-

USDEC's 2023 Global Dairy Business Year-in-Review

By USDEC Staff December 29, 2023- Tweet

We have assembled the important mergers, key acquisitions, joint ventures, new facilities, executive hires and marketing initiatives that made 2023 a noteworthy year for global dairy business.

.png?width=257&height=257&name=2023%20Dairy%20Business%20News%20%20(450%20%C3%97%20450px).png)

Across the international dairy sector, business activity has been brisk this year, as one can see from the U.S. Dairy Export Council's 2023 Global Dairy Business Year-in-Review.

USDEC monitors global dairy business developments for our members and curates them for our weekly, members-only newsletter, Global Dairy eBrief. At the end of the year, we aggregate and summarize what's most relevant for this retrospective annual review.

USDEC has done this since 2015, creating a one-of-a-kind archive that includes the following annual dairy business reviews:

We start the 2023 Global Dairy Business Year-in-Review review with items from the January 6 Global Dairy eBrief and end with news from the December 22 edition.

This is a fast-paced yet lengthy review. We put company names in bold for easy scanning.

Tip: To quickly find mentions of a company, search this long page. The easiest way to search on a PC is to use the keyboard shortcut Ctrl+F on Windows or Command+F on a Mac.

A one-stop review of 2023's most important dairy business news

What follows is USDEC's 2023 Global Dairy Business Year-in-Review, a curated summary of important global dairy business developments, presented in month-by-month chronological order, beginning in January.

Qatari milk producer and dairy processor Baladna Food Industries is exploring a large-scale dairy project in Algeria. Late last year, Baladna representatives and officials from Algeria’s Ministry of Agriculture visited a model farm project in the west of the country and presented plans for a 25,000-acre dairy farm and processing facility. The company is conducting a feasibility study on the soil and climate in the area, and depending on the results, it could launch the project by the beginning of 2024. Founded in 2017 in Qatar, the vertically integrated dairy company has been on a global expansion streak over the past few years. It has farm-to-bottle dairy projects in various stages of development in Malaysia, Indonesia and the Philippines, and last year purchased a minority stake in Egyptian dairy, juice and cooking product company Juhayna Food Industries. (USDEC Middle East/North Africa office)

California-based private equity firm Butterfly purchased Minnesota-based Milk Specialties Global. Current Milk Specialties CEO, Dave Lenzmeier, will continue to lead the business. Lenzmeier said he expects the acquisition will enable the company “to achieve a new level of growth.” … The European Commission approved the creation of a new joint venture between Dutch food and nutrition company Royal DSM and New Zealand’s Fonterra Co-operative Group. The new company, Tasman, will be headquartered in the Netherlands and will develop, produce and market fermentation-derived dairy proteins. (Company reports; Agriland, 12/28/22)

A Jan. 2 fire destroyed a butter storage room at the Associated Milk Producers Inc. (AMPI) plant in Portage, Wisconsin. Firefighters contained the blaze but not before butter runoff flowed into other areas of the plant and into storm sewers and a neighboring canal. Operations were temporarily halted on Jan. 3, and AMPI told Dairy Herd Management that cleanup would begin as soon as possible. … U.S. food giant Mars Inc. completed its new ice cream factory in Guangzhou, China, two months ahead of schedule. … Nestlé began testing its first animal-free milk product in California. The drink, branded Cowabunga, was developed with California-based food biotech start-up Perfect Day using precision fermentation technology. … Mead Johnson China launched a new adult nutrition brand called Agijoy. The product is designed for consumers over 50 and reportedly contains 23 nutrients (it is rich in protein and selenium) and lactoferrin. (USDEC China office; Company reports; Dairy Herd Management, 1/3/23; WMTV, 1/2/23; FoodBev.com, 12/22/22)

Dutch dairy giant FrieslandCampina became the latest major dairy manufacturer to venture into the “animal-free” dairy protein realm. The company’s FrieslandCampina Ingredients division signed a strategic partnership with California-based biotech company Triplebar Bio Inc. The two companies will work together to develop and scale up the production of cell-based proteins using precision fermentation technology. FrieslandCampina, which has been using precision fermentations to manufacture human milk oligosaccharides since 2016, said it plans to offer the lab-based proteins side-by-side with its dairy proteins and ingredients. (Company reports)

Ireland’s Ornua and its U.S. subsidiary Ornua Foods North America are suing New Zealand-based Westland Dairy Co. Ornua claims Westland’s Westgold butter infringes on its own Kerrygold trademark due to the similarity in packaging between the two brands. A hearing is slated for Feb. 9. …Yili Group completed Phase 1 of its new US$250-million fluid milk plant in Inner Mongolia. Product safety testing took place at the end of December, and the company expects to begin commercial production soon. … Finnish food and dairy company Fazer Foods is considering exiting the dairy business. Fazer characterized its dairy operations as “small scale” and is studying plans to convert its Koria, Finland, diary facility to oat-based drink and product manufacturing. … Alamar Foods, the master franchisee of Domino’s Pizza in the Middle East, North Africa and Pakistan opened its 600th Domino’s outlet in the region. The ribbon-cutting took place in Dubai. (USDEC China office; USDEC Middle East/North Africa office; Agriland, 1/10/23; FoodBev.com, 1/5/23)

Valley Milk is adding a 10,000-sq.-ft. addition to its Turlock, California, milk processing facility. The project, slated for completion in 2024, will produce AMF in drums and totes initially, with plans to expand to pails to serve industrial and foodservice customers. The company is targeting domestic and export markets with the new investment. There are “strategic opportunities” to export AMF into the international market, Valle Milk said. (Company reports)

Corman Miloko, a joint venture dairy spread and butterfat manufacturer based in Carrick-on-Sur, Ireland, plans to close its doors this June. Belgian butter, spread and fats and oils maker Corman owns a 55% stake in the operation, Ireland’s Tirlán (formerly Glanbia Ireland) owns the other 45%. Corman, in turn, is part of the French dairy company Savencia Fromage and Dairy. The closure comes after “significant restructuring” failed to turn around sagging volume sales. The joint venture company, which has been in business since 2005, sells primarily to export markets. (Agriland, 1/21/23)

Italian dairy-co-op Latteria Soresina plans to acquire Italian gorgonzola maker Fratelli Oioli. Sorensina said it hoped the acquisition would open additional export opportunities. … New York-based global equity firm General Atlantic paid $130 million for a 5.6% stake in Indonesian dairy and food processor Cisarua Mountain Dairy, also known as Cimory. Cimory said it plans to use the funding to accelerate growth initiatives, including new product development and broadening its distribution network. (Company reports; FoodBev.com, 1/18/23)

Korea’s Lotte Confectionery is investing $55 million over the next five years to expand its Indian ice cream subsidiary, Havmor Ice Cream. The project centers on a new 650,000 sq. ft. manufacturing plant in Pune, Maharashtra. Havmor operates 216 ice cream parlors in India. … Nestlé Health Science is spending $43 million to add two new production lines to its Eau Claire, Wisconsin, manufacturing plant for ready-to-drink beverages. The facility produces an array of medical nutrition products and nutritional drink brands such as BOOST and Carnation Instant Breakfast. (Leader-Telegram, 1/25/23; FoodBev.com, 1/19/23)

Saputo announced a series of capital investments and related consolidation plans impacting facilities in California and Wisconsin. The company is building a C$240-million (about US$180 million) greenfield cut-and-wrap facility in Franklin, Wisconsin. The plant, slated to be fully operational by the third quarter of 2025, will become the center of the company’s Midwest cut-and-wrap operations. Saputo plans to transfer regional cut-and-wrap activities to the new Franklin site, resulting in the permanent closure of its Green Bay, Wisconsin, and Big Stone, South Dakota, facilities. Green Bay will shut down in the third quarter of fiscal 2025 and Big Stone will halt operations in the third quarter of fiscal 2024. In California, Saputo is investing C$75 million (about US$56 million) to convert its Bardsley Street plant in Tulare into a string cheese packaging facility. The plant was previously a cut-and-wrap site. Saputo expects the facility to be operating at full capacity by the third quarter of 2025. In conjunction with the conversion, the company will permanently close its South Gate, California, facility in the fourth quarter of fiscal 2025.

