-

Q&A: Dairy Farmers Ask Questions About Exports

By Margaret Speich and Mark O'Keefe July 15, 2019- Tweet

Topics include the impact of Chinese tariffs on U.S. dairy exports, progress toward USDEC's Next 5% goal and the dairy boom in Southeast Asia.

Editors' note: John Brubaker is an Idaho farmer who serves as treasurer of the United Dairy Industry Association and chairs the export committee of Dairy Management Inc., the parent organization of the U.S. Dairy Export Council.

With times as tough as they have been in recent years, Brubaker gets plenty of comments and questions about exports from fellow dairy farmers.

As a member of USDEC's new Farmer-Funder Editorial Advisory Group, Brubaker passed those questions on to us. To provide concise answers, we summarized information from USDEC staff experts and our 2019 half-year progress report sent last week to state and regional checkoff organizations. The Q&A follows.

Q: Why do we need exports, and why do we need to increase them so much with "The Next 5% "strategy?

A: Milk production continues to increase. In 1950, the average U.S. cow produced roughly 5,500 pounds of milk per year. We had virtually no exports. With advances in technology, nutrition and animal care, the average cow produces four times as much today.

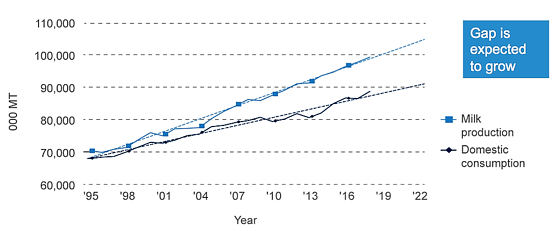

Since 2000, U.S. milk production has grown at a compound annual growth rate of around 1.5%, while domestic consumption has grown at 1%. USDEC estimates production will continue to significantly outpace U.S. dairy consumption in the years ahead.

Since 2003, around half of all new milk has gone to export markets in the form of cheese and ingredients. The United States shipped nearly 70% of nonfat dry milk/skim milk powder to overseas markets last year. Cheese exports have grown from less than 1.5% of production in 2000 to nearly 6.5% in 2018.

Dairy export value has risen from $1 billion in 2000 to $5.6 billion last year.

Thanks in no small part to the dairy checkoff, domestic consumption continues to grow—but not as fast as supply, as this chart shows. To close the gap, we need to either decrease supply or increase demand. Increasing demand through exports is the best option and a huge opportunity because 95% of the world’s population lives outside the United States.

The Growing Gap Between Domestic Milk Production and Consumption

Q: Dairy farmers are thirsty for good news. Can you give us some regarding exports?

A: U.S. dairy exports set a record in 2018, with volume reaching 15.8% of U.S. milk solids production—well above the five-year average of 14.7%. It was a solid first step in The Next 5% plan.

That plan’s ultimate goal is to lift volume to the equivalent of 20% of milk solids by 2022 while simultaneously raising the average value of U.S. dairy exports.

On the journey to any significant goal, obstacles are likely to emerge. This year's challenges include Chinese retaliatory tariffs, compounded by African swine fever that has decimated the hog industries in China and Vietnam. Pigs eat components of whey, a cheese byproduct. Fewer pigs means plummeting demand for whey exported by U.S. suppliers.For the first four months, all U.S. dairy exports were the equivalent 14.1% of U.S. milk solids production (down from a record 16.8% over the first four months of 2018).

U.S. export value, however, rose 1% to $1.93 billion for the January-April period, the best start to a year since 2015.

Q: How have retaliatory tariffs by Mexico and China affected our exports?

A: Without retaliatory tariffs, we estimate exports might have reached 17% of production in 2018 instead of 15.8%. Without those tariffs, we could have made a giant leap, instead of a small step, toward our Next 5% goal of 20%.

Fortunately, the U.S. and Mexico have lifted their retaliatory tariffs, paving the way for Congress to ratify the U.S.-Mexico-Canada Agreement (USMCA), a high priority for the U.S. dairy industry and all of U.S. agriculture.

