-

Six Factors Sure to Influence U.S. Dairy Exports in 2016

By Alan Levitt December 15, 2015- Tweet

USDEC offers a preview of the year ahead, identifying trends that will shape bottom lines.

Predicting the future is not a science, but at the U.S. Dairy Export Council our experts have identified six underlying factors that will shape supply, demand and the U.S. dairy industry’s ability to compete in the international marketplace in the year ahead. Here they are:

1. A world awash in milk

For months, USDEC has said milk production growth from the world’s dairy exporters needs to decrease to match lower buying levels in China and Russia.

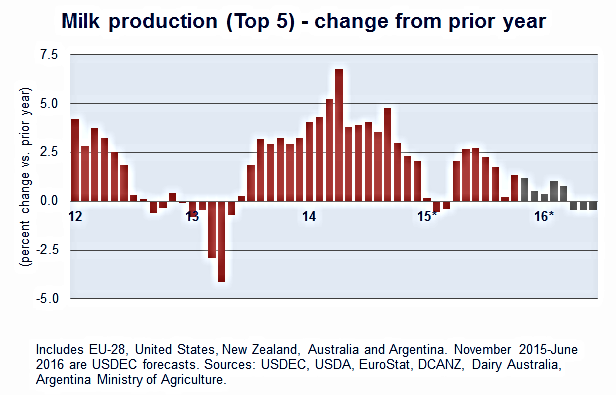

Despite sharply reduced Chinese and Russian purchasing and declining farmgate prices, milk production for many has remained sufficiently profitable to slow but not halt major shifts in net supply growth. Milk output from the top five suppliers—the European Union (EU), United States, New Zealand, Australia and Argentina—rose 2 percent from April 2015 (after EU milk production quotas fell away) through September. USDEC estimates fourth quarter 2015 output from the top five will show a rise of about 1 percent.

Milk flows are slowing, but not quickly enough to account for the decline in demand. Moving into 2016, the big questions about supply include:

- What impact will El Niño (and subsequent La Niña?) have on production, particularly in Oceania?

- Will European processors continue to pay their farmers enough to keep contraction on hold?

- Will China milk production continue to climb, even in the face of a pullback in investment in the sector, thereby mitigating the need for imports?

2. Changing product mix

This year, New Zealand strategically shifted its product mix to lessen reliance on whole milk powder (WMP) trade to China. Similarly, the EU redirected milk meant for Russian cheese sales. Both export giants moved more heavily into skim milk powder (SMP) and butter, broadened export marketing efforts and increased their presence in key U.S. markets, including Southeast Asia, South Korea, Japan, the Middle East and even Mexico.

Intensified competition in cheese, milk powder and other dairy products quickly followed. New Zealand, in fact, will export about the same volume of cheese this year as the United States, after we claimed the title of “world’s largest cheese exporter” in 2013.

Assuming no shifts in the Russian embargo or China’s buying habits in 2016, where will the EU and New Zealand direct their milk supply as well as their processing capacity investments?

Over the last few years, major European processors have invested hundreds of millions of dollars in plants for drying milk powders and whey proteins. New Zealand investment has run the gamut from milk powder to more high-value products, including lactoferrin, UHT milk, milk protein concentrate and cheese.

3. China’s economic growth

Economic growth drives dairy consumption. The economic signals for the year ahead are decent—the International Monetary Fund (IMF) projects a respectable 4.5 percent GDP gain for emerging and developing markets in 2016, up half a point on this year’s 4 percent estimate.

However, political unrest, six-year low oil prices and worries about China’s economy have created significant downside risk. A weaker Chinese economy (what China is calling “the new normal”) brings particular concern not only for its impact on domestic consumption, but also how it would affect the economies (and consumption) in Southeast Asia, Japan, Korea and the rest of the world. (Britain’s The Guardian newspaper ran an informative series of infographics illustrating lost export value from the rest of the world due to slower Chinese buying.)

A few things to keep in mind:

- China’s GDP growth is still expanding at a greater-than-6-percent rate, and 6-7 percent growth on an economy the size of today’s China actually leads to larger overall gains than the double-digit growth of a decade ago when China’s overall GDP was smaller.

- Despite danger signs in banking, manufacturing and other sectors, Chinese consumer spending remains strong. In fact, it’s the best part of the economy, a positive sign for the administration’s efforts to convert from an export-based economy to one based on private consumption.

- China is making moves to support consumption growth, like removing its one-child policy and lobbying successfully for the IMF to grant the yuan reserve currency status, a move some analysts say will help drive further reforms to facilitate a consumption economy.

4. Fast-changing laws and regulations

USDEC has been working with Chinese authorities to implement a new dairy plant registration requirement for import suppliers since May 2014. Currently, China is evaluating the results of plant audits conducted this past summer. The situation is a perfect example of the time and effort required to meet proliferating overseas regulatory requirements and facilitate continued U.S. dairy export growth.