Danone is exploring strategic options for its organic dairy activity in the U.S., including a potential sale. The company said its Horizon Organic and Wallaby businesses “fall outside our priority areas of focus.” … Hong Kong-listed Vita International exercised its option to buy a 49% stake in dairy alternative manufacturer Vitasoy Australia. Vita paid Vitasoy Australia co-owner Bega Cheese A$51 million (about US$36 million) to acquire the outstanding shares. Bega said it would seek other ways to re-enter the dairy alternative category. … New York-based infant nutrition company ByHeart purchased DairiConcepts’ manufacturing plant in Allerton, Iowa. DairiConcepts is a wholly-owned subsidiary of Dairy Farmers of America (DFA), which said it looked forward to continuing to work with ByHeart. The acquisition triples ByHeart’s supply capacity, “strengthening the vulnerable infant formula supply chain in this country,” the company said. For more, see this press release. (Company reports; Sydney Morning Herald, 1/30/23)

FrieslandCampina CEO Hein Schumacher will step down effective May 1, 2023, to lead multi-national food and personal care company Unilever. Schumacher will replace retiring CEO Alan Jope on July 1 after a one-month handover period. FrieslandCampina has initiated an accelerated process to select a new leader. … Anchor Food Professionals, owned by New Zealand’s Fonterra Co-operative Group, signed a deal with Walmart China to provide a lineup of new bakery products to 400 Chinese stores. The products, which are made using Fonterra ingredients, include a New Year’s cream cake, Basque cheesecake and a Swiss roll. (USDEC China office; Company reports)

China’s Junlebao plans to spend $442 million to build a dairy processing facility and three dairy farms in the Yangtze River Delta region. The project will support the government’s school milk program. The company expects to begin construction in March. Separately, Junlebao purchased a 10% stake in cheese manufacturer Shanghai Laoshen Health Technology Development Co. and plans to build a cheese factory this year, with an eye toward becoming one of China’s top cheese manufacturers over the next five years. (USDEC China office)

On Jan. 31, Japan’s Meiji began production at the first of three new facilities set to open in China this year. The fluid milk/yogurt processing plant is in Tianjin, China. … McDonald’s plans to open 900 new units in China in 2023. It has increased store openings for the past two years: 480 in 2020, 660 in 2021 and 700 in 2022. It currently operates more than 5,000 stores in China. … Malaysia-based investment group Wellspire Holdings is looking to import dairy beverages, including yogurt and UHT milk, as part of an effort to expand business in Thailand. … Danone opened a new research and innovation center at its Paris-Saclay campus in France. The facility, with a staff of more than 550, pilot plants and labs, will focus on “fresh dairy and plant-based products” and mineral water. (USDEC China office; USDEC Southeast Asia office; Company reports)

Fonterra Co-operative Group rolled out two new functional dairy products in Thailand through an exclusive partnership with 7-Eleven. Anchor Actif-Fiber and Anchor Beaute are being sold at more than 14,000 7-Eleven stores across the country. Actif-Fiber is fortified with fiber to aid digestion. Beaute contains zinc and collagen and is being marketed as an “ingestible beauty” product that Fonterra says provides “an inside-out kind of glow.” (USDEC Southeast Asia office; Company reports)

Subway confirmed that it is exploring selling its business and hired JPMorgan Chase to advise as it looks for potential buyers. Subway has 37,000 stores worldwide. Wall Street Journal estimates a sale price of about $10 billion. … The Seoul High Court upheld a lower court’s ruling and ordered Korean dairy processor Namyang Dairy to abide by a 2021 deal to sell a majority stake (53%) in the business to private equity firm Hahn & Co. Namyang’s owners claimed the deal was invalid just months after they made it, prompting Hahn to file the lawsuit. (Wall Street Journal, 2/14/23; Korea Herald, 2/9/23)

FrieslandCampina is consolidating its butter production in the Netherlands. The company said that increased cream demand from the foodservice channel created a structural overcapacity in butter. FrieslandCampina plans to expand its Lochem plant and merge all butter production to that location, closing its 's-Hertogenbosch facility in mid-2025. … China’s Terun Dairy is raising funds to build a $145-million dairy processing plant in the Xinjiang Autonomous Region in northeast China. The facility will focus on shelf-stable dairy products. (USDEC China office; Company reports)

Saputo is spending A$20 million (about US$14 million) to add cream cheese manufacturing to its Smithton, Tasmania, manufacturing plant. The new capacity replaces cream cheese operations at Saputo’s Maffra, Victoria, plant, which the company shuttered last week. (It announced the planned closure last November.) Saputo CEO Lino Saputo Jr. said that he expected more plant closures in Australia due to the country’s shrinking milk supply, “but there will be heavy investments as well in other facilities to focus on higher valued categories of dairy products that we can sell domestically and around the world.” (Just Food, 2/17/23; ABC News, 2/15/23)

Saudi Arabian dairy processor Almarai completed the acquisition of International Dairy and Juice Ltd. (IDJ) from its former joint-venture partner PepsiCo. The company paid an estimated 255 million riyals (about US$68 million) for PepsiCo’s 48% share in IDJ. Almarai said that full ownership would facilitate expansion efforts. … Malaysian distributor Farm Fresh paid RM84 million (about US$19 million) for a 65% stake in ice cream chain The Inside Scoop. The company plans to pursue brand collaboration between The Inside Scoop and its Jom Cha boba tea and soft-serve chain. … German regulators will only permit German dairy processor Theo Müller’s purchase of FrieslandCampina’s German dairy business if it divests two of the Dutch dairy giant’s brands. Müller said it is already in talks to sell the Tuffi and Landliebe businesses. (USDEC Southeast Asia office; The National News, 2/19/23; New Straits Times, 2/16/23)

Fonterra Co-operative Group COO Fraser Whineray is resigning at the end of Fonterra’s fiscal year on July 31. … Lactalis is facing criminal charges in France related to a 2017 salmonella outbreak linked to its infant formula that sickened more than 40 children in Europe and impacted Lactalis formula distribution in 80 countries. Prosecutors contend that the company failed to properly carry out a product recall and withdrawal. (Company reports; DairyReporter.com, 2/20/23; Food Safety News, 2/18/23)

Leprino Foods signed a non-binding agreement to take full ownership of Glanbia Cheese, the European joint venture it operates with Ireland’s Glanbia plc. Leprino will initially pay €160 million (about US$170 million) for Glanbia plc’s stake, with additional contingent consideration of €25 million (about US$26 million) over the next three years, depending on business performance. The deal includes manufacturing plants in Llangefni, Wales; Magheralin, Northern Ireland; and Portlaoise, Ireland. Current Glanbia Cheese CEO Paul Vernon will continue to head the business. “Having successfully partnered with Glanbia since 2000, we are proud of the high-quality business that we have helped build,” Leprino President and CEO Mike Durkin said. “We look forward to working with Paul Vernon and the local team to ensure a seamless transition for our employees, customers and suppliers. We intend to take advantage of our combined expertise, knowledge and strengths to further enhance the business and are committed to ongoing investments in the core capabilities and the talented people that set us apart from our competition.”

Vertically integrated Qatari dairy manufacturer Baladna formed a strategic partnership with French cheesemaker Bel Group. Baladna will begin producing Laughing Cow jarred cheeses this year under the terms of the agreement, but more Bel products are reportedly slated for production “in the near future.” Baladna said the deal will help reduce imports and the potential supply chain disruptions and eventually increase product options for regional consumers. (USDEC Middle East/North Africa office; Company reports)

Australia’s Bega Cheese is closing its Griffith, Canberra, manufacturing plant following a review of its fresh dairy operations in the Australian Capital Territory and New South Wales. Declining farm numbers and milk production made supplying the facility inefficient and unsustainable. The closure follows the recent shuttering of Saputo’s Maffra, Victoria, plant and Saputo CEO Lino Saputo Jr.’s prediction that he expected more plant closures in Australia due to the country’s shrinking milk supply. (FoodBev.com, 2/27/23)

Fast-food player Wendy’s signed a deal with India’s Rebel Foods to scale up the restaurant’s presence in India. Rebel will become the master franchisee, with plans to develop about 150 units over the next decade. Wendy’s originally partnered with Rebel in 2020 to build and operate 250 cloud kitchens across India to grow a home-delivery business in the country. (Bloomberg, 2/27/23)

FrieslandCampina Engro Pakistan signed a partnership with Dubai-based trading company Engro Eximp FZE. The deal aims to expand FrieslandCampina Engro dairy exports to the UAE and the broader Middle East region. … McThai Co., the operator of McDonald’s restaurants in Thailand, is spending 300 million baht (about US$9 million) to open 10-15 new outlets this year, pushing its total number of units to 237-242. (USDEC Southeast Asia office; PKrevenue.com, 2/23/23)

Spanish dairy processor Calidad Pascual partnered with Angolan beverage company Refriango on a new milk manufacturing facility in Angola’s capital city of Luanda. Pascual has been exporting yogurt to Angola for 25 years, but this is its first Angolan production plant. It will reportedly produce UHT milk and milk powder. Pascual said it expects to raise international revenues to €125 million a year (about US$134 million) in three years through the Angolan investment as well as capacity expansion projects in South and Central America. (Company reports)

