-

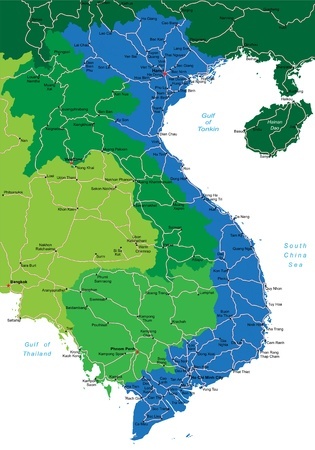

Stepping Up in Vietnam

By USDEC Staff June 10, 2014- Tweet

In 2013, the value of U.S. dairy exports to Vietnam grew 72 percent compared to 2012.

In 2013, the value of U.S. dairy exports to Vietnam grew 72 percent compared to 2012. Last year could not have been much better for U.S. dairy suppliers in Vietnam. U.S. dairy export value grew 72 percent to $240 million compared to 2012. The United States held dominant positions in three of four key ingredient markets, with a 66 percent share of lactose imports, 59 percent of SMP imports and 54 percent of whey protein imports.

“We have not only built strong positions, we have clear opportunities for future growth,” says Ross Christieson, USDEC senior vice president, market research and analysis, who guided a USDEC country analysis of Vietnam earlier this year.

Indeed, demand trends are in the United States’ favor. Analysts project 5-percent-plus annual economic growth in Vietnam through 2018. The World Bank estimates education and plentiful jobs will continue to draw rural dwellers to cities, expanding the nation’s middle class and exposing millions to dairy products at modern retail and foodservice outlets.

The national government is aggressively pushing dairy consumption as part of its National Nutrition Program (set to run through 2020), and the messages are getting through.

“People are more aware of the benefits of dairy products than ever before—not only the young generation but the senior consumer as well,” says Phuong Dang, USDEC Vietnam office representative. “Milk, cheese and dairy equal calcium and good nutrition in the minds of consumers.”

Food industry blossoms

Concurrently, the country’s food and dairy industries are booming. Baked goods, biscuits, chocolate confectionery, yogurt, infant formula and recombined milk—all significant users of milk powder, whey and/or lactose— are growing anywhere from 15-25 percent annually.

Foodservice, the biggest user of imported cheese, is expanding annually at double-digit rates as well, fueled by rising incomes and a fast-growing middle class enamored with Western culture.

Growth is creating opportunities, but U.S. suppliers face challenges similar to those faced in other emerging markets. Buyers question U.S. commitment, citing some suppliers’ inability to meet tight SMP specifications and ingredient packaging that is easily torn.

“Some buyers have had difficulties with powders caking because of high heat and humidity, and some U.S. suppliers have responded poorly,” says Christieson. “Some buyers believe U.S. suppliers see the country as a place to unload ingredients of inconsistent quality.”

On the cheese side, many local buyers are simply unaware of U.S. cheese, and the United States is penalized for being late to the market.

“The EU, New Zealand and Australia have been in the market a long time and have set the benchmark for local perceptions,” says Dang. “So people who do know that the United States makes cheese, often say things like, ‘Your mozzarella is too white.’”

“The solution is reliable communication and customer care,” says Dang. “Visit the market, maintain business relationships, respond promptly to questions or requests, expand your product portfolio, pay attention to quality concerns, and provide technical support. Never assume Vietnamese importers and distributors are familiar with product specifications, applications, handling and storage.”

The government has ambitious plans to raise domestic milk production levels, but that shouldn’t deter imports.

Says Dang, “Production will grow, but demand will also grow and grow more quickly.”

(This article first appeared in the June 2014 edition of Export Profile.)

Image copyright: 123RF Stock Photo

The U.S. Dairy Export Council is primarily supported by Dairy Management Inc. through the dairy farmer checkoff that builds on collaborative industry partnerships with processors, trading companies and others to build global demand for U.S. dairy products.

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (65)

- Africa (5)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (16)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (8)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Geographical Indications (GIs) (10)

- Global Marketing (87)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (248)

- Member Services (17)

- Mexico (40)

- Middle East (10)

- Middle East & North Africa (3)

- Middle East/North Africa (10)

- Milk (3)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (17)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (306)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (25)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- March 2014 (11)

- April 2015 (11)

- December 2015 (11)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- April 2024 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- USDEC (183)

- USDEC Staff (140)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Nick Gardner (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

.png)