-

Three Global Consumer Groups Driving Demand for Whey Protein

By USDEC February 6, 2017- Tweet

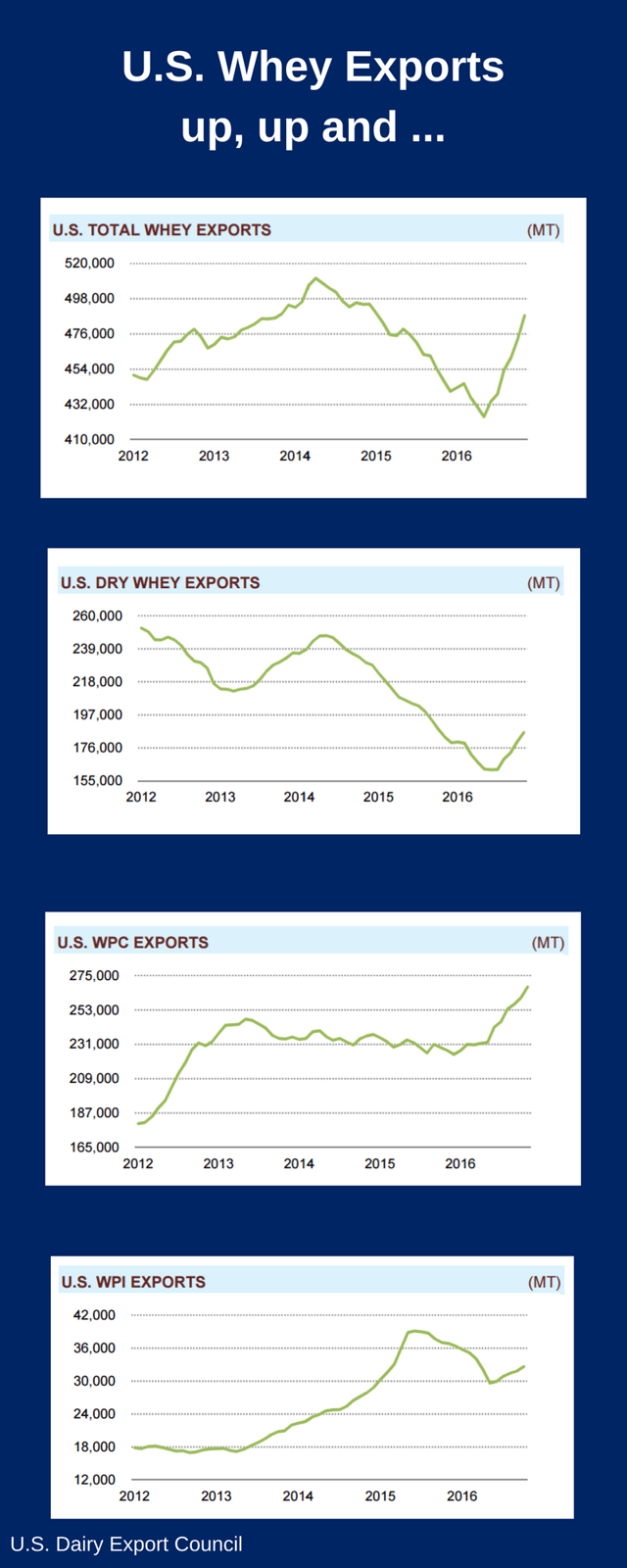

U.S. exports of whey are up and some suppliers are increasing plant capacity to meet global demand for more protein.

U.S. whey exports are up across the board, thanks in part to three consumer groups eager for more protein-powered energy.

The U.S. Dairy Export Council's latest monthly trade data report documents the surge in whey exports.

In the second half of 2016 through November, total whey exports were up 32% from the same period in 2015, with a 47% gain in November alone, wrote USDEC's Al Levitt. "More than half of the November sales went to China, which posted a new high of 24,130 tons, up 147% from a year earlier. Nearly 15,000 tons of that volume was WPC, also a record high. Meanwhile, sales to Southeast Asia were up 63% year-over-year."

USDEC projects that the global whey trade will grow 4.6% annually through 2021, which should generate more than 400,000 metric tons of additional whey sales in 2021 compared to 2016.

Underlying that optimism is the growing demand for whey protein concentrate and whey protein isolate in meeting the nutritional needs of consumers. This is an exciting component within the total whey picture, and forms the basis for the following discussion.

Three demographic groups driving global demand

Kristi Saitama, vice president of export marketing ingredients at the U.S. Dairy Export Council, sees three demographic groups driving global demand, each presenting export opportunities in identifiable markets.

Those groups are:

1. Health-conscious adults and seniors. In countries such as Japan, South Korea and the eastern seaboard of China (including the cities of Beijing, Shanghai and Guangzhou), there are growth opportunities for mainstream health-and-wellness food and beverage products and healthy-aging-oriented food and beverage products with whey proteins. It should be noted that the United States also falls into this category.

According to United Nations' projections, the number of people over 65 worldwide will triple from 530 million in 2010 to more than 1.5 billion in 2050. This is an opportunity for whey protein because it can reduce the risk of sarcopenia, the age-related loss of muscle mass and strength. Read “Global Boom of 65+ Population Opens Door for U.S. Whey Protein.”

2. Infants and toddlers. In countries such as China, Vietnam and Saudi Arabia, there is growth potential for whey protein use in child nutrition formulas. Singapore is also included because it serves as a production base for child nutrition products to Southeast Asia. While breast-feeding remains a preferred method of infant feeding, dairy protein can play an important role in the overall child nutrition picture.

