-

Global Dairy Market Rally Runs Out of Steam

By Alan Levitt November 5, 2015- Tweet

Necessary supply corrections have yet to materialize.

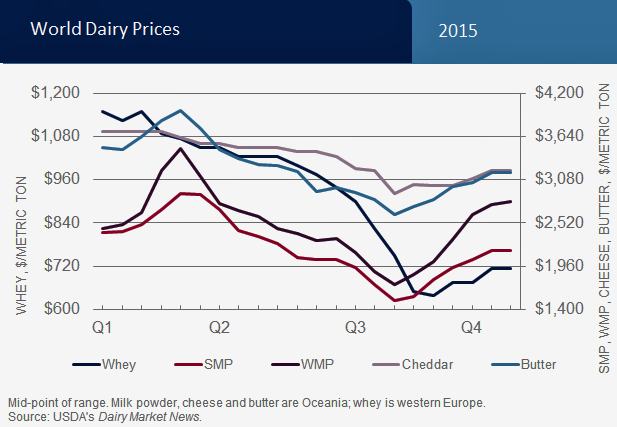

Global markets rallied in August and September, as fears of supply shortages out of New Zealand brought buyers off the sidelines to re-stock their cupboards at bargain-basement prices. After slumping to levels unseen in more than a decade, world benchmark milk powder prices increased 40-60 percent from their summer lows. But as USDEC forecast earlier, the rally has proven to be more of a correction from prices that went too low this summer rather than a sustained recovery, according to USDEC’s new issue of Global Dairy Market Outlook (pdf download). Prices remain well below long-term averages and in recent weeks they’ve pulled back again in the face of an oversupplied, buyers’ market.

In this competitive environment, U.S. dairy exports are lagging in 2015 (pdf download) In the first three quarters of 2015, U.S. shipments are down 27 percent by value and 9 percent by volume vs. the prior year.

The key factors necessary to deliver better market balance—production contraction, inventory reduction, China buying—have yet to materialize.

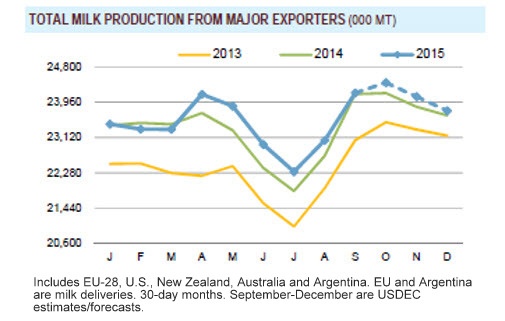

From April to August, milk production from the top five exporters (EU-28, United States, New Zealand, Australia and Argentina) was up 2.1 percent vs. the prior year—nearly 500,000 tons of additional milk per month. September production, on the other hand, is estimated to be up only fractionally, but it will take many more months of flat or declining output to rebalance the market.

In the third quarter, milk deliveries in Ireland and the Netherlands were up 14 percent and 10 percent, respectively. This more than offset a 4 percent decline in production in New Zealand. Australia milk production this year is up 8.3 percent from two years ago, but output was up less than 1 percent in September, as hot, dry weather is impacting productivity.

We expect production from the Top 5 to be up about 1 percent in Q4 and Q1-2016, then retreat to -1 percent in Q2-2016 as lower farm-gate margins continue to bite.

Heavy milk powder stocks throughout the world will continue to be a drag until they’re worked through. In Europe, offers to invention have wound down, but industry SMP inventories are estimated to be about 275,000 tons, double the desired level. In addition, more than 100,000 tons of butter and cheese are still sitting in PSA. In the United States, commercial inventories of NDM, cheese and butter this summer were about 100,000 tons more than the usual summer peak. New Zealand suppliers are believed to have inventory scattered in various places: in local warehouses, in markets, with distributors, in subsidiary offices all over the globe. And pipelines are quite full in China and other importing markets.

China imports have leveled off, and were actually above year-ago levels in many categories in September, including record purchases of fluid milk and infant formula. But last year’s imports were severely depressed, and critical milk powder purchases are typically the lightest in Q3, so September imports aren’t necessarily indicative of a shift in the prevailing trend.

Under the China-New Zealand FTA, China can import about 140,000 mt of WMP under preferential duty (2.5 percent tariff vs. normal 10 percent tariff) in 2016. Typically orders pick up in November and December to capitalize on these rates.

In the first half of the year, global dairy trade, excluding China and Russia, was up more than 10 percent. Key importers, including Mexico, Japan, Malaysia, Egypt and the Philippines have all posted double-digit growth in 2015. Venezuela hasn’t published official import numbers, but WMP exports to Venezuela from major suppliers were up 42 percent in the first three quarters of the year.

As impressive as these figures are, it appears most users stocked up on historically low prices and are now well covered into 2016. Therefore, there is less need to buy aggressively.

Among key suppliers, the EU and Australia have been the most aggressive in recent months. In the June-August period, EU exports of milk powder, cheese, butterfat and whey were up 10 percent. Australia exports were up 17 percent, while New Zealand exports were flat and the United States was down 20 percent.

We maintain our view that the global markets, particularly for milk powder and whey-based ingredients, will not move into better balance before the middle of next year. At the closely watched GDT auction on Nov. 3, prices decreased for the second straight time, after gaining 56 percent in the previous four events. As a signal of current market sentiment, WMP averaged $2453/ton and SMP averaged $2018/ton. NZX futures for WMP average $2400/ton for H1-2016.

Buyers’ pipelines are well filled and they have little urgency to bid prices higher. De-stocking must take place, and we expect that to be a gradual process. We look for prices to roll back further in the months ahead and stay relatively depressed, with some periodic fluctuations reflecting market uncertainty and strategic buying.

Subscribe to the U.S. Dairy Exporter Blog

The U.S. Dairy Export Council fosters collaborative industry partnerships with processors, trading companies and others to enhance global demand for U.S. dairy products and ingredients. USDEC is primarily supported by Dairy Management Inc. through the dairy farmer checkoff.

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (65)

- Africa (5)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (16)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (8)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Geographical Indications (GIs) (10)

- Global Marketing (87)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (247)

- Member Services (17)

- Mexico (40)

- Middle East (10)

- Middle East & North Africa (3)

- Middle East/North Africa (10)

- Milk (3)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (17)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (305)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (25)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- March 2014 (11)

- April 2015 (11)

- December 2015 (11)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- April 2024 (1)

- Mark O'Keefe (183)

- USDEC Staff (139)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Nick Gardner (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

.png)