-

How the spread of African swine fever to Asia's pigs may affect U.S. dairy exports

By USDEC September 25, 2019- Tweet

In the short term, fewer pigs mean less demand for pig feed and the U.S. whey products that fortify that feed. But USDEC sees longer-term opportunities.

South Korea confirmed a sixth case of African swine fever on Wednesday in a town near its border with North Korea. This follows an acknowledgement last week of the first case in South Korea, indicating the deadly virus is spreading in Asia, with rippling effects on global markets, including dairy.

"There is no treatment or vaccine available for this disease," says the U.S. Department of Agriculture in an AFS fact sheet. "The only way to stop this deadly

disease is to depopulate all affected or exposed swine herds."More than 20,000 pigs had been slaughtered in South Korea as of Tuesday, with about 30,000 more expected to be culled as a preventative measure, according to a report by Reuters news agency. Meanwhile, China's pig herd is down about one-third from a year ago, according to the Chinese government. Outside analysts have suggested that number is most likely too low, and that the ASF toll will get worse before it gets better.

"We hold the view that it will take over five years for China’s pork production to recover fully from ASF," Rabobank said in a recent analysis.

What does this mean for U.S. dairy exports?

In the short term, fewer pigs mean less demand for pig feed and the U.S. dairy whey products that fortify that feed.

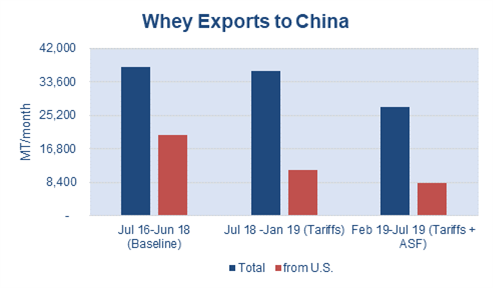

"Swine fever and retaliatory tariffs have imposed a double-whammy on U.S. whey exports," said Al Levitt, U.S. Dairy Export Council vice president of market analysis.

China’s whey imports have declined by about 10,000 tons a month since February, when ASF began to spread more aggressively, according to an analysis by Levitt.

Includes exports of HS 040410 from U.S., EU, Belarus, Argentina, Ukraine, Australia. Source: USDEC, Global Trade Atlas.

Includes exports of HS 040410 from U.S., EU, Belarus, Argentina, Ukraine, Australia. Source: USDEC, Global Trade Atlas.

With lost overall demand and lost share due to retaliatory tariffs, U.S. exports are down about 12,000 tons a month compared to the two years prior to retaliatory tariffs being imposed.

South Korea imported 34,633 tons of whey last year with 15,102 tons coming from the United States.

Looking ahead, the U.S. dairy industry has the ingredients, science and nutrition expertise to help Asian countries rebuild their business. Our recommendation for increasing the ratio of permeate in the feed presents a win-win for both growers and U.S. exporters. The potential was discussed last week at a gathering of USDEC's Ingredient Advisory Group (IAG) meeting in Denver.

American Farm Bureau Federation Economist Michael Nepveux traced the progression of ASF across Asia and explained at the USDEC meeting how China’s pork industry will restructure in the future as small producers are replaced by larger commercial operations.

This could, over time, drive demand for commercial feed rations (using whey permeate) as China’s pig herd is repopulated, he said.

African swine fever definedAccording to the World Organization for Animal Health, a global intergovernmental organization responsible for improving animal health, African swine fever:- Is a severe viral disease affecting domestic and wild pigs.

- Is responsible for serious production and economic losses.

- Is a transboundary animal disease (TAD) that can be spread by live or dead pigs, domestic or wild, and pork products.

- Insects and ticks can also transmit ASF.

Those points and others are made in the video below.Reuters reported that eight Asian countries, including China, Philippines, and North Korea, have now reported outbreaks of the virus, which originated in Sub-Saharan Africa.As the disease spreads, so does concern. One striking example: The Manila Times has called the situation a ‘porkocalypse’ and has demanded "drastic action."USDEC discusses solutions in China

In an Aug. 30 meeting in Beijing with government officials at the Ministry of Finance and Commerce (MOFCOM), USDEC President and CEO Tom Vilsack said the United States has the dairy ingredients, scientific research and practical know-how to help rebuild China's pig herd.

