-

New data released on World Milk Day shows dairy proteins unsung heroes of global innovation

By Kara McDonald June 1, 2021- Tweet

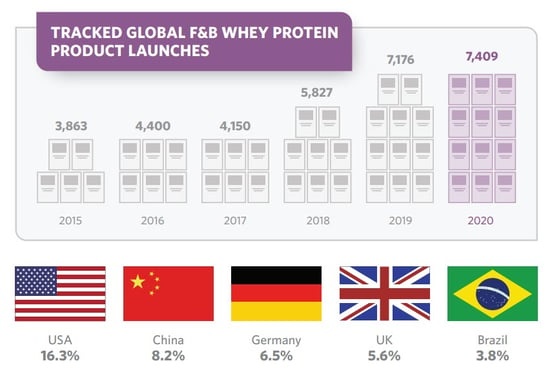

Whey and milk proteins shattered new product launch records in 2020 as 7,409 whey protein products were introduced around the world.

As consumers and the dairy community across the globe unite today in celebrating World Milk Day, many are sure to be enjoying the nutritional benefits of milk both in—and beyond—the glass.

Consumers are the winners as the range of products powered with dairy protein ingredients continues to climb, providing plentiful choice to deliciously consume dairy-based products in new and exciting ways.

Tracking data from Innova Markets Insights’ Innova Database affirms this upward growth trajectory, revealing that the number of new global food and beverage product introductions made with whey proteins and with milk proteins both set new records in 2020.

Read a news release on this data here. Share these findings on social media using the hashtag #WorldMilkDay.

As further outlined in a new infographic unveiled today by the U.S. Dairy Export Council (USDEC), a record 7,409 whey protein products were introduced around the world in 2020, with annual launches nearly doubling from 2015. This represents a double-digit (13.9%) compound annual growth rate (CAGR) from 2015 to 2020, demonstrating that food formulators are tapping into these nutritional and functional ingredients to fuel innovations that deliver on consumer desires.

The data points above are a small part of a larger infographic telling the dairy protein story. Click on the button below to download the full infographic.

Milk protein product launches also smashed prior year records, reaching 9,413 products in 2020, a 3.7% CAGR from 2015 to 2020. Aggregated dairy protein product introductions outpaced plant proteins in 2020 by over 3,000 products (17,652 dairy proteins, 14,584 plant proteins), maintaining a consistent lead held for the past decade.

.png?width=520&name=Picture2%20(2).png)

“This impressive growth in whey, milk and dairy protein introductions aligns with other Innova Market Insights’ survey data showing strong consumer demand for proteins from both animal and plant based sources,” says Lu Ann Williams, Global Insights Director, Innova Market Insights. “Innovation potential remains bright across global markets and diverse product categories for these versatile ingredients from cow’s milk, offering formulators the sweet spot of nutritionally high-quality proteins that complement today’s plant forward lifestyles."

The number of whey and milk protein products carrying a high or source of protein claim is rising in tandem with the growth in new product launches. 60% of tracked whey protein and 28% of milk protein product introductions carried a high or source of protein claim on-pack in 2020, signaling that global manufacturer are harnessing protein’s powerful consumer allure for marketing advantage.

“Consumer interest in protein for health is no longer just in Western markets where the protein trend started but gaining momentum and driving new product introductions around the world,” said Kristi Saitama, vice president, global ingredients marketing for USDEC.

“Launch activity is likely to accelerate in coming years as manufacturers in Asian, Latin American, Middle Eastern and African countries further discover and seek out whey and milk protein’s powerhouse nutritional package to develop local-friendly products supporting consumer health and wellness goals, such as fitness, weight management and healthy aging.”

More than one third (35.4%) of whey protein new product introductions in 2020 were outside of Europe and North America, with one in five (21.2%) launches in Asia.

The top five markets — United States, China, Germany, United Kingdom and Brazil — accounted for 40% of tracked 2020 introductions. On a country by country basis, the United States accounted for 16% of the 2020 whey protein food and beverage launches followed by China (8.2%), Germany (6.5%), the United Kingdom (5.6%) and Brazil (3.8%).