New Zealand’s second-largest dairy processor, Open Country Dairy, named Mark de Lautour as its new COO, replacing Steve Koekemoer. Koekemoer is taking over as COO of Talley’s Group, the parent company of Open Country and meat processor Affco. De Lautour is presently the general manager of sales and marketing at Affco. (Rural News Group, 3/15/23)

Domino’s China has aggressive expansion plans. The company expects to open 180 outlets in 2023, 240 in 2024, 200 in 2025, and 300 in 2026. The company currently operates more than 600 stores in 17 Chinese cities. … Fraser & Neave Holdings (F&N) secured exclusive rights to manufacture and market Nestlé’s Bear Brand sterilized milk in Cambodia until 2037. The new deal expands F&N’s existing contract with Nestlé, under which it makes and distributes Nestlé’s Bear Brand sterilized milk and Bear Brand Gold milk for Thailand and Laos. … Saputo named Frank Guido president and COO of Dairy Division (USA), and Haig Poutchigian president and COO, of Dairy Division (Canada), effective April 1, 2023. … Olam Food Ingredients says it is on track to complete Stage 1 of its new Tokoroa, North Island, New Zealand powder plant in the second half of 2023. The plant will begin with WMP production, but Olam is already moving forward with Stage 2, which would focus on specialized, high-value protein-based ingredients. … Leprino Foods selected Illinois-based ingredient distributor Univar Solutions as an authorized distributor of Leprino nutritional ingredients and dairy products in Canada and the United States. … Australian co-op Norco is one of the latest dairy processors to enter the plant-based dairy alternative categories. The company launched pea- and oat-based beverages under the P2 Pea Protein Mylk and Oat Mylk brands, respectively. It is marketing the products in Australia. (USDEC China office; USDEC Southeast Asia office; Company reports; Just Food, 3/13/23; Rural News Group, 3/8/23)

FrieslandCampina’s ingredients arm opened a new lactoferrin manufacturing facility in Veghel, Netherlands. The plant quadruples the company’s total lactoferrin capacity to 80 MT annually. FrieslandCampina said it built the facility to meet rising global demand in early life and adult nutrition markets due to lactoferrin’s reported immunity-enhancement properties. Separately, FrieslandCampina appointed Jan Derek van Karnebeek as the company’s new CEO. Van Karnebeek is currently CEO of GreenV, an international group of operating companies active in the horticultural sector, but spent most of his career at Heineken in commercial, marketing and management positions. He will begin on June 1, replacing Hein Schumacher, who is leaving the company on May 1 to become the new CEO of Unilever. (Company reports)

Suntado LLC, a partnership between Idaho dairymen Jesus Hurtado and Dick Reitsma, began construction on a $150-million, 190,000-square-foot dairy processing facility in Burley, Idaho. Dairy West is partnering with Suntado to help the company get to market with products that meet shifting consumer demands. When completed in the spring of 2024, the facility will be able to process up to 450 MT of milk per day. The plant will open with six production lines making ESL and UHT conventional and organic dairy beverages and related products. Future plans call for up to 18 production lines. Former Glanbia USA CEO Jeff Williams is heading the company. (Ag Proud Idaho, 3/20/23; Capital Press, 3/18/23; KLIX, 3/16/23)

Oregon-based Tillamook County Creamery Association purchased the former Prairie Farms ice cream plant in Decatur, Ill. Tillamook reportedly plans to spend $50 million to retrofit the facility and acquire adjacent property for future expansion. (Company reports; Herald & Review, 3/16/23)

Swiss cheese manufacturer Emmi is looking to capitalize on rising global demand for goat’s milk powder. The company formed a new division—Emmi Nutrition Solutions (ENS)—focused exclusively on goat’s milk powder manufacturing, new product development and marketing. ENS consolidates activities of Emmi’s AVH dairy trading business and manufacturer Goat’s Milk Powder. The company is backing the venture with a new CHF40 million (about US$44 million) goat’s milk powder manufacturing facility in Etten-Leur, Netherlands. In addition to infant formula, Emmi plans to expand its goat’s milk powder portfolio to a range of products, including special nutrition for adults and seniors and products targeting consumers seeking healthy and active lifestyles. (Company reports)

Wisconsin-based Grande Cheese purchased the former Foremost Farms cheese plant in Chilton, Wisconsin. Grande operates eight other manufacturing facilities in the state. … Saputo is selling fresh milk processing facilities in Australia to retailer Coles Group for A$95 million (about US$64 million). Saputo called the sale an important step in executing its long-term vision for success in Australia. ... German dairy processor Hochwald is buying the Tuffi brand from Müller Group and seeking to purchase the Landliebe label as well. German regulators required Müller to divest the brands as part of its deal to purchase portions of FrieslandCampina’s German consumer dairy business. (Company reports; Post-Crescent, 3/29/23)

PT Kian Mulia Manunggal, a division of Indonesian conglomerate TempoScan Group, opened a new milk powder plant in Cikarang, West Java. The plant will produce inputs for TempoScan’s infant formula and growing milk businesses. (USDEC Southeast Asia office)

France-based Savencia Fromage & Dairy purchased Argentine dairy manufacturer Sucerores de Alfredo Williner and its Ilolay dairy brand. Williner was founded in 1928 in Santa Fe Province, the heart of Argentina’s dairy region. The company operates three manufacturing plants producing cheese, fluid milk and cream, milk powder, butter, yogurt, dulce de leche and desserts. Savencia said the acquisition expands its existing portfolio of brands and strengthens its presence in Argentina. (Company reports)

French dairy giant Lactalis officially opened a new US$8-million milk powder dryer at its Bonnievale cheese plant in Western Cape Town, South Africa. It added the dryer to serve rising local demand for milk powder and projections for 6% annual growth through 2028. The facility also reinforces the commitment Lactalis has made to the country, the company said. Over the past four years, Lactalis has invested an average of 400 million rands (about US$22 million) per year in South Africa. (Food Business Africa, 4/6/23; Consulate General of France)

Danone China and Qingdao University opened a new innovation center to focus on research into gut health, early-life nutrition and healthy aging with an emphasis on the specific needs of Chinese consumers. The Qingdao University–Danone Nutrition and Health Innovation Centre will utilize resources from the university’s School of Public Health, Institute of Nutrition and Health, and its analysis and test capabilities, combined with Danone Open Science Centre’s research and innovation capabilities. The partnership is the latest in a series of relationships Danone is cultivating with Chinese universities. Since 2020, the company has published 37 scientific papers and reports together with local Chinese health and research institutes. (NutraIngredients-Asia.com, 4/11/23)

Papa Johns International signed a 10-year development deal with UAE-based PJP Investments Group to open 650 Papa Johns outlets in India. PJP already operates 100 locations in the Middle East, with plans to open 250 more over the next decade. The first Indian location is slated to debut in 2024. … Two Malaysian companies—ag investment firm Kulim (Malaysia) and A2 Fresh Holdings, a subsidiary of investment firm Rhone Ma Holdings—are reportedly moving forward on a joint venture dairy business. The new company, Jemaluang Dairy Valley in Johor, will be a vertically integrated operation, including dairy farming, processing and marketing. … China’s Behai Dairy (also known as Hokkai Pastures) completed a new $146-million dairy manufacturing plant. The facility can produce more than 150,000 MT of shelf-stable and refrigerated dairy products per year. Behai was founded in 2018 and focuses on yogurt products. … Singapore-based Hao Food is looking to expand the White Rabbit ice cream brand throughout Southeast Asia. The ice cream was developed through a partnership between the owner of the iconic White Rabbit candy brand, Shanghai Guan Sheng Yuan Food, and China’s Bright Dairy. Hao Food is the official regional distributor, rolling the line out in Singapore in 2021, and says it is exploring inquiries to launch in Indonesia, Malaysia and Vietnam. (USDEC Southeast Asia office; USDEC China office; The Malaysian Reserve, 4/6/23; Restaurant Business Online, 4/5/23; DairyReporter.com, 3/27/23)

Singapore-based Growtheum Capital Partners paid US$100 million for a 15% stake in Vietnam’s International Dairy Products (IDP). Growtheum said the deal would allow the company “to participate in Vietnam’s rising consumption story.” IDP manufactures drinking yogurt, fluid milk and other products and posted sales of about US$260 million last year. … Vilkyškių Pieninė, the parent company of Lithuanian dairy business Vilvi Group, acquired the remaining 30% stake of Latvian dairy processor Baltic Dairy Board (BDB). The company originally purchased 70% of BDB in 2018. BDB manufactures SMP, MPC and other products and Vilkyškių Pieninė said it made the deal to bolster Vilvi Group’s value-added dairy ingredient portfolio. (FoodBev.com, 4/17/23; Bloomberg, 4/12/23)

