-

Six Growth Drivers for U.S. Dairy in Southeast Asia

By USDEC April 17, 2015- Tweet

A two-day U.S. Dairy Business Conference in Singapore ends with optimism fueled by powerful trends.

A two-day U.S. Dairy Business Conference by the U.S. Dairy Export Council at the InterContinental Hotel in Singapore ended on Friday with optimism that growth in the region can continue if not accelerate due to powerful trends.

More than 100 foodservice operators and dairy and food processing companies from Southeast Asia connected with U.S. dairy suppliers to gain actionable insights on encouraging global market trends and product developments.

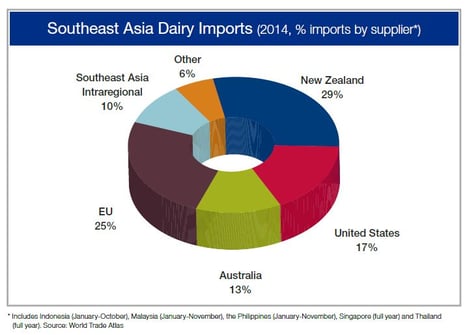

"Southeast Asia is probably one of the most dynamic dairy markets in the world," said Singapore-based Tony Emms, regional director of USDEC's Southeast Asia office. "This region does not produce much milk and needs imports."The 10-member Association of Southeast Asian Nations (ASEAN) is the second largest market for U.S. dairy exports, trailing only Mexico. In the last five years, sales have more than tripled in value to $1.3 billion.

USDEC has idehtified at least six factors driving increasing demand for U.S. dairy exports to Southeast Asia:

- Booming population: As a whole, Southeast Asia’s population topped 620 million in 2014, a little less than twice the size of the United States. That includes Indonesia, Malaysia, the Philippines, Singapore, Thailand and Vietnam, plus Brunei Darussalam, Burma, Cambodia, Laos and Timor-Leste. At the same time, Southeast Asia’s population is growing 1.3 percent per year vs. only 0.4 percent for the United States. By 2050, more than 830 million people will be living there vs. less than 400 million in the United States.

- Steady economies: The International Monetary Fund (IMF) projects strong and steady growth of 5-6 percent annually through 2019 for the six main target markets, higher if you factor in their less developed neighbors. By comparison, the IMF forecasts GDP growth of 3.4 percent for the world as a whole. Unemployment rates should remain at 3 percent or lower for Malaysia, Singapore and Thailand through 2019, IMF forecasts. Vietnamese unemployment is steady at 4 percent and the Philippines and Indonesia are 6-7 percent but declining. Economic conditions are fueling middle class expansion and dietary shifts.

- Thriving food manufacturing industry: The reduction in trade barriers through ASEAN coupled with rising demand has proven extremely attractive to food and beverage firms. Local as well as multi-national companies are investing in nations like Indonesia, Malaysia and Singapore to build capacity and product development capabilities to not only service national demand but to export to the broader region and even to places like China, the Middle East and Africa. It has created a significant market for high-value dairy ingredients made to tight specifications.

- Foodservice expansion: Cheese imports from the six major Southeast Asian dairy buyers have grown for eight consecutive years, topping 80,000 tons in 2014. Foodservice users, either buying directly from the supplier or buying processed cheese from a domestic manufacturer who bought from the supplier, are driving consumption. And they are well poised for further growth. Although chain restaurant penetration varies by nation, as a whole, the region is not nearly saturated. Vietnam got its first McDonald’s and Starbucks just last year. The outlets were an immediate hit. In a nation of 90 million, that is a lot of room for milk and cream for coffee and cheese for burgers.

- Youthful demographics: These nations are growing more urbanized; lifestyles are becoming faster paced. Time pressures and changing social habits have increased the number of consumers looking for convenient foods that fit modern lifestyles. Populations skew young compared to Europe and the United States. Sixty percent of the Vietnamese population is under 35—a young and dynamic segment that is driving demand for new products, including processed foods and fast-food. In highly urbanized and developed areas like Singapore that boast five-star hotels and upscale dining, there is a growing opportunity for high-end cheese.

- Healthier lifestyles: Southeast Asian consumers, often backed by government initiatives, have grown much more knowledgeable about dairy’s role in health and nutrition. Vietnam’s National Nutrition Program, for example, encourages calcium consumption for bone strength, milk for infant health, and overall dairy as part of a healthy diet to raise average height levels. It is set to run through 2020. Trust in dairy is driving people to incorporate milk, cheese and dairy containing products into their traditional diets. Functional foods are becoming more prevalent.

Challenges exist, such as an uneven playing field with some competitors due to trade agreements, but taken as a whole the outlook for U.S. dairy in Southeast Asia is bright.

The U.S. Dairy Export Council is primarily supported by Dairy Management Inc. through the dairy farmer checkoff that builds on collaborative industry partnerships with processors, trading companies and others to build global demand for U.S. dairy products.

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (67)

- Africa (6)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (20)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (9)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farmer leaders (1)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Future trends (1)

- Geographical Indications (GIs) (10)

- Global Marketing (86)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (271)

- Member Services (17)

- Mexico (41)

- Middle East (9)

- Middle East & North Africa (3)

- Middle East/North Africa (9)

- Milk (4)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (19)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (329)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (26)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- April 2015 (11)

- December 2015 (11)

- March 2014 (10)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- January 2026 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- April 2024 (2)

- June 2024 (2)

- July 2024 (2)

- November 2024 (2)

- December 2024 (2)

- February 2025 (2)

- June 2025 (2)

- July 2025 (2)

- September 2025 (2)

- November 2025 (2)

- December 2025 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- May 2024 (1)

- August 2024 (1)

- September 2024 (1)

- October 2024 (1)

- January 2025 (1)

- March 2025 (1)

- April 2025 (1)

- May 2025 (1)

- August 2025 (1)

- February 2026 (1)

- USDEC (183)

- USDEC Staff (167)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Nick Gardner (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Krysta Harden, USDEC President and CEO (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Becky Nyman (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Erica Louder (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

.png)