-

Reasons to Believe in the Long-term Growth of U.S. Dairy Exports

By USDEC Staff October 21, 2015- Tweet

USDEC President, Rabobank strategist, see better times ahead as global markets rebalance and demand increases.

“Is this just a speed bump on the road to expansion of U.S. dairy in the world market? Or is this a major detour that could cast doubt on the premise that U.S. exports can and will move beyond their recent high of shipping 15.5 percent of U.S. milk production?”

Those were the questions posed by Tom Suber, president of the U.S. Dairy Export Council (USDEC), at last week’s USDEC Board of Director’s and Membership Meeting in Chicago. They are, in fact, questions many commentators have been asking these days, given the international dairy sector’s prolonged market downturn, slow recovery and the U.S. dairy export slump.

Suber’s answer: The fundamentals for long-term U.S. dairy export growth remain in place, but changes in the marketplace require successful U.S. suppliers to intensify their efforts in the years ahead.

“Specifically, what we’ve seen is the situation forecast six years ago in the landmark Globalization Report authored by Bain & Co. for the Innovation Center for U.S. Dairy: a more intensely competitive dairy environment,” said Suber.

That report clearly stated that the United States had a finite window of opportunity to better equip itself to compete globally before the squeeze of surging demand against constrained supply brought forth new milk. The study’s authors missed only the source of that milk, predicting the development of low-cost producers like Belarus and Brazil rather than the European Union (EU), but the milk nonetheless has flowed and competition has tightened.

“The window of opportunity is closing on easy market access gains, but the structural changes driving worldwide demand growth are still in place,” said Suber. “The world’s growing middle class will continue to drive dairy demand and export growth, but a narrow supply/demand balance means we will have less sure-fire, almost default opportunities for U.S. success that existed when the EU constrained its own growth.”

Rabobank Cites Five Reasons for Optimism

Board meeting speaker Tim Hunt, global dairy strategist in Rabobank’s Food and Agribusiness Research Advisory, expressed similar views in his presentation.

“A severe downturn does not necessarily equate to structural change, so don’t rush to that conclusion,” Hunt said. “What we see is a cyclical downturn overlaid by market shocks that really made things nasty.”

Hunt outlined five reasons why Rabobank maintains its positive long-term outlook:

- The world economy is poised to grow 3.5-4 percent annually for the next five years—“much higher than population growth, so incomes will rise,” says Hunt.

- There is ample room for consumption growth in emerging markets, even if you compare similar cultures. “As incomes rise, we have a fairly good record of bringing those countries up on a consumption basis,” said Hunt.

- A prolonged period of lower retail prices is going to do enormous good in unlocking consumption growth. “I think we forget how much damage we did to the market through the record pricing of 2013/14,” Hunt said.

- Emerging markets are still expensive and difficult places to produce milk. They will struggle to keep up with domestic requirements.

- Facing significant environmental, political and other constraints to production, the EU, New Zealand and other surplus regions cannot meet demand growth on their own.

Expect international dairy trade to expand by over 3 percent annually through 2020, Hunt said. That’s about half the growth rate of the past five years or so, but still a healthy gain that would leave the world looking for around another California’s worth of milk between 2014 and 2020.

Getting There Will Take Some Time

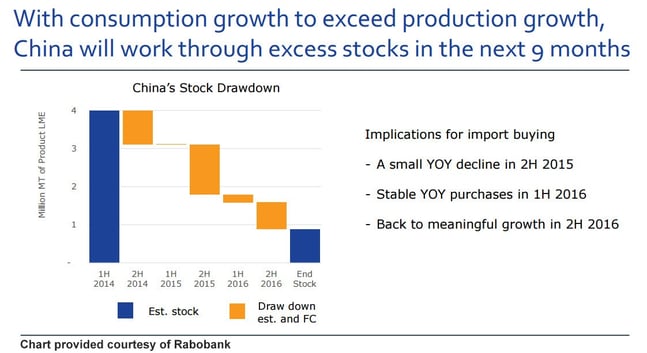

To get there, however, we need to pull out of the current market imbalance. That requires a greater production response to low prices and the ability to work through an estimated 5 million tons (milk equivalent) in excess inventory in key trading regions globally.

