-

U.S. dairy exports keep pace for record year

By USDEC Staff January 8, 2021- Tweet

Even as the streak of year-over-year volume growth ends after 14 straight months, U.S. dairy exports remain 4% ahead of previous record with one month to go.

Overall, November did little to dampen year-to-date (YTD) dairy export volume and value. Through 11 months, U.S. dairy export volume on a milk solids equivalent basis (MSE) is up 14% over 2019 to a total of 1,923,176 metric tons (MT) – 71,345 MT greater than the previous record year in 2018. Value is on a similar trajectory, up 10% over 2019 to $6.06 billion through November. Both volume and value have already surpassed 2019 year-end levels.

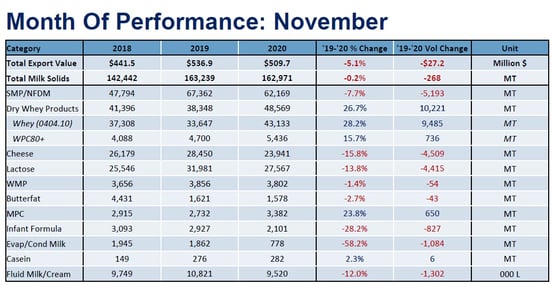

Still, falling just 0.2% in November, U.S. dairy exports declined on a milk solids equivalent basis for the first time in 2020. A 27% gain in whey products (+10,221 MT) was not enough to account for reduced volumes of NFDM/SMP (-8%, -5,193 MT), cheese (-16%, -4,509 MT), and lactose (-14%, -4,415 MT). As a higher value product on a per MT basis, the diminished cheese exports – in part caused by record high U.S. domestic prices in the summer and fall – contributed to the 5.1% decline in total value for the month.

U.S. whey exports maintain momentum

As mentioned above, U.S. whey exports delivered another month of growth in November and helped mitigate declines in milk powder, cheese and lactose. Whey volume rose 27% to 48,569 MT for the month and is up 24% YTD.

The major factors driving U.S. whey sales remain the same: heavy Chinese purchasing to support efforts to rebuild a pig herd decimated by African Swine Fever. China reported that its herd had reached about 90% of normal levels at the end of November 2020. But given that pork output is still far short of demand and dry whey pricing levels suggest strong Chinese buying activity, we expect whey import gains to persist into the new year. Reiterating what we said in last month’s summary, volumes to China “demonstrate that the market has moved from recovery to demand expansion.”

Overall, U.S. whey shipments to China more than doubled in November to 21,616 MT and were up 111% year to date. U.S. suppliers have been able to grow volume and recapture market share in large part due to the retaliatory tariff exemption secured in 2019 and renewed for another 12 months in 2020.

China also topped all buyers for higher value whey products (WPC80+) in November, with volume soaring 254% to 1,740 MT for the month. Reinforced by its nutritional reputation (a particular selling point over the pandemic period where we have seen populations focus more squarely than ever on healthy eating), U.S. WPC80+ exports continue to find more broad-based geographical growth, setting new records every single year since 2016. With November’s data, 2020 has already guaranteed another record year. Exports to Japan (+27%), Southeast Asia (+73%), South Korea (+165%) and the EU+UK (+294%) all saw big gains in November.

.jpg?width=554&name=November%20chart2a%20(3).jpg)

Divergent signals in Mexico

For much of this year, we have talked about Mexico buying less NFDM/SMP, a development that has driven U.S. suppliers to look elsewhere, especially to Southeast Asia. This trend abated in November with shipments of NFDM/SMP to Mexico posting the second highest month of the year behind only October, gaining 16% (+3,366 MT) over November 2019. It appears that powder demand, while still not consistently back to pre-covid levels may be on the road to recovery with an improved fourth quarter.

On the flip side, exports of cheese to Mexico weakened significantly. Reduced consumer demand inside of Mexico due to the COVID-19 pandemic and its severe economic consequences likely contributed to November’s 38% decline (-3,356 MT) in cheese exports to Mexico. The bigger factor was probably U.S. prices incentivizing international buyers to delay purchases over the summer and fall when domestic spot prices kept breaking records and cheese production was short compared to retail and food box demand. Still, despite the pandemic YTD cheese volumes to Mexico remain close to prior year levels, down just 1%.

