-

NFDM/SMP, cheese and lactose led the way to double-digit export growth in November

By USDEC Staff January 6, 2022- Tweet

With one month of data to go in 2021, U.S. dairy exports are finishing on a high note.

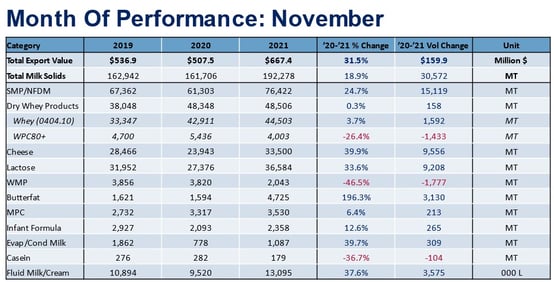

U.S. dairy exports rebounded sharply in November, climbing 19% in volume (milk solids equivalent) and an astonishing 32% in value compared to the same month in 2020. Nonfat dry milk/skim milk powder (NFDM/SMP) and cheese led the way with growth rates of 25% (+15,119 metric tons, or MT) and 40% (+9,556 MT), respectively.

Through the first 11 months of 2021, U.S. dairy export volume (milk solids equivalent) was up 12% and already surpassed the annual record established in 2020. Additionally, U.S. dairy export value also ran 18% ahead of the same period the previous year, reaching $7.14 billion through November.

More data and graphs from November's trade data can be found here.

NFDM/SMP rebounds – Paul Rogers

For the past three years, we have seen strong October NFDM/SMP shipments followed by weaker Novembers. This year, that pattern reversed.

After shipping 66,862 MT in October (only the second month in 2021 that U.S. volume failed to top 70,000 MT), U.S. NFDM/SMP exports boomeranged to 76,422 MT in November—easily a record for the month.

-Jan-06-2022-08-21-19-82-PM.jpg?width=554&name=Chart2%20(2)-Jan-06-2022-08-21-19-82-PM.jpg)

Gains were broad-based, though clearly led by Southeast Asia. U.S. shipments to Southeast Asia grew 37% (+7,275 MT) year-over-year, driven by significant increases to Vietnam (+292%) and the Philippines (+76%). Backlogged product finally making it to buyers likely contributed to regional volumes in November, but the percentage gain to Southeast Asia also benefitted from a weak November 2020. As a result, the United States shipped only 19,611 MT to Southeast Asia in November 2020—which was the lowest monthly total of the year up until that point (December 2020 dipped to 17,181 MT).

U.S. suppliers also posted significant increases in most major markets beyond Southeast Asia: South America (+37%, +2,834 MT), Mexico (+9%, +2,229 MT), Central America (+196%, +2,024 MT) and China (+27%, +726 MT).

An exponential increase in exports to Honduras—1 MT in 2020 vs. 1,372 MT in 2021—drove the Central America total, while a 45% increase (+2,417 MT) to Colombia (presumably in anticipation of January’s quota opening) lifted South American volumes.

Mirroring the spike to Honduras, U.S. NFDM/SMP shipments to Yemen jumped from 25 MT in November 2020 to 1,325 MT in 2021. Both nations made a rare appearance as top-10 U.S. NFDM/SMP destinations in November.

Global NFDM/SMP demand remains strong. In the months ahead, readers should watch whether the U.S. price advantage with the EU and New Zealand, which has narrowed significantly since September, will affect U.S. performance as we move into the New Year.

Cheese soars – William Loux

U.S. cheese exports have surged in the second half of 2021, placing U.S. cheese exports on pace to finally surpass the annual export record set in 2014. Strong demand from the United States’ major partners and weak production from primary competitors have been crucial to accelerated sales. In November, volumes to Mexico particularly shone with an increase of 65% (+3,539 MT), though the rest of Latin America was not far behind (+46%, +2,313 MT). South Korea (+48%, +1,745 MT) and Australia (+107%, +1,157 MT) also had strong months.

-Jan-06-2022-08-22-15-96-PM.jpg?width=554&name=Chart3%20(2)-Jan-06-2022-08-22-15-96-PM.jpg)

Indeed, the U.S. has seen growth in multiple cheese types as economies rebounded in 2021, tourism returned, and consumers went back to restaurants regularly. However, digging into the data more, we see that cheddar exports, in particular, are having a resurgence. Over the past several years, cheddar production has primarily been geared towards the domestic market, with exports increasing by less than 3% per year since 2015.

