-

U.S. dairy exports poised for strong finish to 2025

By USDEC Staff January 30, 2026- Tweet

Widespread growth across categories leads to 14% surge in November U.S. dairy exports.

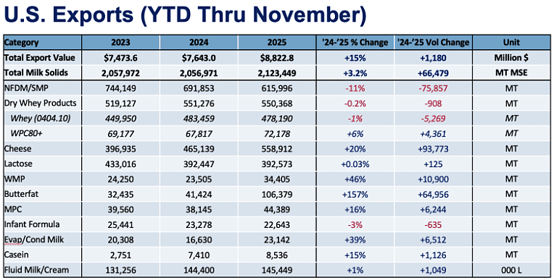

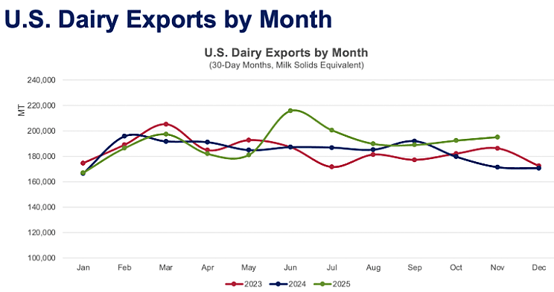

U.S. dairy export volume surged 14% year-over-year (YOY) in November in milk solids equivalent (MSE) terms. This year’s star growth categories—cheese and butterfat—continued to shine, accompanied by solid gains in low-protein whey, lactose, whole milk powder (WMP), and milk protein concentrate (MPC). The November increase put year-to-date MSE volume up 3.2% with one month left to tally.

YOY export value jumped 14% in November to US$801.7 million, making total U.S. dairy export value year to date $8.82 billion. When the government releases December data in three weeks, year-end 2026 U.S. dairy export value should be near the record of $9.66 billion set in 2022. (Note: The U.S. Census Bureau has been releasing trade data on a compressed scheduled as the government continues to catch up on months lost to last year’s shut-down.)

Favorable export conditions

U.S. dairy suppliers are in a strong position at the close of 2025/start of 2026. Ample supply, resilient international demand and favorable pricing converged to boost global dairy trade in the back half of last year, and the United States has been one of the beneficiaries. Global cheese demand is humming, and with U.S. milk production growth and manufacturing capacity expansion, U.S. cheese suppliers continue to capitalize. (For more information on global market dynamics, please check out USDEC’s International Demand Analysis.)YOY cheese export volume jumped 28% (+11,134 MT) in November to 50,775 MT. We’ve made the point before, but it bears repeating: U.S. cheese exports had never crossed 50,000 MT in a single month before 2025; November was the seventh consecutive month of greater-than-50,000 MT of U.S. cheese exports. Volume rose significantly to several geographies in November, including South Korea, which is poised to set an annual record for U.S. cheese purchasing (see below for deeper dive on South Korean cheese buying).

U.S. suppliers also continued to establish a larger role in global butterfat trade in November. YOY U.S. butter shipments soared 245% (+8,079 MT) while anhydrous milkfat/butter blends volume increased 184% (+2,549 MT). Five countries increased YOY volume by more than 1,000 MT in November and total butterfat exports were 15,308 MT—most ever in a single month. (For a deeper dive on U.S. butter business in the Middle East/North Africa (MENA) region, see below.)

Numbers rose across most major product categories, apart from nonfat dry milk/skim milk powder (NFDM/SMP) and high-protein whey (WPC80+):

- YOY low-protein whey exports grew 13% (+5,146 MT), led by a 28% increase to China (+5,124 MT), after USDEC analysts adjusted for misclassified products.

- Lactose shipments rebounded after two months of decline, as volume rose 5% (+1,614 MT). Gains to Indonesia (+1,810 MT) and Uruguay (+1,380 MT) helped offset declines to China (-1,808 MT).

- MPC continued its solid year, rising 52% (+1,329 MT) led by MENA (1,108 MT).

