-

U.S. export performance mixed in September

By USDEC Staff November 8, 2023- Tweet

Solid month for U.S. cheese, WPC80+ exports unable to offset NFDM/SMP and low-protein whey declines.

Despite record shipments of WPC80+ and a rebound in U.S. cheese exports, year-over-year U.S. dairy exports (milk solids equivalent or MSE) fell 12% in September. It was the eighth consecutive decline, dating back to February 2023.

September export value fell 25% to $603 million, the lowest monthly total since January 2022.

Trends that have been keeping overall U.S. exports in check for most of the year remain largely unchanged. U.S. suppliers continue to face strong demand headwinds from tepid global economic growth, elevated inflation and, in the case of low-protein whey, China’s struggling pork sector (though that reportedly has improved of late). While global milk supply growth has slowed, competition from New Zealand and the EU remains tougher than it has been in recent years.

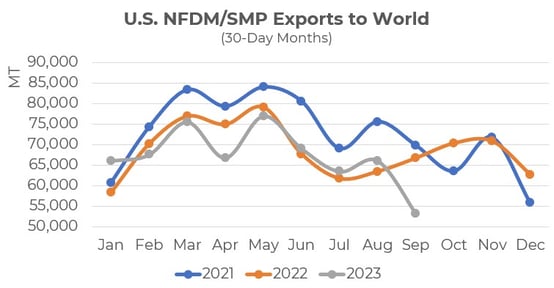

U.S. nonfat dry milk/skim milk powder (NFDM/SMP) exports had their worst month of 2023, falling 20% to 53,256 MT (-13,411 MT). Year-over-year U.S. shipments to Mexico declined for the first time in more than a year (-16%, -5,273 MT). And the nascent recovery in U.S. NFDM/SMP exports to Southeast Asia (+3% for the three-month period of June-August) ended abruptly in September, with year-over-year volume falling 38% (-7,314 MT).

China continued to drag down U.S. low-protein whey sales. U.S. whey shipments to China (0404.10) fell 39% (-11,427 MT), with across-the-board double-digit declines in dry, whey protein concentrate (less than 80%) and modified whey and permeate. U.S. suppliers also saw smaller declines to Mexico (-24%, -928 MT) and Canada (-28%, -1,172 MT).

Gratefully, several positive storylines have emerged in recent months and continued into September, particularly on the higher-value products.

Global cheese demand has proven surprisingly resilient internationally, buoyed by the ongoing post-pandemic recovery in the foodservice sector and Mexico’s robust consumption. Year-over-year U.S. cheese exports rose 4% (+1,531 MT) in September. Shipments to Mexico remained on record pace, jumping 26% (+2,524 MT) and U.S. cheese sales to China more than quadrupled (+1,502 MT). U.S. suppliers also posted strong gains to Southeast Asia (+54%, +543 MT), Central America (+10%, +310 MT) and the Caribbean (+9%, +154 MT).

On top of the positive cheese story, the increasingly global nutritional appeal of high-protein foods and beverages, coupled with favorable pricing of high-protein whey, drove WPC80+ demand to an all-time high. The U.S. shipped 7,356 MT of WPC80+ in September, a 40% increase (+2,118 MT) over the previous year. It was the first time U.S. shipments cleared the 7,000-MT mark—and in a 30-day month no less. U.S. WPC80+ exports to Japan—our top market—more than doubled (+1,078 MT) while volume to China more than tripled (+1,070 MT).

Through three-quarters, on an MSE basis, U.S. dairy exports were down 7.5% compared to the previous year. Value through three quarters was $6.23 billion, down 15%.

For a deeper dive into the key product categories of cheese and NFDM/SMP, see below.

.png?width=554&height=302&name=Chart101%20(2176%20x%201500%20px).png)

For more detailed information, as well as interactive charts and data, visit USDEC's Data Hub

Q3 rebound in cheese exports

After a rough second quarter, U.S. cheese exports returned to neutral in Q3 – decreasing just 16 metric tons compared to the 17% (-20,986 MT) decline in Q2. Mexico remained the largest positive contributor to U.S. cheese exports in Q3, increasing 15% for the quarter and 26% in the month of September thanks to robust consumer demand and a strong peso. Shredded cheese, in particular, has been the cheese of choice for Mexican buyers, more than doubling in 2023.

Still, the major change in Q3 was the improvement in several markets other than Mexico. U.S. cheese exports to Japan went from -29% (-4,358 MT) in Q2 to +15% in Q3 (+1,570 MT); Australia went from +3% (181 MT) to +16% (+878 MT); and sales to Central America jumped 23% (+2,060 MT) compared to a 17% drop in Q2 (-2,350 MT).

Naturally, not every market was positive. Sales to Korea continue to be hammered by weak demand and stiff competition from European suppliers, falling by more than a third in Q3 (-35%, -6,845 MT). Sales to the Middle East/North Africa (MENA) dropped by 41% in Q3 (-3,066 MT) for similar reasons. This contrast between Korea and MENA and most other U.S. markets resulted in cheese trade holding roughly neutral, which is still a marked improvement from Q2 and is being compared against a record 2022.

