-

U.S. Dairy Exports Lower for the Fourth Straight Month

By Alan Levitt October 7, 2015- Tweet

Lighter shipments of cheese and whey were a drag on overall volume.

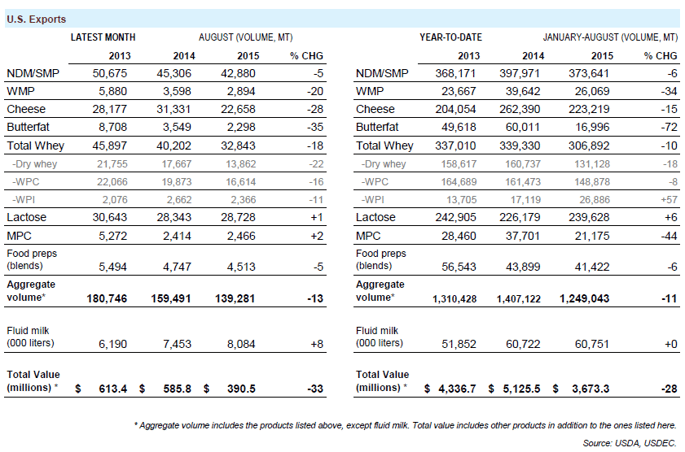

U.S. exports of cheese and whey products were at or near multi-year lows in August, pulling overall volumes down for the fourth straight month. Suppliers shipped 139,281 tons of milk powders, cheese, butterfat, whey and lactose in August, down 13 percent from a year ago and down 6 percent from July. Total overseas sales were valued at $390 million, down 33 percent from last year and down 6 percent from July. Export value was the lowest since February 2011 (on a daily-average basis).

Cheese exports fell for the fifth straight month, dropping to 22,658 tons. This figure is down 28 percent from last year, and marks the lowest total in 31 months. Sales to every major customer were below a year ago, with a notable decline (-59 percent) in exports to Japan. Year-to-date exports to Japan were down 39 percent from last year. Shipments to South Korea also have slowed. In the May-August period, U.S. exports to South Korea were down 37 percent.

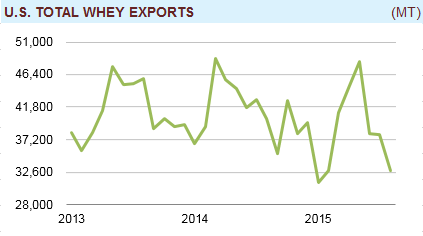

With very weak global whey markets, U.S. whey exports continued trending lower as well. Total whey export volume was just 32,843 tons, down 18 percent from last August and the second-lowest figure in the last five years (daily-average basis). Dry whey exports were off 22 percent; whey protein concentrate (WPC) exports were down 16 percent and whey protein isolate (WPI) exports were down 11 percent from year-ago levels. Overall whey sales to China were down 39 percent from last year, with dry whey exports of just 2,087 tons, the lowest since May 2008. Meanwhile, shipments of WPI to China slowed to just 277 tons/month tons in the June-August period after averaging 2,211 tons per month in the first five months of the year.

Exports of nonfat dry milk/skim milk powder (NDM/SMP) held up better in August. Suppliers moved 42,880 tons, slightly more than July, but still down 6 percent from a year ago. Sales to Mexico (+12 percent) and Southeast Asia (+8 percent) were above year-ago levels, but volumes to China and Middle East/North Africa were lower. In the first eight months of the year, U.S. suppliers sold a record 18,736 tons to Pakistan (+526 percent), making it their 6th largest customer.

Among other products, exports of butterfat (-35 percent year-over-year) and whole milk powder (-20 percent) continue to lag. In August, more than two-thirds of butterfat exports went to Saudi Arabia.

Exports of lactose (+2 percent) and milk protein concentrate (+1 percent) in August were about the same as a year ago.

Fluid milk sales in August were up 8 percent from last year, led by record sales to Taiwan. Taiwan has been the number-three single overseas customer for U.S. milk this year, with year-to-date purchases up 87 percent.

To use interactive charts with current and historical trade data, see usdec.org's page on U.S. export data.

To download a printable pdf summary of the August trade data, click here.

Subscribe to the U.S. Dairy Exporter Blog

The U.S. Dairy Export Council fosters collaborative industry partnerships with processors, trading companies and others to enhance global demand for U.S. dairy products and ingredients. USDEC is primarily supported by Dairy Management Inc. through the dairy farmer checkoff.

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (65)

- Africa (6)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (18)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (9)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farmer leaders (1)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Future trends (1)

- Geographical Indications (GIs) (10)

- Global Marketing (86)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (263)

- Member Services (17)

- Mexico (41)

- Middle East (9)

- Middle East & North Africa (3)

- Middle East/North Africa (9)

- Milk (4)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (18)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (321)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (25)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- April 2015 (11)

- December 2015 (11)

- March 2014 (10)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- April 2024 (2)

- June 2024 (2)

- July 2024 (2)

- November 2024 (2)

- December 2024 (2)

- February 2025 (2)

- June 2025 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- May 2024 (1)

- August 2024 (1)

- September 2024 (1)

- October 2024 (1)

- January 2025 (1)

- March 2025 (1)

- April 2025 (1)

- May 2025 (1)

- USDEC (183)

- USDEC Staff (156)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Nick Gardner (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Becky Nyman (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Erica Louder (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

- Krysta Harden, USDEC President and CEO (1)

.png)