- WMP increased 43% (+1,193 MT). YTD, the category was up 46% (+10,819 MT), driven by MENA (+6,823 MT).

And while NFDM/SMP and WPC80+ didn’t record significant gains, they didn’t crash either. YOY NFDM/SMP volume was flat for the second straight month—a tolerable result given sizable, ongoing declines in U.S. SMP production. YOY WPC80+ slipped 3% (-211 MT) in November, with declines to Japan and China outweighing gains elsewhere.

For more detailed information, as well as interactive charts and data, visit USDEC's Data Hub.

Cheese booms in South Korea

South Korea has long been a critical destination for U.S. dairy exports, and especially for cheese. The Asian nation has held distinction as the second largest destination for U.S. cheese since 2008 and its importance was solidified in November when U.S. shipments rose by 3,674 MT (+136%), the largest increase seen across any market, by far. November’s result extends the growth streak seen over most of this year. With just one month of data outstanding, year-to-date cheese exports to South Korea were up 38% (+19,543 MT) to 71,177 MT—poised to eclipse the U.S. record of 75,789 MT set in 2022.Several other products also felt a bump during the month, including lactose (+32%, +263 MT) and modified whey (+451%, +701 MT), but cheese was the undisputed star. The vast majority of cheese the U.S. ships to Korea is mozzarella and cream cheese for foodservice use, classified under the fresh cheese tariff code (040610). Indeed, this category shouldered the bulk of the increase in cheese exports (+185%, +3,058 MT) during November, but other varieties also saw volumes grow. Exports of cheddar rose 56% (+165 MT), while the other cheese category grew 229% (+477 MT).

U.S. cheese shipments to South Korea have largely grown as a function of rising demand. In November, for example, total cheese trade to Korea grew by 3,938 MT, and nearly all of it (93%) came from U.S. suppliers. While competitive prices have increased the attractiveness of U.S. product, it is encouraging that rather than simply redistributing share, demand in the country is expanding—particularly considering economic challenges. South Korea’s GDP grew by just 1% in 2025, the lowest rate since the pandemic, with slower construction activity and political instability weighing heavily on economic performance.

It is encouraging that Korean cheese demand has persisted despite the trying economic environment, and more favorable days could be on the horizon as the central bank is projecting a GDP growth rebound to 1.8% this year. Overall, South Korea remains a cornerstone of U.S. trade and offers an important avenue for continued growth in cheese exports.

Milk powders support growth in Southeast Asia

After several months of sluggish exports to the region, U.S. dairy shipments to Southeast Asia grew 14% (4,545 MT) YOY in November, with particularly strong volumes to Indonesia (+58%, +3,401 MT), Malaysia (+40%, +1,153 MT), and Singapore (+75%, +1,391 MT). Growth in milk powder exports accounted for the bulk of this increase, with NFDM/SMP up 23% (+2,934 MT) and Indonesia posting the largest growth (+165%, +2,083 MT). In fact, November’s dramatic growth in milk powder exports to Southeast Asia, particularly Indonesia, offset losses in exports to Mexico, which fell 14% (-4,516 MT), and helped keep overall U.S. NFDM/SMP exports virtually flat despite the limited supply of milk powder available.Beyond milk powders, cheese exports to Southeast Asia grew 949 MT (+92%) in November, and lactose exports increased 20% (+1,201 MT). By contrast, exports of low-protein whey fell, with dry whey down 37% (-1,247 MT) and whey protein concentrate with less than 80% protein down 26% (-127 MT).

Looking at the year as a whole, despite a strong November, total U.S. exports to Southeast Asia still lag 2024 by 7% (-33,259 MT). Milk powder exports to the region have fallen 20% (-40,297 MT) over the same period, and whey exports (excluding WPC80+) fell 8% (-9,642 MT). Positively, this has been partially offset by gains in higher value products, namely cheese (+56%, +8,761 MT) and WPC80+ (+51%, +1,981 MT).

