-

U.S. dairy exports set multiple records in 2021

By William Loux February 8, 2022- Tweet

But three big headwinds for 2022 warrant caution in expecting another year of double-digit growth.

In December, U.S. dairy export value rose 17% even as year-over-year volume fell 4% for the month. Cheese exports, particularly to Mexico (+17%, +1,239 MT), starred during the month, posting a healthy gain of 20% (+5,204 MT). But flat milk powder volume and a significant decline in whey shipments in December provided a low-key finish to what turned out to be the best year ever for U.S. dairy exports.

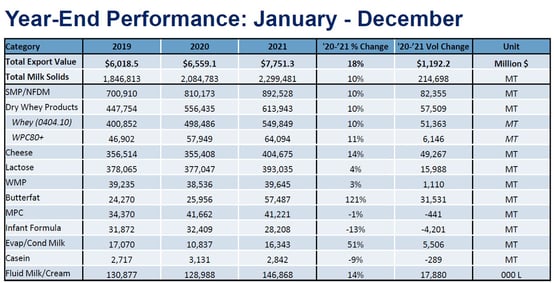

An overall rebound in exports to Mexico and a sharp increase in whey and milk powder to China led widespread gains across products and geographies in 2021. With the December numbers now published, we see that U.S. dairy exports secured record highs in many key metrics and in the largest export categories:

- Total U.S. dairy export VOLUME grew by 10% (+214,698 MT MSE) over 2020 to reach 2.3 million metric tons of milk solids (MSE) shipped to overseas customers;

- Total U.S. dairy export VALUE surpassed the highs of 2014 to reach $7.75 billion in 2021, an 18% increase year over year;

- Cheese volumes also beat the 2014 record with a final total of 404,675 MT (+14%, +49,267 MT);

- NFDM/SMP built upon a successful 2020 (the previous record) and grew an additional 10% (+82,355 MT) to set a new record; and

- Whey exports – in both high- and low-protein varieties – reached new levels with 613,943 MT of whey products exported in 2021, also a gain of 10% (+57,509 MT).

More data and graphs from the latest trade data report can be found here.

There were multiple other records and success stories in the full-year data – whether broken down by market or product - that you can read more about in our press release.

Indeed, by all metrics, 2021 was a tremendous success for U.S. dairy exports.

What then does 2022 hold? Is a third year in a row of double-digit growth possible? To this analyst’s eyes – yes, it’s possible, but it certainly won’t be easy.

First, in 2021, U.S. dairy exporters managed to find success despite substantial headwinds from logistics. Lack of trucking availability, shortages of equipment and containers, carrier companies ignoring export orders for blank loads and, most recently, declining productivity at ports, have all taken their toll on U.S. exports – even though U.S. exports have clearly been positive.

Slower delivery times, higher shipping costs, unexpected fees and reputational damage all hurt U.S. exporters in key markets overseas and continue to limit the ability of U.S. dairy exports to reach their full potential due to lost sales, weaker returns, higher expenses, or all the above.

As we look to 2022, we expect many of these headwinds to remain - even as USDEC staff and policymakers look to find ways of easing the burden.

Fundamentally, labor issues at ports and lack of trucks to move product off crowded docks has limited the throughput of container vessels even as plenty of ships wait to be unloaded. Additionally, carrier companies continue to eschew containers filled with U.S. dairy products for empty ones. Given that the sharp price differential of Asia-to-U.S. freight rates compared to U.S.-to-Asia is expected to continue (driven by U.S. goods consumption), the practice of favoring empties will likely persist absent regulatory or legislative steps to tackle it head-on.

-Feb-08-2022-10-06-21-72-PM.jpg?width=554&name=Chart1%20(2)-Feb-08-2022-10-06-21-72-PM.jpg)

Second, slower-than-average U.S. milk production could limit product availability for export in the short term – even if overseas demand for U.S. dairy is plentiful.

In both 2020 and 2021, U.S. dairy exports grew by twice as much as domestic sales. However, it is worth noting, the supply environment was substantially different with milk production growing by 1.9% in 2020 and 1.7% in 2021.

