-

RIP: U.S. Dairy honors the legacy of NAFTA

By USDEC July 2, 2020- Tweet

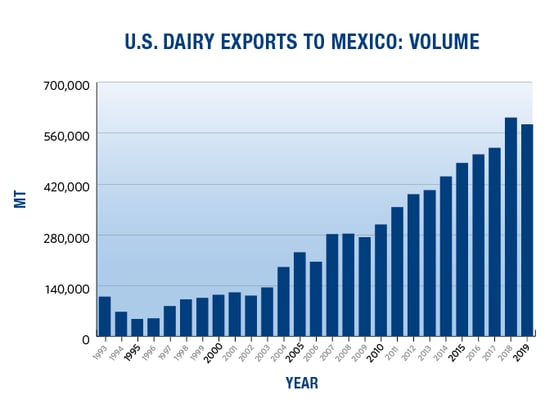

NAFTA swung open a door of opportunity to our southern border that helped increase U.S. dairy export volume to Mexico by 435% while value soared by 646% over 26 years.

.jpg?width=554&name=USMCA1%20(2).jpg)

NAFTA fostered new partnerships between the U.S. and Mexican dairy industries.

Maligned by critics from the get-go but appreciated by the U.S. dairy industry, the landmark North American Free Trade Agreement (NAFTA) died at 11:59 p.m. on Tuesday.

NAFTA was 26.

"U.S. agriculture in general and the U.S. dairy industry, in particular, will remember NAFTA as the landmark agreement that ushered in an era of growing and mutually beneficial free trade between the United States and our neighbor to the south, Mexico," said U.S. Dairy Export Council President and CEO Tom Vilsack.

NAFTA's successor is the U.S.-Mexico-Canada Agreement (USMCA), which went into effect Wednesday.

In a joint news release on Wednesday, the U.S. Dairy Export Council (USDEC) and the National Milk Producers Federation (NMPF) commended the bipartisan effort from the Administration and Congress that made USMCA a reality.

If properly enforced, USMCA will build on NAFTA's foundation by bringing positive changes to U.S.-Canadian dairy trade, protections for common cheese names and increased certainty to U.S.-Mexico trade relations.

As optimistic as U.S. Dairy is about USMCA, it's fitting during this week of transition to reflect on the legacy of its predecessor. This retrospective tribute to NAFTA is loaded with statistics, but two data points stand out.

During NAFTA's 26 years,

U.S. dairy export volume

to Mexico increased 435%

as value soared 646%.

Why should anyone beyond the U.S. dairy industry care? An economic impact study explained in more detail below showed that increased dairy trade with Mexico has had an economic ripple effect that goes far beyond U.S. dairy suppliers and farmers to affect the U.S. economy, including rural communities.

More numbers on NAFTA

NAFTA will be a tough act to follow. Its accomplishments have been recorded and enshrined for dairy posterity, including:

- About 30% of all the NDM/SMP we make in the U.S. is sold to Mexico. That is almost as much as we sell domestically.

- Mexico in recent years became the world’s largest NDM/SMP importer and one of the largest cheese importers. The U.S. dairy industry was able to meet the expanding need, thanks to NAFTA.

- Mexico is still only about 73% self-sufficient in dairy and that percentage is shrinking because consumption continues to rise faster than domestic production, providing more opportunity for increasing U.S. dairy exports to help meet the growing demand needs in Mexico.

- What we sell to Mexico provides vital, affordable dairy nutrition to appreciative consumers.

Moving milk beyond our borders

As impressive as those facts are, U.S. dairy farmers are most eager to see more of their milk travel beyond our national borders. Under NAFTA, it did.

U.S. dairy export volume to Mexico grew 435% under NAFTA

Source : U.S. Dairy Export Council utilizing government trade data. (MT = metric tons)

U.S. dairy exports to Mexico are off to a rough start in 2020 due to the coronavirus pandemic and a struggling Mexican economy with a devalued peso, among other factors.

But the upward year-after-year trend line shown in the chart above speaks for itself. Not only did volume soar 435%, value increased at an even higher rate -- 646% in 26 years.

In 1993, the year before NAFTA implementation, the U.S. sold only $205 million in exports to Mexico. In 2019, the latest year with available 12-month data, the U.S. sold $1.53 billion in dairy products and ingredients to Mexico.That accounted last year for roughly one-fourth of all U.S. dairy exports.

