-

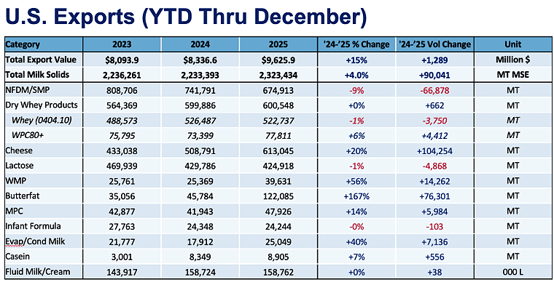

Big December lifts annual U.S. dairy export growth to +4%

By USDEC Staff February 20, 2026- Tweet

Year-end volume and value second only to 2022.

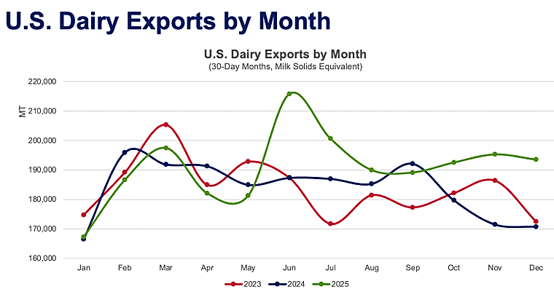

U.S. dairy exports finished 2025 with a flourish, as year-over-year (YOY) milk solids equivalent (MSE) volume rose 13% in December, raising annual growth for the year to 4%. Total MSE volume of 2.32 million MT was the second highest of all time, after 2.41 million MT in 2022.

U.S. export value for the year rose 15% to $9.63 billion, just shy of the 2022 record of $9.66 billion.

December trends were largely consistent with previous months with stellar cheese and butterfat sales driving overall volume. YOY December cheese exports climbed 24% (+10,482 MT), led by record monthly volume to Mexico—19,656 MT, a gain of 15% over the same month the previous year—and steady growth to South Korea (+59%) and Australia (+68%).

Butterfat had its biggest month of the year in December: 15,706 MT. YOY volume increased 260% (+11,345 MT), with butter up 261% (+7,621 MT) and AMF and spreads up 258% (+3,724 MT).

U.S. suppliers continued to ship to more traditional butter customers like Canada in December (+64% YOY, +1,059 MT) while continuing to build relationships with “new” buyers, which has been a hallmark of 2025. North Africa, Australia and Bahrain bought zero U.S. butter in December 2024. In December 2025, U.S. suppliers shipped 2,054 MT to North Africa, 1,344 MT to Bahrain, and 816 to Australia.

December was also helped by nonfat dry milk/skim milk powder (NFDM/SMP), a rarity in 2025. NFDM/SMP broke out of the doldrums and rose 18% (+8,980 MT) year-over-year, driven by gains to Southeast Asia (+53%, +5,679 MT).

However, while welcome, the nonfat increase is due in part to low prior-year volume—only 49,938 MT in December 2024, which, at the time, was the first month of sub-50,000 MT in over five years. Two more sub-50,000 MT months followed in January and February 2025, setting the U.S. up a potential good start percentage-wise for U.S. NFDM/SMP in 2026.

What follows is a product-by-product look at 2025.

For more detailed information, as well as interactive charts and data, visit USDEC's Data Hub.

A dream year for cheese exports

Things couldn’t have gone much better for U.S. cheese exports in 2025, as suppliers demolished the previous record for annual exports. Year-over-year shipments surged 20% (+102,763 MT) to 613,045 MT. YOY volume increased in 11 of 12 months, with only March failing to beat the prior year. Even then, March boasted a healthy total of 49,287 MT, just 1% back on the previous year, which, at the time, was the U.S. record for cheese shipments in a month. Every month from May through the end of the year exceeded 50,000 MT.U.S. cheesemakers investments in new capacity delivered immediate dividends, as cheddar exports led the way, rising 63% (+43,788 MT). Better-than-expected economic growth in key export markets, global consumers’ ever-growing familiarity with cheese flavors and uses (incorporated into local diets and eaten in Western dishes) helped fuel demand. One of the most impressive aspects in 2025 was the geographic spread of sales. The United States exported more than 1,000 MT of cheese to 37 countries in 2024. In 2025, U.S. cheese exports grew to 32 of those 37. Plus, two new countries became 1,000 MT+ buyers. Looking toward 2026, U.S. cheese suppliers have set themselves a high bar.

