-

U.S. Dairy's Momentum in China Threatened

By Shawna Morris August 3, 2018- Tweet

Retaliatory tariffs give global competitors hard-to-reverse advantages in the world's largest market.

Editor’s note: This article is based on written comments submitted Wednesday (August 1) to the House Ways and Means Committee’s Subcommittee on Trade on behalf of the U.S. Dairy Export Council and the National Milk Producers Federation.

After suffering three consecutive years of tight margins and a rural economy that never rebounded following the recession, U.S. dairy producers were hopeful that 2018 would bring a dose of much-needed recovery in milk prices.

U.S. dairy exporters were looking forward to continued growth in global sales after the initial months of this year got off to a promising start.

Our industry had made significant investments in recent years to facilitate sales in large foreign markets, and overseas customers were poised to increase purchases as the global economic outlook improved and demand strengthened for high-quality, high-protein U.S. products.

Exports boost national economy

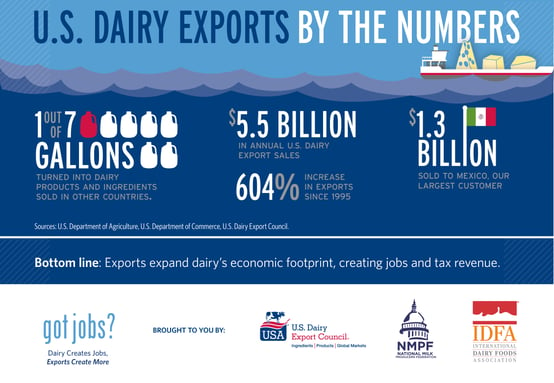

Trade has been increasingly viewed as an indispensable element and overall a bright spot in an otherwise tumultuous time for the dairy industry: U.S. dairy exports grew to $5.5 billion by the end of 2017 and represent nearly 15 percent of domestic production.

Since 2003, dairy exports have added more than $36 billion to the bottom line of producers. Exports support nearly 100,000 jobs and generate another $15 billion in economic input. Exports to Mexico and China, our two most important export markets, fueled much of the overseas success and were up 8 percent and 49 percent, respectively, since 2016.

Hopes for higher prices this year dashed

Our industry was cautiously optimistic at the beginning of the year as market analysts predicted a price uptick in 2018. That is what happened as we began the year. Unfortunately, since then we’ve seen a reversal in the nascent milk price recovery that was forming as mounting barriers to our exports developed.

Prices have continued their downward trajectory, forcing even more farms out of business and applying economic pressure to dairy businesses of all sizes. The ripple effect of this is being felt from coast to coast since dairies operate in all 50 states, providing jobs for nearly 3 million Americans, as the video below shows.

Retaliation by Mexico and China against U.S. imposed Section 232 and Section 301 tariffs, respectively, is a driving factor in the sustained economic pain. Since Mexico’s initial retaliatory tariff announcement on May 31, dairy futures prices sharply declined.

Dairy farmers particularly vulnerable

It is important to note that dairy farmers are particularly vulnerable to such downward price swings because, unlike crop farmers who harvest once a season and can store and market product over time, dairy producers harvest and market their product daily. The price drop resulting from today’s tariffs is hurting dairy today—it is not a projection of what may happen this fall after crops are harvested.

Adding to the angst in the countryside are bleak projections for the future. The U.S. Department of Agriculture recently noted in its July dairy outlook:

"Due to downward price movements in recent weeks, high stock levels, relatively weak growth in domestic use, and expected impacts of new tariffs imposed by China, dairy product prices for the remainder of 2018 are expected to be lower than forecast last month. For 2019, all price forecasts have been lowered except for butter."

Short-term help vs. long-term solution

The U.S. government took an important step in providing assistance on July 24 when it announced a $12 billion tariff-relief package for America’s farmers and ranchers. The details of this package are still being finalized, including how much each sector impacted by retaliatory tariffs will receive to help mitigate the impact of those levies.

That same day, NMPF issued a news release of support for the announcement of this package and noted that it will be important that the dairy industry receive an appropriate share of this aid, including: sufficient direct payments to farmers, investments in export assistance, and effective participation in government purchasing programs.

NMPF has been in contact with USDA officials to pledge help and expertise in designing and administering a system that is reasonable and equitable to dairy farmers. In addition, we have also expressed our appreciation for the Agency’s hard work and our belief that this announcement should be viewed as short-term help instead of a long-term solution.

Trade disputes can cause lasting damage

No amount of assistance can replace the hard-fought markets that are being lost every day that retaliatory tariffs remain in place. Moreover, the longer tariffs persist the more difficult it will be to retain markets as our competitors work to seize the opportunity to expand their market share.

