-

TRADE ANALYSIS: 7 global dairy themes to monitor second half of 2020

By USDEC Staff July 23, 2020- Tweet

USDEC analysts explore the issues expected to have the greatest impact on global dairy markets and U.S. exports over the last six months of 2020.

Global dairy markets will be under pressure in the second half of the year, according to a webinar presented to U.S. Dairy Export Council (USDEC) members in mid-July by analysts Alan Levitt and William Loux.

.png?width=443&name=Levitt%20and%20Loux%20(2).png)

“If you have even a slight reduction in consumer demand in the United States and Europe, and rising milk production in both regions, you’re going to have a lot more milk that has to find a home somewhere – either in export markets or in inventory,” Levitt said.“And then, if importer demand lags a bit, you’re going to be looking at more excess supply by the time we get to the fourth quarter. The upshot is downward pressure on global pricing.”

.jpeg?width=728&name=Whats%20next%20(2).jpeg)

Seven themes to keep an eye on

Loux and Levitt identified seven key themes that will be the defining characteristics of the second half of 2020:# 1. China always gets the first word.

# 2. Latin America is in crisis.

# 3. Customers are carrying higher inventories.

# 4. Supply could overwhelm the market this fall.

# 5. U.S. cheese prices have disconnected from world levels.

# 6. Volatility makes it extra challenging.

# 7. The economic impact of Covid-19 is still playing out.

Overall dairy trade has been stronger than expected in the first few months after the pandemic lockdowns.

A key question Levitt and Loux addressed was whether that trade strength reflected importers stocking up at favorable prices, mitigating second half needs and representing a bubble about to burst—or if it reflected actual consumer dairy consumption.

Assessing China's mixed bag of imports

In the case of China, Loux noted that imports were mixed in the first four months of the year—with stronger whey imports offset by flat purchases of whole milk powder (WMP), cheese, lactose and infant formula and lower imports of skim milk powder (SMP). Even so, the nation built inventories of milk powder.

Loux felt China would continue to buy, carrying higher inventories to protect against possible future supply disruptions. In addition, the continued restocking of China’s hog herd would support whey demand, and demand for lactose for infant formula would be strong.

Refilling pipelines affecting prices

Other regions have refilled pipelines as well, Levitt noted. In Southeast Asia, processors and blenders built stocks to ensure supply continuity. In the Middle East/North Africa (MENA) region, robust retail and on-line sales of basic dairy products and processed foods led importers to buy ahead to make sure grocery shelves were stocked and full product portfolios were available to consumers.

-Jul-23-2020-05-12-11-06-PM.png?width=554&name=Chart3%20(2)-Jul-23-2020-05-12-11-06-PM.png)

This behavior has supported prices, particularly for SMP, whey and lactose, Levitt said. However, rising prices could lead to buyer resistance and reduced purchases in the second half, he added.

This manner of ebbs and flows in dairy import volumes will contribute to price volatility in the second half, Loux predicted, creating an additional challenge for exporters that has to be managed.

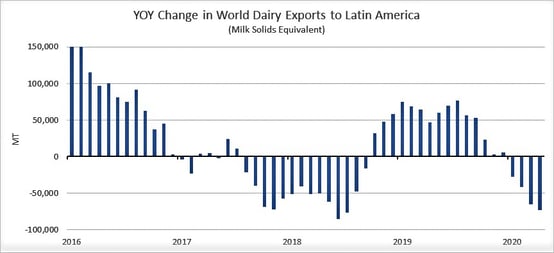

Weakness in Latin America

Closer to home, dairy exports to Latin America were down 6% in April, with significantly lower purchasing from Mexico and Brazil. Year-to-date, Mexico’s imports in total milk solids were off 19%, disproportionately affecting U.S. exporters.

Weak economic factors, including a depressed currency, will reduce purchasing power in Mexico for the remainder of the year, the analysts projected.