A banner year for butterfat

2025 was a banner year for U.S. butter and anhydrous milkfat (AMF) trade as exports surged to 122,085 MT (+167%, +76,301 MT), handily besting the prior record set in 2013 by a margin of 31,655 MT (+35%). Both butter (+163%, +51,726 MT) and AMF (+176%, +24,574 MT) played a role in pushing the butterfat volume to the highest level ever witnessed. Ample availability combined with competitive pricing compared to alternative global suppliers during the year helped to spur U.S. butterfat exports upward to nearly every destination, though volumes to MENA were nearly 17 times larger than during the prior year. This increase complemented other sizeable gains in Europe and Canada. With milkfat production continuing to advance, exports have overcome historical barriers to trade and played a critical role in preventing excess accumulation of butter inventories that could have put even further downward pressure on prices. With no indication that milkfat production in the U.S. will abate, exports are likely to continue to play this important market balancing function into the future.A rollercoaster year for low-protein whey

U.S. exports of low protein whey experienced a volatile 2025 with enormous fluctuations due to rapidly shifting trade policy early in the year. When the dust settled, total shipments of whey under the 040410 heading were nearly on par with prior-year levels, down just 0.7% (-3,671 MT). This steadiness, however, belies the vast differences that materialized across the subheadings. Shipments of dry whey jumped by a sizeable 9% (+17,674 MT) due to improved demand from China and South America. Further adding to the positive momentum was modified whey, which grew 8% (+13,378 MT) due to a stronger pull from Asia and Mexico. However, these gains were canceled out by a 23% (-34,802 MT) drop in exports of whey protein concentrates with less than 80% protein—perhaps not a surprising result considering that output of these products has shrunk as manufacturers pivot toward producing more lucrative, higher value ingredients.Health and wellness drives high-protein whey

Despite losing momentum in the final months of the year, a strong performance in mid-2025 delivered a positive result for U.S. exports of WPC80+, which grew 6% (+4,412 MT) versus prior year. A record large 77,811 MT of U.S. high protein whey moved offshore during the year, besting the prior record set in 2023 by 2,016 MT (+3%). Chinese demand for high protein whey faltered dramatically (-45%, -7,117 MT) in 2025 though an uptick in the appetite in Japan (+32%, +4,065 MT) and Europe (+44%, +3,098 MT) helped to compensate for the loss. A seemingly insatiable worldwide demand for protein due to health and wellness associations bodes well for continued strength in WPC80+ trade. However, with prices at eye watering highs and surging domestic demand absorbing growing output, powerful competitive forces will exert significant pressure on the market in the months ahead.Production hamstrings U.S. NFDM/SMP growth

U.S. NFDM/SMP exports faltered in 2025, falling 9% (-66,878 MT). For the second straight year, lagging U.S. exportable supply constrained U.S. suppliers’ competitiveness. U.S. NFDM production fell 1% in 2025 while SMP slumped 19%, and those declines followed 11% and 21% drops, respectively, in 2024. The lower U.S. profile was compounded by lagging demand from the two largest U.S. markets—Mexico and Southeast Asia—which account for more than 80% of U.S. nonfat exports. For both regions, purchasing shifted significantly during the front and back of the year. U.S. exports to Mexico rose 4% (+7,651 MT) in the first half of 2025 and dropped 12% (-24,256 MT) in the second half. Southeast Asia was generally the opposite: U.S. NFDM/SMP exports fell 26% (-45,792 MT) in the first three quarters of the year, but increased 28% (+10,357) in the fourth quarter. Overall Southeast Asian dairy purchasing from all sources began to improve toward the end of 2025, offering hope for a complete rebound this year.*In order to correct for reporting inconsistencies (made clear by suspiciously low high-protein whey prices to China) and provide a more realistic picture of product flows, USDEC adjusts official whey export data, aligning reported unit values with actual market prices. If you have any questions or would like more information, don’t hesitate to reach out to any member of the Economics team.

Learn more about global dairy markets-

U.S. dairy exports poised for strong finish to 2025

- October U.S. dairy exports jump 7%

-

U.S. dairy export volume up 1.7% through three quarters

-

August exports continue growth streak, rise 3%

Subscribe to the U.S. Dairy Exporter Blog

The U.S. Dairy Export Council fosters collaborative industry partnerships with processors, trading companies and others to enhance global demand for U.S. dairy products and ingredients. USDEC is primarily supported by Dairy Management Inc. through the dairy farmer checkoff. How to republish this post.

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (67)

- Africa (6)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (20)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (9)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farmer leaders (1)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Future trends (1)

- Geographical Indications (GIs) (10)

- Global Marketing (86)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (272)

- Member Services (17)

- Mexico (41)

- Middle East (9)

- Middle East & North Africa (3)

- Middle East/North Africa (9)

- Milk (4)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (19)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (330)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (26)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- April 2015 (11)

- December 2015 (11)

- March 2014 (10)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- January 2026 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- April 2024 (2)

- June 2024 (2)

- July 2024 (2)

- November 2024 (2)

- December 2024 (2)

- February 2025 (2)

- June 2025 (2)

- July 2025 (2)

- September 2025 (2)

- November 2025 (2)

- December 2025 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- May 2024 (1)

- August 2024 (1)

- September 2024 (1)

- October 2024 (1)

- January 2025 (1)

- March 2025 (1)

- April 2025 (1)

- May 2025 (1)

- August 2025 (1)

- February 2026 (1)

- USDEC (183)

- USDEC Staff (168)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Nick Gardner (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Krysta Harden, USDEC President and CEO (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Becky Nyman (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Erica Louder (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

.png)