Category wise, Sports Nutrition led with a 36.9% share of total whey protein product introductions last year followed by Baby & Toddlers (27.4%), Dairy (6.4%), Cereals (6.1%) and Bakery (5.8%). Additional key categories included Desserts & Ice Cream (4.3%), Snacks (2.4%), Confectionery (2.2%), Ready Meals & Side Dishes (2.2%) and Soft Drinks (1.9%), reflecting broadening performance strength across both traditional and novel end-use applications.

“U.S. whey and milk protein ingredients deliver on formulator goals to boost protein content in health and wellness product offerings while providing the right flavor, nutrition, functionality, and clean labels in ways where newer proteins may struggle,” says Saitama.

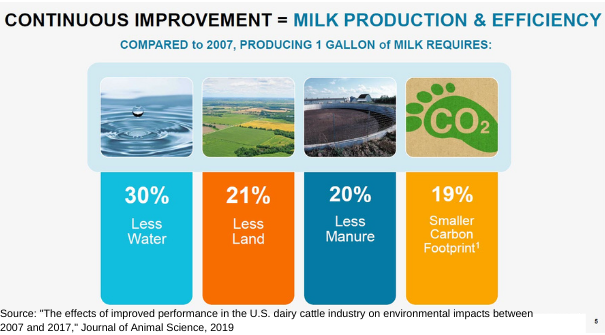

“And with a long-legacy of environmental stewardship and ambitious environmental goals to become carbon neutral or better by 2050, global manufacturers can count on the U.S. dairy community for sustainable ingredient and innovation solutions that are healthful for both the body and the planet.”

Visit ThinkUSAdairy.org to download the new infographic snapshot of whey and milk protein product introduction data as well as further information on U.S. dairy protein nutrition and innovation opportunities.

Data Source and Product Information

Innova Market Insights, Innova Database.

Food and Beverage category only, excludes supplements and medical nutrition.- Whey Protein group includes Whey Protein, Whey Protein Concentrate, Whey Protein Hydrolysate, and Whey Protein Isolate.

- Milk Protein group includes Milk Protein, Milk Protein Concentrate, Milk Protein Hydrolysate, Milk Protein Extract, and Milk Protein Isolate.

- Dairy Protein group includes 32 whey protein, milk protein, casein protein, and other dairy-based protein ingredients.

- Plant Protein group includes 70 ingredients, including soy, pea, almond, potato, wheat, rice, oat, lupin, and more.

Kara McDonald is Vice President, Global Marketing Communications, for USDEC.

Subscribe to the U.S. Dairy Exporter Blog

The U.S. Dairy Export Council fosters collaborative industry partnerships with processors, trading companies and others to enhance global demand for U.S. dairy products and ingredients. USDEC is primarily supported by Dairy Management Inc. through the dairy farmer checkoff. How to republish this post.

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (65)

- Africa (6)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (19)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (9)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farmer leaders (1)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Future trends (1)

- Geographical Indications (GIs) (10)

- Global Marketing (86)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (264)

- Member Services (17)

- Mexico (41)

- Middle East (9)

- Middle East & North Africa (3)

- Middle East/North Africa (9)

- Milk (4)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (18)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (322)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (25)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- April 2015 (11)

- December 2015 (11)

- March 2014 (10)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- April 2024 (2)

- June 2024 (2)

- July 2024 (2)

- November 2024 (2)

- December 2024 (2)

- February 2025 (2)

- June 2025 (2)

- July 2025 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- May 2024 (1)

- August 2024 (1)

- September 2024 (1)

- October 2024 (1)

- January 2025 (1)

- March 2025 (1)

- April 2025 (1)

- May 2025 (1)

- USDEC (183)

- USDEC Staff (158)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Nick Gardner (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Becky Nyman (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Erica Louder (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

- Krysta Harden, USDEC President and CEO (1)

.png)