While talks between China and the United States are continuing, we are less than optimistic that we will see Chinese tariffs lift soon. Tariffs as high as 45% on U.S. dairy products and ingredients are having a negative effect.

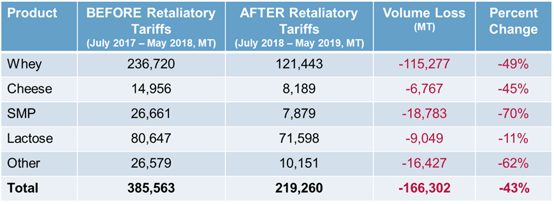

As the chart below shows, since the tariffs were enacted last July, the volume of combined U.S. dairy exports to China has dropped 43% compared to the same period of time before tariffs went into effect.

Dairy Exports to China Before and After Tariffs

Q. How does the China trade conflict affect our future plans?

Tariffs on U.S. dairy products tilt the playing field toward our global competitors in China. This makes reaching our goals more challenging. USDEC estimates Chinese retaliatory tariffs alone knocked about 1.4 percentage points off U.S. exports as a percentage of milk solids production in the first four months of 2019.

With more than a billion mouths to feed, the long-range upside for U.S. Dairy in China remains huge. We project it's only a matter of time before China becomes the world's largest cheese importer. Our trade policy team continues to work tirelessly to see retaliatory tariffs lifted. This will benefit the dairy industries in both countries.

In the meantime, we maintain a strong presence in China with our international office, our partnership with Jiangnan University and other opportunities. For example, at USDEC's request, U.S. Ambassador to China Terry Branstad gave an address in April to the China Chamber of Commerce of Foodstuffs and Native Produce, which has more than 6,000 member organizations devoted to agriculture, including more than 1,000 in the dairy sector alone.

These ongoing efforts send a message that the U.S. dairy industry remains committed to China and is poised to meet growing demand when tariffs are lifted.

Q: The Next 5% seeks to increase exports as a percentage of production volume. But it also seeks to raise value. How will that happen?

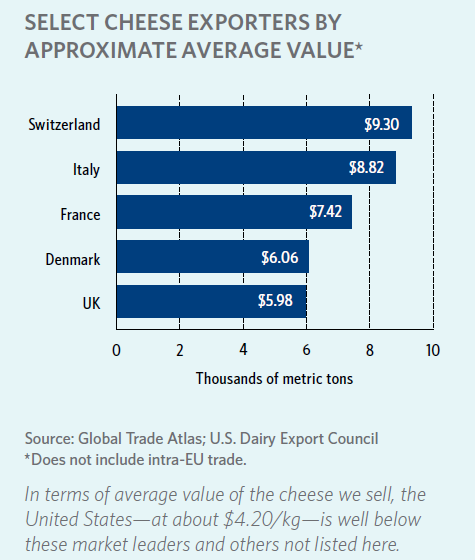

A: Cheese is our best opportunity. Some people are shocked to learn the United States is the world’s largest single-country cheese exporter, ahead of European cheesemaking countries like France and Italy.

However, U.S. cheese, on average, sells for less than half the price of Swiss and Italian cheese for a number of reasons. U.S. suppliers have traditionally focused on bulk and commodity sales, for example. These countries get higher prices by promoting their historical cheesemaking traditions and focusing on high-end, consumer-packaged retail varieties and specialty cheeses.

This is not an issue of paying more for higher quality cheese. Since 2011, U.S. cheeses rank third overall in the medal count at the World Cheese Awards, ahead of France and Italy and behind only Spain and the UK. The problem is perception.

To improve our image, USDEC has crafted a strategy increasing awareness of the heritage of U.S. natural cheese. Among other efforts, we have established USA Cheese Specialist™ Culinary Training Courses at three class levels—Associate, Intermediate and Advanced. Training has taken place in Dubai, Japan, South Korea and Taiwan with plans for other locations in the coming months.

Proud graduates of a USA Cheese Specialist™ Culinary Training Course in Dubai.

Q: Which global market should dairy farmers be excited about?A: Southeast Asia, where a growing population hungry for more dairy now exceeds 660 million, nearly double the size of the United States.

