-

U.S. dairy exports lagged in May as global headwinds persist

By William Loux July 6, 2023- Tweet

WPC80+ is the sole product category to grow in May as year-over-year MSE export volume slips 13%.

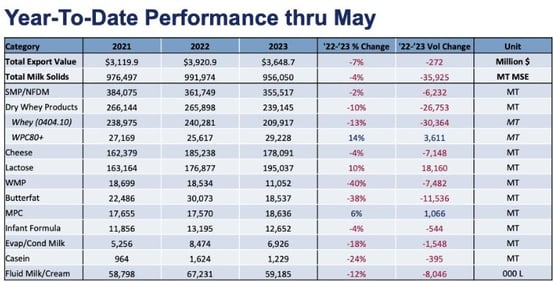

Last month, we laid out the key reasons why U.S. dairy exports were liable to struggle through the middle part of the year. As we examine May’s data, that analysis still holds true, as exports declined for the third straight month. U.S. dairy exports dropped 13%, the equivalent of 29,296 metric tons (MT) milk solids equivalent (MSE), as nearly all products fell below prior-year levels.

Cheese continued to struggle, declining 18% (-7,494 MT) – reflecting the uncompetitive prices that persisted for much of the fourth quarter of last year and into the first quarter of 2023 – as did low-protein whey exports (-29%, -15,950 MT). Positively, nonfat dry milk/skim milk powder (NFDM/SMP) held close to even (-3%, -2,221 MT) and WPC80+ trade increased sharply (+17%, +945 MT).

As always, we recommend against overemphasizing one month’s worth of results and remind readers of the lagging nature of trade data. Instead, we should focus on what the data tells us about market conditions and opportunities moving forward. Ultimately, the data reflects the saturated condition of the global dairy market as economic headwinds dent demand in Asia and the United States’ global competitors maximize the benefit of improved supply. But positively, Latin America remains a beacon of hope, with Mexico in particular continuing to impress.

Looking ahead, U.S. prices, particularly for cheese and proteins, have been much more competitive internationally (at least on a spot basis) and affordable to global consumers recently compared to earlier in the year. This should boost U.S. exports in the third quarter, but with the demand headwinds in Asia likely to remain through the end of the year, we expect limited upside for U.S. dairy exports until economic conditions improve or competitors’ milk production slows down.

.jpg?width=554&height=296&name=Chart2%20for%20May%20trade%20stats%20(3).jpg)

For more detailed information, as well as interactive charts and data, visit USDEC's Data Hub

Cheese sales remain slow

U.S. cheese exports fell 18% (-7,494 MT) to 33,149 MT in May. It was the largest year-over-year volume decline since the summer of 2015, when the Russian embargo on EU cheese led to EU suppliers shifting their focus to burgeoning U.S. export markets.

The U.S. posted significant drops to its two largest cheese markets in Asia—South Korea (-59%, -4,408 MT) and Japan (-44%, -2,347 MT)—and a 40% decrease in volume (-1,169 MT) to the Middle East/North Africa. Those three markets remain some of the most highly competitive in the world with U.S., European and Oceania suppliers all aggressively vying for market share.

On the positive side, U.S. suppliers continued their strong start to the year in Mexico. Year-over-year cheese sales jumped +21% (+1,960 MT) in May and were up 15% (+7,302 MT) year-to-date. May’s gain came almost entirely due to a 142% increase (+2,743 MT) in shipments of grated/powdered cheese.

While the cheese export growth trend continued in Mexico, May dented the strong start to the year in the rest of Latin America. U.S. volume to Central America fell 27% (-1,240 MT), due almost entirely to a 63% reduction in shipments to Panama. Cheese sales to South America were flat for the month, while sales to the Caribbean slipped 4% (-75 MT). However, even with the small regression, year-to-date U.S. cheese sales remain up to Central America (+11%), South America (+9%) and the Caribbean (+4%).

The May decline aligns with headwinds noted in last month’s trade data analysis: the shift in product mix in New Zealand toward cheese (and SMP), increased cheese supply out of Europe, and overall dampened global consumer demand.

Moving forward, inflation and lackluster global economic growth are likely to continue to vex consumption. However, milk production growth in the EU is waning and New Zealand has entered its off-season. In addition, U.S. cheese sales could see at least a short-term boost from pricing trends.