2. Infants and toddlers. In countries such as China, Vietnam and Saudi Arabia, there is growth potential for whey protein use in child nutrition formulas. Singapore is also included because it serves as a production base for child nutrition products to Southeast Asia. While breast-feeding remains a preferred method of infant feeding, dairy protein can play an important role in the overall child nutrition picture.

3. Middle-class fitness enthusiasts. Ripe opportunities exist in countries with a rising middle class where the sports nutrition market is relatively small now, but ready for take off. In China, Southeast Asia and the Gulf Cooperation Council nations in the Middle East, there is potential for whey protein sports nutrition powders and energy/nutrition type products for sports- and fitness-inclined consumers. The benefits of whey protein for athletes are well documented. Read "Proof That Whey Protein Really is the Best for Building Muscle" and this research summary supporting the role of dairy products for athletes.

U.S. plant expansions increase capacity for whey exports

Some U.S. dairy exporters are placing bets on whey by expanding their plants or building new ones.

The Hilmar Cheese Company's flagship facility in Hilmar, California, is the largest single-site whey and cheese operation in the world, points out Gwen Bargetzi, director of marketing communications. And its Dalhart, Texas, facility is nearing the production capacity of the Hilmar plant. The newest addition, a milk powder facility in Turlock, Calif., "contributes to our heft in the global whey market by enabling us to offer portfolio of dairy products for stronger customer partnerships," she adds.

"Our product line includes robust whey proteins designed for the UHT drinks that help emerging markets become familiar with whey. We also offer high-end fractions like lactoferrin and alpha-lactalbumin for special infant formulas in China, and whey isolates for the clear drinks so popular with elite athletes preparing for the next Olympics," Bargetzi said.

"We’re excited about the global growth opportunity for whey protein," she adds. "People don’t see whey as a cheap source of protein, they see it as an efficient food. That’s an outstanding opportunity for us to deliver whey proteins that provide function and nutrition."

Swiss Valley Farms, named the 2016 Exporter of the Year by Dairy Foods magazine, is similiarly bullish on whey.

Growth in the whey market was one reason Swiss Valley expanded its cheese production facility in Luana, Iowa, by 49,000 square feet—to the tune of $20.6 million. The plant will produce more cheese, which will significantly add more whey available to be exported and sold domestically, says Swiss Valley CEO Chris Hoeger.

Global consumers drawn to energy-boosting snacks with whey protein

“Consumers are embracing protein powders as an easily added high-quality protein source for products,” said Kara McDonald, vice president of global marketing communications at the U.S. Dairy Export Council. “In fact, 60% of

consumers seek snacks they can draw on immediately for energy. Using dairy proteins to create snacks such as sports drinks, smoothies and bars promotes all-day protein consumption. Dairy proteins can also be added to soups and baked goods.”

proteins to create snacks such as sports drinks, smoothies and bars promotes all-day protein consumption. Dairy proteins can also be added to soups and baked goods.”Growing interest in whey protein can be seen in the popularity of online recipes, both domestically and globally. Consider, for example, very strawberry protein cookies and protein ice cream. The social media site Pinterest has a shareable board featuring whey protein recipes, visually displayed.

Product proliferation

Around the world, people are finding thousands of ways to use whey protein in their products.

As reported in USDEC's Dairy Spotlight, the number of new product launches tracked globally with whey protein rose to nearly 6,000 in 2015, according to Innova Market Insights. And the pace of the launches is accelerating, growing at a 34% compound annual growth rate between 2010 and 2015 compared to 6% between 2005 and 2009.

Global competition is keen to take advantage of these trends. But U.S. dairy exporters are positioning themselves to meet the growing worldwide demand. .

Mark O'Keefe is vice president of editorial services at the U.S. Dairy Export Council.

Learn more:

- 5 Research-Based Strategies to Improve Whey Protein Messaging

- Alpha-lactalbumin Golden Opportunity for U.S. Dairy

- What Consumers Want in Snacks

- Protein Selection to Maximize Muscle Favors Whey

- Protein Popularity Accelerates Whey Protein Usage

- High Quality Dairy Proteins' Appealing Offerings

Subscribe to the U.S. Dairy Exporter Blog

The U.S. Dairy Export Council fosters collaborative industry partnerships with processors, trading companies and others to enhance global demand for U.S. dairy products and ingredients. USDEC is primarily supported by Dairy Management Inc. through the dairy farmer checkoff. How to republish this post.

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (67)

- Africa (6)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (20)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (9)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farmer leaders (1)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Future trends (1)

- Geographical Indications (GIs) (10)

- Global Marketing (86)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (271)

- Member Services (17)

- Mexico (41)

- Middle East (9)

- Middle East & North Africa (3)

- Middle East/North Africa (9)

- Milk (4)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (19)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (329)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (26)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- April 2015 (11)

- December 2015 (11)

- March 2014 (10)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- January 2026 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- April 2024 (2)

- June 2024 (2)

- July 2024 (2)

- November 2024 (2)

- December 2024 (2)

- February 2025 (2)

- June 2025 (2)

- July 2025 (2)

- September 2025 (2)

- November 2025 (2)

- December 2025 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- May 2024 (1)

- August 2024 (1)

- September 2024 (1)

- October 2024 (1)

- January 2025 (1)

- March 2025 (1)

- April 2025 (1)

- May 2025 (1)

- August 2025 (1)

- February 2026 (1)

- USDEC (183)

- USDEC Staff (167)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Nick Gardner (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Krysta Harden, USDEC President and CEO (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Becky Nyman (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Erica Louder (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

.png)