-

U.S. dairy exports maintain momentum in April

By USDEC Staff June 8, 2021- Tweet

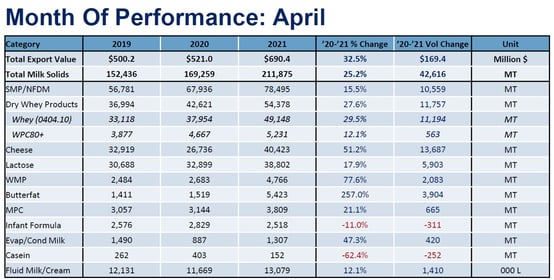

April proved another robust month of growth for U.S. dairy exports. Volume on a milk solids equivalent grew by 25% compared to April 2020, with gains in every major U.S. dairy product.

Cheese led the way with an astonishing 51% increase (+13,687 metric tons, or MT) with whey (+28%, +11,757 MT) and non-fat dry milk/skim milk powder (NFDM/SMP) close behind (+16%, +10,559 MT). With the U.S. shipping greater volumes of higher-priced products like cheese and whey protein concentrates, U.S. export value surged by 33%.

Overall, the picture is clearly optimistic. Still, we must include some caveats. The scale of the growth was almost certainly enabled by an improved port situation in April that allowed U.S. exporters to clear a backlog of shipments from the fourth quarter of 2020 and early 2021. Additionally, U.S. cheese exports in April 2020 were weakened by the global pandemic making the comparison month particularly favorable. However, even accounting for these caveats, the data suggests impressive international demand for U.S. dairy.

More detailed data and charts can be found here.

Here are our three main takeaways from April’s export data:

U.S. cheese resurgence

Towards the end of last year and into January of this year, U.S. cheese exports were sluggish due to weaker demand in Mexico alongside U.S. government purchases causing U.S. cheese to be priced well above the world market during the summer and fall of 2020. However, the past two months have shown that as government spending and price volatility waned over the winter and Mexico’s economy began to reopen, U.S. cheese exporters took advantage to book more export sales.

In April, U.S. cheese exports hit a record with gains spread across major markets. Shipments to Korea grew by 3,620 MT, Mexico by 3,056 MT, Central America by 1,799 MT, South America by 1,159 MT, Japan by 1,427 MT, Australia by 559 MT, and the list goes on. The gains in Latin America, especially Mexico and Central America, are perhaps the most encouraging, considering cheese demand in those markets was acutely hit by the COVID-19 pandemic, its economic effects and loss of international tourism. Increased exports indicate recovering demand in those markets as vaccine distribution accelerates and travel resumes.

-Jun-08-2021-06-49-18-14-PM.jpg?width=554&name=Chart2%20(2)-Jun-08-2021-06-49-18-14-PM.jpg)

Given that U.S. cheese production grew by 8% in April off strong milk production and new processing capacity, increased U.S. cheese exports for the month should not come as a surprise. With supplies generally available, international buyers clearly sought out affordable U.S. cheese, and the U.S. had the cheese to sell.

This dynamic provides further reason for optimism for U.S. cheese exports in the coming months as U.S. milk and cheese production continues to expand. Overall, with international demand accelerating and available product out of the U.S., we should continue to see strong cheese exports into the summer and early fall.

NFDM/SMP: Rebound in Mexico, slowdown in SEA

Cheese wasn’t the only major product category to grow. U.S. NFDM/SMP exports in April gained 16% (+10,500 MT) compared to April 2020, thanks to a strong rebound in exports to Mexico and new business in the Middle East/North Africa (MENA). Total NFDM/SMP shipments to Mexico grew by 43% (+8,052 MT).

Like cheese, NFDM/SMP demand in Mexico had been weaker over the past year due to the pandemic and the economic situation. April marks the third consecutive month of growth and points to greater demand within the country. Whether this increased demand persists largely depends on the cause.

In April, nearly 85% of Mexico was facing drought conditions, including its major milk-producing regions. This likely drove Mexican buyers to the international market for dairy products and inputs to ensure adequate supplies on hand, which has helped bolster U.S. exports. If the drought was the primary cause of the growth and not increased consumer demand, we could see a slowdown in shipments by June.