For 2022, slower growth in milk production (and thus dairy product production) combined with the usual expansion of domestic consumption, as well as port congestion adding costs to exporting, will likely mean fierce competition to secure product. Certainly, exports will be a key component of that demand picture regardless of the short-term supply forecast, but more U.S. demand to satiate makes double-digit export growth challenging (but again, not impossible).

-Feb-08-2022-10-07-13-08-PM.jpg?width=554&name=Chart2%20(2)-Feb-08-2022-10-07-13-08-PM.jpg)

I do want to point out that we remain incredibly bullish about the U.S. having a clear opportunity to be the growing dairy supplier to the world. U.S. milk production growth should return to above 1% by the second half of 2022. And in the longer term, underlying supply-demand fundamentals, a supportive investment and policy environment and U.S. dairy’s commitment to international customers all signal long-term export growth potential. But short-term tightness in the market is likely to create headwinds to substantial growth in the near term.

Finally, on the data side of things, year-over-year comparisons to 2021 data will be strong across most major markets and products.

Perhaps the data-geekiest point, U.S. exports will be trying to match a record year with no laggards by market or product that would suggest low-hanging opportunities for booming volumes. Trade to all our major markets except New Zealand grew year-over-year, and all of the United States’ primary export products (along with most of the secondary ones) grew by double digits in 2021.

This final point is in sharp contrast to the comparisons used in 2020 and even 2021 as there were substantial opportunities in several markets. In 2020, U.S. exports to Southeast Asia had significant untapped potential after European intervention SMP flooded into the market at below-market prices the year prior. Additionally, the U.S.-China Phase I Agreement re-opened the door for U.S. dairy exports into the country in January 2020. By 2021, there was still plenty of opportunity to recapture market share in a booming Chinese market, particularly post-African Swine Fever, and Mexico’s import demand was sharply recovering after suffering from the worst of the COVID-19 pandemic in 2020.

To be 100% clear, there remain plenty of opportunities for growth in U.S. dairy exports. Demand is expanding around the world and competitors are struggling to keep up. But unlike the past two years where volumes were boosted by recovery in several key markets, 2022 growth will need to be built exclusively by new business.

Ultimately, even as export growth faces challenges in the short-term keeping up this record-setting pace, we believe U.S. dairy is still set up for long-term, sustainable success in growing export volume and value.

(For more information on our expectations of 2022, check out Part I and Part II of our recent “signpost” article, breaking down the key factors to influence global dairy consumption and trade in the year ahead.)

Learn more about global dairy markets:

-

NFDM/SMP, cheese and lactose led the way to double-digit export growth in November

-

Cheese, butterfat exports soar in October; milk powder, whey lag

-

Increases across the board keep U.S. dairy exports on pace for another record year

-

Seventh straight month of growth for U.S. dairy exports

Subscribe to the U.S. Dairy Exporter Blog

The U.S. Dairy Export Council fosters collaborative industry partnerships with processors, trading companies and others to enhance global demand for U.S. dairy products and ingredients. USDEC is primarily supported by Dairy Management Inc. through the dairy farmer checkoff. How to republish this post.

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (67)

- Africa (6)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (20)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (9)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farmer leaders (1)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Future trends (1)

- Geographical Indications (GIs) (10)

- Global Marketing (86)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (271)

- Member Services (17)

- Mexico (41)

- Middle East (9)

- Middle East & North Africa (3)

- Middle East/North Africa (9)

- Milk (4)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (19)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (329)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (26)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- April 2015 (11)

- December 2015 (11)

- March 2014 (10)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- January 2026 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- April 2024 (2)

- June 2024 (2)

- July 2024 (2)

- November 2024 (2)

- December 2024 (2)

- February 2025 (2)

- June 2025 (2)

- July 2025 (2)

- September 2025 (2)

- November 2025 (2)

- December 2025 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- May 2024 (1)

- August 2024 (1)

- September 2024 (1)

- October 2024 (1)

- January 2025 (1)

- March 2025 (1)

- April 2025 (1)

- May 2025 (1)

- August 2025 (1)

- February 2026 (1)

- USDEC (183)

- USDEC Staff (167)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Nick Gardner (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Krysta Harden, USDEC President and CEO (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Becky Nyman (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Erica Louder (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

.png)