-

Importance of Trade Impossible to Overstate

By Jim Mulhern March 21, 2019- Tweet

NMPF and USDEC are working hand-in-hand on trade policy issues that will affect dairy exports to China, Mexico, Canada, Japan, Vietnam and other countries.

.png?width=168&name=Mulhern%20(2).png) Trade winds are growing more turbulent, adding uncertainty to the business plans of dairy farmers as they weather a wave of consolidation that’s closing more than four U.S. dairies every day, according to U.S. Department of Agriculture data.

Trade winds are growing more turbulent, adding uncertainty to the business plans of dairy farmers as they weather a wave of consolidation that’s closing more than four U.S. dairies every day, according to U.S. Department of Agriculture data.At the National Milk Producers Federation (NMPF), where I am president and CEO, we see and hear the pain of these farmers. They need to access more global markets for their milk to be exported in the form of dairy products and ingredients.

The quality of U.S. dairy products is world-class. At the prestigious 2018 World Cheese Awards in Norway, U.S. cheeses won 89 medals, more than France and Italy. It surprises some to learn that in 2018 the United States was the world’s largest cheese exporter.

To continue to compete and win overseas, we need a level playing field through free-trade agreements.

Working closely with the U.S. Dairy Export Council, we see more than the usual uncertainty on trade these days.

Chinese and U.S. negotiators are grappling with how to reset the world’s biggest bilateral trading relationship, with hopes of an agreement later this month. The U.S.-Mexico-Canada Agreement, the signature U.S. trade achievement of 2018, has yet to be ratified by Congress. The U.S. Section 301 and 232 tariffs that have invited retaliation against dairy from crucial trade partners—China and Mexico, respectively—remain in place, with no clear way out yet.

Thousands of jobs rely on U.S. dairy exports

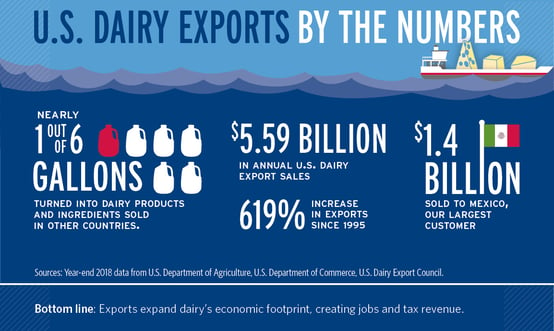

The importance of international trade to the U.S. dairy economy is almost impossible to overstate.

Dairy exports support nearly 100,000 jobs and generate another $15 billion in economic output, according to data on the #GotDairyJobs portal.

About one-half of all increased dairy production since 2003 has been soaked up by exports. Last year, despite trade actions that crimped sales to China and Mexico, a record 15.8 percent of U.S. milk production went abroad—a percentage that will need to increase out of necessity as dairy farmers become only more productive.

Each trade policy discussion is crucial for dairy, which is ever-more-dependent on global markets to support prices as U.S. production rises to meet global demand growth. Over the past 15 years one-half of U.S. production growth has gone to exports, and the percentage of the U.S. milk supply sent abroad has steadily increased.

Ripple effect of trade deals

The outcome of each trade policy debate, in turn, will shape the direction of other negotiations important to the sector, including potential bilateral talks with Japan, the European Union, and the post-Brexit U.K., and potential negotiations with the Philippines and Vietnam.

As discussions grow more complex—and headlines swing wildly from hopeful to gloomy and back again—it becomes only more important to be mindful of two things:

- In our advocacy at NMPF and the work we support with the U.S. Dairy Export Council, we advance dairy’s interests at all times.

- When it comes to improving market access, dairy is in it for the long haul, and we will settle for nothing less than the best possible trade terms for our producers.

One example of these principles in action is how we are calling for the immediate approval of USMCA as well as demanding that negotiations on Section 232 tariffs conclude and retaliatory tariffs are lifted. Our job is to support USDEC and to ensure that the U.S. government and Congress pursue policies that benefit producers.

U.S. dairy cannot be collateral damage

To ensure prosperous dairy trade over the long term, an overarching need is for agriculture in the current environment to be excluded from trade disputes that may or may not be justified. Because agriculture is a rare part of the U.S. economy with a trade surplus, it’s a tempting target for trade partners looking to retaliate against actions against them—and that’s a recipe to make our industry collateral damage in any trade war.