Thankfully, the U.S. has become increasingly diversified. Last year, the U.S. relied heavily on Southeast Asia (SEA) as an alternative destination. While volumes to SEA remain substantial, April shipments lagged 2020 volumes, falling 27% (-9,112 MT). Looking back, U.S. NFDM/SMP exports to SEA in April 2020 were the second highest on record. So, a decline in and of itself is not overly concerning. Still, port delays out of the West Coast remain a concern and have left some buyers frustrated with not being able to source product when they need it. Active communication about delays by U.S. exporters and improved port conditions will be essential to maintain market share in the region.

Instead, the U.S. shipped much greater volumes to MENA. In fact, the past two months posted the second and third highest NFDM/SMP export months of all time to the region (9,215 MT in March, 9,012 MT in April). This is relatively new business for U.S. exporters as the MENA region is the priority region for the European Union, so greater volumes here are particularly encouraging.

-Jun-08-2021-06-50-16-50-PM.jpg?width=554&name=Chart3%20(2)-Jun-08-2021-06-50-16-50-PM.jpg)

Butterfat exports booming

The United States may not boast the export volumes of the world’s dominant butterfat suppliers—New Zealand and the EU—but we haven’t seen this level of butterfat shipments since 2014. April butterfat exports jumped 257% (+3,904 MT) over the previous year, but this trend has persisted before April. U.S. shipments over the first four months of 2021 were 17,039 MT, an increase of 146%, or more than 10,000 MT.

-1.jpg?width=554&name=Chart4%20(3)-1.jpg)

A prolonged period of price competitiveness alongside strong demand from the Gulf Cooperation Council, assisted by the broader region’s ongoing efforts to diversify suppliers, have been the main drivers all year. U.S. butter exports to MENA grew 623% (+5,558 MT) over the first four months, compared to the same period in 2020.

In April specifically, the Middle East still led the gains (+450%, +1,336 MT), but Canada contributed to the big month as well, with U.S. shipments north of the border up 389% (+1,128 MT).

With U.S. butter stocks at an 18-year high, the volumes U.S. suppliers are moving on the international market have helped ease some of the pressure on butter prices. We remain optimistic that this growth and engagement in the international market should continue into the summer as U.S. butterfat prices remain well below those of New Zealand and the EU.

Still, with foodservice demand recovering and the wildcard of U.S. government purchases potentially tightening the butter market, we will be watching this space closely to see whether the recent increases in butterfat exports become a permanent fixture of the U.S. export portfolio.

Learn more about global dairy markets:-

U.S. dairy exports hit all-time record in March

-

U.S. dairy exports surge despite shipping woes

-

U.S. dairy exports continue, even as shipping issues create headwinds

Subscribe to the U.S. Dairy Exporter Blog

The U.S. Dairy Export Council fosters collaborative industry partnerships with processors, trading companies and others to enhance global demand for U.S. dairy products and ingredients. USDEC is primarily supported by Dairy Management Inc. through the dairy farmer checkoff. How to republish this post.

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (65)

- Africa (6)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (19)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (9)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farmer leaders (1)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Future trends (1)

- Geographical Indications (GIs) (10)

- Global Marketing (86)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (264)

- Member Services (17)

- Mexico (41)

- Middle East (9)

- Middle East & North Africa (3)

- Middle East/North Africa (9)

- Milk (4)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (18)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (322)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (25)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- April 2015 (11)

- December 2015 (11)

- March 2014 (10)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- April 2024 (2)

- June 2024 (2)

- July 2024 (2)

- November 2024 (2)

- December 2024 (2)

- February 2025 (2)

- June 2025 (2)

- July 2025 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- May 2024 (1)

- August 2024 (1)

- September 2024 (1)

- October 2024 (1)

- January 2025 (1)

- March 2025 (1)

- April 2025 (1)

- May 2025 (1)

- USDEC (183)

- USDEC Staff (158)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Nick Gardner (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Becky Nyman (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Erica Louder (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

- Krysta Harden, USDEC President and CEO (1)

.png)