-

New year, same story: U.S. dairy exports keep growing

By USDEC Staff January 5, 2023- Tweet

Impressive growth in cheese, whey and lactose maintain momentum.

While we’ve all turned our calendars to 2023, the publication of U.S. trade data slightly lags current conditions. Even still, the just published November 2022 data showed U.S. dairy exports will certainly set another record in 2022 and are prepared to keep on growing into 2023.

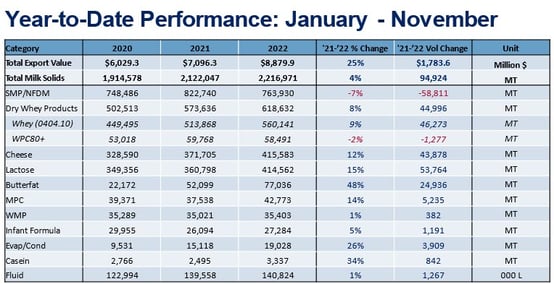

In milk solids equivalent (MSE) volume, U.S. dairy exports expanded by 9% (+16,011 MT) in November, putting year-to-date (YTD) exports up 4% (+94,924 MT MSE) for a total of 2.2 million MT MSE. In value terms, the U.S. had already set the annual record in October, but a 23% growth in November (+$148 million) is still worth celebrating.

Overall, the reliable growth of cheese (+13%, +4,282 MT) and whey products (+17%, +8,018 MT) kept U.S. volumes on their positive trajectory in November. Both products will be discussed in more depth below. Butter (+160%, +5,192 MT) and lactose (+9%, +3,189 MT) also shone. Of the major product categories, only NFDM/SMP (-3%, -2,185 MT) and fluid milk/cream (-25%, -3,383 MT) fell.

Visit USDEC’s Data Hub for more detailed information

Looking ahead, with shipping conditions considerably improved compared to this point last year, milk production expanding and international demand in key markets holding steady or growing, we expect U.S. dairy exports to continue 2022’s success into 2023 though there will certainly be plenty of challenges ahead. For this month’s report, let’s highlight the positive with two success stories: cheese and whey.

U.S. cheese exports set another monthly record in November

U.S. cheese exports extended their year-over-year (YOY) growth streak to 17 straight months in November. The United States shipped 37,495 MT of cheese to overseas markets, a 13% increase over the previous year and easily a November record. In fact, every month since February 2022 has been a new volume record for cheese exports for the respective month.

Major U.S. cheddar and gouda buyers led November gains, with overall cheese shipments to Japan rising 56% (+1,424 MT), Australia growing 56% (+1,432 MT) and Mexico gaining 15% (+1,370 MT).

Cheddar, gouda and other natural cheese under HS 0406.90 have fueled U.S. cheese export volume all year, and the story in November was no different. Year-to-date through November, U.S. cheddar exports were up 60% (+29,785 MT) while all other natural cheese exports under 0406.90 grew 21% (+18,151 MT).

November also benefitted from the continued rebound in U.S. grated cheese exports, which is predominantly mozzarella/pizza cheese. U.S. grated cheese exports were down 9% over the first seven months of the year, but from August-November, they rose 12%, with November showing the biggest increase. U.S. shipments of grated cheese rose 27% (+1,954 MT) for the month, supported by strong sales to Central America and the Middle East.

Total U.S. cheese sales to Central America rose 12% YOY in November (+370 MT), with grated cheese sales to the region more than doubling (+868 MT). Similarly, overall U.S. cheese sales to the Middle East jumped 80% (+1,175 MT) in November, with grated cheese sales to the region more than tripling (+732 MT).

Looking ahead, we are still cautiously optimistic about the coming year. We continue to see growth ahead, but a rebound in EU milk production, economic factors that support cheese analogue use in Latin America and potentially tighter U.S. exportable cheese supplies will likely lower the double-digit growth rate we’ve seen for much of 2022.

Whey exports to China soar

U.S. whey exports increased 17% (+8,018 MT) in November, as a huge increase to China (+71%, +11,948 MT) helped offset declines in other regions. Year-to-date, U.S. whey exports were up 8% (+44,996 MT), with much of the growth, especially in the first part of the year, coming from low-protein whey.

However, more recently, we have seen a sharp jump in high-protein whey exports as U.S. inventories ballooned amid weaker domestic purchases pushing U.S. manufacturers to look increasingly toward export markets. Corresponding with weaker domestic demand, prices have also eased. U.S. WPC80 and WPI prices have fallen roughly 40% since May which, when paired with weaker domestic purchases, has allowed greater export opportunity as many international importers balked at the high prices earlier in the year or purchased reduced volumes.

On the commodity side, Chinese whey imports have been on a rebound since late summer and have been driven by higher pork prices which incentivize greater whey use in hog feed to accelerate production and growth. We’ve talked about this demand factor in previous reports, but a more recent development has been the strong price correction in Chinese pork prices since late November.

Pork prices topped out just shy of ¥42/kg in November but have since come down to ¥33/kg. While still higher than the roughly ¥25/kg average price seen throughout 2021 and in the years prior to African Swine Fever-induced price volatility, that ¥33/kg price will likely start to soften demand moving forward, especially as pork supply preparations in advance of Chinese New Year have all but concluded. We may see continued growth in Chinese whey demand into 2023, but as we transition into Q2 of next year, expect lower pork prices to cap volume growth compared to what we have seen over the last several months.

-Jan-05-2023-07-56-43-8971-PM.jpg?width=554&height=264&name=Chart2%20(2)-Jan-05-2023-07-56-43-8971-PM.jpg)

Learn more about global dairy markets:-

U.S. dairy export growth streak hits seven months in October

-

U.S. dairy exports rise 7% in September

-

U.S. dairy exports grow for 5th consecutive month

Subscribe to the U.S. Dairy Exporter Blog

The U.S. Dairy Export Council fosters collaborative industry partnerships with processors, trading companies and others to enhance global demand for U.S. dairy products and ingredients. USDEC is primarily supported by Dairy Management Inc. through the dairy farmer checkoff. How to republish this post.

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (67)

- Africa (6)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (20)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (9)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farmer leaders (1)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Future trends (1)

- Geographical Indications (GIs) (10)

- Global Marketing (86)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (271)

- Member Services (17)

- Mexico (41)

- Middle East (9)

- Middle East & North Africa (3)

- Middle East/North Africa (9)

- Milk (4)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (19)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (329)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (26)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- April 2015 (11)

- December 2015 (11)

- March 2014 (10)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- January 2026 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- April 2024 (2)

- June 2024 (2)

- July 2024 (2)

- November 2024 (2)

- December 2024 (2)

- February 2025 (2)

- June 2025 (2)

- July 2025 (2)

- September 2025 (2)

- November 2025 (2)

- December 2025 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- May 2024 (1)

- August 2024 (1)

- September 2024 (1)

- October 2024 (1)

- January 2025 (1)

- March 2025 (1)

- April 2025 (1)

- May 2025 (1)

- August 2025 (1)

- February 2026 (1)

- USDEC (183)

- USDEC Staff (167)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Nick Gardner (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Krysta Harden, USDEC President and CEO (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Becky Nyman (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Erica Louder (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

.png)