-

Increases across the board keep U.S. dairy exports on pace for another record year

By USDEC Staff November 4, 2021- Tweet

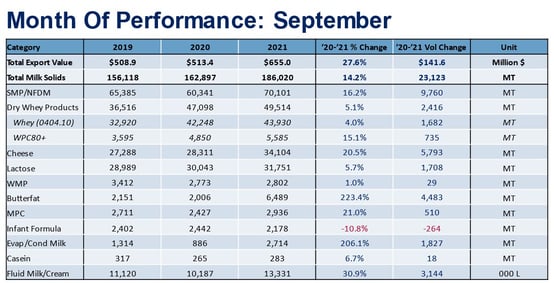

U.S. dairy export volume on a milk solids equivalent (MSE) basis climbed 14% in September with gains to most major markets and across products.

Nonfat dry milk/skim milk powder (NFDM/SMP) led the way with a 16% increase (+9,760 MT) followed by cheese (+20%, +5,793 MT) and butterfat (+223%, +4,483 MT). Whey and lactose exports also improved by 5% (+2,416 MT) and 6% (+1,708 MT), respectively.

More data and graphics from September's trade data can be found here.

Positively, dairy export value strengthened in September at nearly double the rate of volume, increasing 28% over the same month in 2020. Digging deeper into the value data, we have seen average export unit values steadily climb in 2021 due to both strengthening dairy prices and a higher percentage of U.S. dairy exports coming from higher-value products.

For instance, with regard to rising global prices, NFDM/SMP – the United States’ largest dairy export product – sold at an average export price of $1.30/lb in September, 23 cents higher than the same time last year. Looking ahead, that price remains well below current markets, so we should anticipate further growth in average export prices in the months ahead.

But the rising export value isn’t just a result of strengthening global prices. It’s also due to U.S. cheese exports climbing by 20%, WPC80+ exports expanding by 15%, and butterfat exports tripling – all are products that fetch relatively higher prices on the export market.

Put together, the average price for a pound of milk solids exported by the U.S. reached its highest point since 2015 with the potential to go higher in the months ahead.

Now, let’s turn our attention to the three markets we’ll be keeping a close eye on in the months ahead:

Mexico – Stephen Cain

U.S. dairy exports to Mexico have recovered in the past year. U.S. shipments to Mexico fell 15% (75,500 MT) overall in 2020, but rebounded by 19% (60,500 MT) so far in 2021. While this is encouraging, the improvement is partially due to favorable year-over-year comparisons. Compared to 2019 levels, U.S. exports to Mexico were still down 1% year-to-date – much better than 2020 but not quite to “new” growth.

The increased exports are likely being driven by a few factors: continued economic recovery, tighter domestic milk supply and product diverted to avoid congestion.

In terms of the Mexican economic recovery, Mexico’s GDP dropped 8.3% in 2020, but is forecasted to reach 6.2% growth in 2021 and 4% in 2022. This economic recovery is helping boost demand for dairy products both from Mexican residents and from tourists.

Another driver is milk production. While official statistics state continued growth, rumors among industry players in the country suggest a tighter market. Also supportive of a potentially tighter milk environment are trade statistics. While Mexico is not a major global player in dairy exports, it is a regional player, mainly supplying other countries in Latin America. Mexican exports continue to be depressed (down nearly 27% YTD), suggesting that domestic milk is needed to supply the local market with none leftover for the export market.

Lastly, continued port congestion (and port data suggests worsened in September) highlights Mexico as an alternative destination for U.S. exporters. While truck and rail rates are elevated alongside ocean rates, truck and rail provide an opportunity to avoid the port congestion now clogging all U.S. coasts. Utilizing truck and rail also allows for some increased level of reliability and generally a better opportunity for having product both leave the US and arrive at its destination on time. This is appealing to both exporters and importers and is leading to product that may have been originally destined for other markets being diverted to customers in Mexico.

All these factors are supportive of U.S. exports to Mexico, and we will likely see continued export momentum through the end of the year and into 2022.

Middle East-North Africa – Paul Rogers

U.S. milk solids exports to the Middle East-North Africa (MENA) region in the first three quarters of 2021 have already exceeded the entire 2020 calendar year total. But this is not just a single-year phenomenon.

U.S. suppliers have been rebuilding the business in MENA since the Russian dairy embargo in 2014 took away one of the largest EU dairy markets, forcing the bloc to re-channel its export efforts to other regions like the Middle East/North Africa. Uncompetitive U.S. butter pricing for most of 2014-2016 added to the problem.

The result: U.S. dairy shipments to MENA dropped off the cliff’s edge in 2015.

But we have been slowly and steadily earning back that MENA business ever since. U.S. dairy solids exports to MENA have now risen for five straight years. From 2016-2020, volume more than doubled to 78,494 MT MSE. Through three quarters of 2021, the United States shipped nearly 85,000 MT to the region.

-1.jpg?width=554&name=chart1%20(3)-1.jpg)

Butter, cheese, and NFDM/SMP fueled the increase, with September numbers continuing the longer term trend. U.S. butter exports to MENA soared 174% (+543 MT) in September, cheese increased 30% (+342 MT) and NFDM/SMP jumped 25% (+619 MT). Through three quarters, MENA accounted for 37% of total U.S. butterfat exports, with U.S. volume up 8,772 MT compared to the same period in 2020.

