-

October U.S. dairy exports jump 7%

By USDEC Staff January 9, 2026- Tweet

Another U.S. cheese export record, ongoing U.S. butterfat strength and an improved month for NFDM/SMP lead to best October since 2022.

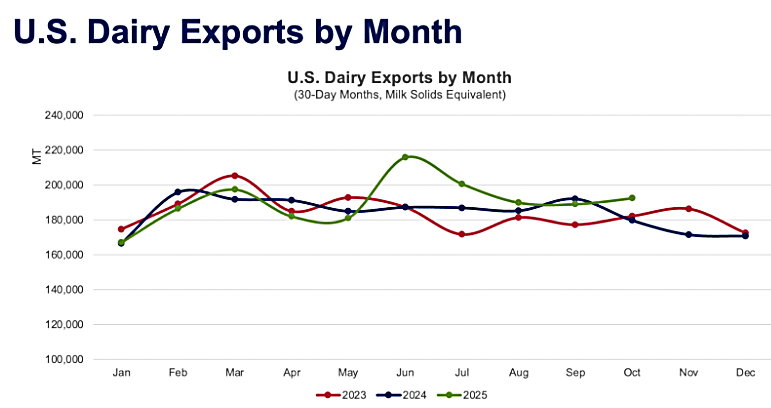

After a dip in September, U.S. dairy exports moved back into growth mode in October, as milk solids equivalent (MSE) volume rose a healthy 7% compared to the previous year. U.S. suppliers saw growth across most major product categories, except for lactose (-10%) and both low- and high-protein whey, which finished the month 1% shy of their previous-year totals. (Note: Whey numbers have been adjusted to account for miscategorized shipments to China. See the deeper dive on whey below for more detail. )

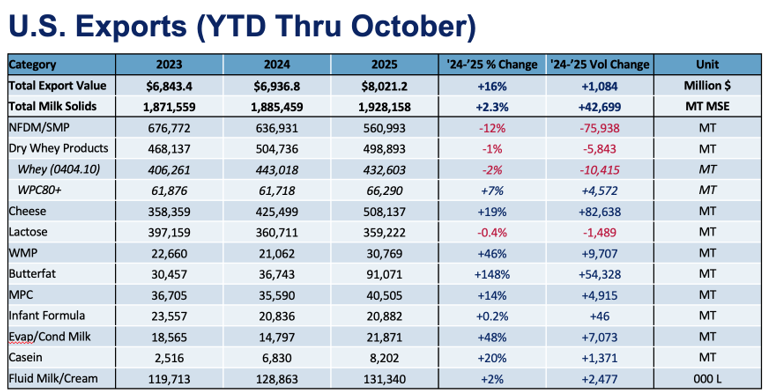

Year-to-date (YTD), U.S. dairy exports were up 2.3% MSE through October, and U.S. suppliers have grown YOY volume in four of the previous five data months. In value terms, YOY U.S. dairy exports jumped 17% to $837.1 million for the month, lifting YTD value to more than $8 billion.

Several high points

The positives in U.S. trade data in October were plentiful. U.S. cheese exports established a new monthly record: 55,060 MT. YOY volume grew 36% (+14,526 MT) with gains to nearly every major market (see the deeper dive below for more detail on cheese). U.S. suppliers have set a new bar after six consecutive months of more than 50,000 MT of cheese exports.Butterfat continued to roll as well. YOY U.S. butter exports soared 170% (+4,650 MT), with gains to the Middle East/North Africa (+1,581 MT), Canada (+1,346 MT) and Australia (+642 MT). October marked six straight months in which U.S. butter shipments have more than doubled. YOY anhydrous milkfat (AMF) volume rose “only” 75%, led by Mexico (+774 MT) and Australia (+433 MT).