.png?width=554&name=NAFTA%20chart1%20(2).png)

"Giant sucking sound" predicted

NAFTA was born in controversy.

In a 1992 debate with Bill Clinton and George H.W. Bush, presidential candidate Ross Perot famously predicted NAFTA would create a "giant sucking sound" of U.S. jobs going to Mexico. Other critics have charged that it was the worst trade deal America ever signed.

For U.S. Dairy, however, NAFTA held promise from the start.

Mexico was a dairy-deficient country. It didn't produce enough milk to meet the increasing demand of its nearly 100 million consumers.

The U.S., on the other hand, had ample milk supplies and the capacity to make and ship more and more dairy products and ingredients Mexican consumers would love.

NAFTA's provisions promised that, over time, Mexican tariffs would be lowered to zero across the entire market basket of dairy products—from milk powder to cheese to fluid milk—giving U.S. dairy suppliers a significant advantage over competitors in Europe and Oceania.

Mexico: Dairy partner first, dairy customer second

NAFTA has yielded benefits to the dairy sectors in both nations, supporting steady milk production growth for Mexican dairy farmers and making Mexico the United States’ No. 1 export market.

But the bonds grown between the U.S. and Mexico dairy industries go beyond just business.

In 2017, Vilsack joined with the CEOs of the National Milk Producers Federation and the International Dairy Foods Association on a goodwill trip to Mexico that USDEC organized, expressing a united front of appreciation from leading U.S. dairy groups.

In an interview with Iowa Public Television prior to the trip (video below), Vilsack explained why "relationships matter" with our Mexican neighbors.

In Mexico City, Vilsack made the same point when he addressed the National Dairy Forum, an annual gathering of Mexican dairy farmers organized by the Mexican Federation of Milk Producers (Femeleche).

"We have always seen Mexico as a partner first and a customer second," Vilsack told the large crowd of farmers. "That’s why we intend to continue working with you and your industry to expand dairy consumption in a way that benefits both countries."

Joining hands across the border

The dairy industries of the U.S. and Mexico have found ways to cement their common interests with partnerships.

In 2007, USDEC and the National Milk Producers Federation (NMPF) signed a Memorandum of Understanding with the Asociación Nacional de Ganaderos Lecheros (ANGLAC), Mexico’s dairy farmer association, creating the North America Dairy Improvement Partnership.

Goals outlined in the agreement included improving farming standards and practices, facilitating trade and identifying and implementing a program to increase dairy consumption in Mexico.

USDEC President and CEO Tom Vilsack, shown standing with microphone, engaged in dialogue in October 2019 with leaders of the Mexican dairy industry.USDEC and NMPF also created the U.S.-Mexico Dairy Alliance with ANGLAC, the Confederación Nacional de Organizaciones Ganaderas (CNOG), and Cámara Nacional de Industriales de la Leche (CANILEC).

Last October, dairy industry leaders from the United States and Mexico met in Torreón, Mexico.

They issued a statement agreeing to work collaboratively on 12 issues that will benefit the dairy sectors of both countries. It was the fourth annual meeting between U.S. and Mexican dairy leaders.

Without a strong trade agreement like NAFTA, across-the-border collaboration like this would have been unlikely.

An impetus to create USDEC

Another legacy of NAFTA is that it was one of several factors persuading Dairy Management Inc. to create the U.S. Dairy Export Council 25 years ago with funding from farmers through the dairy checkoff.

"It was apparent early on that Mexico would be our most important export market," said Les Hardesty, a dairy producer from Greeley, Colo. and a former chairman of USDEC.

"But we needed to invest in a series of programs that, over time, would enable U.S. suppliers to fully capitalize on the opportunity. USDEC was created for integrated activities in marketing, technical assistance and trade policy advocacy to ensure we had markets for growing U.S. production."

What was gouda for Mexico was good U.S. Dairy

With continued generous support from DMI and the dairy checkoff, USDEC has fulfilled its original vision in Mexico. Take, for example, USDEC's "Gouda Initiative".

About one-tenth of the cheese consumed in Mexico is gouda, a variety that the United States made little of a decade ago.

.jpg?width=300&name=Gouda2%20(2).jpg) In 2008-2009, USDEC started a program to build U.S. gouda capabilities to service this untapped market, working closely with U.S. cheesemakers and conducting taste and application tests with key buyers in Mexico.

In 2008-2009, USDEC started a program to build U.S. gouda capabilities to service this untapped market, working closely with U.S. cheesemakers and conducting taste and application tests with key buyers in Mexico.The award-winning program led to U.S. suppliers branching into a “new” variety and displacing other suppliers from South America, New Zealand and Europe.