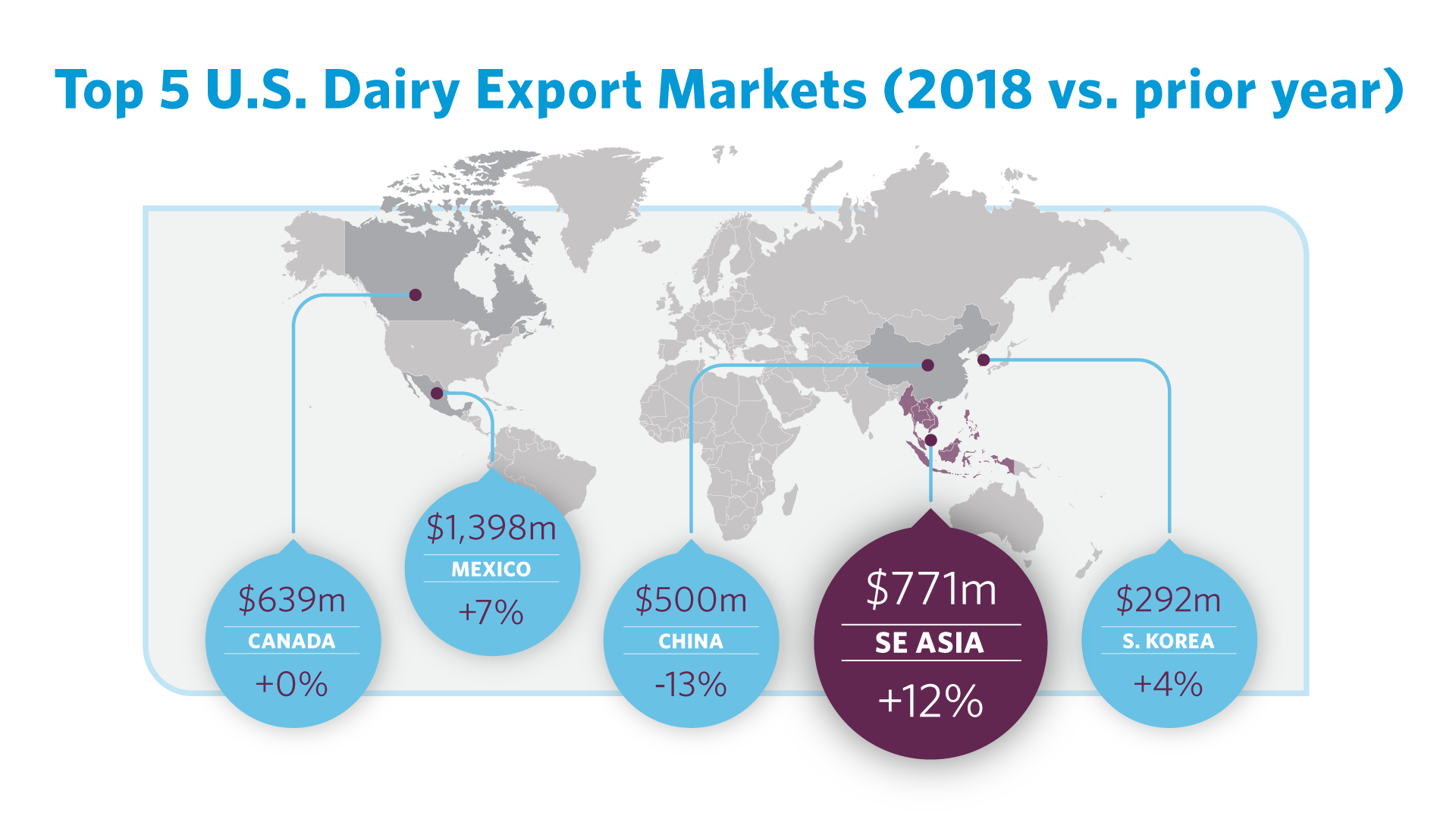

Last year, U.S. dairy exports to Southeast Asia increased 12%, to $771 million, making it the industry's second largest export market, behind only Mexico.

