-

A Grande Forecast for Mexico's Dairy Consumption

By Rodrigo Fernandez November 24, 2015- Tweet

The president of Mexico’s dairy processor association tells USDEC members that coordinated promotion could yield a 30% increase in consumption, boosting U.S. exports.

The president of Mexico’s dairy processor association tells USDEC members that coordinated promotion could yield a 30% increase in consumption, boosting U.S. exports. Despite a tradition of cheese use in Mexico and sizable domestic milk production, Mexican dairy per capita consumption remains less than half of U.S. per capita consumption.

It also falls short of many of its Latin American neighbors, including Argentina, Brazil, Chile and Costa Rica.

It’s a point Juan Carlos Pardo emphasized during a presentation at the USDEC Fall Board of Directors and Membership Meeting, Oct. 15 in Chicago.

“We are not a mature market,” said Pardo, president of CANILEC, Mexico’s dairy processor association. Pardo is also the director of corporate affairs for Nestlé Mexico.

Although it varies with geography, average annual per capita dairy consumption in Mexico as a whole equates to about 126 liters (milk equivalent) or 286 lbs. That comes out to around 345ml per day, significantly less than the 500ml per day recommended by the UN Food and Agriculture Organization and less than half of U.S. consumption of 750ml per day. Despite pockets of growth, per capita consumption has stagnated.

Contrast that to per capita soda consumption in Mexico—a nation with one of the highest obesity rates on the planet—at 450ml per day.

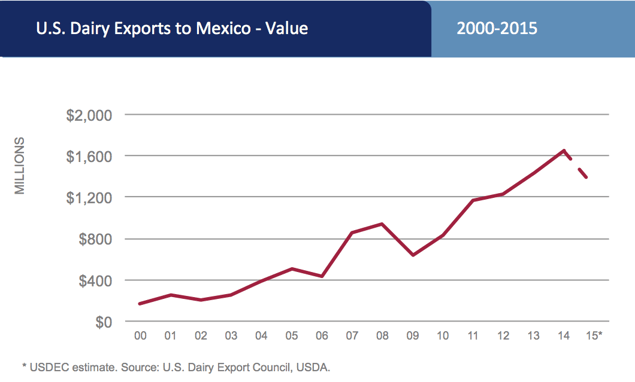

Consumption growth would lead to U.S. export growth

The relatively low consumption numbers coupled with potential to better capitalize on dairy nutritional benefits and replace soft drinks herald export opportunity. In Pardo’s words, “The best way to increase exports to Mexico is to grow consumption.”

The surest boost to further consumption is economic growth, but a series of government reforms implemented last year have yet to stoke the economic engine. Until they do, Pardo believes the key to raising demand now as well as laying the groundwork for the future is promotion.

Industry campaigns promoting dairy consumption exist in Mexico but are minimal and not coordinated. CANILEC is working with dairy farmers and the government to develop a landmark school milk program that Pardo believes will help better embed the importance of and desire for dairy early in life.

Pardo invited the U.S. industry, through USDEC, to meet to discuss how the two countries, as a group, could facilitate dairy promotion to not only boost consumption and grow the overall size of the pie, but to build a regional partnership and sustain the current state of play that has seen Mexican dairy farmers and processors expand side-by-side with U.S. suppliers.

Heightened challenge expected with international competition

The need for greater U.S. engagement in Mexico, possibly through such a coordinated approach to promotion, but also via cooperation on regulatory issues, milk production challenges, trade negotiations and other joint areas of interest, is likely to become more pressing in time.

International competition intensified sharply over the past year cutting into U.S. dominance in Mexico. Europe and New Zealand aggressively sought alternative markets as their largest customers (Russia and China) slashed buying.

The United States still holds a solid market share lead in Mexico, but that share fell to 70 percent for cheese (an 8 percentage-point decline) and 87 percent for nonfat dry milk/skim milk powder (a drop of 9 percentage points) over the first eights months of 2015, according to Mexican Customs data.

U.S. suppliers built their commanding position in the market through a combination of hard work and the advantages gained via the North American Free Trade Agreement (NAFTA), which phased out all Mexican dairy tariffs on U.S. goods by 2004. While the Trans-Pacific Partnership provides the United States with dairy market access gains to multiple nations, it also gives Australia and New Zealand a limited volume of tariff-free access to Mexico for certain dairy products. Those volumes are nowhere near the U.S. tariff gains through NAFTA, but will nonetheless heighten competitiveness.

And now the European Union is poised to renegotiate a trade deal with Mexico that could see further erosion of the U.S. NAFTA advantage, as well as restrict U.S. cheese market access to Mexico through obstructive geographic indication limitations.

The challenge is great but the opportunity is too good to miss.

“We believe we can achieve an increase in dairy consumption by at least 30 percent,” Pardo said. “Mexico’s US$15 billion dairy market could quickly grow to US$20 billion.”

Exports currently account for around 25 percent of Mexico’s total dairy sector. If Pardo is right, assuming a similar ratio, that’s at least US$1 billion in additional business for responsive foreign suppliers.

Related articles from the U.S. Dairy Exporter Blog:

- Dairy Export Opportunities Series: Mexico

- Cinco de Mayo Reminds Us That Mexico is Still Our Largest Dairy Export Market

Subscribe to the U.S. Dairy Exporter Blog

The U.S. Dairy Export Council fosters collaborative industry partnerships with processors, trading companies and others to enhance global demand for U.S. dairy products and ingredients. USDEC is primarily supported by Dairy Management Inc. through the dairy farmer checkoff. How to republish this post.

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (67)

- Africa (6)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (20)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (9)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farmer leaders (1)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Future trends (1)

- Geographical Indications (GIs) (10)

- Global Marketing (86)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (271)

- Member Services (17)

- Mexico (41)

- Middle East (9)

- Middle East & North Africa (3)

- Middle East/North Africa (9)

- Milk (4)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (19)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (329)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (26)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- April 2015 (11)

- December 2015 (11)

- March 2014 (10)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- January 2026 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- April 2024 (2)

- June 2024 (2)

- July 2024 (2)

- November 2024 (2)

- December 2024 (2)

- February 2025 (2)

- June 2025 (2)

- July 2025 (2)

- September 2025 (2)

- November 2025 (2)

- December 2025 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- May 2024 (1)

- August 2024 (1)

- September 2024 (1)

- October 2024 (1)

- January 2025 (1)

- March 2025 (1)

- April 2025 (1)

- May 2025 (1)

- August 2025 (1)

- February 2026 (1)

- USDEC (183)

- USDEC Staff (167)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Nick Gardner (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Krysta Harden, USDEC President and CEO (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Becky Nyman (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Erica Louder (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

.png)