-

Global Dairy Markets May not Fully Rebound Until 2017

By Alan Levitt December 2, 2015- Tweet

USDEC’s Global Outlook Webinar suggests a return to a sellers’ market might still be a long ways off.

It’s been a tough year for global dairy markets. The pendulum that swings between supply and demand swung way too high to the supply side and now appears to be defying gravity. While we know it will swing back, its force and timing remain unclear.

“What we have today is most likely what we will have for 2016—a market looking for equilibrium, an equilibrium that is sustainable for the entire supply chain,” noted Marc Beck, USDEC executive vice president, strategy and insights, at USDEC’s Global Market Outlook webinar yesterday. “It may be 2017 before we return to a scenario where supply and demand are more closely aligned."

As noted during the webinar, clues to the future can be found in the past. The following four charts show how the imbalance came about and offer insight into what’s needed to reach that equilibrium.

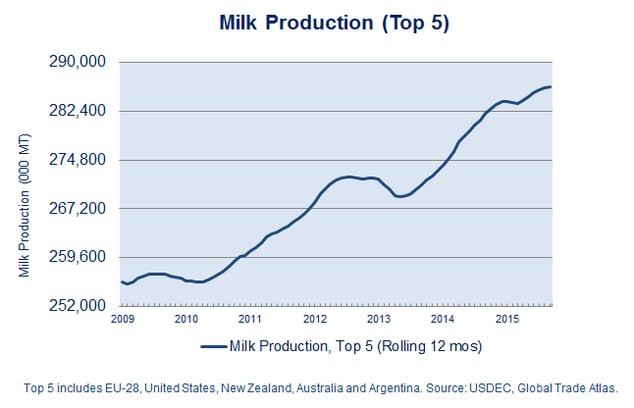

Over the past five years, aggregate milk production from the top 5 global dairy suppliers—the European Union (EU), New Zealand, the United States, Australia and Argentina—grew nearly 2 percent annually. That equates to an additional 5 million tons of milk per year.

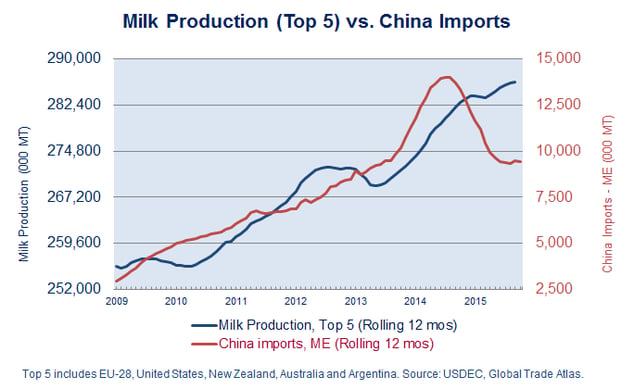

For most of that time, seemingly unrelenting demand growth—driven primarily by China—fueled those production gains and absorbed the additional product. But in late summer 2014, demand growth abruptly evaporated, and a boom in Chinese purchasing that began in 2013 proved to be a bubble.

When you overlay the 12-month rolling average of China imports (milk equivalent) on top of milk output growth from the top 5 suppliers, the problem becomes clear.

Then if you combine Russia’s import numbers with China’s, the contrast grows even starker. From boom to bust, China and Russia imports were slashed nearly in half—a drop of 8 million tons, milk equivalent, that simply vanished from global dairy demand. For context, that loss represents more than 10 percent of total world dairy trade.

And while global milk production is slowing, suppliers are still pushing a quantity to match the boom import levels of 2014, import demand that isn’t there anymore. In fact, the top five suppliers are still producing about half-a-million tons more milk per month today than they were in July 2014, before the market crashed.

Other nations have helped relieve some of the pressure. In the first half of the year, world imports not counting China and Russia grew more than 10 percent vs. last year. However, even a healthy 10 percent increase isn’t nearly enough to fill the huge hole left by China and Russia.

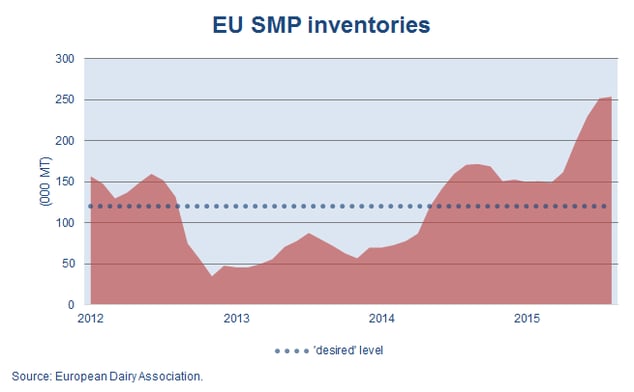

Much of that excess production has accumulated in inventories. EU SMP and cheese stocks are at their highest levels in at least five years. U.S. commercial milk powder stocks hit record highs this summer.

