-

Global Dairy Markets: Rebalancing Starts in 2019

By Alan Levitt and Marc Beck May 28, 2019- Tweet

Market conditions are improved this year. Global production growth has slowed to a crawl, EU government inventories have been drawn down, and world demand remains good.

Despite some significant headwinds, 2018 was a record year for U.S. dairy exporters. Export volume was up 10% from the prior year, led by all-time highs in overseas shipments of nonfat dry milk and skim milk powder (NDM and SMP), high-protein whey products, and lactose.

Along the way, we grew our share of global trade against our major competitors from Europe and Oceania.

Why are exports so important?

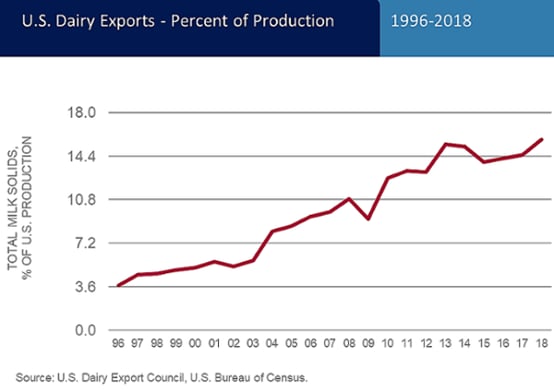

Simply put, exports support the growth aspirations of the U.S. dairy sector. For an industry whose fortunes rose and fell almost exclusively on the mood of the domestic market in an earlier era, U.S. dairy exports have taken off in the last 15 years.

Robust growth over the years

Milk production has climbed 1.6% per year since 2013 (plus 28% overall), and exports enabled about half of that growth. Exports grew from 6% of U.S. milk solids production in 2003 to nearly 16% in 2018.

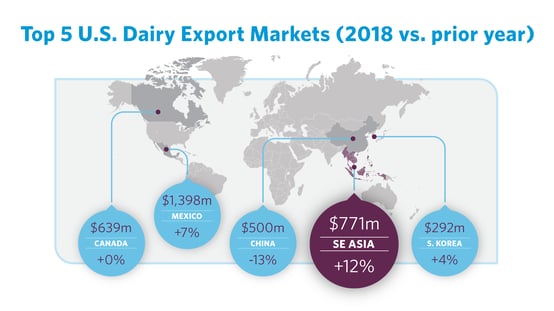

But U.S. exporters weren’t exactly taking victory laps at the end of last year. Volumes sank in the second half of 2018, attributed primarily to retaliatory tariffs on U.S. dairy exports to China (and to a lesser degree, on U.S. cheese to Mexico). Likewise, 2019 got off to a slow start as the tariffs remain in place.

Still, market conditions are improved this year after four years of surpluses. Global production growth has slowed to a crawl, EU government inventories have been drawn down, and world demand remains good. It’s the start of market rebalancing.

That’s the good news.

A look at milk prices

It doesn’t necessarily mean world prices will break out of their four-year range, though. Prices won’t be as low as they were in recent years, but barring some unforeseen shock, there are a number of drivers that will limit a significant break to the upside.

- Price elasticity for dairy commodities is critical. Buyers have demonstrated that they stock up when prices are low and then back off as prices become too rich.

- Global demand growth is heavily reliant on China. Import growth from China was robust in late 2018 and early 2019, but when that pace slows, there really aren’t enough other buyers in the world big enough to pick up the slack.

- On the supply side, European farmers can respond quickly to higher prices, preventing markets from getting too hot. This is a big difference from the last major market boom in 2013 to 2014, when milk production quotas limited the ability of EU farmers to increase supply.

- Macro factors play a key role as well. Feed is cheap, maintaining margins even at lower milk prices. The U.S. dollar has strengthened over the last year, which puts downward pressure on global prices. It’s unlikely we’ll see a major breakout in oil prices anytime soon, which constrains dairy import demand from the Middle East/North Africa region.

Opportunity for continued growth

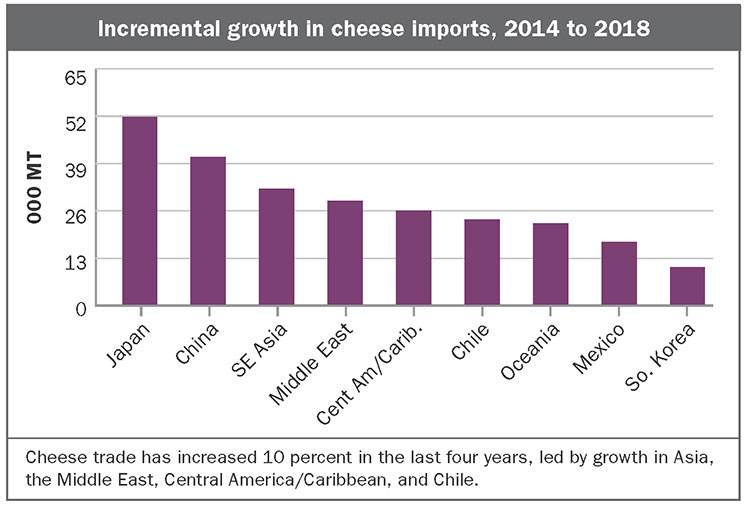

And yet, the opportunity to grow export volumes is as real today as it was 15 years ago. Dairy trade rose 3% in 2018, the best showing in the last four years.

