-

U.S. dairy exports post record April

By USDEC Staff June 7, 2022- Tweet

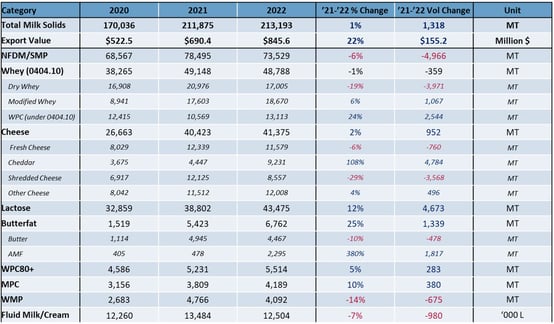

Export volume (milk solids equivalent) ekes out a 1% increase over the previous year with solid performances from multiple product sectors overcoming a 6% drop in NFDM/SMP.

U.S. dairy exports (milk solids equivalent, or MSE) grew 1% in April, setting a new volume record for the month. While the increase was modest, it marked the first year-over-year MSE gain of 2022 and built on a very strong March performance.

April was only the fifth time U.S. dairy exports topped 200,000 MT MSE—the others being March 2022 and March-May 2021. The past two months are encouraging, given that they came in the face of ongoing supply chain challenges, COVID lockdowns depressing Chinese demand, and rampant global inflation.

Year-over-year U.S. export value soared 22% to $845.6 million, second only to March 2022 for highest monthly U.S. export value.

Month of Performance: April

More data and graphs from April’s trade data can be found here.

On a straight volume basis, U.S. cheese exports grew 2% to 41,375 MT in April—only the third time they’ve exceeded 40,000 MT in a single month. Total butterfat exports grew 25% to 6,762 MT. However, that increase was attributable to a nearly five-fold increase in AMF shipments. Year-over-year U.S. butter exports fell for the first time in 17 months, dropping 10% to 4,476 MT.

U.S. lactose exports in April rose 12% to 43,475 MT. Whey product shipments were down 0.1% to 54,302 MT, although that was due wholly to a 19% decline in sweet whey (see below for more on whey).

Outside of sweet whey, the biggest U.S. dairy export decline in April came from NFDM/SMP. Volume fell 6% to 73,529 MT. As in March, U.S. suppliers were unable to duplicate last year’s spike in sales to the Middle East/North Africa (MENA). U.S. NFDM/SMP exports to the region fell 90% (-8,080 MT) compared to April 2021 as limited available supplies focused on Mexico and Southeast Asia.

On the NFDM/SMP plus side, U.S. April shipments to Southeast Asia grew 30% (+7,570 MT), aided by competitive U.S. pricing and slight improvements in U.S. port and shipping operations.

Here’s a closer look at two of April’s main developments:

U.S. cheese shines again

Cheese continues to be the U.S. export star in 2022. After shipping a record 41,693 MT of cheese in March, U.S. suppliers repeated the performance in April with 41,375 MT in exports. It was the first time the United States ever exported more than 40,000 MT in two consecutive months.Furthermore, given only 30 days in April, it was technically a second consecutive record: per-day volume in March was 1,345 MT; per-day volume in April was 1,379 MT.

Central America led growth in April (+40%, +1,189 MT) but volume gains were geographically widespread. April U.S. cheese shipments to Mexico rose 8% (+785 MT); exports to the Caribbean soared 56% (+763 MT); volume to Japan jumped 17% (+738 MT); and exports to the Middle East/North Africa rose 18% (+421 MT).

The gains were more than enough to offset year-over-year shortfalls to Australia, Korea, China and South America.

New U.S. cheddar capacity is helping to fuel the gains. Year-over-year U.S. cheddar exports more than doubled in April to 9,231 MT, with a big portion destined for Japan (likely for further processing). April U.S. cheddar shipments to Japan soared 271% to 3,409 MT.

International cheddar prices continue to favor U.S.-origin product. Even with this week’s dip in Global Dairy Trade cheddar prices and even with CME block cheddar sitting $2.28/lb. (US$5,026/MT) as of Tuesday, U.S. cheddar continues to enjoy a significant price advantage over competitors, suggesting further solid numbers could be in the offing.

Whey hangs tough

Reduced Chinese demand for sweet whey continues to undermine overall U.S. whey exports.Overall U.S. whey export volume was virtually identical to April 2021, despite a 43% decline (-4,234 MT) in shipments of sweet whey to China. U.S. sweet whey exports to all other markets grew 2% (+263 MT). And U.S. shipments of all other whey products (modified whey, WPC and WPC80+) to all markets grew 12% (+3,895 MT).

WPC80+ continued to rebound in April. After five consecutive months of year-over-year shortfalls dating back to October 2021, U.S. suppliers posted two straight year-over-year gains in March (+2%) and April (+5%).

As in cheese, WPC80+ demand was widespread geographically, led by South Korea (+152%, +399 MT), South America (+155%, +360 MT) and the UK (+83%, +284 MT).

Year-over-year U.S. WPC (less than 80% protein) exports grew 24% (+2,417 MT) in April while modified whey (primarily permeate) increased 6% (+1,035 MT). Positive demand from Asia helped drive both categories. U.S. WPC and modified whey shipments to Southeast Asia rose a combined 66% (+3,150 MT), exports to China grew 9% (+1,373 MT) and volume to South Korea increased 168% (+1,048 MT, all of it modified whey).

With no expectations for Chinese sweet whey demand to rebound in the short term, the focus moving forward will remain on other sweet whey markets and the rest of the whey complex continuing to pick up the slack.

Learn more about global dairy markets:

-

U.S. dairy exports finished Q1 strong, as value soared and volume nearly matched 2021 record

-

February butter, cheese exports help mitigate declines in milk powder, whey

-

Dairy export value keeps climbing in January even as supply constrains volume

-

U.S. dairy exports set multiple records in 2021

Subscribe to the U.S. Dairy Exporter Blog

The U.S. Dairy Export Council fosters collaborative industry partnerships with processors, trading companies and others to enhance global demand for U.S. dairy products and ingredients. USDEC is primarily supported by Dairy Management Inc. through the dairy farmer checkoff. How to republish this post.

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (67)

- Africa (6)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (20)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (9)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farmer leaders (1)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Future trends (1)

- Geographical Indications (GIs) (10)

- Global Marketing (86)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (271)

- Member Services (17)

- Mexico (41)

- Middle East (9)

- Middle East & North Africa (3)

- Middle East/North Africa (9)

- Milk (4)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (19)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (329)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (26)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- April 2015 (11)

- December 2015 (11)

- March 2014 (10)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- January 2026 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- April 2024 (2)

- June 2024 (2)

- July 2024 (2)

- November 2024 (2)

- December 2024 (2)

- February 2025 (2)

- June 2025 (2)

- July 2025 (2)

- September 2025 (2)

- November 2025 (2)

- December 2025 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- May 2024 (1)

- August 2024 (1)

- September 2024 (1)

- October 2024 (1)

- January 2025 (1)

- March 2025 (1)

- April 2025 (1)

- May 2025 (1)

- August 2025 (1)

- February 2026 (1)

- USDEC (183)

- USDEC Staff (167)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Nick Gardner (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Krysta Harden, USDEC President and CEO (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Becky Nyman (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Erica Louder (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

.png)