-

Ingredient exports keep U.S. on pace for record year

By USDEC Staff December 4, 2020- Tweet

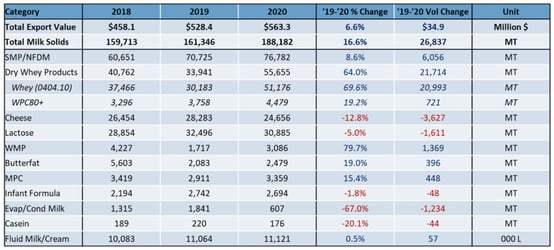

Powered by strong whey and NFDM/SMP sales to Asia-Pacific, U.S. dairy exports posted their 14th consecutive month of year-over-year gains in October.

Trade data shows aggregate sales of major products (milk powder, whey, cheese, butterfat, and lactose) increased by 14% to 201,902 metric tons. It was a record for October and the third time this year that U.S. suppliers topped the 200,000-MT mark in a single month.

Over the first 10 months of 2020, total U.S. exports grew 16% (milk solids equivalent), while value was up 12% to $5.54 billion. We remain on pace for a record volume year.

October in a nutshell: A big rebound in whey sales to China and strong sales of SMP to Southeast Asia were enough to offset reduced demand across categories in Mexico and slow U.S. cheese sales in most other regions.

Looking at the data, the three major trends we see are:

1. China drives record whey volumes

While we talked about China in last month’s summary, the sheer scale of U.S. whey exports bears repeating for October. U.S. volumes hit an all-time high at 55,655 MT of whey products. That was a 64% increase from October 2019 – an improvement of over 20,000 MT.

.jpg?width=554&name=October%20trade%20stats6%20(4).jpg)

China was far and away the primary driver of the growth, accounting for 48% of total U.S. whey exports in October. For much of the past year, we have talked about 2020 as a recovery year for whey following retaliatory tariffs placed on U.S. dairy going to China and African Swine Fever reducing demand in 2019. However, October volumes to China demonstrate that the market has moved from recovery to demand expansion.

October volumes to China were up 328% (+20,285 MT), which, while from a low 2019 base, was still 3% greater than the previous volume record to China in December 2017. Encouragingly, China was not alone – volumes to Southeast Asia were up 42% (+3,235 MT) thanks to substantial growth to Vietnam (+2,847 MT) and smaller gains in Indonesia, Philippines, Thailand, and Malaysia.

These improvements confirm market reports that increased export interest was a major driver of strengthening dry whey prices over the past couple of months. With prices still supported at the time of writing, this should indicate that volumes could keep up the momentum through Q4 and into early 2021.

As an aside, the growth in whey is not only driven by product for China’s feed market. Exports of WPC80+ grew for the 12th straight month. This continues the long-term growth trend for the product category. China was the largest export destination here too, but shipments of WPC80+ are more diversified with growth to Japan, Korea, Southeast Asia, and Europe, making up for the effective closing of the Indian market earlier this year.

2. Asia keeping NFDM/SMP market in balance

For NFDM/SMP, October was a similar story compared to previous months. October shipments posted another month of growth, up 9% (+6,056 MT), with a 20% expansion in volumes to Southeast Asia (+5,125 MT), making up for a 10% decline in volumes to Mexico (-3,195 MT).

A 5,000-MT gain in volumes to Southeast Asia (despite strong 2019 figures) signals robust demand for U.S. powder to the region. One piece to watch moving forward is which countries in the region grow. In October, the Philippines was the market driving growth (+137%, +7,611 MT) while others in the region were static or fell slightly in October. Determining whether this results from a change in market share, slower demand growth, or a combination of both will need to wait for the European Union’s data.

Still, aside from Southeast Asia, other volumes grew as well. SMP exports to China have proven sustainable after six straight months of greater-than-1,000-MT volumes. October exports to China came in at 3,833 MT compared to just 463 MT in October 2019. China was the largest destination for U.S. SMP after Southeast Asia and Mexico.

Ultimately, strong export volumes – particularly to Southeast Asia and China – have helped keep markets in balance, despite the substantial increase in milk production in October and weaker Mexican demand. While inventories climbed in October, they are far from burdensome, especially compared to March-April-May levels.

.jpg?width=554&name=October%20trade%20stats7%20(3).jpg)

.jpg?width=1&name=October%20trade%20stats7%20(3).jpg)

3. Uncompetitive prices trip up U.S. cheese exports

It was expected that record-high U.S. cheese prices would eventually catch up to U.S. cheese exports. October volume fell 13% to 24,646 MT, the lowest monthly volume since September 2018. U.S. exports put up a valiant fight during the first peak in U.S. cheese prices in the spring/summer (May-September cheese exports increased 13% compared to the same period the previous year), but the second price spike in summer/fall appears to have had an impact.

The biggest drop in October came from Mexico, where year-over-year cheese exports fell 46% (-4,135 MT). It was Mexico’s lowest monthly import volume in more than seven years. A struggling economy and pandemic fallout on foodservice continue to weigh on demand.

And Mexico wasn’t alone: We also saw a weakening in U.S. cheese sales to Southeast Asia (-13%), Central America (-8%), the Middle East (-6%), Australia (-21%), and the Caribbean (-13%).

On the positive side, U.S. cheese shipments to South Korea (+21%), Japan (+44%), and Chile (+52%) recorded gains, but it not enough to compensate for the decline to Mexico.

U.S. cheese prices have also come back to earth over the last month, putting us back in a competitive range with Oceania and the EU, but there may be more months similar to October until recent sales are shipped.

.jpg?width=554&name=October%20trade%20stats8%20(3).jpg)

More information, data and charts on specific products and markets can be found here.

Learn more about global dairy markets:-

U.S. dairy exports rise for 13th consecutive month

-

U.S. dairy year-to-date exports up 16%

- September's Dairy Data Dashboard

-

U.S. dairy export volume up 16% through July

Subscribe to the U.S. Dairy Exporter Blog

The U.S. Dairy Export Council fosters collaborative industry partnerships with processors, trading companies and others to enhance global demand for U.S. dairy products and ingredients. USDEC is primarily supported by Dairy Management Inc. through the dairy farmer checkoff. How to republish this post.

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (67)

- Africa (6)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (20)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (9)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farmer leaders (1)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Future trends (1)

- Geographical Indications (GIs) (10)

- Global Marketing (86)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (271)

- Member Services (17)

- Mexico (41)

- Middle East (9)

- Middle East & North Africa (3)

- Middle East/North Africa (9)

- Milk (4)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (19)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (329)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (26)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- April 2015 (11)

- December 2015 (11)

- March 2014 (10)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- January 2026 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- April 2024 (2)

- June 2024 (2)

- July 2024 (2)

- November 2024 (2)

- December 2024 (2)

- February 2025 (2)

- June 2025 (2)

- July 2025 (2)

- September 2025 (2)

- November 2025 (2)

- December 2025 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- May 2024 (1)

- August 2024 (1)

- September 2024 (1)

- October 2024 (1)

- January 2025 (1)

- March 2025 (1)

- April 2025 (1)

- May 2025 (1)

- August 2025 (1)

- February 2026 (1)

- USDEC (183)

- USDEC Staff (167)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Nick Gardner (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Krysta Harden, USDEC President and CEO (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Becky Nyman (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Erica Louder (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

.png)