Nations representing around half the world’s population are in the process of rewriting their food safety laws. That does not include countries that might be tightening their geographical indications systems or contemplating nutritional or labeling regulations. Issues making their way into 2016 include the ongoing Turkish health certificate revision and an in-the-works plant registration system in South Korea. Any change to existing regulatory regimes has the potential to throw a wrench into U.S. dairy exports. No doubt there will be more in 2016. (Nothing can help minimize border entry risk better than keeping abreast of the latest regulatory changes with the USDEC Export Guide.)

5. A growing maze of international free trade agreements (FTAs)

USDEC is still analyzing the more than 6,000 pages of the draft Trans-Pacific Partnership (TPP) agreement to determine the deal’s ’s impact on dairy industry trade prospects. No matter the ultimate assessment, from a dairy standpoint it will not alter the fact that the United States needs to remain aggressive in negotiating trade deals that benefit U.S. dairy to enhance our global competitiveness.

On Dec. 20, the Australia-China and New Zealand-South Korea FTAs are expected to enter into force and will bolster competition from Oceania in two key U.S. markets in the New Year.

Not counting TPP, Australia, New Zealand and the EU combined are currently negotiating FTAs with more than 40 countries, including other large U.S. buyers. Not only is dairy market access a priority for all three, the EU is using trade deals to transfer its restrictive geographic indication regime to as many countries as possible, creating market access barriers to U.S. cheese trade.

Well-negotiated FTAs lead directly to U.S. export gains. An analysis of the 18 existing U.S. FTAs by National Milk Producers Federation Economist Peter Vitaliano indicate the agreements added nearly $6 billion to U.S. exports from 2004-2014 (major product sales). There is so much to gain from negotiating FTAs and so much to lose by standing on the sidelines while our competitors forge their own deals.

As our competitors keep moving aggressively ahead, it is incumbent upon us to ensure we are doing so as well—particularly with key trading partners in need of dairy imports.

6. The rising U.S. dollar

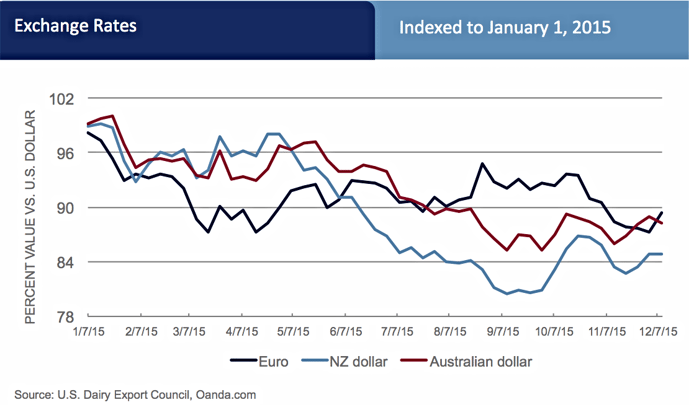

The U.S. dollar gained 11-15 percent against the currencies of our three main competitors—Australia, the EU and New Zealand—over the course of 2015. An impending boost to U.S. interest rates could drive the dollar higher in the months ahead. For U.S. dairy exports, that’s not exactly great news, but it’s important to keep exchange rates in perspective.

Although currency plays a role in dairy trade, that role is secondary to many other factors, with supply and demand at the very top of the list. The main area of concern for a rising dollar is the potential impact it has on overall demand from major importing nations. Because dairy trade is denominated in U.S. dollars, a strong dollar could lift import prices that will eventually work their way through to consumers and potentially deter consumption. That can curb demand growth, and that would be bad for dairy exporters from all countries.

Learn more: These and numerous other articles on market conditions have appeared in the U.S. Dairy Exporter Blog:

- Global Dairy Markets May not Fully Rebound Until 2017

- Three Pieces of a Global Dairy Turnaround

- What Will It Take to Turn Dairy Markets Around?

Subscribe to the U.S. Dairy Exporter Blog

The U.S. Dairy Export Council fosters collaborative industry partnerships with processors, trading companies and others to enhance global demand for U.S. dairy products and ingredients. USDEC is primarily supported by Dairy Management Inc. through the dairy farmer checkoff. How to republish this post.

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (67)

- Africa (6)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (20)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (9)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farmer leaders (1)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Future trends (1)

- Geographical Indications (GIs) (10)

- Global Marketing (86)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (271)

- Member Services (17)

- Mexico (41)

- Middle East (9)

- Middle East & North Africa (3)

- Middle East/North Africa (9)

- Milk (4)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (19)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (329)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (26)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- April 2015 (11)

- December 2015 (11)

- March 2014 (10)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- January 2026 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- April 2024 (2)

- June 2024 (2)

- July 2024 (2)

- November 2024 (2)

- December 2024 (2)

- February 2025 (2)

- June 2025 (2)

- July 2025 (2)

- September 2025 (2)

- November 2025 (2)

- December 2025 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- May 2024 (1)

- August 2024 (1)

- September 2024 (1)

- October 2024 (1)

- January 2025 (1)

- March 2025 (1)

- April 2025 (1)

- May 2025 (1)

- August 2025 (1)

- February 2026 (1)

- USDEC (183)

- USDEC Staff (167)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Nick Gardner (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Krysta Harden, USDEC President and CEO (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Becky Nyman (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Erica Louder (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

.png)