Value to SE Asia increased 12% last year, the biggest jump among major export markets.

The equivalent of one day of total U.S. milk production per month now goes to Southeast Asia, with plenty of upside for dairy farmers because booming populations in many Southeast Asia countries are just now discovering cheese.

Numerous activities have already taken place this year, notably an expanded roster of work through USDEC’s partnership with Singapore Polytechnic’s Food Innovation & Resource Centre (FIRC). USDEC is not only holding more customer workshops this year through FIRC, it is expanding their scope from permeate to dairy proteins, foodservice cheese and cream cheese.

Q: What does USDEC do?

It's important to note what we don't do; that is, sell products or control global markets or prices. That's the job of our member companies, which USDEC works with to increase the value and volume of exports by:

- Marketing and promoting U.S. dairy products overseas.

- Providing technical consulting and guidance on import requirements to ensure U.S. dairy products are able to access export markets.

- Securing beneficial free trade agreements that provide greater access for U.S. dairy exports overseas.

Bottom line: Our job is to expand global awareness of U.S. Dairy, build demand, facilitate trade and help our suppliers find and keep more global customers, which is what we're doing.

Q. How much does the dairy checkoff fund USDEC?

Dairy Management Inc. founded USDEC 24 years ago and remains USDEC's parent organization.

The national dairy checkoff funds 63% of USDEC’s 2019 budget, with an additional 12% from state and regional checkoff organizations that have chosen to support The Next 5% initiative.

In addition to checkoff funding:

- 18% of our budget is funded by the USDA's Foreign Agricultural Service, which links U.S. agriculture to the world to enhance export opportunities and global food security

- 6% is collected from USDEC members to support our work on trade policy

- 1% comes from other sources

While suppliers join USDEC as dues-paying member companies, farmers are our primary funders. We are grateful for their support and welcome their questions.

Farmers: Get Export Information Like This in Your Inbox

Learn more:

- 7 Things Farmers Need to Know About Their Investment in Exports

- Skeptical Dairy Farmers Should Embrace Exports

- What Dairy Farmers Need to Know About Increasing Exports to "The Next 5%"

Ask us more questions, request the half-year report

Report available to U.S. dairy farmers on request

Contact us if you have additional questions or would like a copy of the half-year progress report recently sent to state and regional checkoff organizations.

Send an email to:

- Margaret Speich, senior vice president (mspeich@usdec.org)

- Mark O'Keefe, vice president, editorial services (mokeefe@usdec.org)

The U.S. Dairy Export Council fosters collaborative industry partnerships with processors, trading companies and others to enhance global demand for U.S. dairy products and ingredients. USDEC is primarily supported by Dairy Management Inc. through the dairy farmer checkoff. How to republish this post.

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (67)

- Africa (6)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (20)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (9)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farmer leaders (1)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Future trends (1)

- Geographical Indications (GIs) (10)

- Global Marketing (86)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (271)

- Member Services (17)

- Mexico (41)

- Middle East (9)

- Middle East & North Africa (3)

- Middle East/North Africa (9)

- Milk (4)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (19)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (329)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (26)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- April 2015 (11)

- December 2015 (11)

- March 2014 (10)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- January 2026 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- April 2024 (2)

- June 2024 (2)

- July 2024 (2)

- November 2024 (2)

- December 2024 (2)

- February 2025 (2)

- June 2025 (2)

- July 2025 (2)

- September 2025 (2)

- November 2025 (2)

- December 2025 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- May 2024 (1)

- August 2024 (1)

- September 2024 (1)

- October 2024 (1)

- January 2025 (1)

- March 2025 (1)

- April 2025 (1)

- May 2025 (1)

- August 2025 (1)

- February 2026 (1)

- USDEC (183)

- USDEC Staff (167)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Nick Gardner (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Krysta Harden, USDEC President and CEO (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Becky Nyman (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Erica Louder (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

.png)

.png?width=554&name=Brubaker8%20(3).png)