.jpg?width=749&name=November%20chart3a%20(2).jpg)

Looking ahead, more affordable U.S. cheese towards the end of 2020 should have been the signal for international buyers, particularly in Mexico, to buy U.S. product. As a result, exports should rebound, but with more price volatility on the way, volatility in export volumes may follow.

Non-fat dry milk/skim milk powder sales to Southeast Asia slow in November

Let’s start off with some context. Through November, U.S. NFDM/SMP exports to Southeast Asia were up 50% compared to the same period last year – growth of more than 100,000 MT in 11 months. That acceleration was due primarily to a change in market share as the U.S. went accounting from 31% of total Southeast Asian NFDM/SMP trade in 2019 to 46% on an annualized basis. So, overall trade to the region is still very strong in 2020 despite November’s figures.

Still, NFDM/SMP exports to Southeast Asia in November represented a slowdown in the pace we have become accustomed to. Exports to the six major markets of the region (Indonesia, Malaysia, Philippines, Singapore, Thailand and Vietnam) dropped 27% (-7,399 MT). Shipments to Indonesia grew by 22% (+1,597 MT), but exports to the other destinations declined. Vietnam declined the most (-2,885 MT) followed by the Philippines (-2,686 MT), Malaysia (-2,314 MT), and Thailand (-1,099 MT).

The question remains “Why?” and “Should we expect this to persist?”

As to why – there were likely multiple factors all at play. A 46% share of trade for any supplier is well above the norm in such a highly competitive region with European, New Zealand and Australian suppliers all focused on gaining business. Thus, some regression in market share or volumes was to be expected.

Additionally, November was the strongest month of growth in 2019 so if volumes were to fall behind year-over-year levels, November would be the most likely candidate. Plus, October’s volumes were buoyed by record shipments to the Philippines, so it may just be a case that difference in shipping dates are causing some month-to-month declines.

The most relevant unknown, however, is whether demand in the region is slowing. Total NFDM/SMP trade to Southeast Asia accelerated sharply in the second and third quarters this year, up 16% from the same period in 2019. After total trade to the region declined 0.6% in October despite U.S. volumes increasing, a drop in U.S. exports in November likely presages of a drop in global NFDM/SMP trade to Southeast Asia for the month as well. European export figures will clarify that in a couple weeks’ time, but for now it is something to monitor.

Looking ahead, we will be watching closely what happens with Southeast Asian demand but going into 2021, U.S. exports to the region should remain much closer to the record-breaking levels we saw in 2020 than the preceding era given the growing U.S. presence in the region, price competitiveness, and product availability going into a strong spring flush.

.jpg?width=554&name=November%20chart4a%20(4).jpg)

More information, data and charts on specific products and markets can be found here.

Learn more about global dairy markets:-

Ingredient exports keep U.S. on pace for record year

-

U.S. dairy exports rise for 13th consecutive month

-

U.S. dairy year-to-date exports up 16%

Subscribe to the U.S. Dairy Exporter Blog

The U.S. Dairy Export Council fosters collaborative industry partnerships with processors, trading companies and others to enhance global demand for U.S. dairy products and ingredients. USDEC is primarily supported by Dairy Management Inc. through the dairy farmer checkoff. How to republish this post.

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (65)

- Africa (6)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (19)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (9)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farmer leaders (1)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Future trends (1)

- Geographical Indications (GIs) (10)

- Global Marketing (86)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (264)

- Member Services (17)

- Mexico (41)

- Middle East (9)

- Middle East & North Africa (3)

- Middle East/North Africa (9)

- Milk (4)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (18)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (322)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (25)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- April 2015 (11)

- December 2015 (11)

- March 2014 (10)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- April 2024 (2)

- June 2024 (2)

- July 2024 (2)

- November 2024 (2)

- December 2024 (2)

- February 2025 (2)

- June 2025 (2)

- July 2025 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- May 2024 (1)

- August 2024 (1)

- September 2024 (1)

- October 2024 (1)

- January 2025 (1)

- March 2025 (1)

- April 2025 (1)

- May 2025 (1)

- USDEC (183)

- USDEC Staff (158)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Nick Gardner (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Becky Nyman (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Erica Louder (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

- Krysta Harden, USDEC President and CEO (1)

.png)