-

February butter, cheese exports help mitigate declines in milk powder, whey

By USDEC Staff April 6, 2022- Tweet

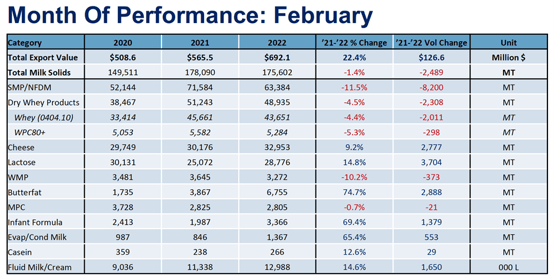

U.S. export value sets February record, reaching nearly $700 million.

Year-over-year U.S. dairy export value surged 23% in February, fueled by elevated international commodity prices and strong sales of higher-value products like cheese. At $696.8 million, U.S. suppliers set a February record.

U.S. export volume, however, posted its third straight monthly shortfall. Strong U.S. shipments of cheese, butterfat and lactose came close to offsetting declines in milk powder and whey, but fell just shy. The result: a 1% drop in U.S. export volume (milk solids equivalent) compared to the previous year.

U.S. shipments of butterfat jumped 75% to 6,755 MT. That was the biggest month for U.S. butterfat exports in nearly eight years, since April 2014. U.S. lactose exports grew 15% to 28,776 MT, and cheese gained 9% to 32,953 MT.

Nonfat dry milk/skim milk powder (NFDM/SMP) exports fell 11% (-8,200 MT) to 63,382 MT. Declines to the top two U.S. milk powder markets—Mexico (-5%, -1,296 MT) and Southeast Asia (-12%, -3,528 MT)—led the decline, but shipments were down to most major buyers.

Reduced Chinese demand continues to dampen U.S. whey exports, but overall volume in February finished better than expected, slipping only 4.5% (-2,308 MT). There were some encouraging signs in whey in February, including a 14% increase in modified whey shipments and a much stronger buying presence by Japan in the WPI sector. In February, U.S. WPI exports declined 5%, primarily due to a 67% drop in WPI shipments to China (-1,498 MT). Japan, however, increased WPI purchases from the U.S. by 164% (+1,010 MT).

For a recap of cheese performance and a look at Mexico, read on.

Cheese sets February record – Paul Rogers

U.S. cheese suppliers shipped 32,953 MT in February, setting a record for the month and extending the year-over-year growth streak to eight consecutive months. February volume topped the previous year by 9% (+2,777 MT).

Japan led the increase (+59%, +1,401 MT), but almost all major markets posted gains: Mexico +5% (+394 MT); Central America +26% (+527 MT); Southeast Asia +39% (+661 MT); South America +32% (+422 MT, rebounding from a lackluster January); the Caribbean +30% (+369 MT); and South Korea +4% (+204 MT).

U.S. cheese sales to the Middle East/North Africa fell 22% (-596 MT), but that was against a very strong February 2021 when U.S. suppliers shipped 2,687 MT to the region.

.jpg?width=554&name=Cheese%20chart%20for%20Feb%20trade%20stats10%20(4).jpg)

Global cheese demand remains strong, and tight supply and favorable pricing continue to benefit U.S. suppliers. Much of the U.S. cheese growth in February came from a 59% increase in cheddar volume, which is being primarily driven by competitive pricing, available supply and good demand.

Through the first two months of the year, U.S. cheese shipments were up 13%, and the United States has gained share on our two major competitors: the EU and New Zealand. New Zealand cheese exports through February were down 6.5% vs. the first two months of 2021; EU cheese exports in January (latest data available) fell 3%.

February Contraction for Mexico – Stephen Cain

The recovery in U.S. dairy exports to Mexico has somewhat stalled as of late. In February, overall U.S. dairy exports to Mexico contracted 10% (-3,987 MT) in terms of milk solids equivalent but jumped 28% in value. Strong prices helped boost overall growth in value of exports despite the decline in volume.

Year-over-year U.S. NFDM/SMP exports to Mexico dropped 5% (-1,296 MT) in February, while whey product shipments fell 25% (-894 MT). Cheese (+5%, +394MT), lactose (+18%, +400 MT) and butterfat (+133%, +508 MT) all gained.

Conflicting factors are buffeting demand for dairy imports. On the one hand, Mexican milk production has been stumbling. Despite official statistics stating production has been consistently up around 2% over the last year, we hear that many processing facilities are struggling to run at full capacity, with some running as much as 40% below capacity.

While the government remains optimistic about milk production in 2022, Mexico’s leading dairy trade association, Femeleche, has pushed back against the official statistics and expects production to be down by 3.3% this year. This tighter domestic environment for milk is supportive of U.S. imports into the country, and it is likely to continue in 2022. However, a strong dollar could still temper demand.

While the peso has strengthened against the U.S. dollar in the last few weeks, it’s still near some of the weakest levels it’s been against the dollar in years. A peso that doesn’t stretch quite as far as it used to stretch may challenge U.S. exports.

In addition to the challenging currency environment, prices are also likely testing Mexican buyers’ willingness to pay, especially for NFDM. NFDM prices are roughly 34% higher today than they were six months ago and 55% higher than they were a year ago. Despite the tighter domestic milk environment in Mexico, these higher prices may be pushing buyers to limit their purchases, buy only what they need in the near term, and push off heavier volumes in the hopes that prices will come down.

Learn more about global dairy markets:

-

Dairy export value keeps climbing in January even as supply constrains volume

-

U.S. dairy exports set multiple records in 2021

-

NFDM/SMP, cheese and lactose led the way to double-digit export growth in November

Subscribe to the U.S. Dairy Exporter Blog

The U.S. Dairy Export Council fosters collaborative industry partnerships with processors, trading companies and others to enhance global demand for U.S. dairy products and ingredients. USDEC is primarily supported by Dairy Management Inc. through the dairy farmer checkoff. How to republish this post.

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (67)

- Africa (6)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (20)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (9)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farmer leaders (1)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Future trends (1)

- Geographical Indications (GIs) (10)

- Global Marketing (86)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (271)

- Member Services (17)

- Mexico (41)

- Middle East (9)

- Middle East & North Africa (3)

- Middle East/North Africa (9)

- Milk (4)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (19)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (329)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (26)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- April 2015 (11)

- December 2015 (11)

- March 2014 (10)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- January 2026 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- April 2024 (2)

- June 2024 (2)

- July 2024 (2)

- November 2024 (2)

- December 2024 (2)

- February 2025 (2)

- June 2025 (2)

- July 2025 (2)

- September 2025 (2)

- November 2025 (2)

- December 2025 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- May 2024 (1)

- August 2024 (1)

- September 2024 (1)

- October 2024 (1)

- January 2025 (1)

- March 2025 (1)

- April 2025 (1)

- May 2025 (1)

- August 2025 (1)

- February 2026 (1)

- USDEC (183)

- USDEC Staff (167)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Nick Gardner (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Krysta Harden, USDEC President and CEO (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Becky Nyman (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Erica Louder (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

.png)