The full impact of those weak economic indicators in Mexico and elsewhere hasn’t been felt yet, Levitt said. Government stimulus in all major countries has deferred some of the pain, which businesses and consumers would continue to feel over the balance of the year. Sharply lower global GDP, coupled with continued high unemployment, will put downward pressure on dairy demand, added Loux.

The impact of U.S. cheese prices

As part of the price discussion, Loux noted that wide disparities between U.S. cheese prices and much lower offering prices from other regions are expected to be a significant headwind against U.S. cheese export performance in the second half. Among the major exporters, the United States typically accounts for 15-18% of cheese trade, but that figure is likely to fall below that range this year.

In contrast, U.S. milk powder prices were highly competitive, they pointed out.

What will happen to global milk production?

In this environment, milk production from the major suppliers is expected to post modest growth in the second half—around +0.5% from the six major suppliers (EU-28, United States, New Zealand, Australia, Argentina and Belarus). For the EU, any slowdown in demand from the MENA region will force EU supply into markets that compete more directly with the United States. Likewise, any pullback in China imports leaves New Zealand looking elsewhere, Levitt and Loux said.

-Jul-23-2020-05-16-14-46-PM.png?width=554&name=Chart4%20(2)-Jul-23-2020-05-16-14-46-PM.png)

Projection: Global trade to be down 2.2% second half of 2020

Weighing all the factors, Loux and Levitt project global dairy trade, on a total milk solids basis, to be down about 2.2% in the second half of the year.SMP trade would be off about 5.0%, attributed mostly to declines from Mexico and China. Cheese trade would be down 1.7%, with losses across Latin America. Shipments of whey products, however, would grow 2.7% from year ago, thanks to the continued restocking of China’s hog industry.

.jpg?width=554&name=Chart5%20(3).jpg)

Bottom line

The bottom line is that global dairy demand held up better than expected in the first half, and the next six months will hinge on the themes Levitt and Loux discussed, as well as other variables not specifically addressed.

USDEC members with a usdec.org login can still watch the complete webinar with an option to download a PDF version of the slide deck.

Learn more about global dairy markets:

-

U.S. dairy export volume hits 2-year high

- June's Dairy Data Dashboard

- Record sales to Southeast Asia drive April U.S. dairy export numbers higher

- May's Dairy Data Dashboard

- U.S. dairy export volume up 7th straight month, despite coronavirus outbreak

- April's Dairy Data Dashboard

- Exports higher ahead of COVID-19 disruptions

Subscribe to the U.S. Dairy Exporter Blog

The U.S. Dairy Export Council fosters collaborative industry partnerships with processors, trading companies and others to enhance global demand for U.S. dairy products and ingredients. USDEC is primarily supported by Dairy Management Inc. through the dairy farmer checkoff. How to republish this post.

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (67)

- Africa (6)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (20)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (9)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farmer leaders (1)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Future trends (1)

- Geographical Indications (GIs) (10)

- Global Marketing (86)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (271)

- Member Services (17)

- Mexico (41)

- Middle East (9)

- Middle East & North Africa (3)

- Middle East/North Africa (9)

- Milk (4)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (19)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (329)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (26)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- April 2015 (11)

- December 2015 (11)

- March 2014 (10)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- January 2026 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- April 2024 (2)

- June 2024 (2)

- July 2024 (2)

- November 2024 (2)

- December 2024 (2)

- February 2025 (2)

- June 2025 (2)

- July 2025 (2)

- September 2025 (2)

- November 2025 (2)

- December 2025 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- May 2024 (1)

- August 2024 (1)

- September 2024 (1)

- October 2024 (1)

- January 2025 (1)

- March 2025 (1)

- April 2025 (1)

- May 2025 (1)

- August 2025 (1)

- February 2026 (1)

- USDEC (183)

- USDEC Staff (167)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Nick Gardner (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Krysta Harden, USDEC President and CEO (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Becky Nyman (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Erica Louder (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

.png)