-

Manage Your Dairy Export Supply Chain as a Strategic Asset

By USDEC February 2, 2016- Tweet

One study showed companies that effectively manage their global supply chains double their profit margins.

Editor’s Note: This is the first post of a three-part series on successful export supply chain management.

It seems simple enough: Smart warehousing, shipping and documentation will get products delivered on time and in good condition, keeping customers happy.

But research by the U.S. Dairy Export Council finds that while some companies manage their export supply chains in a strategic and proactive manner, others don't. For companies that do invest wisely in the export supply chain, it can be a rewarding proposition that boosts bottom-line profits and provides a competitive edge.

"The U.S. dairy industry has a competitive supply chain proposition," says Ross Christieson, senior vice president of market research and analysis at the U.S. Dairy Export Council. "It is located in proximity to key markets; its farmers are engaged in year-round production, the country has a great reputation for food safety and there is a well-developed infrastructure consisting of efficient manufacturing facilities, rail lines and shipping ports."

While infrastructure is critical, a company is still responsible for putting the right people, technology and processes in place to deliver its products to customers in an effective and efficient manner.

One example is in-market warehousing.

"Because warehouses are a prime asset in the export supply chain, dairy companies might consider locating warehouses in the foreign countries where they ship," said Christieson. "Having in-market warehouses will allow them to react sooner to customer needs and ensure on-time delivery. It will also allow for repackaging and specialized handling to meet customer specifications."

Better supply chains, bigger profit margins

Studies show clear economic advantages for companies that manage their supply chains efficiently.

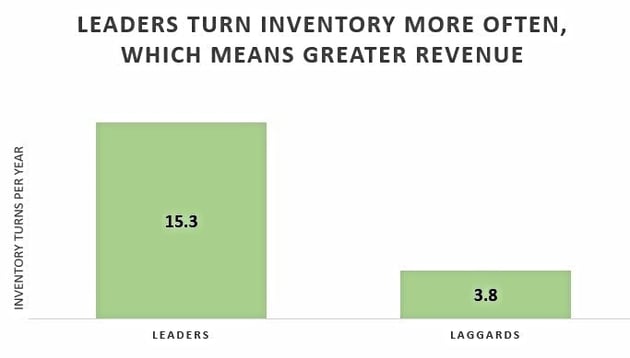

For example, a 2013 Global Supply Chain Survey by PwC found that companies that excel in supply chain management (identified as “leaders”) across a range of industries had an impressive 15.3 inventory turns per year compared to just 3.8 inventory turns per year for companies that consistently underperform (identified as “laggards”).

A high turnover rate suggests greater efficiency and the ability to turn stock into more revenue.

Indeed, leaders enjoy an average earnings-before-interest-and-taxes margin of 15.6 percent versus 7.3 percent for laggards. (EBIT margin is a measure of a company’s profitability and is calculated as EBIT ÷ net revenue.)

"It should be extremely motivating for USDEC members to know that leading ESC companies have more than double the profit margin of the laggards in their respective industries," said Christieson.

Three reasons supply chain management pays off

In order to achieve supply chain success, a company must first have buy-in from its ownership and senior management, said Rob Davenport, manager of international business for the C.F. Sauer Co., the United States’ second-biggest spice company and third-largest domestic mayonnaise maker. As this previous blog post explains, over three years, C.F. Sauer’s exports have grown from 10 percent to 16 percent of overall sales, which are just over $400 million.

Speaking at a USDEC Export Supply Chain Best Practices Forum, Davenport offered three reasons why exporting and strategic use of the supply chain can lead to bottom-line success:

- Re-investment. A company can invest the profits from international sales back into its domestic operations.

- Brand growth. The C.F. Sauer Co. bought a brand of mayonnaise in 1995 that was mainly sold in and around Alabama, and within the next 20 years turned it into one of the leading imported edible consumer products in the continent of Africa.

- A hedge against uncertainty. “If you have your operations concentrated in the United States and you’re not exporting and something happens to your sales—whether it be through competitive pressures or environmentally—you have nowhere to turn to try to offset those issues in sales. If you are exporting, you can probably offset some of those though international sales,” Davenport said.

“While it does require an investment, U.S. companies will find that optimizing their supply chain will bring returns in profitability and customer relationships,” said Tom Suber, president of USDEC.

Adds USDEC's Christieson: "When markets are tough, you have to be even better to keep your customers. In a highly competitive market, the export supply chain becomes even more important."

Our series on export supply chain management consists of these installments:

- Manage Your Supply Chain as a Strategic Asset

- Focus on Customers to Improve Your Dairy Supply Chain

- Outsource, But Don’t Lose Control of Your Dairy Export Supply Chain

Learn more:

- Supply Chain Tips from an Award-Winning Exporter

- Editor’s Advice to U.S. Dairy Exporters: “Be There”

- California Dairies Etches Bold Vision in Crystal Globe

The U.S. Dairy Export Council fosters collaborative industry partnerships with processors, trading companies and others to enhance global demand for U.S. dairy products and ingredients. USDEC is primarily supported by Dairy Management Inc. through the dairy farmer checkoff. How to republish this post.

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (65)

- Africa (6)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (19)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (9)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farmer leaders (1)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Future trends (1)

- Geographical Indications (GIs) (10)

- Global Marketing (86)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (265)

- Member Services (17)

- Mexico (41)

- Middle East (9)

- Middle East & North Africa (3)

- Middle East/North Africa (9)

- Milk (4)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (18)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (323)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (25)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- April 2015 (11)

- December 2015 (11)

- March 2014 (10)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- April 2024 (2)

- June 2024 (2)

- July 2024 (2)

- November 2024 (2)

- December 2024 (2)

- February 2025 (2)

- June 2025 (2)

- July 2025 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- May 2024 (1)

- August 2024 (1)

- September 2024 (1)

- October 2024 (1)

- January 2025 (1)

- March 2025 (1)

- April 2025 (1)

- May 2025 (1)

- August 2025 (1)

- USDEC (183)

- USDEC Staff (159)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Nick Gardner (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Becky Nyman (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Erica Louder (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

- Krysta Harden, USDEC President and CEO (1)

.png)