-

Cheese and whey drive U.S. dairy exports to 6th straight month of growth

By USDEC Staff September 2, 2021- Tweet

U.S. exported 17.7% of production in July even as port congestion slowed NFDM/SMP shipments.

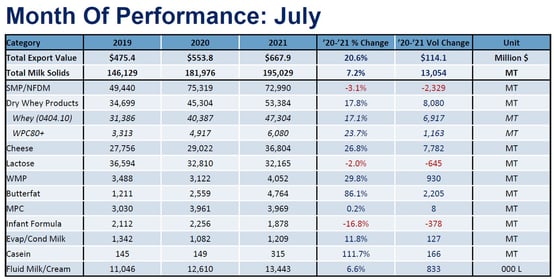

July U.S. dairy export volume (milk solids equivalent or MSE) rose 7% year over year, marking the 6th straight monthly increase. Gains of nearly 10,000 metric tons (MT) MSE to China and nearly 9,000 MT MSE to Mexico more than made up for reduced shipments to Southeast Asia (SEA). A surge in higher-value products (namely, cheese, WPC80+ and butter/AMF) in addition to overall volume growth helped boost U.S. export value by more than 20% to $667.9 million in July.

More data and graphs from July's trade data can be found here.

Below are our analysts’ three big takeaways from this month’s trade data:

Port congestion hampered U.S. NFDM/SMP to SEA – William Loux

Despite a resurgence in exports to Mexico (+14%, +3,491 MT) and a dramatic rise in shipments to China (+5,083 MT), U.S. NFDM/SMP exports still fell behind year-over-year comparisons in July – almost entirely due to reduced shipments to major markets in Southeast Asia (-31%, -9,365 MT). Shipments to every one of the six major markets fell. Exports to the Philippines dropped the most (-39%, -4,372 MT), followed by Indonesia (-35%, -2,873 MT) and Vietnam (-1,194 MT). Declines to Thailand (-36%, -436 MT), Singapore (-39%, -381 MT) and Malaysia (-3%, -109 MT) were smaller but still significant.

Some of the deterioration in exports to the region could be due to comparisons, but July 2020 was not an abnormally strong month last year. Demand in the region could also be weaker given Delta variant outbreaks and higher prices relative to this time last year. Still, at least through June of this year, total shipments from all suppliers to the region held relatively strong. Instead, port congestion here in the U.S. is the likely culprit.

More than 60% of U.S. NFDM/SMP sent via ocean freight is shipped out of ports in California, which remains the epicenter of port congestion in the U.S. Unfortunately, the data suggests the congestion became worse in July rather than better.

Although the major California ports of Los Angeles, Long Beach and Oakland did manage to process slightly more containers (of all products, not just dairy) compared to June, the total outbound shipments were still lower than any point in the past year besides the month prior. Additionally, once you take into account that an astonishing 70% of those containers were empty (an all-time record), the quantity of full containers shipped out of California ports was the lowest in over a decade.

.jpg?width=554&name=July%20trade%20stats1%20(2).jpg)

.jpg?width=554&name=July%20trade%20stats2%20(2).jpg)

With that context, the decline in NFDM/SMP shipments to Southeast Asia makes much more sense. Container companies opted to transport empty containers back to Asia to shorten turnaround times rather than pick up U.S. agricultural products unless exporters were willing to pay extravagant prices and extra fees, as well as deal with short and rapidly moving return windows to get U.S. dairy products on a ship.

Thankfully, as mentioned in the introductory sentence, resurgent demand in Mexico – where port congestion is not an issue – and China emerging as a major market for U.S. SMP helped support export volumes in July.

Looking ahead, the U.S. still has plenty of product that is sold to customers that needs to ship. So, while congestion will undoubtedly act as a headwind to the U.S. exporting all that committed product in a timely manner or clearing the backlog by December, U.S. NFDM/SMP should still move at a steady pace through the end of the year. Regardless, Mexico’s demand recovery is one of the most supportive factors for U.S. exports moving forward.

Cheese soars in July – Paul Rogers

After a disappointing June where volume slipped 13% year over year, U.S. cheese exports rebounded strongly in July. Sales soared 27%, reaching 36,804 MT—easily a record for the month of July, typically slower for cheese exports. For reference, U.S. cheese exports averaged a little over 27,000 MT per July over the last five years.

Volumes were up across most countries and regions with robust sales to Latin America leading the way. U.S. cheese exports to Central America more than doubled (+2,382 MT), and shipments to South America jumped 70% (+892 MT). Both regions are on a U.S.-cheese buying streak, with year-to-date cheese shipments up 56% and 31%, respectively.

U.S. cheese shipments to Mexico rose 23% (+1,796 MT). After trailing overall 2020 volume for the first six months of the year, total cheese exports to Mexico finally broke into the black, with volume up 1% year to date through July.