Taking advantage of favorable pricing, buyers have filled their pipelines. Many have bought forward well into 2016 and may not need to buy too heavily in the months ahead.

USDEC estimates there currently could be 400,000 tons of excess milk powder inventory in suppliers’ hands and throughout buyers’ inventory pipelines.

“Inventory is really going to play a big role in 2016,” says Beck. “Even when supply syncs with demand, heavy inventories hanging over the market will delay a true market rebalancing.”

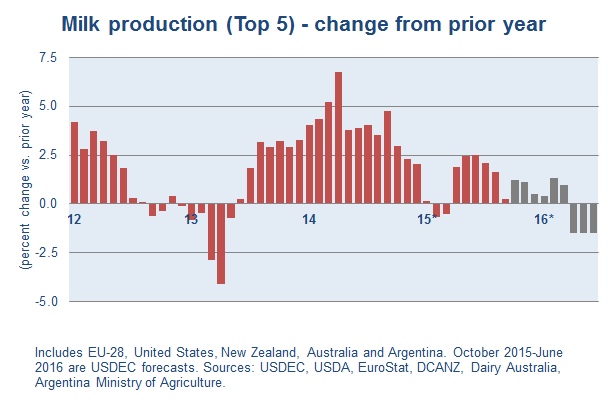

Getting supply to sync with demand is a task in itself. Global milk production has not pulled back quickly enough to account for the drop in demand.

After a small decline in milk output from the top 5 suppliers in the first quarter of 2015, milk production grew 2.1 percent over the April-August period. The EU—led by Ireland and the Netherlands—has been the biggest contributor to growth.

“New Zealand farmers have pulled back, and U.S. and Australian output is flattening. But we still need to see EU supply retract, and that is not likely to happen until the second quarter of 2016,” says Beck.

China milk production (not included on the chart above) is playing a role in China’s reduced import demand as well. USDEC estimates Chinese milk production rose 10 percent over the past two years. That represents another 3 million tons of milk, most of which went into whole milk powder, stoking those aforementioned inventory levels. China has worked through much of its inventory in the past few months, but we expect Chinese milk production to continue to grow.

“There are three basic keys here to strengthening global dairy markets: a pullback in milk production, destocking and demand expansion,” says Beck. “Economic growth projections suggest we will not get a huge demand lift in the near future, so the bottom line is that 2016 appears poised to be a year of gradual rebalancing and destocking, setting the stage for tighter market conditions in 2017 and carrying over into 2018.”

This relatively bearish outlook isn’t meant to dissuade or discourage U.S. exporters, Beck noted.

“We’ve talked a lot about the loss of China and Russia imports, but for the United States, the reality is that we didn’t actually lose any sales to Russia—we weren’t selling to them anyway—and China makes up less than 10 percent of our overall exports, and our volume sales there are off only about 10 percent this year. So unlike New Zealand and Europe, we haven’t directly lost much volume from those two markets.

“The real issue for us is that the competitive playing field has changed. There’s just a lot more European and Oceania product on the market right now that we have to compete with. The good news is that the rest of the world continues to buy and consume dairy. That isn’t going to change. But U.S. exporters really have to gear up for much more competition than they’ve seen in the past.”

Watch the full webinar: The archived version of the USDEC Global Market Outlook is now available for viewing online. If you are registered already, you may view the recording by logging in with your email address here. If you did not register, you can still do so, and then watch the recording. Follow this link.

Learn more: These and numerous other articles on market conditions have appeared in the U.S. Dairy Exporter Blog:

- Three Pieces of a Global Dairy Turnaround

- What Will It Take to Turn Dairy Markets Around?

- Global Dairy Market Rally Runs Out of Steam

Subscribe to the U.S. Dairy Exporter Blog

The U.S. Dairy Export Council fosters collaborative industry partnerships with processors, trading companies and others to enhance global demand for U.S. dairy products and ingredients. USDEC is primarily supported by Dairy Management Inc. through the dairy farmer checkoff. How to republish this post.

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (65)

- Africa (6)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (17)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (8)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Geographical Indications (GIs) (10)

- Global Marketing (86)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (254)

- Member Services (17)

- Mexico (40)

- Middle East (9)

- Middle East & North Africa (3)

- Middle East/North Africa (9)

- Milk (4)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (18)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (312)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (25)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- April 2015 (11)

- December 2015 (11)

- March 2014 (10)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- April 2024 (2)

- June 2024 (2)

- July 2024 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- May 2024 (1)

- August 2024 (1)

- September 2024 (1)

- October 2024 (1)

- USDEC (183)

- USDEC Staff (146)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Nick Gardner (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

- Krysta Harden, USDEC President and CEO (1)

.png)