We also saw sizable gains from whole milk powder (+121%, +1,748 MT) and milk protein concentrate (+43%, +1,387 MT). Even nonfat dry milk/skim milk powder (NFDM/SMP) showed some signs of life in October. For the first time in five months, YOY NFDM/SMP exports grew. The gain was less than 1% (+213 MT), but compared to the average 17% monthly decline from July through September, it was a welcome change.

Whether that increase is a signal that more growth is imminent is another story. YOY NFDM/SMP volume to our biggest customer, Mexico, fell 16% (-6,267 MT) in October. Over the three months ending October, U.S. NFDM/SMP exports to Mexico plunged 18% (-20,167 MT).

While YOY shipments to our No. 2 market, Southeast Asia, rose 13% (+1,744 MT), the increase came against a poor October 2024 performance. Most of October’s growth originated from uncharacteristic sources: A more-than-2,000% spike in sales to Honduras (+3,118 MT) and atypical jumps in volume to Peru (+128%, +1,432 MT) and Colombia (+250%, +1,526 MT).

It’s still early, but recent U.S. and global data provide some optimism on global demand. While milk production continues to surge in the U.S., EU and New Zealand, world dairy trade rose for three straight months (including a hefty 5.2% in September).

For more detailed information, as well as interactive charts and data, visit USDEC's Data Hub.

Cheese exports impress once more

Exceptional has become the new normal for U.S. cheese exports this year. In four out of the ten months for which export data is available in 2025, cheese exports set a new record, including the most recent release of October results. Compared to the prior year, October cheese exports grew 36% (+14,526 MT). This brought 2025’s year-to-date cheese exports within 655 MT of the 2024 full-year total, which was record-setting at the time. With two months still outstanding, it is safe to say that 2025 was a year for the history books in terms of cheese exports.Exports of all cheese varieties jumped, but cheddar continued on a tear with volumes more than doubling compared to last year (+167%, +6,367 MT), and accounting for over 40% of total cheese export growth in October. Cheddar production stateside has grown 5.8% YTD, as new processing facilities continue to ramp up production, so there’s ample product available for export. Other categories of cheese shouldn’t be discarded, though; YOY fresh cheese exports jumped 40% (+3,920 MT) and shreds grew 15% (+1,922 MT) in October.

All this cheese is destined for ports and customers across the globe. Exports to almost all major markets were up significantly, except for China/Hong Kong/Macao (-9%, -55 MT) and South Asia (-2%, -0.4 MT). Mexico continues to be the top destination for U.S. cheese and shipments rose again in October (+11%, +1,926 MT). However, Australia holds the title for the largest absolute growth, swelling an impressive 117% (+2,808 MT) and surpassing the 5,000 MT mark for the second month in a row.

Even outside of Mexico, Latin America remains a strong growth market for U.S. cheese exports, as YOY shipments to Central America and the Caribbean grew 32% (+2,069 MT) and cheese bound for South America jumped 70% (+1,044 MT). After a mediocre 2024, Japan (+91%, +2,084 MT in October) and Korea (+29%, +1,320 MT) have reclaimed their place as major sources of growth for U.S. cheese.

Price dynamics in the latter half of 2025 have encouraged U.S. exports of most products, but cheese exports have especially benefitted from the United States’ competitive prices. Despite aggressive pricing from the EU at the beginning of Q4 2025, the U.S. has maintained its price advantage into the new year, which suggests exports should remain positive in the near term. However, global milk production is shaping up to be persistently strong in the coming months, so U.S. cheese exports will likely face stiff competition as the year marches on and market dynamics shift.

Whey a mixed bag in October

October brought mixed results to the whey complex. In aggregate, the data showed modest declines across both high- and low-protein products, but significant nuance appears upon further investigation.High-protein whey* volumes declined by 1% (-29 MT) year over year in October and posted the weakest performance since February. However, it was only dramatically lower demand from China (-78%, -1,299 MT) that weighed heavily on the monthly figure—performance was decidedly better across other destinations. YOY volumes to Japan jumped by 41% (+338 MT), underscoring the strength of demand—even in the face of moderating economic performance and a weaker yen. Larger exports to Europe (+85%, +305 MT) and South America (+39%, +176 MT) also contributed positively to the total figure.