So, what drove the improvement in Q3 after the challenging second quarter?

Certainly, price was a major determinant. As we said in plenty of past reports, U.S. cheese prices were uncompetitive for late 2022 and the first half of 2023 as European cheese prices dropped precipitously and domestic sales and exports to Mexico helped keep U.S. prices elevated relative to the world market. This naturally led to a sharp drop in Q2, but as U.S. prices declined over the summer and European prices firmed, exports to highly competitive markets like Japan improved.

Fortunately, U.S. cheese prices have improved since the lows of June and July with roughly comparable prices across the major exporters, which should help maintain the stabilization of U.S. cheese exports into the fourth quarter and 2024, provided global demand improves with a (slightly) more optimistic economic outlook.

NFDM/SMP turns downward again in September

U.S. NFDM/SMP exports had almost drawn back to even through the first eight months of 2023, with gains in June, July and August. Volume was 558,407 MT—only 283 MT less than the previous year. However, a 20% year-over-year shortfall in September dug the year-to-date hole a little deeper. U.S. NFDM/SMP exports through the first three quarters were 611,663 MT, a 2% decline from the first three quarters of 2022.

September’s weak performance stems largely from our two largest buyers—Mexico and Southeast Asia—although the reasons behind each market’s decline varied.

U.S. shipments to Southeast Asia fell 38% (-7,314 MT) in September to 11,738 MT. The disappointing result came after U.S. suppliers appeared to be rebounding from a longer-term slump in growth to Southeast Asia. U.S. NFDM/SMP exports to the region rose 3% (+2,034 MT) over the June-August period. While that three-month period compared to a down year in 2022, volume still averaged more than 20,000 MT per month.

The September results marked a significant step down. At 11,738 MT, it was the lowest U.S. monthly volume (30-day months) to the region in six years. While it is true that New Zealand has been channeling more milk to butter/SMP, boosting its export supply, the broader issue overall is slow Southeast Asian demand. New Zealand SMP exports to Southeast Asia fell 34% in September and were down 24% in the third quarter. EU SMP exports to Southeast Asia fell 15% in August (latest available data).

Mexico is a different story. U.S. NFDM/SMP exports to our No. 1 market fell 16% (-5,272 MT) in September. It was the first year-over-year decline since August 2022. But it did not come out of nowhere. U.S. NFDM/SMP exports to Mexico jumped 31% in the first eight months of the year to 286,141 MT—well on their way to a new annual record. While they are still on record pace, the size of the year-over-year gains has been dwindling since May, dropping into the negative in September.

We see a few reasons behind the slowdown in growth, including the build-up in supply, the value of the peso and slowdowns at the U.S.-Mexico border that began worsening in September.

The Mexican peso reached a multi-year high against the U.S. dollar in July, making U.S. powder more affordable. But the peso slowly lost value from July through mid-October, overlapping a rise in U.S. NFDM/SMP prices that began in early August.

Improvements in the peso-U.S. dollar exchange rate since mid-October provide some reasons for optimism on NFDM/SMP shipments to Mexico moving forward, particularly as stalled product is accounted for. But uncertainties remain regarding Southeast Asian demand.

Learn more about global dairy markets:

-

Global headwinds hamper U.S. dairy exports again in August

-

Slow whey demand in China holds back U.S. dairy exports in July

-

Dairy exports still challenged by global headwinds in June; What does the second half hold?

-

U.S. dairy exports lagged in May as global headwinds persist

Subscribe to the U.S. Dairy Exporter Blog

The U.S. Dairy Export Council fosters collaborative industry partnerships with processors, trading companies and others to enhance global demand for U.S. dairy products and ingredients. USDEC is primarily supported by Dairy Management Inc. through the dairy farmer checkoff. How to republish this post.

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (67)

- Africa (6)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (20)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (9)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farmer leaders (1)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Future trends (1)

- Geographical Indications (GIs) (10)

- Global Marketing (86)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (271)

- Member Services (17)

- Mexico (41)

- Middle East (9)

- Middle East & North Africa (3)

- Middle East/North Africa (9)

- Milk (4)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (19)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (329)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (26)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- April 2015 (11)

- December 2015 (11)

- March 2014 (10)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- January 2026 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- April 2024 (2)

- June 2024 (2)

- July 2024 (2)

- November 2024 (2)

- December 2024 (2)

- February 2025 (2)

- June 2025 (2)

- July 2025 (2)

- September 2025 (2)

- November 2025 (2)

- December 2025 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- May 2024 (1)

- August 2024 (1)

- September 2024 (1)

- October 2024 (1)

- January 2025 (1)

- March 2025 (1)

- April 2025 (1)

- May 2025 (1)

- August 2025 (1)

- February 2026 (1)

- USDEC (183)

- USDEC Staff (167)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Nick Gardner (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Krysta Harden, USDEC President and CEO (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Becky Nyman (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Erica Louder (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

.png)