-

U.S. Exports to Chile, Colombia and Peru Surge

By USDEC Staff September 10, 2015- Tweet

Four factors have helped increase U.S. sales 17 to 34% the first half of this year, with more growth projected as South America's foodservice sector drives demand for cheese.

Colombia, Peru and Chile.

That triad along South America’s western coast each accomplished something this year that few other nations have managed: Each increased its purchases of U.S. dairy products.

In fact, not only did they buy more U.S. dairy, they did it with gusto (with dollar sales rising 17-34 percent) in a very challenging market environment.

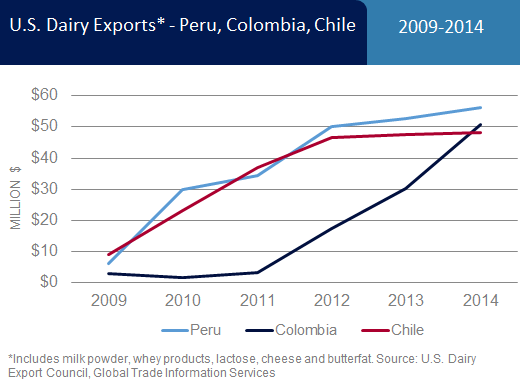

"This year’s gains come on top of fairly steady U.S. growth over the past five years and attest to U.S. competitiveness in those markets,” says Cesar Leiva, USDEC South America office representative. “Given each country’s relatively low per capita dairy consumption, favorable economic growth forecasts and—in Peru and Colombia—deficit milk production, we believe U.S. suppliers can sustain growth.”

In terms of dairy import needs, the three countries are similar in some ways but distinct in others. All three are price-sensitive buyers, so low international dairy commodity prices have helped drive overall dairy purchasing this year.

“Peru is the biggest in terms of milk deficit, and every year the difference between production and demand grows larger,” says Leiva. “In Colombia, although milk production is growing, rising land and input costs will moderate any gains and increase the deficit there as well.”

Colombia holds some of the best potential for U.S. export growth, as USDEC explored in a 2014 report on the nation’s cheese and ingredient sectors. With just under 50 million inhabitants, it is the second most populous nation on the continent. It boasts a highly urbanized, young-skewing demographic—both positive factors for increased dairy consumption. And its economy appears to be on a path to sustainable growth.

Its food industry is expanding to meet demand, creating opportunities for both dairy ingredients (milk protein, whey, lactose and milk powder in dairy, confectionery, bakery and meat processing) and finished products (cheese in pizza making).

The evolution of all three countries suggests rising demand for protein, particularly as food and beverage manufacturers expand their knowledge base for whey proteins and milk protein concentrate.

All three countries also promise solid growth in cheese demand due to double-digit expansion in the foodservice sector—burger chains, pizza restaurants, sandwich shops, and crepe and ice cream chains.

More growth, in other words, is in the cards. At least four factors bolster U.S. positioning in the markets.

- Proximity. U.S. suppliers can deliver product with less lead-time than suppliers from Europe, Oceania or even nearby dairy exporters like Argentina and Uruguay due to the land barrier created by the Andes.

- Product options. The expanded U.S. portfolio is bolstering U.S. opportunity in categories where the United States had not previously played. For example, U.S. whole milk powder (WMP) exports to Chile, Colombia and Peru grew 38 percent in the first half of 2015 after easily setting a record (4,152 tons) in 2014.

- Free trade agreements (FTAs). The European Union (EU) has free trade deals with all three nations and New Zealand has one with Chile, but U.S. FTAs preceded those agreements and have helped U.S. suppliers remain competitive.

- Market commitment. “We’ve seen some U.S. suppliers develop the U.S. brand, demonstrating their long-term interest in the market and building trust, which has opened doors to other brands,” says Leiva. “How much further U.S. dairy exports grow in the three nations is somewhat dependent on the interest of U.S. suppliers to protect the market and their brands.”

Such factors have led to solid defense of the markets at a time when the EU and New Zealand are aggressively combing the world for alternatives to China and Russia.

Such factors have led to solid defense of the markets at a time when the EU and New Zealand are aggressively combing the world for alternatives to China and Russia.On a volume basis, according to Global Trade Information Services, U.S. exports of major dairy products to Chile, Colombia and Peru grew a combined 89 percent in the first six months of 2015, and U.S. share of dairy imports jumped significantly in each market.

USDEC is looking to help lift those numbers further by creating the first foreign-language microsite of its customer-focused ThinkUSAdairy.org in Spanish. The site, presently in development, will provide information on U.S. capabilities, U.S. dairy ingredient use, dairy nutrition and U.S. suppliers to encourage greater dairy consumption and strengthen the identification of the United States as a committed, reliable and knowledgeable supplier.

More articles about South America can be found on the U.S. Dairy Exporter Blog:

Subscribe to the U.S. Dairy Exporter Blog

The U.S. Dairy Export Council is primarily supported by Dairy Management Inc. through the dairy farmer checkoff that builds on collaborative industry partnerships with processors, trading companies and others to build global demand for U.S. dairy products.

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (65)

- Africa (5)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (16)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (8)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Geographical Indications (GIs) (10)

- Global Marketing (87)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (247)

- Member Services (17)

- Mexico (40)

- Middle East (10)

- Middle East & North Africa (3)

- Middle East/North Africa (10)

- Milk (3)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (17)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (305)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (25)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- March 2014 (11)

- April 2015 (11)

- December 2015 (11)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- April 2024 (1)

- Mark O'Keefe (183)

- USDEC Staff (139)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Nick Gardner (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

.png)