At an Aug. 30 meeting with Chinese government officials in Beijing, Secretary Vilsack (center right) said the U.S. dairy industry has ingredients and expertise to help China rebuild its decimated pig herd. Photo: Courtesy of China Ministry of Finance and Commerce (MOFCOM).

At an Aug. 30 meeting with Chinese government officials in Beijing, Secretary Vilsack (center right) said the U.S. dairy industry has ingredients and expertise to help China rebuild its decimated pig herd. Photo: Courtesy of China Ministry of Finance and Commerce (MOFCOM).

"Research shows that more permeate given to piglets in a higher ratio results in faster growth," said Vilsack, describing the China meeting in an article he wrote. "We also know that more whey protein given to lactating sows results in more pigs per sow."

The Chinese thanked Vilsack for his offer. Eleven days later China announced it was waiving its retaliatory tariff on U.S. permeate for feed (protein content 2%-7% by weight, lactose content 76%-88%). Effective Sept. 17, permeate sold under HS 04041000 reverted to its pre-retaliatory tariff rate of 2%.

"Our permeate can now compete on a level playing field in a nation that produced and consumed roughly half of the world’s pork last year," said Vilsack.

The decision culminated months of groundwork by USDEC staff pursuing the tariff exemption by working closely with Chinese government and industry officials.

China tariffs + ASF = declining exports

The tariff waiver by China only applies to permeate but will help nonetheless.

Levitt echoed Nepveux’s expectation for a recovery in whey demand once herds begin to repopulate over the next several years. In fact, a shortage in the world’s largest pork market has led to record-high prices, making pigs very profitable.

"Operations have a strong financial incentive to restock as soon as it’s safe to do so," Levitt said. "They also should be quite receptive to increasing whey permeate inclusion rates on piglets to bring them to market faster."

USDEC organizes 'win-win' feed seminars

USDEC is looking to play a role in accelerating the uptake of permeate to rebuild China’s swine population with two full-day seminars Oct. 29 in Beijing and Oct. 31 in Nanchang.

The meetings will present the latest scientific findings demonstrating how incorporating permeate into swine nursery diets can improve profitability, optimize nursery pig growth and gut health, and help farmers rebound from the disease.

"We trust that the information and perspectives shared during our event will help the Chinese swine industry during its herd-rebuilding efforts," said Annie Bienvenue, USDEC's vice president, technical services. "We believe that increasing the inclusion rate of permeate in nursery pig diets is a cost-effective strategy to help maximize pig productivity and offers a 'win-win' dairy solution for the U.S. and China."

USDEC members interested in attending the events can contact Bienvenue at abienvenue@usdec.org. Also see the USDEC Technical Feed Seminar page.

Mark O'Keefe is vice president of editorial services at the U.S. Dairy Export Council.

Subscribe to the U.S. Dairy Exporter Blog

The U.S. Dairy Export Council fosters collaborative industry partnerships with processors, trading companies and others to enhance global demand for U.S. dairy products and ingredients. USDEC is primarily supported by Dairy Management Inc. through the dairy farmer checkoff. How to republish this post.

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (67)

- Africa (6)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (20)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (9)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farmer leaders (1)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Future trends (1)

- Geographical Indications (GIs) (10)

- Global Marketing (86)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (271)

- Member Services (17)

- Mexico (41)

- Middle East (9)

- Middle East & North Africa (3)

- Middle East/North Africa (9)

- Milk (4)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (19)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (329)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (26)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- April 2015 (11)

- December 2015 (11)

- March 2014 (10)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- January 2026 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- April 2024 (2)

- June 2024 (2)

- July 2024 (2)

- November 2024 (2)

- December 2024 (2)

- February 2025 (2)

- June 2025 (2)

- July 2025 (2)

- September 2025 (2)

- November 2025 (2)

- December 2025 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- May 2024 (1)

- August 2024 (1)

- September 2024 (1)

- October 2024 (1)

- January 2025 (1)

- March 2025 (1)

- April 2025 (1)

- May 2025 (1)

- August 2025 (1)

- February 2026 (1)

- USDEC (183)

- USDEC Staff (167)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Nick Gardner (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Krysta Harden, USDEC President and CEO (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Becky Nyman (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Erica Louder (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

.png)