-

Vilsack lists reasons for U.S. dairy farmers to smile about the future of exports

By USDEC October 4, 2019- Tweet

At World Dairy Expo, the USDEC president and CEO cites new developments and marketing strategies to increase exports to our North American neighbors as well as overseas markets.

Despite a lingering trade war with China, U.S. Dairy Export Council President and CEO Tom Vilsack says U.S. dairy farmers have many reasons to be optimistic about the long-term growth of U.S. dairy exports -- especially in high-demand markets such as the Middle East, Asia and Mexico.

"This will require patience. We have to play the strategic long game. But I am convinced now more than ever that we are competing to win, not just for today's dairy farmers, but for the next generation," Vilsack said in prepared comments for a Friday address at World Dairy Expo.

Held in Madison, Wisconsin, World Dairy Expo is the largest dairy-focused trade show in the world.

Exponential increase in exports

.jpg?width=554&name=Percentofproduction(0).jpg)

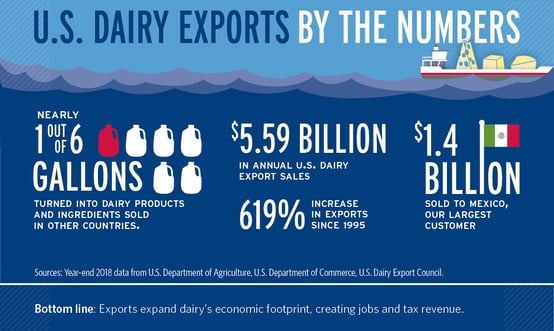

Since USDEC was founded and funded by its parent organization, Dairy Management Inc., U.S. dairy exports have increased seven-fold to more than $5.4 billion annually. Last year, the U.S. dairy industry exported the equivalent of nearly 16% of U.S. milk solids produced in this country.

That 2018 volume percentage set an all-time U.S. dairy export record—despite the drag of retaliatory tariffs in the largest U.S. export market, Mexico, and in the world’s biggest country, China.

For several years, export volume had plateaued around 15% of total U.S. milk solid production. Vilsack began an industry-wide initiative in 2017 called “The Next 5%.” It aims to increase export volume five percentage points, to 20% of production.

Value is also up. Through the first six months of 2019, U.S. suppliers exported about $800 million more in dairy products and ingredients compared to the same period in 2016. That’s a value increase of more than 30%.

Trade challenges in Mexico, China

The 2018 retaliatory tariffs have been lifted in Mexico and Vilsack said if Congress passes the United States-Mexico-Canada Agreement (USMCA) to replace the North American Free Trade Agreement, it will bring more stability.

Another positive development: an interim agreement announced last week with Japan, the world’s largest importer of cheese, that will deliver improvements in market access for U.S. Dairy.

But there is no denying that China's retaliatory tariffs combined with an outbreak of African swine fever have taken a heavy toll.

From July 2018 to June 2019, U.S. dairy solids exported to China dropped by 43 percent overall – the equivalent of 1.9 percent of total U.S. milk production. Or to put it another way, roughly 3.7 billion pounds of farmer milk needed to find other markets even though China continued to increase their overall buying as shown below.

.jpg?width=554&name=China%20one%20year%20later11%20(2).jpg)

Vilsack met Aug. 30 in Beijing with officials from China’s Ministry of Finance and Commerce to stress that the United States has the dairy ingredients, scientific research and know-how to help rebuild China's pig herd decimated by African swine fever. Eleven days later, China announced it was waiving its retaliatory tariff on U.S. permeate for feed.

USDEC is playing a role accelerating the uptake of permeate to rebuild China’s swine population with two full-day seminars Oct. 29 in Beijing and Oct. 31 in Nanchang.

Investment in Southeast Asia

.png?width=554&name=Top%205%20Markets%20(2).png)

Vilsack said one of the most promising markets is Southeast Asia, where U.S. dairy exports increased 12% last year and USDEC is making a new investment to develop the U.S. Center for Dairy Excellence in Singapore.

“The vision,” said Vilsack, “is to create an educational center within the hub of Southeast Asian food innovation.”