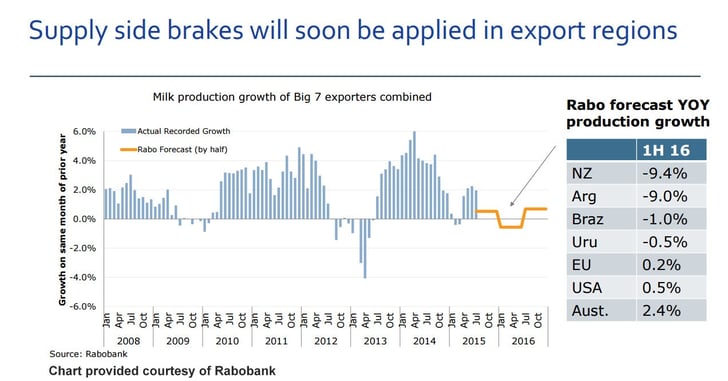

“We believe producers in export regions will apply the supply side breaks in the first half of 2016,” said Hunt. “We expect international trade to return to expansion in first half of next year with growth accelerated in the second half.”

Rabobank expects WMP prices midway between $3,000 and $4,000/ton for next five years or so.

That being said, it will not be business as usual for U.S. exporters moving forward. From 2010-2014, China practically accounted for all global dairy trade growth. In the future, it will account for about 20 percent, with greater representation from Southeast Asia, the Middle East, Africa and parts of South America.

“Trade growth will be more broadly driven. That will require U.S. suppliers to implement broader marketing strategies,” said Hunt.

Not Easy, but Feasible

“We are in a much better position than 20 years ago when we exported 5 percent of our production, half of which was subsidized by the government,” said Suber. “We have a totally different, more positive set of durable assets today.”

Among those assets are mid-range cost of production, a geographically diverse milk supply with less seasonality than many competitors, ever-better risk management tools, a large internal market for scale and stability, high-productivity herd management, and effective supply chain improvement programs, including efforts on sustainability, traceability, food safety and consumer confidence campaigns.

“But despite the progress, the hard work really starts now,” said Suber. “We are in a more competitive environment, which means we will have to bear down to compete—commercially, in regulatory matters and politically.”

Learn more: Related articles have appeared in the U.S. Dairy Exporter Blog:

- Global Dairy Market Rebound Not Expected Until mid-2016 at Earliest

- U.S. Dairy Exports Lower for the Fourth Straight Month

- Down Cycles of Global Dairy Markets Teach Persistence

- Why U.S. Dairy Exporters Are Taking the Long View

Subscribe to the U.S. Dairy Exporter Blog

The U.S. Dairy Export Council fosters collaborative industry partnerships with processors, trading companies and others to enhance global demand for U.S. dairy products and ingredients. USDEC is primarily supported by Dairy Management Inc. through the dairy farmer checkoff. How to republish this post.

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (67)

- Africa (6)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (20)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (9)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farmer leaders (1)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Future trends (1)

- Geographical Indications (GIs) (10)

- Global Marketing (86)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (271)

- Member Services (17)

- Mexico (41)

- Middle East (9)

- Middle East & North Africa (3)

- Middle East/North Africa (9)

- Milk (4)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (19)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (329)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (26)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- April 2015 (11)

- December 2015 (11)

- March 2014 (10)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- January 2026 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- April 2024 (2)

- June 2024 (2)

- July 2024 (2)

- November 2024 (2)

- December 2024 (2)

- February 2025 (2)

- June 2025 (2)

- July 2025 (2)

- September 2025 (2)

- November 2025 (2)

- December 2025 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- May 2024 (1)

- August 2024 (1)

- September 2024 (1)

- October 2024 (1)

- January 2025 (1)

- March 2025 (1)

- April 2025 (1)

- May 2025 (1)

- August 2025 (1)

- February 2026 (1)

- USDEC (183)

- USDEC Staff (167)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Nick Gardner (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Krysta Harden, USDEC President and CEO (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Becky Nyman (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Erica Louder (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

.png)