-

Slow whey demand in China holds back U.S. dairy exports in July

By USDEC Staff September 7, 2023- Tweet

Challenged low-protein whey exports disguised stabilization across rest of the portfolio.

As we’ve discussed in past trade data analyses, global dairy markets remain in a funk. Economic challenges in Asia combined with increased competition from Europe and New Zealand continued to limit U.S. dairy export growth in July. Positively, in most dairy products, declines seen in the second quarter did lessen or even switch to growth.

Source: USDEC, USDA

Source: USDEC, USDAFor more detailed information, as well as interactive charts and data, visit USDEC's Data Hub

NFDM/SMP exports grew for a second straight month, albeit slightly at +3% (+1,783 MT) year-over-year (YOY), almost entirely thanks to robust purchasing from Mexico (+14%, +3,529 MT). Positively, cheese exports, after a challenging second quarter, were roughly flat compared to July 2022 (-1%, -433 MT), thanks to a rebound in sales to Japan and continued growth to Latin America. Still, growth was limited as, sales to Korea and Southeast Asia still faced challenges from demand and competitors selling at lower prices. Similarly, WPC80+ and lactose shipments were effectively flat (-1%, -65 MT; and -2%, -884 MT respectively), though there remains wide variation in performance across markets.

By contrast, with most export products holding steady in July, low-protein whey exports (under the HS code 0404.10) pulled back sharply (-40%, -22,092 MT). In fact, nearly all of July’s overall decline came from weaker low-protein whey shipments. On a milk solids equivalent basis (MSE), export volume declined by 12% (-24,272 MT MSE). Surprisingly, that 12% decline is still a modest improvement compared to the 17% decline in the second quarter. This was despite low-protein whey shipments posting the lowest monthly export volume since 2019, when U.S. whey exporters faced African Swine Fever and retaliatory tariffs on shipments to China.

So, what drove the sharp turn in low-protein whey exports?

As we noted in previous releases, China is the primary driver of the decline. U.S. low-protein whey exports to the country dropped 21% (-32,898 MT) year-to-date (YTD) and that decline continued in July with exports falling 46% (-12,125 MT) to the lowest monthly level in 18 months.

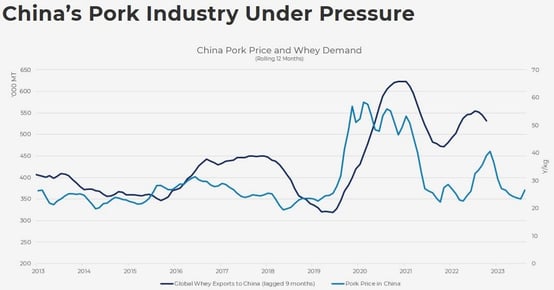

The fall in whey exports to China largely reflects weaker demand in the feed sector. Chinese pork prices declined sharply earlier in the year, limiting increases in pork production and therefore whey needs. Pork prices are an effective leading indicator for Chinese low-protein whey for feed demand as it signals expansion incentives for local pork producers–

Positively, pork prices have increased 15% from ¥23.65/kg in late July to ¥27.26/kg today. We believe the increase thus far has primarily been driven by lower pork supply rather than increased consumer demand. Additionally, we anticipate a modest seasonal increase in pork consumption in the back half of the year. That improved demand amidst a tighter pork supply should incentivize pork production expansion in China, which should support low-protein whey export recovery towards the end of 2023 and into 2024.

Source: USDEC, Trade Data Monitor, Ministry of Agriculture

Source: USDEC, Trade Data Monitor, Ministry of AgricultureStill, concerns around China’s economy continue to cast doubt on overall consumption within the country – both for pork and dairy. While we anticipate a demand recovery later this year, it is far from certain that China’s demand volatility will stabilize.

Other Relevant Datapoints from July’s Trade Data

- Improved price competitiveness helped support U.S. cheese exports in July. U.S. cheese shipments to Japan had their strongest month of the year, climbing 29% (+935 MT). Similarly, exports to Chile, China and Australia all improved. Even Korea, where cheese exports still lagged 2022 volumes for the month of July by 23% (-1,234 MT), the volume was still notably stronger than the first half of the year (-47% through June). Looking ahead, this improvement in exports should continue in August data, but Q4 cheese exports still face headwinds with lower European and Oceania prices.