While trade agreements that may be past their prime can be legitimately ripe for renegotiation, we then need to strengthen and renew those ties, not limit them in ways that harm U.S. dairy producers.

New agreements needed

We also need to negotiate and pass new trade agreements. The U.S. last successfully completed trade treaties in 2012, when agreements with Panama, Colombia and South Korea came into force. Meanwhile, competitors continue to conclude new agreements. The Trans-Pacific Partnership sailed without the U.S. last year, as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership completed its journey. And the EU jumps from accord to accord, most recently with Japan.

We need to ensure that negotiators focus on key sectors important to agriculture and not accept any drive for freer trade that puts farmers in the back seat.

That’s why NMPF and USDEC support breaking down trade barriers as a matter of principle, but we can’t simply allow the EU to get away with preserving a status quo that unfairly protects its farmers and hampers U.S. agricultural competitiveness, especially irritants such as the EU’s use of geographical indications to pursue protectionist policies, when it insists on excluding agriculture from any U.S. trade talks. We want trade deals – but not simply for the sake of having them.

Patience and persistence

We will always represent our dairy farmers and processors.

Working closely with USDEC, we have patiently, consistently and effectively worked on behalf of our industry, and our efforts will persist. For example:

- We told the U.S. Trade Representative’s office of the importance of including agriculture in any EU negotiations and pointed out a study by USDEC outlining a potential loss of $20 billion farm revenue should the EU view of geographical indications take hold.

- USDEC studied how a changed competitive position in Japan could lead to more than $5 billion in losses, as the U.S. may lose market share as other nations implement trade agreements while the U.S. stands still.

- We met with officials in the United Kingdom to discuss what post-Brexit dairy trade could look like—and of course, we are no strangers in talking to counterparts in Mexico, Canada and China.

Dairy’s prosperity depends on exports

These efforts take time and energy, with payoffs that are years in the making—and are absolutely critical for our industry’s future.

Such patience is vital as trade developments twist, turn, and frustrate. The fact is, dairy needs greater market access.

Increased dairy shipments abroad are the central reason behind the USDA’s forecast for a mild milk-price recovery forecast in its Agriculture Outlook forecast made in February. Greater access would provide an even greater recovery, one that’s hampered so long as tariffs continue to bite.

When dairy’s prosperity returns, exports will be a big reason behind it. But easing the path for exports must be done right. That’s what we will stand for, and will always stand for, no matter how much the momentary shifts in trade winds may try to blow us off that path.

Jim Mulhern is the President and CEO of the National Milk Producers Federation. A version of this article first appeared in NMPF’s CEO Corner column.

Learn more:

- Despite Tariffs from Mexico and China, 2018 U.S. Dairy Exports Reach Record High

- 7 Things Farmers Need to Know About Their Investment in Exports

- Data: Dairy's Positive Impact on U.S. Economy

- U.S. Dairy Industry Supports Changes to Section 232 Process

- U.S. Cheesemakers Win 89 Medals at World Cheese Awards

Subscribe to the U.S. Dairy Exporter Blog

The U.S. Dairy Export Council fosters collaborative industry partnerships with processors, trading companies and others to enhance global demand for U.S. dairy products and ingredients. USDEC is primarily supported by Dairy Management Inc. through the dairy farmer checkoff. How to republish this post.

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (67)

- Africa (6)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (20)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (9)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farmer leaders (1)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Future trends (1)

- Geographical Indications (GIs) (10)

- Global Marketing (86)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (271)

- Member Services (17)

- Mexico (41)

- Middle East (9)

- Middle East & North Africa (3)

- Middle East/North Africa (9)

- Milk (4)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (19)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (329)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (26)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- April 2015 (11)

- December 2015 (11)

- March 2014 (10)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- January 2026 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- April 2024 (2)

- June 2024 (2)

- July 2024 (2)

- November 2024 (2)

- December 2024 (2)

- February 2025 (2)

- June 2025 (2)

- July 2025 (2)

- September 2025 (2)

- November 2025 (2)

- December 2025 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- May 2024 (1)

- August 2024 (1)

- September 2024 (1)

- October 2024 (1)

- January 2025 (1)

- March 2025 (1)

- April 2025 (1)

- May 2025 (1)

- August 2025 (1)

- February 2026 (1)

- USDEC (183)

- USDEC Staff (167)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Nick Gardner (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Krysta Harden, USDEC President and CEO (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Becky Nyman (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Erica Louder (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

.png)