-Jul-06-2023-08-53-51-5318-PM.jpg?width=554&height=284&name=Chart4%20(2)-Jul-06-2023-08-53-51-5318-PM.jpg)

After months of the U.S. losing sales to cheap European product, U.S. prices dropped sharply in late April, making the U.S. the least expensive spot cheese on the market since then. As a result, we should see improvement in U.S. cheese exports in upcoming trade data reports, particularly in those major markets in Asia. However, a sharp upward futures curve is likely to keep a rally limited to July and August until demand improves or the futures market aligns closer with international market conditions.

Divergence within whey complex

Switching gears to the whey complex, we are seeing some key trends emerge.

Starting on a positive note, U.S. high-protein whey exports are on a tear, climbing for eight straight months. Japan has emerged as the United States’ largest and most reliable WPC80+ market (+11%, +565 MT year-to-date after a record year in 2022), but Japan was not alone with widespread improvement globally, with particularly notable growth in shipments to China (+39%, +1,462 MT YTD), Brazil (+30%, +1,528 MT YTD) and Canada (+27%, +890 MT YTD).

Lower prices and an increase in available supplies for WPC80 and WPI are clearly helping support export growth. For context, export unit values for May 2023 averaged $3.50/lb. compared to $5.45/lb. the year prior. However, the high prices that persisted throughout 2022 have burned off demand in some critical markets that were launching new protein-fortified products, particularly in South Korea (-62%, -1,413 MT YTD) and Southeast Asia (-20%, -495 MT YTD).

.jpg?width=554&height=283&name=Chart3%20for%20May%20trade%20stats%20(3).jpg)

On the flip side, whey permeate demand is clearly lagging. Using the “modified whey, not elsewhere specified” code as a proxy for whey permeate, we saw the lowest monthly export volume in May since July 2020. In total, U.S. modified whey exports were halved in May (-51%, -11,276 MT) and lag 22% (-19,074 MT) through the first five months of the year.

Clearly, whey for feed demand within China has fallen in tandem with pork prices, which has been the primary driver of permeate exports. At the same time, dry whey prices have dropped to historic lows, incentivizing purchasing of sweet whey over permeate for feed rations, which is reflected by dry whey volumes holding up comparatively well (-2%, -396 MT in May).

Looking ahead, we anticipate high-protein whey exports to remain a bright spot for U.S. dairy exports. However, while there is plenty of permeate and dry whey available for international buyers at very affordable prices, persistently weaker demand within China for feed and economic headwinds in Southeast Asia denting whey-for-food use are likely to keep low-protein whey exports subdued in 2023.

Learn more about global dairy markets:

-

Weaker demand and increased competition dent U.S. dairy exports in April

-

U.S. dairy exports dip for first time in a year

-

U.S. dairy exports eke out another volume increase in February

-

U.S. dairy exports start strong in 2023

Subscribe to the U.S. Dairy Exporter Blog

The U.S. Dairy Export Council fosters collaborative industry partnerships with processors, trading companies and others to enhance global demand for U.S. dairy products and ingredients. USDEC is primarily supported by Dairy Management Inc. through the dairy farmer checkoff. How to republish this post.

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (67)

- Africa (6)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (20)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (9)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farmer leaders (1)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Future trends (1)

- Geographical Indications (GIs) (10)

- Global Marketing (86)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (271)

- Member Services (17)

- Mexico (41)

- Middle East (9)

- Middle East & North Africa (3)

- Middle East/North Africa (9)

- Milk (4)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (19)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (329)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (26)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- April 2015 (11)

- December 2015 (11)

- March 2014 (10)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- January 2026 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- April 2024 (2)

- June 2024 (2)

- July 2024 (2)

- November 2024 (2)

- December 2024 (2)

- February 2025 (2)

- June 2025 (2)

- July 2025 (2)

- September 2025 (2)

- November 2025 (2)

- December 2025 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- May 2024 (1)

- August 2024 (1)

- September 2024 (1)

- October 2024 (1)

- January 2025 (1)

- March 2025 (1)

- April 2025 (1)

- May 2025 (1)

- August 2025 (1)

- February 2026 (1)

- USDEC (183)

- USDEC Staff (167)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Nick Gardner (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Krysta Harden, USDEC President and CEO (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Becky Nyman (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Erica Louder (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

.png)