A fair global market, where consumers and producers alike benefit from free-flowing trade is the ultimate objective, and a swift resolution to current trade disputes is essential to meeting that goal.

The current situation unfolding in the Mexican dairy market is a prime example of the lasting damage that trade disputes can do left unchecked. Since ratification of the North American Free Trade Agreement (NAFTA), no country has been as welcoming to U.S. dairy products as Mexico. It is not a coincidence that total U.S. dairy exports have grown more than five-fold since NAFTA’s passage.

Mexico another area of concern

In Mexico, we have worked collaboratively with our industry colleagues to grow dairy demand, build relationships between buyers and suppliers, and improve the infrastructure needed to efficiently move product to market. As a result, U.S. dairy sales there have grown from just $200 million in 2002 to more than $1.3 billion last year. As of last year, U.S. dairy sales accounted for more than three-quarters of Mexican imports.

We are deeply concerned, however about the impact that Mexico’s 20 to 25 percent retaliatory tariffs on U.S. cheeses is having. America, which sold more than $400 million worth of cheese to Mexico, now risks losing sales to it biggest competitors in Europe. Mexico finalized a trade agreement with the European Union in late April that will increase Europe’s market access to Mexico and impose new restrictions on certain common-name cheese products from the United States.

Competitors poised to swoop in

Europe seeks to grab more and more of the Mexican market every day, which is why more than 60 dairy businesses sent the White House a letter on June 26 requesting that the President, “suspend Section 232 steel and aluminum tariffs on Mexican products until the NAFTA renegotiation is completed, particularly in light of Mexico’s willingness to constructively engage with U.S. negotiators.”

We ask for congressional support in accomplishing this important initiative. We similarly ask for assistance in China, where 25 percent tariffs took effect on July 6 against U.S. cheese, milk powder, whey and other common dairy products.

Such tariffs put us at a steep disadvantage to competitors like the EU, Australia and New Zealand that are able to ship products at either the existing Most Favored Nation rate or in the case of the latter two countries under the terms of the FTAs each has with China.

Tariffs threaten to up-end positive momentum

The Chinese dairy market is America’s biggest export destination outside of North America, totaling nearly $600 million in 2017 and showing explosive growth potential. Like Mexico, we’ve invested significantly in China to help facilitate trade. This includes a recent partnership with China’s Jiangnan University to enhance research and education and work with government officials to streamline registration approvals.

Learn more about USDEC's Innovation Partnership with Jiangnan University

U.S. dairy producers and businesses have worked hard to make advancements in China; we believe increased sales throughout Asia are key to our future success, and we are deeply worried that the current trade situation threatens to up-end the positive momentum not just this year but also in the years to come.

Shawna Morris is vice president of trade policy at the U.S. Dairy Export Council.

Learn more:

- Dairy Farmers Face Uncertain Future With New Tariffs (podcast + video)

- American Farmers and Cheese Makers Ask President Trump to Suspend Tariffs on Mexican Products as NAFTA Talks Continue

Subscribe to the U.S. Dairy Exporter Blog

The U.S. Dairy Export Council fosters collaborative industry partnerships with processors, trading companies and others to enhance global demand for U.S. dairy products and ingredients. USDEC is primarily supported by Dairy Management Inc. through the dairy farmer checkoff. How to republish this post.

10 Most Recent Posts

Most Popular Posts in Past Year

Index of Posts by Topic

- #GotDairyJobs (4)

- About USDEC (65)

- Africa (5)

- Australia (4)

- Blog (8)

- Brazil (4)

- Canada (20)

- Central America (1)

- Cheese (58)

- Chile (1)

- China (54)

- Common food names (7)

- Company News (16)

- Consistent Supply (1)

- Crisis Management (3)

- Cuba (2)

- Dairy (6)

- Dairy checkoff (8)

- Dairy Ingredients (5)

- Dairy Management Inc. (2)

- Dairy Resources (1)

- Dairy Supply Chain (1)

- Dairy Trends (5)

- Documentation (3)

- EU (24)

- Experts on Dairy Exports (4)

- Exporter of the Year (2)

- Exports (24)

- Farming (38)

- Food Aid (8)

- Food Safety (8)

- Foodservice (3)

- Free trade agreements (34)

- Geographical Indications (GIs) (10)

- Global Marketing (87)

- Global Shipping Crisis (1)

- Got Jobs? (9)

- Indonesia (1)

- Innovation (17)

- Japan (17)

- Krysta Harden (1)

- Market Access (25)

- Market Conditions (247)

- Member Services (17)

- Mexico (40)

- Middle East (10)

- Middle East & North Africa (3)

- Middle East/North Africa (10)

- Milk (3)

- Milk Protein Concentrate (MPC) (2)

- New Zealand (11)

- Next5% (20)

