-

U.S. dairy exports fall 7% in 2023

By USDEC Staff February 8, 2024- Tweet

Weak demand and increased competition limit U.S. dairy export growth in 2023 to high-protein whey and lactose.

Subdued demand, coupled with increased competition from the EU and New Zealand, translated into a U.S. dairy export decline of 7% in milk solids equivalent terms (MSE) in 2023. The factors complicating U.S. dairy export growth have been consistent most of the year: elevated inflation, disappointing economic growth in key export markets (particularly China), reduced demand for feed whey from China’s struggling pig sector, increased milk output from the EU and New Zealand, and reduced whole milk powder (WMP) purchasing from China causing New Zealand to shift its product mix and redirect exports to key U.S. markets.

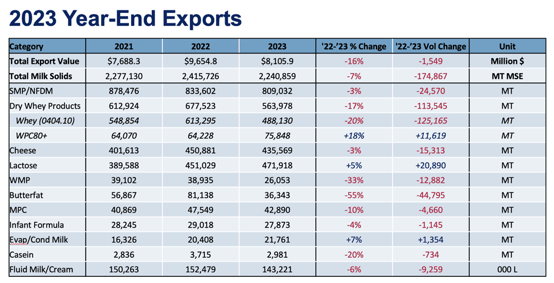

U.S. export value finished the year at $8.11 billion. That is the second largest value of all time but down 16% from the record year of 2022 as both volume and prices eased.

U.S. suppliers posted volume gains in only two major product categories in 2023: high-protein whey (WPC80+) and lactose. Full-year U.S. WPC80+ export volume jumped 18% (+11,619 MT) compared to 2022, rising to a record 75,848 MT. Fueled by strong gains in the first quarter, lactose shipments rose 5% (+20,890 MT) to a record 471,918 MT.

But beyond WPC80+ and lactose, positive year-end numbers were nowhere to be seen. Nonfat dry milk/skim milk powder (NFDM/SMP) fell 3% (-24,570 MT); cheese dipped 4% (- 15,313 MT); low-protein whey dropped 20% (-125,165 MT); butterfat slid 44% (-44,795 MT). Milk protein concentrate, fluid milk and cream and whole milk powder fell 10%, 7% and 33%, respectively, for the year. For more detailed information, as well as interactive charts and data, visit USDEC's Data Hub.

For more detailed information, as well as interactive charts and data, visit USDEC's Data Hub.

That said, we started to see some positive signal to close out the year. U.S. cheese exports recorded gains in November (+4%) and December (+1%), with solid volume increases to Mexico, China, Central America and the Caribbean.

U.S. NFDM/SMP shipments rose 1% in December, its first YOY increase since August 2023. December shipments to Southeast Asia jumped 23% (+3,634 MT) and volume to the Middle East/North Africa more than tripled (+1,868 MT). For Southeast Asia, it was the second straight monthly increase and an optimistic sign that demand in the No. 2 U.S. market is on the road to recovery.

Fluid milk and cream finished the year with four straight months of YOY gains. Volume rose 15% (+6 million liters) from September to December compared to the same period the previous year.

For a product-by-product breakdown of 2023 U.S. export performance, see below..png?width=554&height=300&name=Chart5%20(1662%20x%20900%20px).png)

NFDM/SMP

U.S. NFDM/SMP exports saw slight growth (+1%, 582 MT) in December—the first monthly increase since August. Overall NFDM/SMP exports for the year have been lackluster, with 2023 exports down 3% (-24,570 MT), but the decline only tells a portion of the story. U.S. NFDM exports to Mexico this year have boomed (+16%, 57,040 MT) although largely frontloaded in the year. NFDM exports to Mexico in H1 were up 39% (+62,842 MT). They eased in the back half of the year (-3%, -5,801 MT), but volumes were still large and up against strong exports in H2 of 2022. The Mexican economy has been very strong at a time when economies around the world mostly struggled. In addition to the strong economy, the peso has consistently strengthened against the dollar since Covid, making U.S. imports more attractive.

At the same time, exports to Southeast Asia suffered (-20%, -60,637 MT). 2023 for Southeast Asia was marked by high inflation and challenging domestic economics. Even with lower prices this past year, demand has been weaker. December did build on the slight growth seen in November with NFDM/SMP exports to the region up 23% (+3,634 MT) in the final month of the year.

Looking to 2024, we expect export volumes to Mexico to remain robust, but may not match the record volumes we saw in early 2023. In Southeast Asia, with easing inflation, lower NFDM/SMP prices and after a prolonged period of low import volumes, we expect demand to rebound in 2024. Overall U.S. NFDM/SMP exports should see some growth in the year ahead as the global economy continues to recover.

Cheese

While YOY U.S. cheese exports fell in 2023, it was (at 435,569 MT) the second highest volume we ever shipped in a single year. Volume was driven primarily by a 41% jump (+39,959 MT) in shredded cheese sales to meet foodservice demand, mostly to our top market, Mexico, but also to China. U.S. exports of shredded cheese to Mexico soared 162% (+39,131 MT) last year, while shipments of shredded cheese to China increased more than eight-fold (+5,612 MT).