- The only cheese category to show growth remains grated/powdered cheese. Shipments of grated/powdered cheese (which is primarily mozzarella) are up 38% YTD (+21,103 MT) with month-of exports even better (+52%, +4,259 MT). While Colby and blue cheese did climb, the increase was negligible (+29 MT and +10 MT, respectively). We’ve seen shredded exports climb to many markets, but Mexico has been the clear engine of growth (+138%, +21,103 MT YTD). Tighter milk production in the U.S. keeping domestic prices elevated above global levels and slower mozzarella production may slow this rapid growth of shredded varieties as we move later in the year.

- WPC80+ exports improved in critical emerging markets even as Japan’s demand slowed. U.S. shipments of high-protein whey continued to excel in Brazil as sports nutrition use has taken off (+67%, +236 MT in July; +108%, +2,312 MT YTD). China, too, showed sizeable growth again in July (+17%, +194 MT for the month; +38%, +2,187 MT). Unfortunately, trade to Japan slowed (-26%, -278 MT), even as YTD shipments remain positive (+6%, +451 MT). Looking ahead, even as WPC80 and WPI prices have tightened of late, they remain within a historically normal range, which should maintain international demand growth and production innovation featuring dairy proteins through the end of the year.

- For the second month in a row, U.S. NFDM/SMP exports to Southeast Asia (SEA) held close to flat. U.S. NFDM/SMP dropped just 45 MT to the region. This is a marked improvement from earlier this year with Vietnam in particular showing significant growth for the month (+206%, +2,333 MT). Still, much of this stabilization is due to weaker year-over-year comparisons as June 2022 was when NFDM/SMP shipments to the region first declined sharply. Optimistically, economic recovery and more favorable comparisons should support improved exports to SEA later in the year, but competition remains fierce.

- Butter shipments fell sharply, largely due to sales to Bahrain going to effectively zero. U.S. butter exports to Bahrain fell by 99.7%, dropping from 2,083 MT in July 2022 to just 7 MT in July 2023. By comparison, aggregate butter exports declined by 61% (-3,730 MT) as U.S. prices diverged from the global prices. U.S. butter prices remain above world levels due to strong domestic sales and slower milk production, which is likely to limit butter exports moving forward.

Learn more about global dairy markets:

-

Dairy exports still challenged by global headwinds in June; What does the second half hold?

-

U.S. dairy exports lagged in May as global headwinds persist

-

Weaker demand and increased competition dent U.S. dairy exports in April

Subscribe to the U.S. Dairy Exporter Blog

The U.S. Dairy Export Council fosters collaborative industry partnerships with processors, trading companies and others to enhance global demand for U.S. dairy products and ingredients. USDEC is primarily supported by Dairy Management Inc. through the dairy farmer checkoff. How to republish this post.

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (67)

- Africa (6)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (20)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (9)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farmer leaders (1)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Future trends (1)

- Geographical Indications (GIs) (10)

- Global Marketing (86)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (272)

- Member Services (17)

- Mexico (41)

- Middle East (9)

- Middle East & North Africa (3)

- Middle East/North Africa (9)

- Milk (4)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (19)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (330)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (26)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- April 2015 (11)

- December 2015 (11)

- March 2014 (10)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- January 2026 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- April 2024 (2)

- June 2024 (2)

- July 2024 (2)

- November 2024 (2)

- December 2024 (2)

- February 2025 (2)

- June 2025 (2)

- July 2025 (2)

- September 2025 (2)

- November 2025 (2)

- December 2025 (2)

- February 2026 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- May 2024 (1)

- August 2024 (1)

- September 2024 (1)

- October 2024 (1)

- January 2025 (1)

- March 2025 (1)

- April 2025 (1)

- May 2025 (1)

- August 2025 (1)

- USDEC (183)

- USDEC Staff (168)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Nick Gardner (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Krysta Harden, USDEC President and CEO (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Becky Nyman (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Erica Louder (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

.png)