A combination of factors appears to be driving the gains to Latin America, including favorable U.S. pricing, vaccination progress in South America, nations forging ahead with economic reopenings, and improving tourism numbers in Mexico and Central America—a factor also helping boost sales to the Caribbean (+38%, +528 MT in July). Additionally, the majority of cheese shipped to Latin America leaves the U.S. via the southern border or out of U.S. Gulf or East Coast ports, thereby lessening the impact of West Coast port congestion.

Positively, Latin America was not alone in its U.S. cheese appetite. July sales to Japan rebounded after a poor June, rising +66% (+1,927 MT) year over year, likely aided by post-Olympics restocking. Shipments to Southeast Asia rose 64% (+927 MT). Exports to the Middle East/North Africa grew 56% (+583 MT). We even saw 16 MT of U.S. cheese go into Sub-Saharan Africa, up from less than a ton in July 2020.

Through the first seven months of 2021, U.S. cheese exports were up 5.5% to 233,841 MT, putting the country just over record pace for the year. While COVID uncertainty still clouds the outlook for the coming months—particularly foodservice demand—USDEC remains optimistic that the U.S. cheese price advantage and a recovering Latin America will continue to support export traffic.

Whey exports grow to more than just China – Stephen Cain

Beyond cheese, whey was the other major product category providing robust volume growth, with total exports up 18% (+8,080 MT) in July over the same month last year. When we break down the subsets of total whey, dry whey exports (predominantly sweet whey) were down 9% (-1,618 MT), but increased exports of other whey types were more than enough to offset that decline.

WPC80+ exports were up 24% (+1,163 MT) in July, and the HS code that is primarily whey permeate (modified whey, not elsewhere specified) grew 82% (+7,530 MT). This breakdown likely reflected increased production of both WPC80+ and permeate in the U.S. with less available for sweet whey production. Most encouraging out of the data is the increase in exports among numerous countries and not solely China.

Reduced availability of sweet whey, likely combined with port congestion, resulted in lower year-over-year exports destined for Southeast Asia. Vietnam was the only country in the region showing increased volume while Thailand, the Philippines, Malaysia, and Indonesia all saw declines with a combined total regional decrease of 40% (-2,425 MT). While up 11% (941 MT), China was not enough to offset the decline in Southeast Asia.

Not only was WPC80+ export growth particularly strong in July, but it was also widely distributed amongst countries. Exports to China were up 23% (+300 MT). Not to be outdone by its neighbor to the west, exports to Japan were up 51% (+331 MT), Canada jumped 61% (+280 MT), Latin America (excluding Mexico) doubled (+244 MT) and Mexico more than quadrupled (+182 MT). Over in Europe, the United Kingdom surged 90% (+275 MT).

Whey permeate export performance is harder to break out with product moving under multiple HS codes, but for the majority of product being moved, China continued to be the primary destination and the fastest growing with exports up 164% (+4,548 MT). Still, as with WPC80+ exports, several other countries contributed to the growth. Southeast Asia as a whole gained 90% (+2,069 MT) as Vietnam led the way (+384%,+1,690 MT).

Bigger picture, China continues to be the dominant buyer of whey on the global market, but the entrance of other buyers is encouraging. The easing of global prices from the historic highs seen earlier this year alongside U.S. prices coming more in line with other global suppliers may be part of the reason. Additionally, European milk production has been lackluster and continues to limit export availability of whey coming out of the EU. This, paired with solid U.S. cheese production should enable increased U.S. whey exports in the back half of the year, especially with a more diversified buyer mix.

Learn more about global dairy markets:-

U.S. dairy exports on record pace through first half of 2021

-

Dairy exports show few signs of slowing in May

- U.S. dairy exports maintain momentum in April

Subscribe to the U.S. Dairy Exporter Blog

The U.S. Dairy Export Council fosters collaborative industry partnerships with processors, trading companies and others to enhance global demand for U.S. dairy products and ingredients. USDEC is primarily supported by Dairy Management Inc. through the dairy farmer checkoff. How to republish this post.

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (67)

- Africa (6)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (20)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (9)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farmer leaders (1)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Future trends (1)

- Geographical Indications (GIs) (10)

- Global Marketing (86)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (271)

- Member Services (17)

- Mexico (41)

- Middle East (9)

- Middle East & North Africa (3)

- Middle East/North Africa (9)

- Milk (4)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (19)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (329)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (26)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- April 2015 (11)

- December 2015 (11)

- March 2014 (10)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- January 2026 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- April 2024 (2)

- June 2024 (2)

- July 2024 (2)

- November 2024 (2)

- December 2024 (2)

- February 2025 (2)

- June 2025 (2)

- July 2025 (2)

- September 2025 (2)

- November 2025 (2)

- December 2025 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- May 2024 (1)

- August 2024 (1)

- September 2024 (1)

- October 2024 (1)

- January 2025 (1)

- March 2025 (1)

- April 2025 (1)

- May 2025 (1)

- August 2025 (1)

- February 2026 (1)

- USDEC (183)

- USDEC Staff (167)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Nick Gardner (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Krysta Harden, USDEC President and CEO (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Becky Nyman (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Erica Louder (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

.png)