China’s Yili Group expects to begin trial runs at its new processed cheese factory in Hohhot, Inner Mongolia, this month. The $292-million project will reportedly produce 30,000 MTs of mainly lollipop-shaped cheese per annum. The plant is Yili’s largest cheese project to date. … Chinese dairy processor Junlebao officially opened its new pasteurized milk plant in Henan Province. The $146-million facility can reportedly produce 96,000 MT of pasteurized milk per annum. (USDEC China office)

Nestlé and private equity firm PAI Partners are forming a joint venture for Nestlé’s frozen pizza business in Europe, which distributes pizzas under the Wagner, Buitoni and Garden Gourmet brands. Nestlé will retain a non-controlling stake in the venture. The business will be headquartered in Germany, with manufacturing facilities in Nonnweiler, Germany, and Benevento, Italy. Nestlé’s pizza operations elsewhere are not part of the deal. Nestlé previously teamed up with PAI to create global ice cream maker Froneri in 2016. (Company reports)

Chinese importer and food processor Pinlive Foods says it is building a natural cheese manufacturing plant in Shanghai. It claims the facility will be ready for production by the end of the year. … Coca-Cola and Mengniu Dairy are reportedly running into challenges marketing Fairlife milk in China, which they jointly launched in September 2021. Online marketplaces JD.com and Tmall, and many convenient stores in Beijing, have stopped selling the product due to slower-than-expected sales. Reports suggest a lack of consumer understanding about the product’s ultrafiltration process and its higher price point might be the issue. (USDEC China office) New Zealand dairy processor Westland Milk Products is building a new NZ$70-million lactoferrin plant (about US$43 million) at its South Island facility at Hokitika. Westland, owned by China’s Yili Group, said the investment would more than triple its lactoferrin capacity (currently 20 MT per year) and make the company one of the top three lactoferrin producers in the world. It expects to begin construction in the first half of 2024 and estimates that the plant will take about 16 months to complete. The facility will produce spray-dried lactoferrin, while Westland’s existing lactoferrin supply is produced via freeze-drying. The investment follows a NZ$40-million expansion (about US$25 million) at Hokitika that doubled butter production. (Company reports)

New Zealand dairy processor Westland Milk Products is building a new NZ$70-million lactoferrin plant (about US$43 million) at its South Island facility at Hokitika. Westland, owned by China’s Yili Group, said the investment would more than triple its lactoferrin capacity (currently 20 MT per year) and make the company one of the top three lactoferrin producers in the world. It expects to begin construction in the first half of 2024 and estimates that the plant will take about 16 months to complete. The facility will produce spray-dried lactoferrin, while Westland’s existing lactoferrin supply is produced via freeze-drying. The investment follows a NZ$40-million expansion (about US$25 million) at Hokitika that doubled butter production. (Company reports)

New Zealand’s Fonterra Co-operative Group opened a fifth new application center in China. The latest location—in Shenzhen in southern China—will concentrate on beverage applications, whereas the previous four units focus on food. “Part of the success of our foodservice business in China has been driven by the application centers, which allow us to better support our customers and better understand Chinese consumer preferences,” said Fonterra Greater China chief executive Teh-han Chow. (Stuff.co.nz, 4/25/23)

China’s Junlebao, in cooperation with local government, is investing $434 million to build a new fluid milk, dairy beverages and yogurt plant in Jiangmen, Guangdong Province. The facility will supply six provinces: Guangdong, Guangxi, Hunan, Jiangxi, Fujian and Hainan. … Israeli regulators approved Remilk’s lab-grown protein for food use. The approval follows an agreement made last year between Remilk and Central Bottling Co. (the Israeli franchisee for Coca-Cola) to produce a line of dairy products made with the protein. (USDEC China office; Company news)

New Zealand’s Fonterra Co-operative Group signed a two-year milk powder manufacturing deal with Australia’s Halo Food Co. and its Kiwi subsidiary Keytone Enterprises. Under the terms of the agreement, Keytone will make nine Fonterra milk powder SKUs for sale in China, India, Vietnam, New Zealand and other countries over the two-year contract term. In other Fonterra news, the co-op announced last month that it was closing its office in Egypt after 30 years of operation. The company cited global macroeconomic challenges and its recent decision to exit the Fonterra Consumer Brands business in Egypt. It will continue to service customers in the country from other offices in the Middle East and Africa. (Company reports; edairy news, 4/16/23)

Mexican dairy and food manufacturer and distributor Sigma Alimentos acquired a majority stake in California-based Hispanic cheese and cream manufacturer Los Altos Foods. Sigma Alimentos said the deal, which includes Los Altos’s manufacturing plant near Los Angeles will allow it to meet rising U.S. demand for Hispanic cheese. (Company reports)

Irish dairy and flavor manufacturer Carbery Group opened a new innovation hub in Singapore to serve the greater Asia region. The company said the Carbery Group Asia Business and Innovation Center will foster stronger collaboration with industry partners, start-ups, universities and key customers. … Coca-Cola is building a new $650-million milk processing plant in Webster, N.Y., to make Fairlife brand fluid products. It expects commercial production to begin in the fourth quarter of 2025. (USDEC Southeast Asia office; Company reports)

Dairy Queen is reportedly accelerating expansion plans for China and looking to enter new markets like Australia and Taiwan. The company currently operates about 1,250 units in China, its second-largest market after the U.S. It opened 165 Chinese stores in 2022 and expects to exceed that number this year. … Cacique Foods held a grand opening of its new 200,000 sq.ft. Hispanic cheese and crema manufacturing plant in Amarillo, Texas. The plant will begin production this summer. (USDEC China office; Inside Retail, 5/12/23; News Channel 10, 5/11/23)

Kerry Dairy Ireland and Dairygold Health and Nutrition are highlighting nutrition in their latest new products targeting Chinese consumers. Kerry’s Origimel is an adult milk powder that features what Kerry calls “science-backed ingredients” to support muscle, bone and cognitive health and boost immunity. The company is targeting “aging consumers who are seeking nutritional beverages to maintain and improve their health.” Kerry cited a growing opportunity for fortified products in China as that country’s middle class continues to expand. Dairygold is expanding its Aerabo range of milk powders in China with Aerabo Light, Aerabo Boost and Aerabo Vitality, targeting young professional adults, older health-conscious consumers and adults with active lifestyles. The company says that the products contain “higher values” of the essential amino acid tryptophan, vitamin B2 (riboflavin), conjugated linoleic acid (CLA) and provitamin A, as well as tocopherols and beta carotene. Dairygold launched original Aerabo WMP in China in 2021. (Agriland, 5/17/23, 5/19/23)

Ireland’s Kerry Group opened a new innovation hub in Wageningen University’s “Food Valley” in the Netherlands. The facility will focus on clean-label and food waste technologies. … New Zealand dairy processor Mataura Valley Milk (MVM), which is owned by New Zealand’s A2 Milk Co., is seeking a new chief executive after Bernard May stepped down from the role in May. John Roberts was appointed interim CEO and will oversee MVM’s focus on developing its infant formula manufacturing business. … Qatari milk producer and dairy processor Baladna continues to broaden its global footprint. The company signed Memorandums of Understanding with two Indonesian agribusiness companies to cooperate on milk production initiatives. The joint efforts will aim to identify, assess and initiate projects to bolster Indonesian milk output and processing and strengthen food security. … Arla Foods inaugurated a €10-million dairy farm (about US$11 million) in Kaduna, Nigeria. Arla said the farm—a joint effort between the company, the Nigerian government, non-governmental organizations and the local farming community—will serve as a hub of dairy farming knowledge and “symbolizes the massive potential we see in Nigeria.” (USDEC Southeast Asia office; FoodBev.com, 5/30/23; Food Ingredients First, 5/18/23; New Zealand Herald, 5/9/23)

New Zealand’s Fonterra Co-operative Group formed a new, stand-alone corporate investment arm to incubate, scale and invest in new, innovative nutrition science businesses. Provisionally named Nutrition Science Solutions (NSS), the business will “incubate and scale a portfolio of disruptive ventures by developing solutions that combine science, nutrition and technology to make a real impact on human health,” Fonterra CEO Miles Hurrell said. NSS will seek out, partner and invest in global start-ups with emerging technologies and in novel market channels. Its first investment is a US$10 million minority share in California-based Pendulum, a biotech company focused on developing microbiome-targeted products that advance metabolic health. Together, Fonterra and Pendulum say they will seek to establish a presence in global markets by co-developing and commercializing next-generation microbiome products that are scientifically formulated to make measurable improvements in people’s health. Weeks prior to the NSS announcement, Fonterra also rolled out a new effervescent powdered probiotic drink in Singapore under its Nurture Digestion+Immunity label. The company based the product on consumer research that indicated an interest in probiotic drinks (Southeast Asian consumers believe “that true wellness is impossible without a healthy gut,” Fonterra said) but with lower sugar content and a preference for effervescent beverages. The company is already looking to expand distribution to Indonesia, Malaysia and Thailand. Fonterra has been increasingly active in functional products over the past year—with varying degrees of success. A positive reception to ready-to-drink Nurture Digestion+Immunity beverages in Singapore in 2022 spawned the new powdered, effervescent product. Earlier this year, it also rolled out a line of Anchor Actif-branded products in Thailand. However, Fonterra’s BioKodeLab supplement line launched last October has already been “put on hold.” (USDEC Southeast Asia office; Company reports; DairyReporter.com, 5/23/23)