However, those impressive gains were still insufficient to offset a decline in overall U.S. volume. Inflation-related consumption headwinds in Korea and Japan combined with heightened competition from the EU and New Zealand in South Korea to undercut U.S. cheese sales to both East Asian countries. U.S. cheese exports to Japan fell 15% (-7,155 MT) in 2023 and shipments to South Korea plunged 40% (-30,175 MT). Looking forward, more competitive pricing, European milk production struggling and expectations that Japanese and Korean demand for U.S. cheese may be poised to turn a corner paint a more hopeful picture for the coming year.

WPC80+

High-value U.S. WPC80+ exports crushed the previous volume record by more than 10,000 MT in 2023. Ongoing demand growth for high-protein foods in key markets coupled with lower WPC80+ prices in 2023 created a banner year for U.S. suppliers.

Gains were geographically broad-based. U.S. WPC80+ sales to Japan have risen now for nine consecutive years (+11%, +1,513 MT in 2023). The country took over as the top U.S. WPC80+ market from China in 2022, and despite erosion in YOY monthly growth at the end of 2023, Japan remains our No. 1 buyer. U.S. shipments to China rebounded last year (+47%, +4,520 MT) after higher prices weakened 2022 demand. And, driven by one of the biggest sports nutrition markets in the world, Brazil staked a claim as the fastest growing U.S. WPC80+ buyer in 2023. U.S. shipments of WPC80+ to Brazil are up now for four straight years and more than doubled to 8,462 MT last year. An even more encouraging sign is the ample room for growth. Demand for U.S. WPC80+rose in several developed and emerging markets last year, including Canada (+28%), Mexico (+35%) and India (+36%),while markets like South Korea and Southeast Asia are primed for demand rebounds.

Lower-protein whey (0404.10)

As we have noted in this column throughout the year, the U.S. low-protein whey export shortfall in 2023 is mostly about China. U.S. shipments of 0404.10 whey to China plunged 27% (-79,357 MT) as ongoing troubles in the nation’s pork industry severely curtailed demand. But China can’t be completely to blame for the decline. YOY U.S. export volume fell by a total of 125,165 MT in 2023, so the U.S. declined by more than 45,000 MT to other destinations.

Low-protein whey demand eroded across several geographies last year. In fact, U.S. shipments fell to eight of our top 10 markets in 2023. And exports declined for other suppliers as well. EU27+UK whey exports, for example, were down 10% (-62,429 MT) through November.

The challenges within China appear likely to persist, but our analysts are optimistic that demand in Southeast Asia, where a large portion of the dry whey is used for food applications, will rebound with an improved economic outlook. Given low-protein whey accounted for over 70% of the U.S. dairy’s export decline in 2023, any improvement in demand would put exports on better footing for 2024.

Lactose

YOY U.S. lactose exports fell 3% (-960 MT) in December, but overall lactose exports for the year were up 5% (+20,890 MT)—largely driven by gains to China. U.S. lactose exports to China in 2023 grew 23% (+26,813 MT). Likely supporting the increased exports were lower prices last year and increased usage for standardization within China—as detailed in our October write-up. U.S. lactose prices over the summer reached the lowest levels in nearly a decade. Prices have firmed since then, up 48% since July, which may impact export volumes moving into 2024, but prices are still roughly 30% below the average price since 2020.

Overall, U.S. lactose exports over the last few months have somewhat plateaued after robust growth in 2022 and much of 2023. Looking to 2024, it’s hard to get overly excited about strong growth as demand remains uninspiring.Learn more about global dairy markets:

-

Cheese rebounds in November, but overall U.S. dairy export volume declines

- U.S. dairy exports fall 7% in October

- U.S. export performance mixed in September

Subscribe to the U.S. Dairy Exporter Blog

The U.S. Dairy Export Council fosters collaborative industry partnerships with processors, trading companies and others to enhance global demand for U.S. dairy products and ingredients. USDEC is primarily supported by Dairy Management Inc. through the dairy farmer checkoff. How to republish this post.

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (67)

- Africa (6)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (20)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (9)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farmer leaders (1)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Future trends (1)

- Geographical Indications (GIs) (10)

- Global Marketing (86)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (272)

- Member Services (17)

- Mexico (41)

- Middle East (9)

- Middle East & North Africa (3)

- Middle East/North Africa (9)

- Milk (4)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (19)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (330)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (26)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- April 2015 (11)

- December 2015 (11)

- March 2014 (10)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- January 2026 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- April 2024 (2)

- June 2024 (2)

- July 2024 (2)

- November 2024 (2)

- December 2024 (2)

- February 2025 (2)

- June 2025 (2)

- July 2025 (2)

- September 2025 (2)

- November 2025 (2)

- December 2025 (2)

- February 2026 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- May 2024 (1)

- August 2024 (1)

- September 2024 (1)

- October 2024 (1)

- January 2025 (1)

- March 2025 (1)

- April 2025 (1)

- May 2025 (1)

- August 2025 (1)

- USDEC (183)

- USDEC Staff (168)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Nick Gardner (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Krysta Harden, USDEC President and CEO (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Becky Nyman (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Erica Louder (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

.png)