However, with expanded capacity in the U.S. and competitive pricing, the amount of cheddar cheese moving overseas has reached its highest point since 2015. Year-to-date cheddar exports have increased by 30%, an increase of more than 10,000 MT. In just the last three months, volumes increased more than 7,000 MT year-over-year. Although from a much smaller base, cheddar cheese exports are growing at the fastest pace of any of the major cheese export categories this year.

-Jan-06-2022-08-22-55-79-PM.jpg?width=554&name=Chart4%20(2)-Jan-06-2022-08-22-55-79-PM.jpg)

Overall, most of that growth is attributable to Japan's increased purchasing of cheddar for further processing. In what is arguably the most competitive cheese import market in the world, U.S. competitors failed to have sufficient product for Japanese buyers and U.S. prices were much more in line with global benchmarks, both of which have enabled the U.S. to gain market share.

Looking ahead, the picture for cheese exports – particularly cheddar – appears favorable in the new year. International cheese demand appears resilient despite renewed COVID outbreaks (as GDT climbed again on Tuesday), U.S. prices remain competitive and, even with tight milk supplies domestically, cheddar cheese plants continue to run at full capacity. All those factors should support further growth in cheese exports in 2022.

And whey holds steady – Stephen Cain

Total whey exports in November were essentially flat (+0.3%, +158 MT) compared to November of last year. Increased exports to Southeast Asia (+26%, +2,249 MT), Japan (+40%, +894 MT), South Korea (+22%, +455 MT), Mexico (+40%, +1,269 MT) and other smaller partners helped offset the strong decline in shipments to China (-24%, -5,245 MT).

For this month, let’s dig into whey protein concentrates (WPC) specifically, as exports were down 18% (-3,233 MT) in November with strong declines from China (-40%, -3,950 MT) and Canada (-12%, -301 MT).

Two factors are likely playing into the lower exports.

First, export prices of U.S. WPC are the highest they’ve been in roughly eight years. November export prices reached $4,576/MT, nearly 60% higher than the average 2020 price of $2,901/MT. These higher prices are pushing buyers to purchase only what they need in the short term.

Second, there is likely less exportable supply available. U.S. production of WPC did grow in October as output reached its highest monthly level since early 2018. Usually, with higher production, exports would be the primary destination for the increased volume. However, strong domestic demand (+6% YTD) has kept the product at home and contributed to an overall decline in WPC inventory of 2% year-over-year. This data tracks with the renewed focus on health and wellness as consumers returned to gyms and pursued healthier lifestyles; both driving higher value protein consumption.

So, while exports of WPC may be down, it is unlikely that reduced international demand is the culprit, but rather high prices and tighter exportable supply slowing export growth.

-Jan-06-2022-08-23-28-31-PM.jpg?width=554&name=Chart5%20(2)-Jan-06-2022-08-23-28-31-PM.jpg)

Learn more about global dairy markets:

-

Cheese, butterfat exports soar in October; milk powder, whey lag

-

Increases across the board keep U.S. dairy exports on pace for another record year

-

Seventh straight month of growth for U.S. dairy exports

-

Cheese and whey drive U.S. dairy exports to 6th straight month of growth

Subscribe to the U.S. Dairy Exporter Blog

The U.S. Dairy Export Council fosters collaborative industry partnerships with processors, trading companies and others to enhance global demand for U.S. dairy products and ingredients. USDEC is primarily supported by Dairy Management Inc. through the dairy farmer checkoff. How to republish this post.

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (67)

- Africa (6)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (20)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (9)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farmer leaders (1)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Future trends (1)

- Geographical Indications (GIs) (10)

- Global Marketing (86)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (271)

- Member Services (17)

- Mexico (41)

- Middle East (9)

- Middle East & North Africa (3)

- Middle East/North Africa (9)

- Milk (4)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (19)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (329)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (26)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- April 2015 (11)

- December 2015 (11)

- March 2014 (10)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- January 2026 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- April 2024 (2)

- June 2024 (2)

- July 2024 (2)

- November 2024 (2)

- December 2024 (2)

- February 2025 (2)

- June 2025 (2)

- July 2025 (2)

- September 2025 (2)

- November 2025 (2)

- December 2025 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- May 2024 (1)

- August 2024 (1)

- September 2024 (1)

- October 2024 (1)

- January 2025 (1)

- March 2025 (1)

- April 2025 (1)

- May 2025 (1)

- August 2025 (1)

- February 2026 (1)

- USDEC (183)

- USDEC Staff (167)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Nick Gardner (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Krysta Harden, USDEC President and CEO (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Becky Nyman (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Erica Louder (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

.png)