New Zealand dairy processor Synlait plans to sell Dairyworks (its cheese products division) and Talbot Forest Cheese (a related consumer business unit). Synlait acquired both New Zealand businesses in 2019 in transactions valued collectively at about NZ$150 million (about US$92 million today). Synlait said it is narrowing its businesses to focus on its highest margin segments: B2B advanced nutrition and foodservice. (Radio New Zealand, 6/6/23)

Subway reached an agreement with Chinese master franchisee Shanghai Fu-Rui-Shi Corporate Development to open 4,000 new sandwich shops across China over the next two decades. It is the largest franchise agreement in Subway’s history. There currently are around 500 Subway stores in China. … California-based Flynn Restaurant Group plans to buy Pizza Hut Australia, including the franchise license for the entire country. Australia-based investment firm Allegro Funds currently owns Pizza Hut Australia. Flynn operates about 950 Pizza Huts in the U.S.; the deal—its first outside the United States—will give it another 260. … Mars Inc. is aiming to grow its global ice cream business from $400 million in sales to $1 billion by 2030. Mars said it is eyeing growth in places where it already has ice cream factories, as well as in emerging markets. “Ice cream is about a $80 billion category around the globe, and it’s going to be about $100 billion by 2030,” said Anton Vincent, president of Mars Wrigley in North America and who recently took over global ice cream responsibilities. (Nation’s Restaurant News, 6/7/23; Reuters, 6/6/23; Bloomberg, 5/24/23)

China’s Yili Group and New Zealand’s Olam Food Ingredients (OFI) each expect to bring new plants online over the next two months. Yili is finishing a $138-million infant formula expansion at its Tianjin manufacturing plant. The new line, set to open in July, can produce up to 24,000 MT of semi-finished products per year. OFI expects to open Stage 1 of its new NZ$100-million-plus milk powder plant in Tokoroa on New Zealand’s North Island in August, prior to the 2023/24 milking seasons. The facility will reportedly produce up to 10 MT of powder per hour. Stage 2, which will expand operations to higher-value, functional protein products, should be up and running for the 2025/26 season, the company said. Rumors in New Zealand farming circles suggest OFI is already contemplating a second plant on the South Island, although the company has not publicly stated such intentions. OFI rival Fonterra Co-operative group cautioned that OFI’s plans could lead to excess processing capacity plant closures, given expected declines in New Zealand milk production in the years ahead. (USDEC China office; New Zealand Herald, 6/24/23)

Vinamilk announced it is joining six global nutrition and bioscience companies in a strategic partnership designed to further its mission of providing “international quality” nutritional solutions to Vietnamese children. Companies joining the Vietnamese dairy processor in the initiative include DSM, Chr. Hansen, Beneo, Gnosis, AAK and Kanematsu. Vinamilk CEO Mai Kieu Lien said the partnership will help the company further its commitment to leveraging modern production processes, scientific research and international cooperation to provide Vietnamese children with high-quality nutritional products. (FoodBev.com, 6/19/2023)

Ireland’s Dairygold Health and Nutrition (a business of Dairygold Co-operative Society) acquired a majority stake in Vita Actives Ltd. Vita Actives, also based in Ireland, is a manufacturer, supplier and distributor of bulk nutraceuticals and food-grade ingredients for dietary supplements. Dairygold said the deal positions the company well within the fast-growing life-stage nutrition segment. … Unilever is buying U.S.-based Greek frozen yogurt company Yasso Holdings to advance its position in the premium “better for you” frozen dessert segment. (Company reports; Agriland, 6/23/23)

Firehouse Subs, owned by Restaurant Brands International, signed a development deal to launch in Mexico later this year. The company did not name its partner in Mexico but said the deal, as well as a new store in Switzerland, are the first steps of a broad international push into the Middle East, Latin America, Asia, Europe and Africa. … Saudia Dairy and Foodstuffs (SADAFCO) signed a sales and export agreement with the Sultanate of Oman. SADAFCO, which produces dairy products, dairy alternatives, snacks, processed tomato products and other foods, did not provide information on which products were included in the agreement. The agreement aligns with the company’s efforts to expand its regional and export business. … Bongards Creameries is spending $125 million to increase milk handling capacity at its Perham, Minnesota, manufacturing plant by 30% to around 2,500 MT/day. The project includes expanding milk intake bays, cheese packaging, whey drying, packaging and warehousing, and wastewater treatment. Work is set to begin in July with completion expected in June 2025. (USDEC Middle East/North Africa office; Company reports; Perham Focus, 6/27/23)

Dairy innovation awards offer insights into new product trends

The 2023 World Dairy Innovation Awards were announced in June at Zenith Global’s 16th Annual Global Dairy Congress in London. While the awards are not a comprehensive round-up of new product innovation around the world, they are instructive in terms of product development trends taking place in some key U.S. dairy export markets, particularly China.

Health and nutrition claims continued to play a strong role among award winners and contenders, reflecting the continuing consumer focus on immune and digestive health. China-based Feihe Dairy’s award in the functional dairy category for its Aiben bovine colostrum milk powder highlights interest in the use of natural-based products as nutritional supplements to promote health and the immune system. Singapore-based CP-Meiji took home the prize in the “intolerance-friendly innovation category” with Lactose Free Dairy Milk with Malt.

Other finalists in the functional dairy group included: Feihe Dairy’s Aiben bovine colostrum milk powder

Feihe Dairy’s Aiben bovine colostrum milk powder

- Zhennong High-Calcium Milk and ShuHua AnTangJian Sugar-Control Lactose-Free Milk from Chinese dairy giant Yili Group.

- Feihe’s Aiben Lactoferrin Formula Milk Powder.

- Japanese dairy processor Meiji Co.’s Fat-Fighting MI-2 Yogurt (which it claims reduces belly fat) and Probio R-1 Yogurt, which is fortified with iron and vitamin C.

Many award nominees and winners had innovative product configurations that fit the Congress’s theme of “reimagining dairy.” In the cheese category, Feihe’s Zhuoran High-Calcium Cheese Lolly took top honors, with other finalists including Feihe’s Zhuoran High-Calcium Cheese Lumps and Yijiahao Cheese’s Double-Layer Cheese Lollipops (Yijiahao Cheese is a subsidiary of Yili). Yijiahao Cheese also took top honors in the children’s category with its Cheese Bomb cheese snacks in kid-friendly shapes.

Yijiahao Cheese’s Cheese Bomb cheese snacks

Yijiahao Cheese’s Cheese Bomb cheese snacksSustainability also continued to be an important industry touchpoint. For corporate social responsibility/sustainability initiatives, Yili earned finalist honors for its Satine A2 Beta-casein Organic Pure Milk, which Yili claims is China’s first net-zero carbon milk. Japan’s Meiji Co. was commended for its collaborative efforts with Ajinomoto to work with Japanese dairy farmers to reduce greenhouse gas emissions.

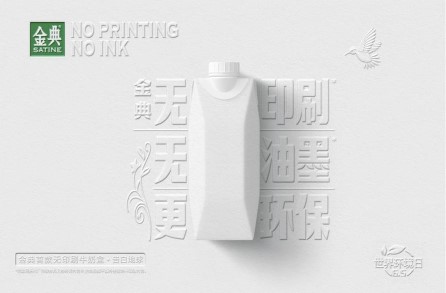

On the marketing side, Yili was a finalist in packaging for its Satine No Printing No Ink Environmentally-friendly Edition—where individual cartons of Satine multipacks are almost completely white. Yili's Satine No Printing No Ink cartons

Yili's Satine No Printing No Ink cartonsFor a full recap of winners, finalists and commended products, go to https://www.foodbev.com/news/world-dairy-innovation-awards-2023-winners/. (Company reports; FoodTalks, 6/25/23; FoodBev.com, 6/21/23)

