-

Weaker demand and increased competition dent U.S. dairy exports in April

By USDEC Staff June 7, 2023- Tweet

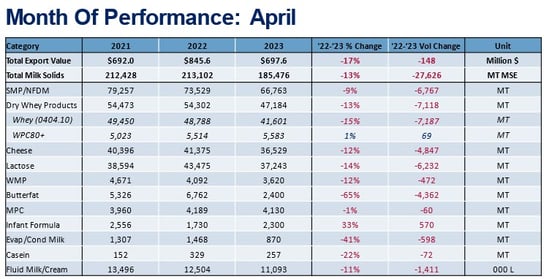

U.S. dairy exports declined by 13% in milk solids equivalent compared to the same month in 2022.

In milk solids equivalent (MSE) terms, April U.S. dairy exports had their worst year-over-year decline in exactly four years. The softness in April exports impacted virtually all the major product categories. Cheese, nonfat dry milk/skim milk powder (NFDM/SMP), low-protein whey, lactose, butterfat, whole milk powder (WMP) and fluid milk/cream all lagged prior-year levels. Of the major products only WPC80+ rose and even that was only by 1%.

In total, the 13% drop in April shipments pulled year-to-date export performance down to -0.3% MSE. Value took an even greater hit, falling 17%, as the recent downturn in dairy product prices is being reflected in the data. Year-to-date value was down 3% through April.

Visit USDEC’s Data Hub for more detailed information

While we anticipated weaker export performance to show up in the data in Q2, particularly in cheese, the scale of the pullback and the variety of products impacted is a surprise.

As we have stated many times, we always caution against over-emphasizing a single month’s worth of data. However, it’s still worth answering the questions of 1) what drove this sharp turn in export performance after several years of consistent growth, and 2) how long should we expect this downturn to persist?

What drove April’s downturn?

At its simplest, global dairy demand has weakened in 2023 at the same time that competition has increased from Europe and New Zealand.

On the demand side, China remains the biggest drag on the global market. Last year, global trade to the largest dairy import market dropped by 22%. This year, while imports have stabilized, they remain subdued, growing by just 2% in the first quarter as a large portion of WMP and fluid milk imports have been displaced by increased domestic production. More recently, weaker margins for pork producers in China have dampened the country’s appetite for whey for feed, which directly impacts U.S. exports.

In addition to the direct impact on U.S. exports, continued weakness in China’s import demand has also sharply increased competition from New Zealand in other key U.S. markets (Southeast Asia, Japan) and products (cheese, SMP), as the Oceania exporter pivoted away from WMP to China. To illustrate this, despite New Zealand production and exports declining in 2022, the decline in China’s WMP purchases effectively increased supply available to the rest of the world by 15% in milk solids equivalent.

However, the challenges in the international environment are not limited to China and New Zealand. Inflation and economic headwinds have dampened consumer demand globally with particularly severe impacts on developing markets in Asia and Africa. Reflecting this weaker demand, U.S. sales to Southeast Asia – still the United States’ second largest market by volume – lagged 2022 volumes by 19% through April.

Compounding all of this, European milk production picked up sharply late last year (+1.2% year-over-year from October 2022 to March 2023) as weather improved and record high milk prices (that persisted even after product prices eased) incentivized additional production. With weak demand within the EU, the surge in milk production was directed towards gouda and mozzarella as well as butter and SMP, leading to a sharp drop in European product prices, effectively undercutting U.S. exports in many key markets.

Expectations moving forward

Clearly, there are headwinds to U.S. dairy exports. Indeed, we’ve highlighted the challenges U.S. dairy exports would face this year for several months. But was April just a singular blip or should we expect further declines?

We expect the next several months of trade data will show similar results, particularly on shipments to Asia, where competition has been particularly fierce and the demand headwinds the strongest.

But as we look towards the later part of the year, we’re optimistic exports will return to growth. Latin America is expected to remain a bright spot for U.S. dairy exports as shipments to Mexico – even in April – remained positive. Additionally, U.S. cheese prices have returned to parity compared to European counterparts which should support a rally in Q3 and Q4 cheese exports to Asia. On top of this, weaker farmgate milk prices within the EU are liable to slow down the bloc’s milk production growth, which in turn should lend support to the market and open opportunities for U.S. exporters again on the ingredient side.

Still, plenty of questions remain on demand in the short-term, particularly in China, Southeast Asia and North Africa. But even so, the U.S. remains well placed to weather the current storm and seize long-term growth opportunities around the world.

Learn more about global dairy markets:

-

U.S. dairy exports dip for first time in a year

-

U.S. dairy exports eke out another volume increase in February

-

U.S. dairy exports start strong in 2023

-

U.S. dairy exports finished record 2022 on a high note

Subscribe to the U.S. Dairy Exporter Blog

The U.S. Dairy Export Council fosters collaborative industry partnerships with processors, trading companies and others to enhance global demand for U.S. dairy products and ingredients. USDEC is primarily supported by Dairy Management Inc. through the dairy farmer checkoff. How to republish this post.

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (67)

- Africa (6)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (20)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (9)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farmer leaders (1)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Future trends (1)

- Geographical Indications (GIs) (10)

- Global Marketing (86)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (272)

- Member Services (17)

- Mexico (41)

- Middle East (9)

- Middle East & North Africa (3)

- Middle East/North Africa (9)

- Milk (4)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (19)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (330)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (26)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- April 2015 (11)

- December 2015 (11)

- March 2014 (10)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- January 2026 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- April 2024 (2)

- June 2024 (2)

- July 2024 (2)

- November 2024 (2)

- December 2024 (2)

- February 2025 (2)

- June 2025 (2)

- July 2025 (2)

- September 2025 (2)

- November 2025 (2)

- December 2025 (2)

- February 2026 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- May 2024 (1)

- August 2024 (1)

- September 2024 (1)

- October 2024 (1)

- January 2025 (1)

- March 2025 (1)

- April 2025 (1)

- May 2025 (1)

- August 2025 (1)

- USDEC (183)

- USDEC Staff (168)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Nick Gardner (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Krysta Harden, USDEC President and CEO (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Becky Nyman (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Erica Louder (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

.png)