-

Down Cycles of Global Dairy Markets Teach Persistence

By Tom Suber July 30, 2015- Tweet

Despite a tough year and major market challenges, USDEC's long-range forecast is unchanged: sustainable growth.

It has been 20 years since Dairy Management Inc. (DMI) founded the U.S. Dairy Export Council on the strength of a basic premise: The combination of growth, both in global population and disposable income, would fuel global dairy consumption at a far faster pace than inside our domestic market. That would create dairy opportunities for nations with the capacity and wherewithal to serve the global market.

It has been 20 years since Dairy Management Inc. (DMI) founded the U.S. Dairy Export Council on the strength of a basic premise: The combination of growth, both in global population and disposable income, would fuel global dairy consumption at a far faster pace than inside our domestic market. That would create dairy opportunities for nations with the capacity and wherewithal to serve the global market.The factors seemed immutable to those dairy farmer leaders, but the exact path and timeline could not be clearly identified. Consequently, a number of doubters existed then, saying global dairy prices would never rise sufficiently to pay an attractive price for U.S. suppliers.

Few skeptics exist now, even under today’s challenging global market conditions.

That steadfast belief in exports is, in itself, a sign of how the U.S. industry has evolved into a world player.

Global dairy markets are in a down cycle. But the U.S. dairy industry is, so far, holding up as well or better than most other major producers.

To cite two examples, our sizable NFDM/SMP exports are steady and high-value whey protein isolate shipments are well on their way to a new record, as the latest monthly market data report shows.

Even though we have lost some export share, our customers and competitors know that the U.S. industry is here to stay and not simply dumping surplus production.

Forged by two decades of experience, we have good reasons for our persistent attitude:

- Population and income growth forecasts continue to drive long-term global supply and demand projections of a bias towards tightness, resulting in favorable prices over time.

- We stack up well against most milk producers in the world in our resources, capabilities, expertise and efficiency—in short, an underlying, relatively attractive cost of production.

- With an expanded product portfolio, investment in facilities and equipment, and a shift into a global mind-set, U.S. supplier capabilities are light years ahead of 20 years ago.

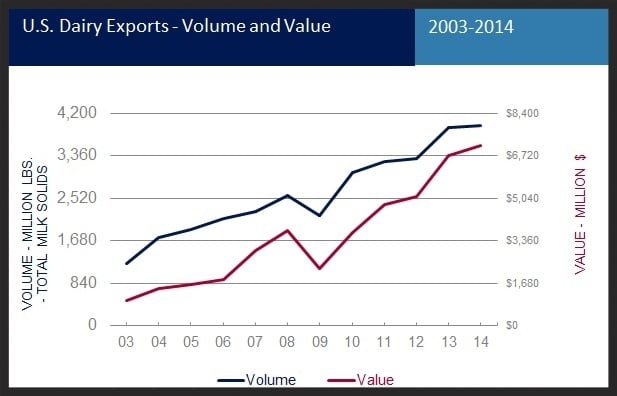

As the chart below shows, U.S. exports in 2014 finished higher for a fifth straight year. Barring an unlikely turnaround in the next five months, our 2015 numbers will be less impressive. But even in a difficult year, we remain optimistic.

U.S. exports in 2014 finished higher for the fifth straight year. Export volume topped 3.96 billion lbs. of total milk solids, up 1 percent from the prior year. Export value finished at $7.11 billion, up 6 percent. - See more at: http://www.usdec.org/research-and-data/top-charts#sthash.0okORsWq.dpuf

U.S. exports in 2014 finished higher for the fifth straight year. Export volume topped 3.96 billion lbs. of total milk solids, up 1 percent from the prior year. Export value finished at $7.11 billion, up 6 percent. - See more at: http://www.usdec.org/research-and-data/top-charts#sthash.0okORsWq.dpufWhy do remain upbeat during the down cycles of global dairy markets? Because we have the knowledge of the past two decades and are cognizant of the changing needs of U.S. suppliers and global customers. With all this in mind, our members look to USDEC for strategies to help them grow.

These strategies mesh member input, the shifting demands of global markets and competitive pressures to develop focused, increasingly refined initiatives to raise the volume and value of U.S. dairy exports and solidify and expand the U.S. standing in the global marketplace.

