-

U.S. Dairy Exports: Lessons From Past Progress

By Tom Suber November 14, 2016- Tweet

As he approaches retirement, Tom Suber reflects on 21 years as president of USDEC and looks ahead to megatrends, challenges and opportunities for U.S. dairy exports.

Twenty-one years ago when Dairy Management Inc. founded the U.S. Dairy Export Council (USDEC), the idea that we could sell the equivalent of 15 percent of the U.S. milk supply overseas, unsubsidized, elicited either skepticism or disbelief.

To many, it was an exotic notion to think that the United States would commercially ship large volumes of cheese to Mexico, skim milk powder to Southeast Asia and whey proteins to China. Many were more certain that trade would only enable low global prices to gut our domestic market, and would never rise to cycle back and forth around U.S. prices.

To many, it was an exotic notion to think that the United States would commercially ship large volumes of cheese to Mexico, skim milk powder to Southeast Asia and whey proteins to China. Many were more certain that trade would only enable low global prices to gut our domestic market, and would never rise to cycle back and forth around U.S. prices.Having had the honor to lead USDEC as president since its inception, I’ve had a front row seat watching U.S. dairy suppliers work with farmers to allay those fears and blossom into significant global players. As I prepare to step down at year’s end, I am left pleased with the progress but also aware that some skepticism may be returning.

Bigger ups than downs

Over the past two-plus decades, I’ve witnessed five major global trade events where forward progress stalled. Yet, each time, U.S. dairy suppliers returned to an ever-higher plane of growth. It’s important to recognize that the initial growth and our ongoing resilience has rested on just a few largely immutable “megatrends,” as powerful 25 years ago as they are today.

First, we have had obvious, predictable population growth rates, i.e., more mouths to feed, with current projections showing 9-9.5 billion people by 2050. Rising per capita income among the higher populations, while not quite as predictable as population gains, has served nonetheless to balloon the size of the middle class in developing nations. With this new disposable income has come every family’s aspirations to foster healthy children, playing directly to dairy’s inherent dense nutrient profile, functional versatility and good taste.

At the same time, travel and the global proliferation of western-style food chains have helped to shift dietary preferences toward dairy-friendly foods. Finally, and the only megatrend currently stumbling a little, is a tendency toward freer trade and more open borders. In 1995, it was the signing of the General Agreement on Tariffs and Trade and the North American Free Trade Agreement that heralded the rise of globalization.

These were all clear trends at the time. Yet, only a few U.S. dairy farmer checkoff leaders saw the need to put up significant funds to partner with U.S. manufacturers, traders and USDA’s Foreign Agricultural Service to accelerate the impact of these trends and expand our global footprint.

USDEC embodied this partnership, and the organization’s array of efforts in trade and regulatory policy, market research, product portfolio expansion, ingredient and dairy food marketing, and creating an overseas office network began to have an impact.

The industry came to a watershed with the landmark Bain Report in 2009 (and refresh in 2011), commissioned by the Innovation Center for U.S. Dairy. The report got at the root of the future, asking the question: Do we want to take the steps necessary to accommodate operating in a globalized dairy market? If so, what do we have to do to get there? And what would it mean to us as an industry, both good and bad?

The industry clearly said we are not going to become Canada and retreat from the volatility that comes with a global market. Neither should we stay at the status quo and let circumstances drive our future. Instead, the Innovation Center, with the participation of multiple industry associations, manufacturers and USDEC, determined to move forward.

USDEC’s role has been to accelerate that move through long-term, pre-competitive initiatives facilitating U.S. participation in global markets. USDEC worked hand-in-hand with the industry to channel investments and collaborative action to maximize the opportunity created by those megatrends.

But it was the industry that really picked up the ball and ran. Without dairy manufacturers and their trading company partners taking action, USDEC’s activities would have been just lip service.

While there are always first movers and those that then follow, the industry largely upped its game, traveling to export markets, talking to customers, refining their product specs and investing in products, plants and personnel to service requirements that often varied from traditional U.S. needs—continuing to plug away even when they met resistance.

Back to the future

That same dedication will be needed moving forward as we encounter new skepticism about where the global upside is now. Some are concerned that recent evolutionary changes have overwhelmed those megatrends and torpedoed U.S. dairy competitiveness.

