-

Dairy Farmer to Congress: 'When Exports Increase, I Benefit'

By USDEC March 18, 2015- Tweet

Trade Promotion Authority (TPA) needed to further expand dairy exports.

Editor's note: The following is adapted from written congressional testimony, given today, by dairy farmer Pete Kappelman before the House Committee on Agriculture. Testifying on behalf of the National Milk Producers Federation, Kappelman runs Meadow Brook Dairy Farms in Manitowoc, Wis., a fifth-generation family business with 450 registered Holstein and Brown Swiss cows that make up one of the highest producing herds in the state. He is chairman of Land O’ Lakes cooperative, a member of the U.S. Dairy Export Council.

Editor's note: The following is adapted from written congressional testimony, given today, by dairy farmer Pete Kappelman before the House Committee on Agriculture. Testifying on behalf of the National Milk Producers Federation, Kappelman runs Meadow Brook Dairy Farms in Manitowoc, Wis., a fifth-generation family business with 450 registered Holstein and Brown Swiss cows that make up one of the highest producing herds in the state. He is chairman of Land O’ Lakes cooperative, a member of the U.S. Dairy Export Council.Pete Kappelman March 18 Congressional Testimony

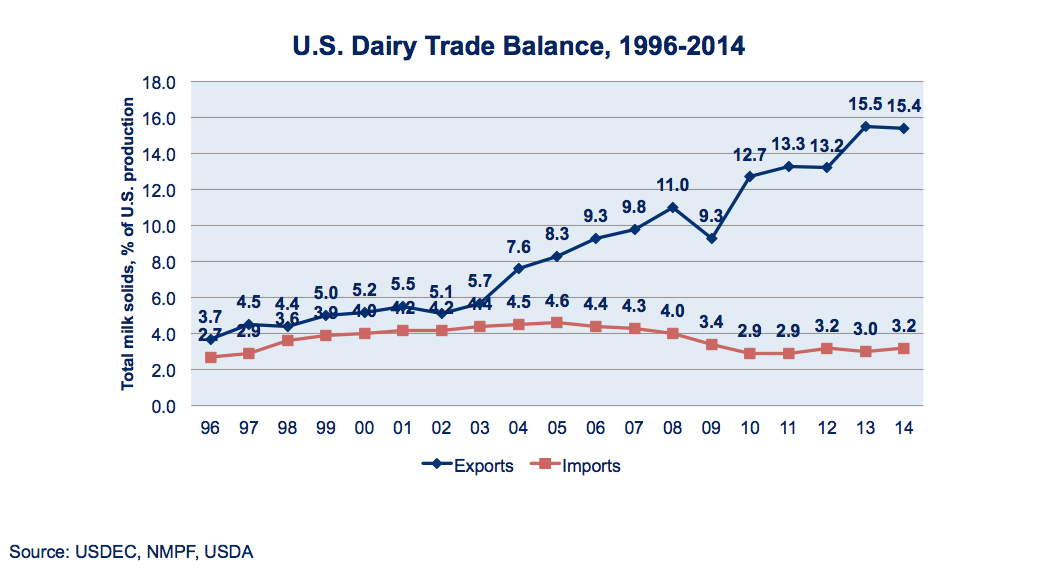

This industry has come a long way on trade in the past several years. Our nation has gone from exporting dairy products valued at less than $1 billion in 2000 to exporting a record $7.1 billion in 2014, an increase of 625 percent. That reflects not just a tremendous jump on a value basis but also a dramatic increase in the proportion of U.S. milk production that’s finding a home overseas.

Fifteen years ago we were exporting roughly 5% of our milk production, now we’re nearly three times that level, even as overall U.S. milk production has continued to grow. That means that the equivalent of one day’s milk production each week from the entire U.S. dairy industry ultimately ends up overseas, making exports integral to the health of my farm and our dairy industry at large.

It is not coincidental that the enormous growth over this period occurred during a time in which the U.S. was implementing a number of market-opening free trade agreements, each of which were approved through the use of Trade Promotion Authority. These agreements lowered and ultimately removed tariffs and in many cases they gave our products a preferential advantage over other supplying countries. They also often helped remove technical and regulatory barriers to our trade. In every case, our dairy exports to countries with which we implemented free trade agreements have shown substantial, sometimes dramatic, increases.

The fact is that 96 percent of the world’s population is overseas. That population is growing faster than ours and that is where the output of our increasing dairy productivity must find a home. This means that for our farmers to continue to grow and processing companies to continue to likewise expand, overseas markets are critical.

