-

Cheese rebounds in November, but overall U.S. dairy export volume declines

By USDEC Staff January 10, 2024- Tweet

Mixed results mark another challenging month.

U.S. cheese suppliers had their best November ever, shipping 38,610 MT—a 4% increase over the previous year. However, the cheese category’s improvement—plus ongoing growth in high-protein whey exports (WPC80+)—were insufficient to offset declines in almost all other product categories.

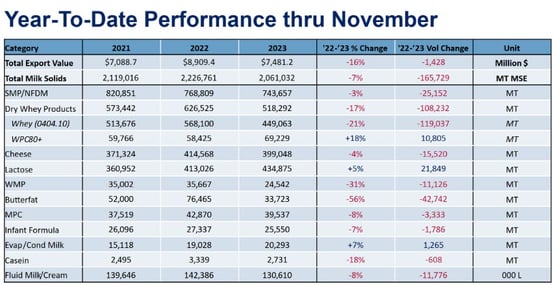

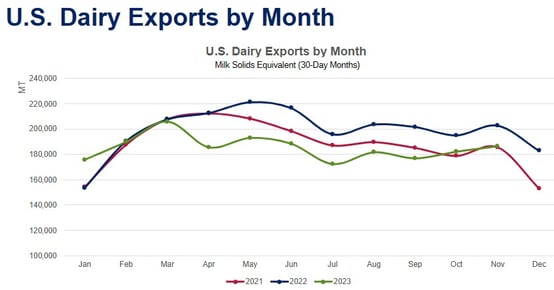

Year-over-year (YOY) U.S. dairy exports fell 8.1% in milk solids equivalent (MSE) terms in November and were down 7.4% year to date (YTD). Even as U.S. exports of high-value products like cheese and whey proteins grew, lower commodity prices pushed U.S. dairy export value down 21% to $631 million in November, putting overall value down 16% YTD (to $7.481 billion) with one month to go. Effectively, even as the declines are moderating and performance is improving, U.S. dairy exports are still trailing the highs of 2022 both on a volume and value basis.

For more detailed information, as well as interactive charts and data, visit USDEC's Data Hub

With tepid global economic growth and inflationary forces still holding sway in key markets, a broad and sustained demand rebound remains elusive.

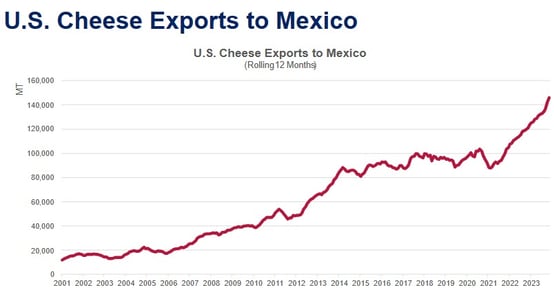

Global cheese demand, however, is showing some green shoots. As we wrote in our International Demand Analysis, global cheese trade (all suppliers) appeared to turn a corner in October, jumping 12% vs. the previous year. That modest improvement in demand combined with competitive prices boosted U.S. cheese exporters in November. U.S. shipments to Mexico soared 42% (+4,370 MT) for the month and have already exceeded the annual record with a full month of data to go. U.S. exports to Central America grew 16% (+565 MT) while volume to the Caribbean rose 14% (+276 MT). Shipments to China grew nearly five-fold (+1,290 MT). (For more details on cheese, see below.)

Similarly, WPC80+ exports jumped 37% (+1,960 MT) as global demand there too seems to be improving. It was a down month for Japan, the No. 1 U.S. market, but shipments to China more than doubled (+920 MT), volume to Brazil nearly tripled (+756 MT) and India came out of nowhere, buying 761 MT (up from only 47 MT in November 2022). YTD U.S. WPC80+ exports grew 18% (+10,805 MT) and, once December numbers come out, will most certainly top 70,000 MT in a year for the first time.

Unfortunately, that is where most of the positive story ends. Skim milk powder/nonfat dry milk (SMP/NFDM) exports slipped 5% (-3.333 MT). Shipments to Mexico declined 5% (-1,988 MT) in November, extenuating the recent downturn as sales have fallen 9% (-9,240 MT) over past three months. U.S. volume in November was a healthy 34,576 MT, but U.S. suppliers continue to find it challenging to duplicate Mexico’s elevated SMP/NFDM appetite in the later part of 2022.

And in what has become a familiar refrain, China continues to undercut U.S. low protein whey (0404.10) export volumes. Total U.S. 0404.10 exports fell 14% (-6,892 MT) in November compared to the prior year with declining U.S. whey shipments to China (not including WPC80+) the primary culprit (-25%, -7,114 MT).

Gratefully, we are seeing positive signs from Southeast Asia for the first time in over a year as both SMP/NFDM shipments and low-protein whey sales grew—potentially signaling the market has found a floor. The region’s growth is not particularly robust yet, but stabilization is welcome news, nonetheless.

Cheese exports impress in November

Robust cheese shipments in November helped to brighten up an otherwise mostly dreary month of U.S. export data. YOY cheese exports rose 4% in November to 38,610 MT. Not only was this the largest volume since March of this year, but it also represented a record large volume of cheese exports for the month.