Sustainable growth depends on responding to a series of market challenges, including these significant six:

- Trade barriers. Non-tariff barriers to trade continue in many markets with low tariffs. USDEC seeks to sustain and maximize our members’ business by improving market access and rules of trade. That includes close participation in all stages of free trade negotiations to further lower tariffs; managing Consortium for Common Food Names efforts to halt European Union attempts to restrict common cheese names; working hand-in-hand with foreign and U.S. governments to overcome regulatory hurdles (such as continuing revisions to Chinese food safety regulations); and collaborating with international groups to boost harmonization of test methods to facilitate transit through overseas customs authorities.

- Lingering Misperceptions. Despite the industry’s hard work to reposition itself as a consistent, customer-centric, global business partner, negative perceptions still linger. With the new ThinkUSAdairy.org global website, we are presenting a unified, consistent message that showcases U.S. strengths and capabilities, distinguishes U.S. products from those of competitors and demonstrates that we are the dairy partner of choice.

- Product Development. Overseas food manufacturers are increasingly sophisticated in new product development and processing. Working with the National Dairy Council, we develop applications for new and underutilized products like permeates and micellar casein concentrate, and we transfer that knowledge to end-users in a way that brings sales openings to U.S. suppliers. We also look to help U.S. suppliers address quality and performance issues associated with U.S. dairy ingredients that limit overseas use.

- Evolving Taste Preferences and Nutrition. Consumers are increasingly sophisticated in taste preferences and nutritional knowledge. We want to boost the U.S. capacity to seize emerging cheese opportunities in foodservice, while also advancing nutritional research to address societal needs, such as dairy protein’s ability to alleviate global health issues stemming from aging and malnourishment.

- Information Flow. This is a new age of global dairy and it is fast paced—more volatile than ever. This blog and an entirely redesigned usdec.org, both launched in February, give us digital platforms to communicate with the speed of business. We seek to provide information (proprietary market analysis and research) and tools (supporting the awareness and usage of dairy futures and options through the Innovation Center for U.S. Dairy) to prepare for rapid market shifts. We try to determine which way the wind will blow before it changes direction.

- Food Safety Issues. Despite stellar advances in processing technology, consumers remain highly sensitive to any hint of food safety threats. That's why we are closely involved with industry programs to improve vital core competencies in food safety, traceability and quality. We are also preparing for the inevitable, occasional food safety incident by continuing to ramp up our crisis management program.

In 20 years we have seen multiple up and down cycles in the global dairy sector, and USDEC programs can’t change the underlying market conditions.

Yet, in meeting members’ requests, we aim to minimize the impact of down cycles and maximize the up cycles that have proven to sustain and enable our industry’s growth over time.

Today’s challenges are far less intimidating than those we’ve faced over the last 20 years. Consistent strategies and persistent, unified effort will continue to pave the way for another 20 years of global U.S. dairy growth.

Subscribe to the U.S. Dairy Exporter Blog

The U.S. Dairy Export Council is primarily supported by Dairy Management Inc. through the dairy farmer checkoff that builds on collaborative industry partnerships with processors, trading companies and others to build global demand for U.S. dairy products.

Stock photo: 123RF. Want to republish this post?

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (67)

- Africa (6)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (20)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (9)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farmer leaders (1)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Future trends (1)

- Geographical Indications (GIs) (10)

- Global Marketing (86)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (271)

- Member Services (17)

- Mexico (41)

- Middle East (9)

- Middle East & North Africa (3)

- Middle East/North Africa (9)

- Milk (4)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (19)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (329)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (26)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- April 2015 (11)

- December 2015 (11)

- March 2014 (10)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- January 2026 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- April 2024 (2)

- June 2024 (2)

- July 2024 (2)

- November 2024 (2)

- December 2024 (2)

- February 2025 (2)

- June 2025 (2)

- July 2025 (2)

- September 2025 (2)

- November 2025 (2)

- December 2025 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- May 2024 (1)

- August 2024 (1)

- September 2024 (1)

- October 2024 (1)

- January 2025 (1)

- March 2025 (1)

- April 2025 (1)

- May 2025 (1)

- August 2025 (1)

- February 2026 (1)

- USDEC (183)

- USDEC Staff (167)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Nick Gardner (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Krysta Harden, USDEC President and CEO (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Becky Nyman (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Erica Louder (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

.png)