Global dairy imports continue to grow for all the reasons they’ve always grown: increasing populations and incomes in emerging markets; difficulties in dairying in hot or humid climates; rising awareness of the health benefits of dairy; improved cold-chain infrastructure; and ongoing innovation in the functionality and application of dairy ingredients.

We expect trade to maintain a solid growth rate of 2.5% annually over the next five years. On a basket of milk powder, cheese, butterfat and whey, that’s an additional 250,000 tons of traded product every year.

Where will growth occur?

The largest-growing import markets for cheese were Japan, China, Southeast Asia, Middle East, Central America/Caribbean, and Chile over the last four years.

The top-growing import markets for NDM/SMP are Mexico, Southeast Asia, China, Pakistan, the Middle East, Central America/Caribbean, and Pakistan.

The top-growing import markets for whey products are China, Southeast Asia, Oceania, North Africa, and South Korea.

Key factor: Trade agreements

U.S. suppliers are positioned to capture a good chunk of these growing markets, but the proliferation of trade agreements by our competitors — while U.S. suppliers suffer fallout from our own trade wars — threatens our progress.

For instance, by 2025, the EU will have preferential access for 24,600 tons of cheese to Japan, plus 15,000 tons of milk powder and butter and 8,440 tons of whey.

In Mexico, our largest export market, the EU will have new access for 25,000 tons of cheese and 50,000 tons of SMP by 2025, while New Zealand, Australia, and Canada will have new access for 37,000 tons of milk powder.

Meanwhile, New Zealand and Australia already have preferential access to China.

Dairy is hardly alone as an agricultural industry needing competitive trade agreements, especially within North America. Much rides on passage of the U.S.-Mexico-Canada Agreement (USMCA).

.jpg?width=554&name=dialogue2%20(2).jpg)

What it all means for U.S. dairy farmers

All this matters for dairy farmers, because over the last five years, less than 20% of the “new” milk produced in the U.S. went to products sold overseas.

Growth in domestic consumption absorbed the bulk of the gains, but about 15% just went into inventory, which continues to weigh on the market. And, in fact, the U.S. milk production growth rate is slowing from the long-term pace.

If global trade keeps expanding as all analysts expect it to, the world will need our milk. Europe and New Zealand can’t supply it all.

But whether exports can continue to support the growth aspirations of the U.S. dairy sector will depend, in large part, on suppliers’ ability to contend against very tough competition.

Alan Levitt is vice president of market analysis and Marc Beck is executive vice president of the U.S. Dairy Export Council.

Editor's note: A version of this article first appeared in Hoard's Dairyman.

Learn more about global dairy markets:

- U.S. Exports Buoyed by Strong Cheese Shipments

- April's Dairy Data Dashboard

- Milk Powder Exports Steady in January but Retaliatory Tariffs Hurt Overall Volume

- March's Dairy Data Dashboard

- Despite Tariffs from Mexico and China, 2018 U.S. Dairy Exports Reach Record High

Subscribe to the U.S. Dairy Exporter Blog

The U.S. Dairy Export Council fosters collaborative industry partnerships with processors, trading companies and others to enhance global demand for U.S. dairy products and ingredients. USDEC is primarily supported by Dairy Management Inc. through the dairy farmer checkoff. How to republish this post.

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (67)

- Africa (6)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (20)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (9)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farmer leaders (1)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Future trends (1)

- Geographical Indications (GIs) (10)

- Global Marketing (86)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (271)

- Member Services (17)

- Mexico (41)

- Middle East (9)

- Middle East & North Africa (3)

- Middle East/North Africa (9)

- Milk (4)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (19)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (329)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (26)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- April 2015 (11)

- December 2015 (11)

- March 2014 (10)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- January 2026 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- April 2024 (2)

- June 2024 (2)

- July 2024 (2)

- November 2024 (2)

- December 2024 (2)

- February 2025 (2)

- June 2025 (2)

- July 2025 (2)

- September 2025 (2)

- November 2025 (2)

- December 2025 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- May 2024 (1)

- August 2024 (1)

- September 2024 (1)

- October 2024 (1)

- January 2025 (1)

- March 2025 (1)

- April 2025 (1)

- May 2025 (1)

- August 2025 (1)

- February 2026 (1)

- USDEC (183)

- USDEC Staff (167)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Nick Gardner (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Krysta Harden, USDEC President and CEO (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Becky Nyman (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Erica Louder (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

.png)