Price levels of high-protein whey products remain elevated. The average export price of products shipped under the high-protein whey HS code rose to $12,676/MT in October, up $1,300 from the prior month and only about $300 shy of the record high. But with the exception of China, it seems that even these lofty levels have been insufficient to curb buyer appetites amid the global protein craze.

With geographic and economic access to GLP-1s expected to expand during 2026, global high-protein whey demand is expected to remain robust. But only time will tell if prices really can persist at these levels, or even move higher, without denting demand.

Low-protein whey exports also slipped by 1% (-359 MT) in October, though performance varied widely across sub-products. On the negative side of the ledger, exports of whey protein concentrate (WPC) with less than 80% protein sank to 9,453 MT, down 20% (-2,408 MT) compared to the same month last year. Lower shipments in this category are a reflection of decreased domestic production. Cumulative U.S. production of WPCs with between 25% and 50% protein was down 8.6% over the first 11 months of the year as manufacturers pivoted toward higher value ingredients.

Meanwhile, dry whey exports rose 9% (+1,561 MT), extending the gains seen in recent months. Following extreme volatility early in the year, U.S. dry whey exports have found some traction with year-to-date exports leading prior year by 7% (+11,808 MT). Stronger demand from South America, and especially Colombia (+153%, +363 MT) and Chile (+56%, +300 MT), complemented gains in China (+13%, +933 MT) to drive total volumes higher. In addition, modified whey exports were up 4% (+488 MT) underpinned by stronger permeate demand in China.

Whey remains an essential component of the U.S. dairy export portfolio and the subdued headline growth belies many opportunities that exist across certain products and geographies. Looking ahead, while challenges will continue to present themselves, a strong undercurrent of protein demand bodes well for U.S. whey exports into the coming months.

*In order to correct for reporting inconsistencies (made clear by suspiciously low high-protein whey prices to China) and provide a more realistic picture of product flows, USDEC adjusts official whey export data, aligning reported unit values with actual market prices. If you have any questions or would like more information, don’t hesitate to reach out to any member of the Economics team.

Learn more about global dairy markets-

U.S. dairy export volume up 1.7% through three quarters

-

August exports continue growth streak, rise 3%

-

July marks second straight month of strong U.S. dairy exports

-

U.S. dairy exports surge in June

Subscribe to the U.S. Dairy Exporter Blog

The U.S. Dairy Export Council fosters collaborative industry partnerships with processors, trading companies and others to enhance global demand for U.S. dairy products and ingredients. USDEC is primarily supported by Dairy Management Inc. through the dairy farmer checkoff. How to republish this post.

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (67)

- Africa (6)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (20)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (9)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farmer leaders (1)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Future trends (1)

- Geographical Indications (GIs) (10)

- Global Marketing (86)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (271)

- Member Services (17)

- Mexico (41)

- Middle East (9)

- Middle East & North Africa (3)

- Middle East/North Africa (9)

- Milk (4)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (19)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (329)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (26)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- April 2015 (11)

- December 2015 (11)

- March 2014 (10)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- January 2026 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- April 2024 (2)

- June 2024 (2)

- July 2024 (2)

- November 2024 (2)

- December 2024 (2)

- February 2025 (2)

- June 2025 (2)

- July 2025 (2)

- September 2025 (2)

- November 2025 (2)

- December 2025 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- May 2024 (1)

- August 2024 (1)

- September 2024 (1)

- October 2024 (1)

- January 2025 (1)

- March 2025 (1)

- April 2025 (1)

- May 2025 (1)

- August 2025 (1)

- February 2026 (1)

- USDEC (183)

- USDEC Staff (167)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Nick Gardner (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Krysta Harden, USDEC President and CEO (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Becky Nyman (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Erica Louder (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

.png)