-

Dairy export value keeps climbing in January even as supply constrains volume

By William Loux March 8, 2022- Tweet

Higher prices and increased cheese exports drove export value by 16% in the first month of the year.

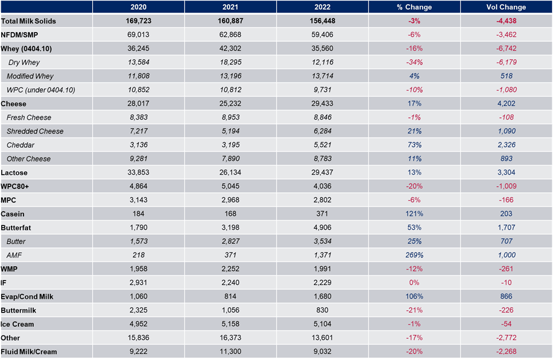

While January’s total export value grew 16% from a year ago (+$80.6 million to $586 million), the volume of dairy solids (MSE) declined by 3% (-4,438 MT MSE).

There were two key reasons for the divergence between volume and value. 1) A tighter global market raised unit values across the dairy complex. For example, the average price of nonfat dry milk/skim milk powder (NFDM/SMP) exports increased by $739 per metric ton (MT) from the previous January. Dry whey rose by $458/MT, and cheese increased by $68/MT. 2) The United States’ export portfolio increased in higher-per-unit-value products like cheese (volume up 17% year-over-year, +4,202 MT) and butterfat (+53%, +1,707 MT).

However, U.S. exports in its two biggest categories, NFDM/SMP and whey, lagged prior year volumes.

NFDM/SMP fell 6% (-3,462 MT) year-over-year caused by a 15% decline to Mexico (-3,587 MT), a 47% decline to South America (-2,544 MT) and a 41% fall to the Middle East/North Africa (-1,246 MT). Still, there were some bright spots for NFDM/SMP, with Southeast Asia up 9% (+2,117 MT) and exports to China doubling (+98%, +1,672 MT) despite logistics constraints shipping to East Asia.

But the major volume decline came from whey, which fell 16% (-6,742 MT) and which we’ll explore more in-depth in the section below.

U.S. dairy exports (month of January, data in metric tons)

We do want to reiterate before going into our major takeaways that it is important not to overstate one month of data. Overall, as we mentioned in our final report of 2021, we anticipate that export volume will likely be choppy in the first half of 2022 given supply chain difficulties, slower supply growth and tough year-over-year comparisons. And that is exactly what we saw in January.

With that in mind, here are our key takeaways from January’s data:

China’s Whey Demand for Feed Use Falling – William Loux

As mentioned above, the major driver behind the decline in dairy export volume is the decline in whey demand, particularly from China. In January, U.S. whey exports to China under HS Code 0404.10, which includes predominantly sweet whey and permeate, dropped by 41% (-9,163 MT). If that sounds familiar, it’s because December’s whey exports to China fell by 52% (-13,034 MT) and November’s fell by 21% (-4,093 MT). So, this decline is more than a one-month blip.

As for the reasons for the decline, we can point to two main factors: China’s falling demand and tight sweet whey supplies.

On the first point, most U.S. low-protein whey products shipped to China end up in the animal feed sector, since the market for whey permeates for food use—a key success in the U.S.-China Phase I agreement—remains a relatively new, albeit growing, market.

-Mar-08-2022-09-26-29-45-PM.jpg?width=554&name=Chart2%20(2)-Mar-08-2022-09-26-29-45-PM.jpg)

In that feed sector, the finances for China’s pig farmers have struggled of late. Pork prices have fallen precipitously from their African Swine Fever (ASF) highs as pork supply rebounded and anecdotes suggest that China’s consumers have switched to other animal proteins, namely chicken. Those lower prices have been compounded by elevated feed costs. The combination of lower prices and higher costs have eaten into China’s pork industry’s margins and thus dampened the incentives to expand production (and thus whey usage).

Beyond a rebalancing market in China, supply of sweet whey—which accounted for the majority of the decline in January—has been limited and expensive. Dry whey prices are at record highs, and U.S. dry whey production fell by 12% in the second half of 2021, caused by milk production slowing and demand for protein in the health and wellness sector pushing more whey towards WPC80 and WPI.

Looking ahead, both factors (China and supply) are likely to act as a persistent headwind to U.S. dairy export volume through the first quarter even as value is likely to stay strong.

Cheese Continues Growth Streak – Paul Rogers

U.S. cheese exports rose for the seventh consecutive month in January, increasing 17% year-over-year (+4,202 MT). Growth was more concentrated than it had been for the previous six months. A 74% jump in sales to Mexico (+3,223 MT) drove the gain, but Australia (+81%, +1,131 MT), the Caribbean (+27%, +369 MT) and Southeast Asia (+30%, +364 MT) also contributed.

On the positive side, it was the seventh straight month of year-over-year gains to Mexico and the 11th straight month to the Caribbean.

Other major U.S. cheese markets from 2021 took a breather in January. Year-over-year sales to the Middle East/North Africa fell 1% in January (after rising 39% in calendar-year 2021); exports to Central America fell 2% (after a 53% increase in 2021); and shipments to Japan fell 1% (after a 13% gain last year).

Those slowdowns might stem in part from foodservice uncertainty related to the omicron wave of the pandemic that began hitting importing nations in late November and is still making its way around the world.

In addition, the U.S. increase to Mexico should be looked at in context. The comparable volume the previous year was quite low. The United States shipped only 4,358 MT of cheese to Mexico in January 2021—the lowest volume of any month since November 2011. On the other hand, the 7,581 MT exported to Mexico in January 2021 marks the third-largest January volume ever.

More clarity on 2022 cheese demand should come in the months ahead, but the U.S. remains well-positioned from a production standpoint and in a favorable price position to meet overseas needs, with a geographic advantage to serve growing Latin American markets. Overall, sharply growing cheese exports should provide a major boost to U.S. export value.

Learn more about global dairy markets:

-

U.S. dairy exports set multiple records in 2021

-

NFDM/SMP, cheese and lactose led the way to double-digit export growth in November

-

Cheese, butterfat exports soar in October; milk powder, whey lag

-

Increases across the board keep U.S. dairy exports on pace for another record year

Subscribe to the U.S. Dairy Exporter Blog

The U.S. Dairy Export Council fosters collaborative industry partnerships with processors, trading companies and others to enhance global demand for U.S. dairy products and ingredients. USDEC is primarily supported by Dairy Management Inc. through the dairy farmer checkoff. How to republish this post.

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (65)

- Africa (6)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (19)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (9)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farmer leaders (1)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Future trends (1)

- Geographical Indications (GIs) (10)

- Global Marketing (86)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (264)

- Member Services (17)

- Mexico (41)

- Middle East (9)

- Middle East & North Africa (3)

- Middle East/North Africa (9)

- Milk (4)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (18)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (322)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (25)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- April 2015 (11)

- December 2015 (11)

- March 2014 (10)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- April 2024 (2)

- June 2024 (2)

- July 2024 (2)

- November 2024 (2)

- December 2024 (2)

- February 2025 (2)

- June 2025 (2)

- July 2025 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- May 2024 (1)

- August 2024 (1)

- September 2024 (1)

- October 2024 (1)

- January 2025 (1)

- March 2025 (1)

- April 2025 (1)

- May 2025 (1)

- USDEC (183)

- USDEC Staff (158)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Nick Gardner (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Becky Nyman (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Erica Louder (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

- Krysta Harden, USDEC President and CEO (1)

.png)