Two New Zealand dairy companies—Happy Valley Nutrition and Dairy Nutraceuticals—have reportedly run into financial troubles. The Bank of China appointed receivers to Dairy Nutraceuticals, which is majority-owned by Hong Kong-based Health Dairy International Ltd. Dairy Nutraceuticals produces a range of dairy products, including infant formula, adult milk powders and foods for special medical needs, out of its factory in Auckland. Separately, administrators were appointed to Auckland-based Happy Valley Nutrition after that company failed to raise sufficient funds to build a new infant formula and dairy nutrition factory in Ōtorohanga, Waikato. The company raised about NZ$13 million (about US$8 million) in an initial public offering but reportedly needed an additional NZ$350 million (about US$220 million) to follow through on its plans. Happy Valley cited high interest rates, a tighter New Zealand milk supply and China's growing domestic milk supply as some of the reasons behind its stalled plans. The administrators said in a statement that they were undertaking “an urgent review” of the company. (Company reports; Stuff.co.nz, 7/5/23; BusinessDesk, 7/4/23)

Japanese dairy Megmilk Snow Brand announced a joint venture with Agrocorp International, a Singapore-based agricultural commodities company, to manufacture and market plant-based food ingredients. The collaboration, which will be based in Singapore, seeks to support sustainable food production in Asia in response to rising food demand in the face of tightening supply. Together, the companies will build a factory in Malaysia to produce pea protein, pea fiber and pea starch that can be used in plant-based meat and dairy products. Production is expected to begin at the end of 2025. (USDEC Southeast Asia office; Company reports; FoodNavigator-Asia.com, 7/4/23; Green Queen, 5/22/23)

Switzerland’s Emmi Group divested its organic dairy processor Gläserne Molkerei in northeast Germany to Mutares, a German holding company that specializes in turnarounds. The transaction is consistent with Emmi’s ongoing efforts to focus its portfolio on profitable strategic markets and niches, such as ready-to-drink coffee, specialty cheeses, premium chilled desserts and plant-based dairy alternatives. … Danone sold its 38% stake in Irish Organic yogurt maker Glenisk to the company’s founders, the Cleary family. (Company reports; FoodBev.com, 7/11/23)

French dairy cooperative Sodiaal appointed Antoine Collette as the company’s new CEO. Collette succeeds Jorge Boucas, who stepped down in February to lead French sugar group Tereos. … McDonald’s Korea expects to add 100 new stores by 2030, raising its total number of outlets in South Korea to 500. … Lactalis opened a new €2.4-million (about US$2.6 million) UHT addition to its plant in Gradačac, Bosnia and Herzegovina. The company expects to spend another €1.3 million next year to expand yogurt capacity at the facility. (Company reports; Just Food, 7/7/23; FoodBev.com, 7/5/23)

Hilmar Cheese Company has revealed a new look and corporate strategy, unifying its products under the brand name Hilmar while marking the integration of the company’s cheese and ingredients businesses. A news release explains that the new logomark features a milk droplet that’s being split into two products: cheese and whey ingredients. The design also reflects the concepts of nature, farmland and sustainability. “We take our role as stewards of the land and environment seriously,” said David Ahlem, Hilmar’s president and chief executive officer. Ahlem also said. “This new brand reflects our commitment to investing in technologies and processes that reduce our carbon footprint and make efficient use of all our resources.” “The new identity aligns with the company’s expanding role in the markets it serves,” said Ahlem. (Dairy Processing, Turlock Journal, 7/14/23)

Russia has taken control of the Russian subsidiary of French dairy group Danone, reports BBC News. The units have been put in “temporary management” of the state under a new order signed by Russian President Vladimir Putin. Danone was in the process of selling its Russian operations. Reuters reported on Monday that Danone is reviewing its legal options. (BBC News, 7/16/23; Reuters, 7/17/23)

Japanese milk producers Megmilk Snow Brand and Yotsuba Milk Products will expand dairy exports to Asian markets to secure new revenue streams as price hikes dent demand at home, reports this article by Nikkei Asia, a Japanese weekly news magazine. Megmilk will soon start exporting its "Hokkaido" brand long-life milk to Thailand. It already ships the product to Singapore, Taiwan, Hong Kong and Palau. Meanwhile, Yotsuba Milk Products plans to lift exports to Singapore by value by 20% every year. Milk packaged at its main factory in Hokkaido will be shipped to Taiwan, Malaysia and other markets. (Nikkei Asia, 7/18/23)

Denmark’s Arla Foods is teaming up with Blue Ocean Closures in a formal partnership to create a fiber-based cap for its milk products. This could be a first in the dairy industry and reduce Arla’s plastic consumption by more than 500 tons annually if implemented … Darigold has joined the Global Dairy Trade platform to better support its growth ambitions and create value for its farmer-owners … China’s Mengniu Dairy has been named an official sponsor of the FIFA Women’s World Cup 2023, which began on Thursday … Nestlé has introduced a new sugar-reduction technology, which uses an enzymatic process that can reduce intrinsic sugar in ingredients such as milk, malt and fruit juices by up to 20% ... China’s Shanghai Youchun Dairy signed a cooperative agreement to build a dairy processing project in Jinchang City in Gansu province capable of producing of 200,000 MTs of dairy products per annum … Seven-Eleven Japan Co. said it will launch a new brand of environmentally friendly prepared foods. The company will start selling the first four items of the brand this week. The items include a tuna mayonnaise "onigiri" rice ball whose tuna is partly replaced by pea protein. (Perishable News.com, 7/14/23; Dairy Reporter, 7/11/23; Sports Mint, 7/17/23; FoodBev Media, 7/1/23; USDEC China Office, 7/18/23; Jiji Press, 7/11/23)

With the pandemic seemingly in the rearview mirror, Western-based chain restaurants are once again moving to grow their international businesses. Here are a few recent highlights:

- McDonald’s Corp. is spending more than A$1 billion (about US$677 million) over the next three years to add 100 new stores and refurbish more than 500 existing outlets in Australia.

- Chipotle signed an agreement with Kuwait-based Alshaya Group to open two stores each in Dubai and Kuwait next year. the Deal is Chipotle’s first franchise agreement (all existing stores in the U.S., Canada and Europe are company-owned) and the stores will be the first in the Middle East. Alshaya is also a franchisee for other major U.S. restaurant brands, including Starbucks, and Shake Shack. Chipotle said the agreement could serve as a new model as the company looks to expand to other global markets.

- Dine Brands is bringing its Applebee’s and IHOP chains to Japan (and a handful of EU countries) but not in a traditional manner. Dine is working with Georgia-based Franklin Junction, a company that specializes in matching restaurant brands with “host kitchens” and providing the technology to set up a delivery-only, virtual presence in the market. Dine said the new strategy will open new opportunities for IHOP and Applebee’s in key international markets.

- Burger King’s Thai outlets rolled out a new sandwich it is characterizing as a “real cheeseburger.” Instead of meat and cheese on a bun, the “cheeseburger” contains up to 20 slices of cheese. The sandwich went viral on social media earlier this month and was reportedly selling well. Thai conglomerate Minor International, which runs more than 2,000 foodservice outlets in over 25 countries, operates the Burger King franchise in Thailand. (USDEC Southeast Asia office; Company reports; Bloomberg, 7/22/23; Restaurant Business, 7/19/23; CNBC, 7/18/23)

Competition concerns have been raised in three pending dairy asset deals, causing anti-trust regulators to call for further investigation before allowing the deals to close. In Brazil, antitrust regulators are challenging Nestlé and Fonterra Co-operative Group’s planned sale of Dairy Partners Americas Brazil to Lactalis. Technical staff at the Council for Economic Defense (CADE) recommended that the regulator block the US$147-million deal because it would likely cause horizontal competition in the Brazilian dairy products market, particularly among the dairy desserts, fermented milk and petit-suisse categories. CADE’s court will conduct a broader review of the deal before voting on its approval. In Ireland, regulatory authorities announced they will conduct a full Phase 2 investigation of the proposed acquisition by Aurivo Consumer Foods of certain assets of Arrabawn Co-Operative Society. The Competition and Consumer Protection Commission (CCPC) said a full investigation is needed to ensure the proposed deal, in which Aurivo would acquire parts of Arrabawn’s business for the supply of branded and unbranded liquid milk, cream and butter products, does not lead to “a substantial lessening of competition in the State." Australia’s Competition and Consumer Commission (ACCC) also identified competition concerns about a proposed deal for Coles Group Limited to acquire two fresh milk processing facilities from Saputo Dairy Australia. The ACCC cited concerns that the acquisition would give Coles, one of Australia’s largest grocery retailers, too much influence in the dairy supply chain. The watchdog is also considering whether the deal would limit competition, which could cause farmers to receive lower prices for their raw milk. (Reuters, 7/25/23; CCPC, 7/14/23; DairyReporter.com, 7/24/23)

USDEC brings you results highlights from recent half-year reports from major global dairy suppliers:

- Nestlé reported broad-based growth across most categories and regions. Dairy group sales rose at a high-single-digit pace, with strong demand for coffee creamers and affordable fortified kinds of milk. Middle East and Africa saw double-digit growth, with infant nutrition as the largest contributor, led by Lactogen, NAN and Cerelac. In Brazil, dairy posted double-digit growth, supported by fortified milks and dairy culinary solutions, while infant nutrition increased by double-digits as well, based on solid momentum for NAN and Nido growing-up milks. In China, infant nutrition saw mid-single-digit growth, led by NAN specialty offerings and illuma.