Seemingly insatiable demand from Mexico underpinned the increase in November and, more broadly, has played a key role in supporting U.S. cheese exports in recent months. U.S. suppliers shipped 14,715 MT of cheese to Mexico in November, the largest volume ever moved in any month. With just one month of data outstanding in 2023, YTD cheese exports to Mexico are up 21% (+25,071 MT) compared to the same period in 2022.

Building on the trend seen in earlier months, the bulk of the increase in cheese exports to Mexico can be traced back to shredded cheese. November exports of shredded cheese to Mexico were four times greater than in the same month last year (+4,808 MT). The vibrant Mexican economy has been a key story of 2023, and the increase in shredded cheese exports is presumably a testament to increased demand for shredded mozzarella through foodservice and hospitality channels.

Mexico is not the only region that saw cheese exports rise in November, however. U.S. cheese exports to China in November were almost 3.5 times greater than in the same month last year (+1,257 MT) with shredded cheese again accounting for most of the gain. Cheese exports to Canada were up by 263 MT while Central America and the Caribbean added 15% (+841 MT)

The increase in shredded cheese exports continues to grab headlines, but another key category also saw growth. Fresh cheese exports were up 10% (+791 MT), suggesting that U.S. cream cheese and fresh mozzarella are also garnering favor with buyers abroad. Fresh cheese growth was most prominent in the Western Hemisphere, with Central America and the Caribbean seeing the largest absolute gain (+584 MT) while Canada, Mexico and South America contributed more moderately to the total.

Though the improvement in cheese exports is welcome news, shipments are still digging themselves out of a big hole with year-to-date exports down 4% during the first 11 months of the year. But as lower domestic cheese prices render U.S. product more competitive relative to other global suppliers, there should be some sustained impulsion behind exports … assuming demand can remain at least at current levels.

Other relevant data points from October’s trade data:

- U.S. lactose exports fell 7% (-2,848 MT) in November. It’s been an up-and-down year for lactose after a tremendous first quarter that saw U.S. suppliers lift volume 27% (+24,585 MT). From April through November, however, YOY U.S. lactose shipments fell 1% (-2,736 MT). Heavy purchasing from New Zealand, Southeast Asia and Japan evaporated as the year went on, fortunately offset by ongoing volume growth to China (YTD +24%. +24,138), Mexico (YTD +18%, +5,431 MT), India (YTD +141%, +5,450 MT) and Brazil (YTD +67%, +3,835 MT).

- U.S. fluid milk and cream sales have been on something of a roll for the past three months with YOY volume up 12% (+3.6 million liters). YOY November volume increased 13% (+1.3 million liters). Increased sales to Canada (+29% September-November) and Mexico (+20%) have led the rebound. YTD U.S. fluid milk and cream exports were still down 8% (-11,422 million liters), but the gap has been shrinking.

- On a geographic basis, Mexico continued to be the standout market for U.S. suppliers in 2023 in November. Despite the aforementioned decline in SMP/NFDM exports in November, Mexico led all regions in volume gain, with November U.S. dairy exports rising 4,434 MT (all major products, not including fluid). A surprising No. 2 on the November list was India (+2,116 MT), buoyed by WPC80+ and lactose. The Philippines (+1,406 MT) and Thailand (+1,033 MT) came in at Nos. 3 and 4, respectively.

Learn more about global dairy markets:- U.S. dairy exports fall 7% in October

- U.S. export performance mixed in September

-

Global headwinds hamper U.S. dairy exports again in August

Subscribe to the U.S. Dairy Exporter Blog

The U.S. Dairy Export Council fosters collaborative industry partnerships with processors, trading companies and others to enhance global demand for U.S. dairy products and ingredients. USDEC is primarily supported by Dairy Management Inc. through the dairy farmer checkoff. How to republish this post.

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (67)

- Africa (6)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (20)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (9)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farmer leaders (1)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Future trends (1)

- Geographical Indications (GIs) (10)

- Global Marketing (86)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (271)

- Member Services (17)

- Mexico (41)

- Middle East (9)

- Middle East & North Africa (3)

- Middle East/North Africa (9)

- Milk (4)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (19)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (329)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (26)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- April 2015 (11)

- December 2015 (11)

- March 2014 (10)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- January 2026 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- April 2024 (2)

- June 2024 (2)

- July 2024 (2)

- November 2024 (2)

- December 2024 (2)

- February 2025 (2)

- June 2025 (2)

- July 2025 (2)

- September 2025 (2)

- November 2025 (2)

- December 2025 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- May 2024 (1)

- August 2024 (1)

- September 2024 (1)

- October 2024 (1)

- January 2025 (1)

- March 2025 (1)

- April 2025 (1)

- May 2025 (1)

- August 2025 (1)

- February 2026 (1)

- USDEC (183)

- USDEC Staff (167)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Nick Gardner (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Krysta Harden, USDEC President and CEO (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Becky Nyman (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Erica Louder (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

.png)