Gouda now comprises roughly one-fourth of U.S. cheese sales to Mexico.

Broad economic impact: double 'bang for the buck'

"The Impact of NAFTA on U.S. Dairy Exports to Mexico" by Informa Economics is a 35-page analysis commissioned by the U.S. Dairy Export Council and the National Milk Producers Federation in 2017.

One of the most striking findings of the Informa study is this:

Every $1 of U.S. dairy exports to Mexico generates $2.50 of economic activity in the United States.

Put another way, the U.S. dairy industry's investment in Mexico has yielded more than "double the bang for the buck."

Other facts generated by the Informa Economics analysis included:

- Overall U.S. dairy exports to Mexico, which includes cheese, employed 16,492 full-time equivalent jobs, according to the Informa report.

- U.S. exports to Mexico generated an aggregate GDP of $8.4 billion over the five-year period Informa studied.

- When Informa included impacts to industries that are linked to dairy exports, the aggregate economic output was magnified to $23.3 billion.

FACT: Nearly 90% of Mexico's dairy imports come from the U.S. This is a tribute to U.S. suppliers and the work they have done to build customer relationships in Mexico. https://t.co/I03oqgru18 #USfarmersMexico pic.twitter.com/yIGSPng7RI

— U.S. Dairy Exporter (@USDairyExporter) October 22, 2019Hello USMCA, goodbye NAFTA

As good as NAFTA has been for the U.S. dairy industry, a modernized USMCA followed up with vigilant enforcement has the potential to be even better.

Let’s not forget, however, that USMCA was built on a foundation NAFTA created.

Even though NAFTA was laid to eternal rest this week, political scientists, economists and historians will continue their assessment and debate over its long-range societal impact on globalization and other topics.

Even though NAFTA was laid to eternal rest this week, political scientists, economists and historians will continue their assessment and debate over its long-range societal impact on globalization and other topics.For U.S. Dairy, however, there is little debate.

That’s why this eulogy from the U.S. Dairy Export Council is more than just an "adios" to the North American Free Trade Agreement.

It's a grateful "muy bien" and "muchas gracias" for 26 years of expanded trade with Mexico under NAFTA.

Mark O'Keefe is vice president of editorial services at the U.S. Dairy Export Council.

Learn more:

- Search for #USMCA on Twitter

- Travelogue: DMI board members examine U.S. Dairy's No. 1 market -- Mexico (many photos)

- 5 compelling economic facts about U.S. dairy exports to Mexico (charts)

- Infographic: Top U.S. Food and Agriculture Exports to Mexico and Canada = $40 Billion in 2018

- 7 Facts About Dairy Exports to Mexico (Infographic)

- $391 Million in Cheese Exports to Mexico Support U.S. Dairy Industry, Boost U.S. Economy

- 9 Shared Priorities of U.S. and Mexico Dairy

Subscribe to the U.S. Dairy Exporter Blog

The U.S. Dairy Export Council fosters collaborative industry partnerships with processors, trading companies and others to enhance global demand for U.S. dairy products and ingredients. USDEC is primarily supported by Dairy Management Inc. through the dairy farmer checkoff. How to republish this post.

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (67)

- Africa (6)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (20)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (9)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farmer leaders (1)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Future trends (1)

- Geographical Indications (GIs) (10)

- Global Marketing (86)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (271)

- Member Services (17)

- Mexico (41)

- Middle East (9)

- Middle East & North Africa (3)

- Middle East/North Africa (9)

- Milk (4)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (19)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (329)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (26)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- April 2015 (11)

- December 2015 (11)

- March 2014 (10)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- January 2026 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- April 2024 (2)

- June 2024 (2)

- July 2024 (2)

- November 2024 (2)

- December 2024 (2)

- February 2025 (2)

- June 2025 (2)

- July 2025 (2)

- September 2025 (2)

- November 2025 (2)

- December 2025 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- May 2024 (1)

- August 2024 (1)

- September 2024 (1)

- October 2024 (1)

- January 2025 (1)

- March 2025 (1)

- April 2025 (1)

- May 2025 (1)

- August 2025 (1)

- February 2026 (1)

- USDEC (183)

- USDEC Staff (167)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Nick Gardner (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Krysta Harden, USDEC President and CEO (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Becky Nyman (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Erica Louder (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

.png)