- FrieslandCampina reported a “challenging” first half, citing “sharply declined commodity dairy prices and lower volumes.” One bright spot was the performance of specialized nutrition, which reported strong revenue and operating profit figures, partially driven by growth in infant nutrition sales under the Friso Prestige brand in the ultra-premium segment in China. (Company reports)

Leprino Foods expanded its relationship agreement with Illinois-based ingredients distributor Univar Solutions. Univar’s Mexican and Brazilian units will distribute Leprino’s nutritional ingredients and dairy products in their respective markets. Leprino said the deal “reinforces our commitments to the food ingredients and nutrition market.” Earlier this year, Leprino selected Univar as an authorized distributor for Canada and the United States. … Japanese probiotic beverage maker Yakult is building a $305-million production facility in Bartow County, Georgia. The company expects to commence manufacturing at the beverage plant in 2026. … Danone claims it remains the legal owner of its operations in Russia despite a Russian decree in July putting the business under “temporary management” of the government. The government justified that move with recently passed rules aimed at companies from “unfriendly” countries. Just prior to the takeover, Danone said it was localizing its Activia brand in Russia, renaming it AktiBio. A company spokesperson said, “What’s going to happen in the future? We don’t know.” (Company report; Al Bawaba, 7/29/23; FoodBev.com, 7/28/23; Bloomberg, 7/26/23)

Milk Specialties Global (MSG) has completed a new production facility in Jerome, Idaho, that will produce acid casein and rennet casein products for food and industrial applications. MSG says its new facility will process 2.5 million pounds of milk each day and offer North American consumers an “alternative supply of domestically produced casein products” … Lactalis Canada has agreed to purchase dessert manufacturer Marie Morin Canada for an undisclosed sum. The acquisition will see the Canadian division of Lactalis Group expand its presence in the dessert category, entering both the Canadian and U.S. markets. The move will complement Lactalis Canada’s extensive dairy portfolio, which includes cheese, table spreads, yogurt and fluid brands … South Korea’s Orion has joined with Thailand’s No. 1 milk beverage company Dutch Mill to enter Vietnam’s dairy market. Orion will first introduce two new product lines – Proyo! and Choco IQ – this month and launch others later … Dow and China’s Mengniu have partnered to introduce a yogurt pouch made entirely from polyethylene. The new packaging solution, which is designed for recyclability, allows previously “hard-to-recycle" packaging to be integrated into closed-loop recycling systems. (FoodBev.com, 8/4/23, 8/3/23; The Korea Times, 8/8/23, Food Bev.com, 8/9/23)

Arla Foods Ingredients (AFI) inked a partnership with biological solutions company Novozymes to jointly develop protein ingredients using precision fermentation technology. The collaboration will initially focus on creating products for disease-specific medical nutrition, with expansion into other market segments expected in the future. “Collaborating with Novozymes fits perfectly with our ambition to explore alternative nutrition platforms and complement our portfolio of dairy and whey solutions,” AFI Group Vice President Henrik Anderson said. (Company reports)

Administrators for aspiring New Zealand-based infant formula manufacturer Happy Valley Nutrition have recommended that the board vote to liquidate the company. … Turkey-based quick-service restaurant operator TFI Tab Food Investments (parent company of Burger King (China) Investment Co.) plans to open 200-300 Burger King outlets in China per year moving forward. The company already runs more than 1,400 restaurants in 150 Chinese cities. … New York-based scoop shop Van Leeuwen Ice Cream is opening its first international outlet in Singapore through a partnership with Singapore-based lifestyle and food and beverage group Caerus Holding. (USDEC China office; USDEC Southeast Asia office; Dao Insights, 8/8/23; Stuff.co.nz, 8/4/23)

Arla Foods Ingredients signed a new partnership agreement with Chinese ingredient and chemical distributor Zhongbai Xingye Food Technology (Beijing) Co., a unit of the Brenntag Group. The two companies have a 15-year relationship that includes a jointly funded Innovation & Application Center in Zhongbai’s Beijing facility to develop China-specific formulations. The new agreement expands their cooperative product development work and covers the full range of Arla’s ingredient products. “This agreement will help us adapt and make our offering to Chinese markets even stronger,” said Luis Cubel, Commercial Director of Arla Foods Ingredients. (Company reports)

Ongoing inflation and increased supply chain expenses continue to hinder companies across the globe as they release their most recent financial performance results:

- Glanbia plc reported first-half earnings that exceeded expectations, driven largely by the strong performance of its Glanbia Performance Nutrition (GPN) business. Group revenues for the company, which recently changed its financial reporting currency from the euro to the U.S. dollar, were $2.8 billion for the first half of 2023, down from $3.1 billion in HY 2022. But group EBITA (before exceptional items) grew 6.1% (constant currency). GPN revenue increased by 3.4% in HY 2023 versus the previous year. Based on its half-year results, Glanbia upgraded its full-year guidance to 12%-15% growth in adjusted earnings per share.

- In its first quarter 2024 report, Saputo revenues fell 2.8% while net earnings rose 1.4% compared to the same quarter last fiscal year. Factors cited by the company as affecting the first quarter performance included the positive carryover effect of previously implemented pricing initiatives in all its sectors, lower average block market price and butter market price in the USA sector, and softening of the global demand for dairy products negatively impacting its sales volumes.

- Bel Group revenues rose 6.3% in the first half of 2022. The company attributed the gain in part to sustained double-digit growth in China and strong performances by core brands, including Kiri and Boursin. Sales in China increased for the fourth consecutive year, driven in part by the performance of Kiri cheese. Strengthening its presence there was Bel’s acquisition of a majority stake in China’s Shandong Junjun Cheese.

- The second quarter 2023 results for Yum China showed record growth in total revenues and operating profit. The unaudited results show total revenues increased 25% to $2.65 billion, up from $2.13 billion in 2022. Total system sales increased 32% year over year, with increases of 32% at KFC and 30% at Pizza Hut. Same-store sales increased 15% year over year, and the company opened 422 new stores during the quarter. Net Income increased 138% to $197 million from $83 million in the prior year period, primarily due to a 216% increase in operating profit, which jumped to $257 million and has already surpassed the entire year for 2022. Company officials credited robust digital capabilities, an agile supply chain and special marketing campaigns for its strong performance, as well as strong sales on holidays including Children’s Day.

- In its FY 2023 annual results, A2 Milk reported revenue for FY23 up 10.1% from the previous year and net profit growth of 26.9%. The company credited its China-focused growth strategy for the revenue increase. The China & Other Asia segment saw revenue rise 37.9%, and it exceeded NZ$1 billion (about US$594 million) for the first time. The gains came despite an overall decline in the Chinese infant formula sector of more than 10% in A2’s FY23. The company attributed the decrease to China’s declining birth rate, challenging macroeconomic conditions and increased competition. A2 said it expected another double-digit decline in China’s infant formula sector in FY24 but expected the company to still post low single-digit revenue growth. (USDEC China office; Company reports; Radio New Zealand, 8/21/23)

Glanbia plc’s Group Managing Director Siobhán Talbot announced plans to step down effective Dec. 31. 2023, and retire from the company in January 2024. Hugh McGuire, currently CEO of Glanbia Performance Nutrition, will take over as CEO of Glanbia plc effective Jan. 1, 2024. Talbot joined Glanbia plc in 1992 and has been managing director for the past 10 years. (Company reports)

Wells Enterprises is more than doubling its ice cream and frozen novelty manufacturing capacity at its Dunkirk, N.Y., facility. Construction will begin this fall. Wells is owned by Italian confectionery company Ferrero Group. … The Cheesecake Factory is set to open its first store in Thailand in December through its relationship with Hong Kong-based foodservice operator Maxim’s Caterers. The new store is located in Bangkok. Last fall, Cheesecake Factory and Maxim’s announced they planned to open 18 Cheesecake Factory locations in Thailand by 2028. (Company reports; Lifestyle Asia, 8/17/23)

Australia’s Bega Cheese paid A$11 million (about US$7 million) for certain assets of TasFoods Ltd.’s Betta Milk and Meander Valley Dairy businesses. The deal includes a perpetual, royalty-free license for Bega to use the Pyengana Dairy brand in Australia. (Company reports)

John Jordan, CEO of Irish dairy manufacturer and marketer Ornua, is stepping down to take on a new position as COO of a U.S.-based private equity firm. The Ornua board named current CFO Donal Buggy as interim CEO while it began a search for a permanent replacement. … McDonald’s Malaysia plans to spend more than US$40 million to open 36 new stores in Sabah, the Malaysian state on the island of Borneo. The company expects to complete the expansion by 2030, giving it 52 total stores in Sabah. … Tim Hortons China plans to open 1,700 Popeyes units in China over the next decade. (USDEC Southeast Asia office; USDEC China office; Company reports)

2022 was a good year for large companies in Rabobank’s Global Dairy Top 20. They had a combined turnover gain of 7.4% in U.S. dollar terms (based on 2022 sales, plus acquisitions completed by June 30, 2023.) Favorable commodity prices, inflation and a tight dairy market were contributing factors. Yet, as Rabobank points out, the degree to which a dairy company’s revenues benefitted from price developments depended on a combination of its product portfolio, geographic presence and distribution channels. French dairy giant Lactalis held onto the No. 1 spot with an estimated turnover of $28.6 billion. Two U.S. companies made significant jumps on the list. Dairy Farmers of America moved from No. 4 to No. 2 – leaping over Nestlé and Danone -- with a turnover of $24.5 billion. Schreiber Foods moved from No. 19 to No. 16. New Zealand’s Fonterra dropped three spots from No. 6 to No. 9. To download the full Rabobank report, click here.

