barriers being erected last year, effectively blocking the U.S. from that market.

Moving forward, the continued reopening of economies and the associated refocus on health and wellness should be a major boost for WPC80+ demand. Additionally, increased cheese capacity coming online in the U.S. paired with the strong growth in milk production bodes well for both WPC80+ production and exports.

Learn more about global dairy markets:-

U.S. dairy exports maintain momentum in April

-

U.S. dairy exports hit all-time record in March

-

U.S. dairy exports surge despite shipping woes

Subscribe to the U.S. Dairy Exporter Blog

The U.S. Dairy Export Council fosters collaborative industry partnerships with processors, trading companies and others to enhance global demand for U.S. dairy products and ingredients. USDEC is primarily supported by Dairy Management Inc. through the dairy farmer checkoff. How to republish this post.

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (67)

- Africa (6)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (20)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (9)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farmer leaders (1)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Future trends (1)

- Geographical Indications (GIs) (10)

- Global Marketing (86)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (271)

- Member Services (17)

- Mexico (41)

- Middle East (9)

- Middle East & North Africa (3)

- Middle East/North Africa (9)

- Milk (4)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (19)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (329)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (26)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- April 2015 (11)

- December 2015 (11)

- March 2014 (10)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- January 2026 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- April 2024 (2)

- June 2024 (2)

- July 2024 (2)

- November 2024 (2)

- December 2024 (2)

- February 2025 (2)

- June 2025 (2)

- July 2025 (2)

- September 2025 (2)

- November 2025 (2)

- December 2025 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- May 2024 (1)

- August 2024 (1)

- September 2024 (1)

- October 2024 (1)

- January 2025 (1)

- March 2025 (1)

- April 2025 (1)

- May 2025 (1)

- August 2025 (1)

- February 2026 (1)

- USDEC (183)

- USDEC Staff (167)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Nick Gardner (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Krysta Harden, USDEC President and CEO (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Becky Nyman (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Erica Louder (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

.png)