We now have a transformed, quota-free Europe. We have a certain muted demand—not zero demand, not zero growth in demand, but muted growth compared to recent expansion. We have a stronger dollar than in recent years—although no stronger than it was when USDEC came onto the scene. And legislatures certainly now have a fear of trade that is impeding efforts necessary to increase our overseas market access and match that of our competitors.

The path—the task—is the same. We have to keep working on the fundamentals: communicating the story of U.S. dairy, developing stronger food safety systems, traceability programs and risk management systems, and innovate across the board in cheese, dry ingredients and fluid products. This all starts with listening to and serving the customer. We need to outdo our competitors who are excelling at meeting their (our) customers' needs.

Concerning the politics of trade that are holding up the benefits we would see from the Trans-Pacific Partnership, we cannot just sit back and wait for politicians to take action. U.S. suppliers and farmers need to play a role by talking to colleagues, customers and neighbors about the importance of trade for their companies. Facts on what trade means to a company’s community and the jobs it brings are largely lacking in the misinformed commentary we have today.

The megatrends still apply and still foretell of a brighter global dairy future ahead. Come next year, I’ll be watching from the sidelines, but I have little doubt the industry is as up for the challenge today as it was 25 years ago.

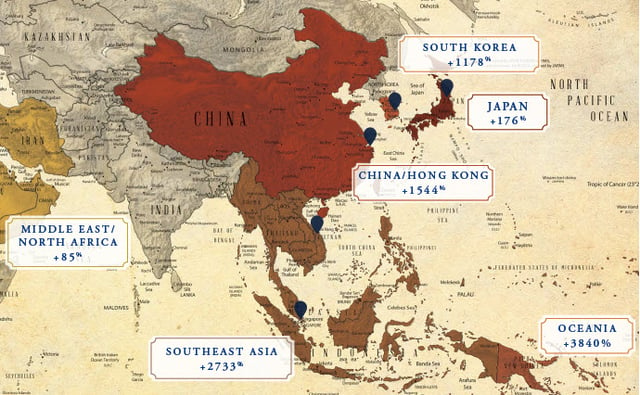

Editor's note: At last month's USDEC board and membership meeting, members honored USDEC president Tom Suber with a framed map quantifying the growth of U.S. dairy exports during his tenure. The gift included a written tribute honoring "our compass." Click here or on any of the images below for a downloadable PDF of the map and tribute.

Thumbnail of map with message.

Zoomed portion of map.

This article was first published in the Nov. 11, 2016, edition of CHEESE MARKET NEWS.

Learn more:

- Dairy Exports Will Grow, But So Will Competition

- For our 20th Anniversary, We'd Like More China

- Happy 20th Birthday, U.S. Dairy Export Council

Subscribe to the U.S. Dairy Exporter Blog

The U.S. Dairy Export Council fosters collaborative industry partnerships with processors, trading companies and others to enhance global demand for U.S. dairy products and ingredients. USDEC is primarily supported by Dairy Management Inc. through the dairy farmer checkoff. How to republish this post.

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (67)

- Africa (6)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (20)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (9)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farmer leaders (1)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Future trends (1)

- Geographical Indications (GIs) (10)

- Global Marketing (86)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (271)

- Member Services (17)

- Mexico (41)

- Middle East (9)

- Middle East & North Africa (3)

- Middle East/North Africa (9)

- Milk (4)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (19)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (329)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (26)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- April 2015 (11)

- December 2015 (11)

- March 2014 (10)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- January 2026 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- April 2024 (2)

- June 2024 (2)

- July 2024 (2)

- November 2024 (2)

- December 2024 (2)

- February 2025 (2)

- June 2025 (2)

- July 2025 (2)

- September 2025 (2)

- November 2025 (2)

- December 2025 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- May 2024 (1)

- August 2024 (1)

- September 2024 (1)

- October 2024 (1)

- January 2025 (1)

- March 2025 (1)

- April 2025 (1)

- May 2025 (1)

- August 2025 (1)

- February 2026 (1)

- USDEC (183)

- USDEC Staff (167)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Nick Gardner (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Krysta Harden, USDEC President and CEO (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Becky Nyman (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Erica Louder (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

.png)