Other USDEC strategies and initiatives

Customers lucky enough to get into the Costco grand opening in Shanghai saw cheeses made in the U.S. from Belgioioso, Sartori, Tillamook, Pacific Cheese, Saputo, Schuman Inc. and Lactalis -- thanks in part to a new partnership facilitated by USDEC. #USDairyChina #UndeniablyDairy pic.twitter.com/ZjyxMXMzdh

— U.S. Dairy Exporter (@USDairyExporter) September 3, 2019Curves President Maki Sakamoto shakes hands on a growing partnership with USDEC's Tom Vilsack that distributes U.S. whey protein through the largest fitness club in Japan, with 2,000+ outlets. USAdairyJapan pic.twitter.com/I2hm1wJLNH

— U.S. Dairy Exporter (@USDairyExporter) September 3, 2019

Vilsack highlighted other USDEC long-term investments in fast-growing markets where he said there are “outsized” opportunities for growth as reasons for optimism, including:- Broadening partnerships within Mexico to further build demand for U.S. Dairy to capitalize on USMCA, once ratified.

- Launches of U.S. cheese in Mexico and China through Costco retail partnerships, as well as in Chile through focused retail engagement.

- The launch of the USA Cheese Guild™ an internationally branded effort to facilitate education about and preference for U.S. cheeses within culinary, foodservice, communications and retail channels.

- Halal food training for dairy exporters exploring growth in Islamic nations, such as Indonesia – a top 10 global dairy importer.

- USDEC is in Indonesia on a trade mission this week with the Foreign Agricultural Service of the U.S. Department of Agriculture and a dozen U.S. dairy ingredient exporters. Indonesia is working to expand its dairy supply chain amid trade difficulties with the EU.

- A pop-up U.S. Dairy display to increase visibility and induce product trial across regions.

- Partnerships with fitness centers and cheese marketers in Japan. USDEC has a partnership with fitness chain Curves, which sells concentrated whey protein from the United States to customers at its 2,000 locations.

- USDEC Japanese cheese marketing partner Chesco is introducing high-end U.S. cheeses in its own stores, as well as other Japanese grocery and department stores.

“At USDEC, we’re about planting the seeds of new ideas and approaches to grow export markets for a brighter future for the U.S. dairy industry, “ Vilsack concluded. “We are poised to compete to win and get to The Next 5%.”

Mark O'Keefe is vice president of editorial services at the U.S. Dairy Export Council.

Learn more:

- Vilsack cites reasons for long-range optimism about exports

- Vilsack optimistic about exports after China, Japan trips

- Travelogue: Vilsack takes U.S. Dairy message to China, Japan

- Vilsack in China: U.S. dairy industry building relationships for ‘long haul’

- Q&A: Dairy Farmers Ask Questions About Exports

- U.S.-China Dairy Partnership Launched to Meet Future Demand for Nutritious Products (VIDEO)

Subscribe to the U.S. Dairy Exporter Blog

The U.S. Dairy Export Council fosters collaborative industry partnerships with processors, trading companies and others to enhance global demand for U.S. dairy products and ingredients. USDEC is primarily supported by Dairy Management Inc. through the dairy farmer checkoff. How to republish this post.

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (67)

- Africa (6)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (20)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (9)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farmer leaders (1)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Future trends (1)

- Geographical Indications (GIs) (10)

- Global Marketing (86)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (271)

- Member Services (17)

- Mexico (41)

- Middle East (9)

- Middle East & North Africa (3)

- Middle East/North Africa (9)

- Milk (4)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (19)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (329)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (26)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- April 2015 (11)

- December 2015 (11)

- March 2014 (10)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- January 2026 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- April 2024 (2)

- June 2024 (2)

- July 2024 (2)

- November 2024 (2)

- December 2024 (2)

- February 2025 (2)

- June 2025 (2)

- July 2025 (2)

- September 2025 (2)

- November 2025 (2)

- December 2025 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- May 2024 (1)

- August 2024 (1)

- September 2024 (1)

- October 2024 (1)

- January 2025 (1)

- March 2025 (1)

- April 2025 (1)

- May 2025 (1)

- August 2025 (1)

- February 2026 (1)

- USDEC (183)

- USDEC Staff (167)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Nick Gardner (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Krysta Harden, USDEC President and CEO (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Becky Nyman (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Erica Louder (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

.png)