Strong sales gains to Bahrain (+4,855 MT) and Egypt (+2,815 MT) in the first three quarters led U.S. butter growth, while the UAE (+2,345 MT) and Saudi Arabia (+2,371 MT) led cheese. Algeria (+10,146 MT) and Egypt (+5,249 MT) fueled U.S. NFDM/SMP in the first three quarters.

We’ve also seen a healthy jump in U.S. whey shipments this year to MENA, with year-to-date volume up 41% (+1,167 MT).

Questions on continued growth revolve around recent halal certification issues in the region. (USDEC members can see the Member Alert “Egypt altering its Halal requirements” and Global Dairy eBrief, 10/8/21). In addition, the U.S. price advantage on NFDM/SMP and cheddar has narrowed in recent weeks.

However, crude oil prices recently reached a six-year high, supporting MENA economic growth and dairy demand in key oil-producing nations. Overall, a significant U.S. price advantage in butter and limited EU dairy supplies provide additional positive signs for continued U.S. export growth to the region in the fourth quarter and into 2022.

China – William Loux

It’s difficult to write a dairy market summary in 2021 without talking about China. China has been the driving force behind growing international demand for dairy products in 2021. Over the last 12 months of data, international dairy trade (from all suppliers, not just the U.S.) to China grew by 29% – equivalent to growth of more than 600,000 metric tons (MT) of milk solids (MSE). For context, no other market grew by more than 100,000 MT, and global trade to the rest of the world declined by 3%, or 225,966 MT MSE.

U.S. dairy exports to China have fared relatively well over the past year, climbing 51% year-to-date (+113,848 MT MSE) – though I should mention the usual caveats that 1) 2020 was a relatively low base and 2) outside of whey and lactose products, U.S. market share in China remains relatively small. September maintained this pattern – total U.S. exports gained 28% (+7,696 MT MSE) year-over-year.

Still, as we start to look to 2022, there are a couple of areas to watch closely.

First, U.S. low protein whey exports continue to slow month-to-month and will face steeper year-over-year comparisons in the 4th quarter and into 2022. Certainly, some of the slowdown can be attributed to congestion at west coast ports. However, the underlying demand fundamentals surrounding whey for feed use are worth watching closely as pork prices within China have fallen sharply alongside a steady rise in feed and other input costs. Together, that is likely to dampen the incentive for local pig farmers – a key customer for whey permeate and sweet whey – to expand production.

-Nov-04-2021-07-33-11-40-PM.jpg?width=554&name=chart2%20(3)-Nov-04-2021-07-33-11-40-PM.jpg)

Second, the U.S. has benefitted from the rise in China’s milk powder demand this year, more than doubling the United States’ exports of NFDM/SMP this year. However, after so much buying this year (global NFDM/SMP exports to China have climbed more than 100,000 MT in the last 12 months), we are hearing numerous reports that China is well stocked and thus unlikely to maintain its current buying pace. Additionally, U.S. market share remains small (just over 10%) and behind New Zealand, the European Union and Australia. So, if China purchases were to slow, the growth in U.S. exports to the country that we’ve seen in 2021 could slow as well as other suppliers, particularly Oceania, fight to maintain volumes.

.jpg?width=554&name=chart3%20(3).jpg)

Get more dairy trade data at USDEC's Data Hub

Learn more about global dairy markets:-

Seventh straight month of growth for U.S. dairy exports

-

Cheese and whey drive U.S. dairy exports to 6th straight month of growth

-

U.S. dairy exports on record pace through first half of 2021

-

Dairy exports show few signs of slowing in May

Subscribe to the U.S. Dairy Exporter Blog

The U.S. Dairy Export Council fosters collaborative industry partnerships with processors, trading companies and others to enhance global demand for U.S. dairy products and ingredients. USDEC is primarily supported by Dairy Management Inc. through the dairy farmer checkoff. How to republish this post.

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (67)

- Africa (6)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (20)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (9)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farmer leaders (1)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Future trends (1)

- Geographical Indications (GIs) (10)

- Global Marketing (86)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (271)

- Member Services (17)

- Mexico (41)

- Middle East (9)

- Middle East & North Africa (3)

- Middle East/North Africa (9)

- Milk (4)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (19)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (329)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (26)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- April 2015 (11)

- December 2015 (11)

- March 2014 (10)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- January 2026 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- April 2024 (2)

- June 2024 (2)

- July 2024 (2)

- November 2024 (2)

- December 2024 (2)

- February 2025 (2)

- June 2025 (2)

- July 2025 (2)

- September 2025 (2)

- November 2025 (2)

- December 2025 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- May 2024 (1)

- August 2024 (1)

- September 2024 (1)

- October 2024 (1)

- January 2025 (1)

- March 2025 (1)

- April 2025 (1)

- May 2025 (1)

- August 2025 (1)

- February 2026 (1)

- USDEC (183)

- USDEC Staff (167)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Nick Gardner (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Krysta Harden, USDEC President and CEO (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Becky Nyman (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Erica Louder (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

.png)