While much of this decline is due to a lack of export availability in milk powders from the U.S., reports indicate a slight decrease in GDP growth rates in some Southeast Asian economies as tariffs begin to take effect. However, with signed trade deals in Malaysia and Cambodia and others in negotiation, this effect may lessen as we move into 2026.

Demand surges in MENA

U.S. exports to the Middle East/North Africa (MENA) more than doubled in November (+136%, +5,555 MT MSE). Competitive pricing for several U.S. products has increased their attractiveness, despite the proximity of the EU to the region. This advantage gave U.S. suppliers an edge in November when demand surged as buyers prepared for an early Ramadan.U.S. exports of butterfat to MENA have been running hot for much of 2025 but accelerated in November to over 4,000 MT (monthly exports don’t typically surpass 1,000 MT). This month, MENA was second only to Canada as a destination for U.S. butterfat. Bahrain and Saudi Arabia drove much of the growth in demand, jumping from practically 0 MT in 2024 to 1,723 MT and 1,102 MT, respectively, in 2025. The price of U.S. butter remains its most attractive quality at the moment for Middle East buyers, but it is notable that the region has been one of the more aggressive in sourcing from the U.S. Their apparent eagerness for U.S. product is likely driven by preexisting familiarity with U.S. butter, a general preference towards white butter, and Bahrain being a key processed cheese hub in the region.

To add to the diversity of product to the region, MENA was also the top buyer of U.S. MPC in November, surpassing Mexico after months of running a close second. MPC shipments to the region jumped to 25 times that of 2024 levels (+1,108 MT). Not to be forgotten, demand for cheese (+54%, +1,279 MT) and lactose (+239%, +598 MT) also contributed to the rise.

U.S. exports to MENA have been trending slowly downward in recent years. However, given the price advantage several U.S. products had for much of 2025, that trend has turned distinctly positive. MENA is typically a price-sensitive region; competitively priced U.S. product should continue to drive strength in exports to the region, though perhaps at a less impressive pace.

*In order to correct for reporting inconsistencies (made clear by suspiciously low high-protein whey prices to China) and provide a more realistic picture of product flows, USDEC adjusts official whey export data, aligning reported unit values with actual market prices. If you have any questions or would like more information, don’t hesitate to reach out to any member of the Economics team.

Learn more about global dairy markets-

October U.S. dairy exports jump 7%

- U.S. dairy export volume up 1.7% through three quarters

-

August exports continue growth streak, rise 3%

-

July marks second straight month of strong U.S. dairy exports

Subscribe to the U.S. Dairy Exporter Blog

The U.S. Dairy Export Council fosters collaborative industry partnerships with processors, trading companies and others to enhance global demand for U.S. dairy products and ingredients. USDEC is primarily supported by Dairy Management Inc. through the dairy farmer checkoff. How to republish this post.

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (67)

- Africa (6)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (20)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (9)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farmer leaders (1)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Future trends (1)

- Geographical Indications (GIs) (10)

- Global Marketing (86)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (271)

- Member Services (17)

- Mexico (41)

- Middle East (9)

- Middle East & North Africa (3)

- Middle East/North Africa (9)

- Milk (4)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (19)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (329)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (26)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- April 2015 (11)

- December 2015 (11)

- March 2014 (10)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- January 2026 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- April 2024 (2)

- June 2024 (2)

- July 2024 (2)

- November 2024 (2)

- December 2024 (2)

- February 2025 (2)

- June 2025 (2)

- July 2025 (2)

- September 2025 (2)

- November 2025 (2)

- December 2025 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- May 2024 (1)

- August 2024 (1)

- September 2024 (1)

- October 2024 (1)

- January 2025 (1)

- March 2025 (1)

- April 2025 (1)

- May 2025 (1)

- August 2025 (1)

- February 2026 (1)

- USDEC (183)

- USDEC Staff (167)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Nick Gardner (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Krysta Harden, USDEC President and CEO (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Becky Nyman (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Erica Louder (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

.png)