Despite ongoing inflation, cautious optimism was a common theme among many companies looking ahead as they released their most recent financial statements:

- Arla Foods: The numbers: Denmark-based Arla Foods’ revenue was up 10.7% compared to the first half of the previous year, but Arla saw net profit drop to 1.5% of revenue from 3.0% in the last half-year. Beyond the numbers: Arla predicts inflation will continue to influence consumer patterns—and put pressure on branded volumes in most markets—for the rest of 2023. But the company expects its branded-product growth numbers will climb again in the second half of this year. The commodity market, however, “continues to be marked by uncertainty,” Arla said.

- Bega Group: The numbers: For the full year ending in June, Australia-based Bega posted revenue growth of 12% from 2022, while EBITDA dropped 4%. Beyond the numbers: Now in the final phase of its transition to a predominantly branded business, Bega credits its brands for driving performance in the second half of its fiscal year. The company expects the majority of profit for the coming fiscal year will come from this branded segment.

- Dutch Lady Milk Industries: The numbers: The Malaysia-based dairy processor reported a net profit increase of 12.7% in the second quarter that ended June 30, 2023. Quarterly revenue also increased 3.3% for the same period. Beyond the numbers: Dutch Lady says higher revenue was driven by strong demand and selective price increases designed to offset inflationary headwinds.

- Emmi Group: The numbers: Emmi’s first-half 2023 sales increased by 4.3% from the previous half-year, with net profit jumping 25.2%. Beyond the numbers: Emmi Group, based in Switzerland, credits its rebound from a challenging 2022 in part to the strength of its ready-to-drink coffee brands, such as Emmi Caffè Latte, as well as chilled premium desserts.

- Feihe Ltd.: The numbers: The first half of 2023 saw revenues tick up 0.6% from the previous year for the Chinese formula company. Gross profit for the same period decreased by 2.7%. Beyond the numbers: Feihe says it is dedicated to innovation in “fresh keeping” technology and expanding its business into formula and nutritional products covering the age cycle from infant to senior. In the first half of 2023, sales of its adult milk powder jumped 57% from the previous year.

- Mengniu Dairy: The numbers: Mengniu’s 2023 half-year revenue increased 7.1% compared to the same period the previous year, with an operating profit increase of 29.9%. Beyond the numbers: The China-based company saw liquid milk revenues increase 5% from the previous year, while its ice cream business revenue increased 10.5%. Its cheese segment, which is self-operated by its Shanghai Milkground Food Tech business, increased 310% compared to the same period last year—a jump attributed to the rising cheese demand in China.

- New Hope Dairy: The numbers: The China-based dairy supplier reported that revenues increased 10.8% in the first half of 2023. Net profit climbed 25.1% for the same period. Beyond the numbers: New Hope said it will continue to focus efforts on its pasteurized milk segment, which posted a revenue increase of more than 10% from the previous year.

- Panda Dairy Corp.: The numbers: For the first half of 2023, the China-based company’s revenue was up 18.3% year over year, and net profit leaped 107.1% for the same period. Beyond the numbers: The company attributes the growth to the active development of new channels and customers, including adding distributors for catering and establishing strategic partnerships with food companies. Looking ahead, it expects cheese and cream to be new growth categories.

- Yili Group: The numbers: China’s Yili saw a 4.3% increase in revenue for the first half of 2023, and net profit was up 2.9% over the previous year. Beyond the numbers: China’s largest dairy company credits its revenue growth to strong sales of infant formula and ice cream, both of which posted double-digit gains during the period. A company official said demand for liquid milk is also on the rise and that the slowdown in its milk powder business is showing signs of improvement. (Company reports; USDEC China office; Yicai, 8/29/23; The Edge Malaysia, 8/24/23)

New Zealand-based dairy cooperative Fonterra is seeking US$596 million in cost savings, likely leading to the potential loss of jobs, reports an article in Just Food. “While this focus on efficiencies will have implications for staff numbers, we don’t want this to be at the expense of driving value growth,” CEO Miles Hurrell said in a letter to its farmer owners. The cost-cutting plan will be implemented over the next seven years.

French cheese giant Bel Group offered its take on doing business in China in a recent piece in DairyReporter.com. The company said it tried for years to break into the China market by selling its Laughing Cow cheese cubes, all in savory flavors popular in other markets. But Bel realized Chinese consumers wanted sweeter cheeses. “As soon as we thought out of the box and integrated fruit juices to develop the fruity range, the products started doing extremely well,” said Gorge Bai, Bel China general manager, cheese. But that does not mean abandoning traditional product lines, Bai said. He recommended a dual approach: innovate to local tastes while simultaneously introducing tastes and products that might be new to the market. (DairyReporter.com, 8/29/23)

Tillamook County Creamery Association is working with Golden West Food Group on “premium, restaurant-quality” frozen meals, which comprise three types of mac’n’cheese products and four frozen pizza flavors. It’s a new segment for Tillamook, which markets fresh products such as cheese, butter, spreads, ice cream and sour cream … Denmark’s Arla Food Ingredients has taken full control of MV Ingredients, with Volac exiting the joint venture, which has been in place for more than 10 years. MV Ingredients is a whey processing facility based at Arla Foods Ingredient’s Taw Valley creamery in the UK … HP Hood will expand its manufacturing operations at the Genesee Valley Agri-Business Park in Batavia, New York. The $120 million project is expected to create 48 jobs in Genesee County … Müller Yogurt and Desserts has launched Müller Corner Originals, bringing back favorites from the last 30 years. The first retro flavors from the English dairy company’s back catalog will be Mississippi Mud Pie Inspired and Strawberry and Choc Orange Balls. (Dairy Reporter, 9/4/23; Food Ingredients First, 9/4/23; Area Development, 9/4/23; FoodBev Media, 9/6/23)

An international dairy development collaboration created to further the development of organic dairy production in Indonesia recently introduced that country’s first locally produced organic cheese. The launch is the result of a partnership between Denmark-based dairy cooperative Arla Foods and partners, including Indonesia-based dairy producer Mazaraat Artisan Cheese, the Indonesian government and the Danish Ministry of Foreign Affairs.The effort began with Indonesian farmers and other stakeholders making research trips to Denmark in 2018, where Arla shared its agricultural experience and best practices for organic dairy production. The organizations formed a partnership that went on to convert a number of conventional Indonesian farms to certified organic dairy producers. Mazaraat processed milk produced at those farms to become the country’s first organic cheese. The partnership was formed to meet Indonesia’s growing dairy demand. Roughly 80% of the country’s dairy consumption comes from imported products, and demand is expected to increase by 6% in 2023. The Indonesian government is also working to increase local organic food production from 2% to 20% by 2024. The cheese will be sold locally in hotels, cafés, and restaurants, and Mazaraat says it has inked its first export agreement with Singapore. (Company reports, 8/31/23)

Mengniu Dairy, China’s second-largest dairy company, said it believes increasing consumer demand will make innovation in protein products, especially in the ready-to-drink (RTD) beverage format, a key component to the country’s domestic dairy growth. At the Food and Beverage Innovation Forum in Shenzhen, China, Mengniu Nutrition and Health GM Ben Wu said the company believes RTD protein products will drive the dairy category as Chinese consumers seek the health and nutritional benefits of dairy across all life stages. Other factors Wu identified as contributing to the increased demand for protein products include the aging of Chinese society and a rise in the number of professional Chinese athletes. Wu also said opportunity areas exist around protein products with Chinese cultural significance and those with flavors catering to Chinese tastes. Mengniu recently launched its first range of locally produced RTD beverage line called M-Action, which features products targeted to men and women based on their genetic differences and activity levels. (DairyReporter.com, 9/6/23)