As a producer myself, I know first-hand what this means to me and my bottom line. When our exports increase, I benefit. And when, for whatever reason, our exports are impeded or we give up market shares, the effect is ultimately felt by the farmer in the price we receive.

But it is not just dairy producers who are affected for better or worse when exports rise or fall. USDA’s Economic Research Service (ERS) estimates that each billion dollars of U.S. dairy exports generates 20,093 jobs at the milk production level and that $2.76 dollars of economic output are generated for each $1.00 of dairy exports. It is remarkable that, while for agriculture as a whole each billion dollars in exports generates 5,780 jobs, in the dairy sector each billion dollars in exports generates over three times as many jobs. Thus, the $7.1 billion that we exported in dairy products in 2014 supported more than 142,000 U.S. jobs at the production level. And according to the ERS multipliers, those exports generated nearly $19.6 billion in additional economic activity at that level.

At the manufacturing level, where the milk is turned into cheese and other processed dairy products, ERS estimates that each billion dollars of exports generates 3,150 jobs. So, our exports in 2014 supported 22,300 jobs at the manufacturing level. This, in turn, generated additional economic activity of nearly $25 billion.

Exports account for approximately 31.7 billion pounds of U.S. milk and nearly 4 billion pounds of milk solids, equating to the milk from 1.4 million cows.As global demand for dairy continues to rise, U.S. dairy exporters are meeting the challenge by making the right products with the right packaging and the right specifications for each customer. The U.S. is now the world’s leading single-country exporter of skim milk powder, cheese, whey products and lactose, thereby benefiting millions of customers in hundreds of countries around the world.

To best understand the level of importance that exports have today for the U.S. dairy industry and farmers in particular, a key barometer is the percentage of incremental milk solids going to support U.S. dairy exports. Since 2003, total U.S. milk production increased by nearly 35.7 billion lbs. Over that time, 61 percent of the increase in U.S. milk solids produced was required to supply U.S. dairy product exports. That means that more than 21.8 billion lbs of the additional milk the U.S. has produced since 2003 has been devoted to exports. At the 2014 all-milk price of $24.00/cwt, this represents nearly $5.2 billion in additional dairy farm revenue. That amount of milk also represents the amount that more than 4,800 average sized (i.e. 204 cows per farm) dairy farms would produce.

There is no doubt that exports will continue to play an increasingly important role within the U.S. dairy industry. Our future is dependent on continued growth in dairy exports.USDA’s long-term baseline projects U.S. milk production to increase to 230.4 million lbs. by 2019, which represents an increase of 24.354 million lbs. If 57% of new milk continues to supply export markets, an additional 13.882 million lbs will be used for exports. During that time period, milk production per cow is expected to increase to 24,580 pounds per cow. That means that, without growth in dairy exports, 623,676 fewer cows would be required to produce milk in the United States and 5,423 fewer average-sized farms would be needed to keep up with the supply and demand for U.S. milk. For U.S. milk producers to continue to see robust milk production growth, exports must increase in not only absolute terms, but also in relative terms because the rate of domestic consumption growth is insufficient to maintain milk production growth, as projected by USDA.

When we talk about the importance of agricultural exports, or in my case, dairy exports, it is easy to wade too deeply into statistics, and for that I apologize. It is important to also stress that the benefits of agricultural exports go not just to the farmers in your districts back home. The benefits also go to the people who sell farmers fuel, fertilizer, seed and other inputs, and to the people involved in processing, packaging, storing, transporting and marketing the farm products that end up moving overseas. And, of course, the multiplier effect goes even farther -- to the benefit of people in the communities where farmers buy goods and services, from school clothes to haircuts.

I have painted a rosy picture so far of the potential trade offers. But when it comes to trade, those who stand still fall behind. Our competitors are negotiating trade agreements all over the globe. Unfair import barriers remain in place and new ones are erected all the time. These types of challenges are detailed in our 2014 National Trade Estimate comments. They range from unjustifiable health and safety measures to certification requirements to the more recent and extremely protectionist efforts by the EU to prevent the use of common cheese names -- by misusing Geographical Indications to give its producers a lock on international markets. If we aren’t in the game actively negotiating on these issues, we’re ceding ground to our competitors and those looking to make it tougher for us to do businesses in their markets.

