-

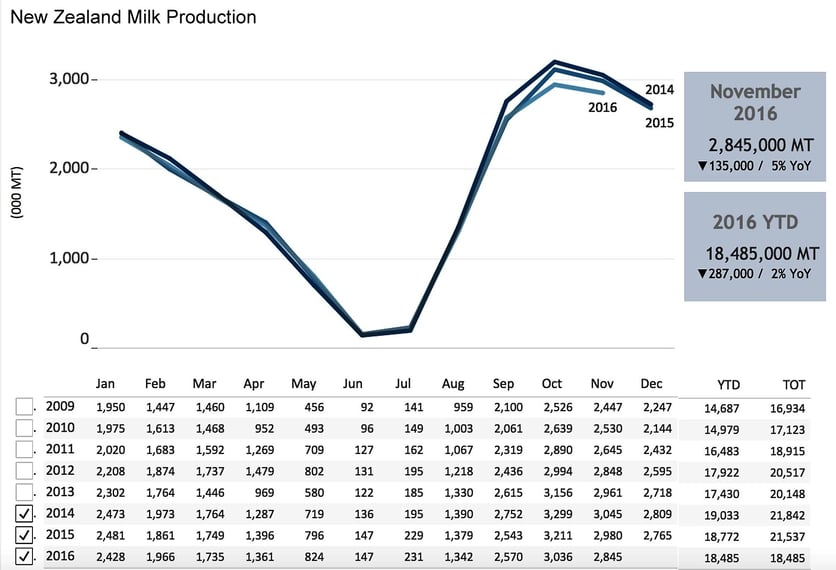

CHART: New Zealand Milk Output Down

By USDEC Staff January 25, 2017- Tweet

New Zealand won't be posting a milk gain for its current production year, but the decline may be significantly less than many believe.

Extremely wet weather on the North Island and a cautious approach from farmers after two years of belt-tightening contributed to a 3 percent decline in New Zealand milk output over the first half of the 2016/17 year starting June 1. For October-November (the height of the Southern Hemisphere spring flush), milk collection fell 5 percent from the same period in 2015.

Interactive charts: Go to our market information section, where you can drill down interactively for granular data based on specific dates, exporters and more. Charts like the one shown above can be created in the trade flows section.

Analysts currently project up to a 7 percent decline in New Zealand milk for the full 2016/17 season. But given market conditions and New Zealand production history, USDEC estimates a decline closer to 3 percent.

Wet weather in the New Zealand spring certainly eroded North Island output, and now some parts of the island are facing potential drought. However, pasture conditions are improved across most of the country compared to three months ago—North and South Island alike. And South Island output for the June-November period was already outperforming the weather-challenged north.

After two-years of deficit operations with farmgate prices well below break-even levels, New Zealand raw milk prices are once again supportive of growth. Payout estimates moved into the black in the back half of 2016 and are likely to remain there for the remainder of the 2016/17 year.

We are seeing a general softening in the pessimistic outlook. Fonterra Co-operative Group, the nation’s No. 1 dairy company, collecting more than 80 percent of New Zealand milk, recently adjusted its full-season milk production estimate from -6 percent to -4 percent.

And New Zealand milk production forecasts historically lean to the conservative side, sometimes dubiously so. For instance, four months into the nation’s 2015/16 year (June-May), for example, Fonterra and industry analysts were cautioning about a decline of 6 percent that year, based on low farmgate milk prices and El Niño-related weather concerns. Those projections were arguably a driving force behind the short-lived commodity price upswing in the fall of 2015. When the dust settled at the end of the New Zealand production year on May 31, 2016, milk output had fallen only 1.6 percent.

A similar episode occurred this season. Commodity prices rallied last fall in concert with falling Kiwi production forecasts.

New Zealand won't be posting milk gains for 2016/17, but the fall may not be as much as many believe.

Editor's note: This analysis is based on data available on January 24.

Learn more about global dairy markets:

- January's Dairy Data Dashboard

- December's Dairy Data Dashboard

- U.S. Dairy Exports Led by Ingredient Sales to Asia

- CHART: Cheese Trade Volumes Quietly Climb

- November's Dairy Data Dashboard

- Milk Powder, Whey Products Highlight September Trade Data

- Chart: Global Milk Supply Tightens, For Now

Subscribe to the U.S. Dairy Exporter Blog

The U.S. Dairy Export Council fosters collaborative industry partnerships with processors, trading companies and others to enhance global demand for U.S. dairy products and ingredients. USDEC is primarily supported by Dairy Management Inc. through the dairy farmer checkoff. How to republish this post.

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (67)

- Africa (6)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (20)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (9)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farmer leaders (1)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Future trends (1)

- Geographical Indications (GIs) (10)

- Global Marketing (86)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (271)

- Member Services (17)

- Mexico (41)

- Middle East (9)

- Middle East & North Africa (3)

- Middle East/North Africa (9)

- Milk (4)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (19)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (329)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (26)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- April 2015 (11)

- December 2015 (11)

- March 2014 (10)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- January 2026 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- April 2024 (2)

- June 2024 (2)

- July 2024 (2)

- November 2024 (2)

- December 2024 (2)

- February 2025 (2)

- June 2025 (2)

- July 2025 (2)

- September 2025 (2)

- November 2025 (2)

- December 2025 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- May 2024 (1)

- August 2024 (1)

- September 2024 (1)

- October 2024 (1)

- January 2025 (1)

- March 2025 (1)

- April 2025 (1)

- May 2025 (1)

- August 2025 (1)

- February 2026 (1)

- USDEC (183)

- USDEC Staff (167)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Nick Gardner (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Krysta Harden, USDEC President and CEO (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Becky Nyman (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Erica Louder (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

.png)

.png?width=836&height=490&name=Chart1%20(2).png)