That’s why we need to continue to be able to use trade agreements to keep expanding export opportunities. Not one of the free trade agreements that have been so beneficial to us in the past has been implemented without some form of trade negotiating authority from Congress (TPA). Knowing that a trade agreement will be considered by Congress under such a process is what allows our negotiating partners to make their best offers on issues and products of greatest sensitivity. Inevitably, dairy and many other agricultural products fall into that category.A case in point is the Trans-Pacific Partnership (TPP) negotiations. Access to the TPP’s most protected dairy markets – Japan and Canada – is essential to us and both countries have pointed to the importance of having TPA in place as TPP talks enter their final stages on agricultural negotiations. Our negotiators have moved the ball forward on many key issues but in order to ensure that we conclude a high-standard, balanced agreement that delivers net trade benefits for the U.S. dairy industry, we need to have TPA in place.

We also see tremendous value in TPA’s ability to not only spur our trading partners to make hard decisions in the final hours of trade negotiations, but also in its ability to highlight issues that Congress deems to be of critical importance in order to direct the Administration to focus on addressing those topics. The TPA legislation introduced last year included strong new provisions instructing U.S. negotiators to tackle sanitary and phytosanitary (SPS) measures in a heightened manner and address the abuse of geographical indications to impede U.S. exports. Both of these types of nontariff barriers have posed sizable challenges to U.S. exports in fast-growing markets and we very much look forward to seeing TPA legislation introduced that retains a focus on addressing these critical issues.

In addition, TPA has given U.S. negotiators the direction to prioritize products that are subject to significantly higher tariffs in major producing countries. This prioritization is extremely important for our industry since dairy tariffs, particularly into large and developed dairy markets, are often extremely high. A case in point is Canada where dairy tariffs typically range from 200% – 300%. We want to ensure that our negotiators devote particular priority to the highest tariffs confronting U.S. agricultural exports and see TPA as a vital tool in ensuring that that appropriate focus is not lost.

All of this is why TPA is so important in order to allow us to deal with these tough issues effectively via well-negotiated trade agreements. TPA is a clear directive to the Administration about what types of agreements will be acceptable to Congress and a reassurance to our trading partners that if they make tough calls to address those problems the U.S. has identified, they can take confidence in seeing the agreement get a fair hearing by Congress.More about Pete Kappelman: Kappelman's keen interest in building a value chain for farmers has taken him to the board room of Land O’ Lakes cooperative, an USDEC member, where he has been chairman for 12 years.

With an eagerness to grow U.S. dairy exports, Kappelman has been dedicated to helping build an industry fit to compete in the global marketplace. He became involved with the U.S. Dairy Export Council as a board member and in 2011 was jointly appointed by the United States Trade Representative (USTR) and the Secretary of Agriculture to the Agricultural Policy Advisory Committee (APAC). In the interest of furthering the cause of the farmer owned system, he has also been on the board of directors of the National Milk Producers Federation (NMPF) for more than 10 years.

More about the hearing: Written testimony provided by the witnesses is linked below. Click here for more information, including Chairman Conaway's opening statement and the archived webcast.

Witness List::

Mr. Bob Stallman, President, American Farm Bureau Federation, Washington, DC

Dr. Howard Hill, President, National Pork Producers Council, Cambridge, IA

Mr. Pete Kappelman, Chairman, International Trade Committee, National Milk Producers Federation, Two Rivers, WI

Mr. Robert Guenther, Senior Vice President for Public Policy, United Fresh Produce Association, Washington, DC

The U.S. Dairy Export Council is primarily supported by Dairy Management Inc. through the dairy farmer checkoff that builds on collaborative industry partnerships with processors, trading companies and others to build global demand for U.S. dairy products.

For another example of how U.S. dairy exports help dairy families, watch this video:

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (67)

- Africa (6)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (20)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (9)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farmer leaders (1)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Future trends (1)

- Geographical Indications (GIs) (10)

- Global Marketing (86)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (271)

- Member Services (17)

- Mexico (41)

- Middle East (9)

- Middle East & North Africa (3)

- Middle East/North Africa (9)

- Milk (4)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (19)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (329)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (26)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- April 2015 (11)

- December 2015 (11)

- March 2014 (10)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- January 2026 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- April 2024 (2)

- June 2024 (2)

- July 2024 (2)

- November 2024 (2)

- December 2024 (2)

- February 2025 (2)

- June 2025 (2)

- July 2025 (2)

- September 2025 (2)

- November 2025 (2)

- December 2025 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- May 2024 (1)

- August 2024 (1)

- September 2024 (1)

- October 2024 (1)

- January 2025 (1)

- March 2025 (1)

- April 2025 (1)

- May 2025 (1)

- August 2025 (1)

- February 2026 (1)

- USDEC (183)

- USDEC Staff (167)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Nick Gardner (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Krysta Harden, USDEC President and CEO (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Becky Nyman (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Erica Louder (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

.png)