- Nonfat Dry Milk/Skim Milk Powder (8)

- Nutrition (17)

- Product Innovation (6)

- Protein (4)

- Regulations (5)

- Research & Data (305)

- Russia (3)

- Singapore (10)

- South America (8)

- South Korea (10)

- Southeast Asia (25)

- Strategic Insights (1)

- Supply (1)

- Sustainability (25)

- Technology (2)

- ThinkUSADairy (5)

- TPM23 (1)

- TPP (13)

- Traceability (8)

- Trade Barriers (5)

- Trade Data (7)

- Trade Policy (72)

- TTIP (5)

- UHT Milk (7)

- USMCA (2)

- Vietnam (4)

- Whey (6)

- Whey Ingredients (2)

- Whey products (10)

- Whole Milk Powder (WMP) (3)

- World Dairy Expo (1)

- World Milk Day (1)

- Yogurt (1)

Index of Posts by Date, Author

- June 2021 (13)

- March 2015 (12)

- September 2015 (12)

- March 2014 (11)

- April 2015 (11)

- December 2015 (11)

- February 2015 (10)

- October 2015 (10)

- October 2014 (9)

- June 2015 (9)

- July 2015 (9)

- November 2015 (9)

- March 2016 (9)

- October 2019 (9)

- September 2013 (8)

- May 2015 (8)

- August 2015 (8)

- January 2016 (8)

- February 2016 (8)

- March 2017 (8)

- December 2018 (8)

- May 2019 (8)

- December 2019 (8)

- June 2014 (7)

- November 2016 (7)

- May 2017 (7)

- May 2018 (7)

- July 2020 (7)

- June 2023 (7)

- July 2016 (6)

- August 2018 (6)

- October 2018 (6)

- November 2018 (6)

- February 2019 (6)

- June 2019 (6)

- August 2019 (6)

- March 2020 (6)

- April 2020 (6)

- June 2020 (6)

- June 2022 (6)

- February 2014 (5)

- June 2016 (5)

- August 2016 (5)

- September 2016 (5)

- December 2016 (5)

- February 2017 (5)

- July 2017 (5)

- October 2017 (5)

- January 2018 (5)

- April 2018 (5)

- June 2018 (5)

- July 2018 (5)

- September 2018 (5)

- January 2019 (5)

- March 2019 (5)

- April 2019 (5)

- July 2019 (5)

- September 2019 (5)

- November 2019 (5)

- January 2020 (5)

- August 2020 (5)

- October 2020 (5)

- April 2021 (5)

- January 2022 (5)

- May 2013 (4)

- September 2014 (4)

- April 2016 (4)

- May 2016 (4)

- October 2016 (4)

- January 2017 (4)

- April 2017 (4)

- June 2017 (4)

- August 2017 (4)

- September 2017 (4)

- December 2017 (4)

- February 2018 (4)

- February 2020 (4)

- May 2020 (4)

- February 2022 (4)

- September 2022 (4)

- April 2023 (4)

- December 2023 (4)

- November 2017 (3)

- March 2018 (3)

- September 2020 (3)

- December 2020 (3)

- February 2021 (3)

- May 2021 (3)

- August 2021 (3)

- December 2021 (3)

- March 2022 (3)

- April 2022 (3)

- May 2022 (3)

- October 2022 (3)

- December 2022 (3)

- May 2023 (3)

- July 2023 (3)

- November 2023 (3)

- March 2011 (2)

- June 2011 (2)

- September 2011 (2)

- March 2012 (2)

- June 2012 (2)

- July 2012 (2)

- March 2013 (2)

- July 2013 (2)

- November 2020 (2)

- January 2021 (2)

- March 2021 (2)

- July 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- July 2022 (2)

- August 2022 (2)

- January 2023 (2)

- March 2023 (2)

- October 2023 (2)

- January 2024 (2)

- February 2024 (2)

- January 2010 (1)

- February 2010 (1)

- March 2010 (1)

- April 2010 (1)

- May 2010 (1)

- June 2010 (1)

- July 2010 (1)

- August 2010 (1)

- September 2010 (1)

- October 2010 (1)

- November 2010 (1)

- December 2010 (1)

- January 2011 (1)

- February 2011 (1)

- April 2011 (1)

- May 2011 (1)

- July 2011 (1)

- August 2011 (1)

- October 2011 (1)

- November 2011 (1)

- December 2011 (1)

- January 2012 (1)

- February 2012 (1)

- April 2012 (1)

- August 2012 (1)

- September 2012 (1)

- October 2012 (1)

- November 2012 (1)

- December 2012 (1)

- January 2013 (1)

- February 2013 (1)

- April 2013 (1)

- June 2013 (1)

- August 2013 (1)

- October 2013 (1)

- November 2013 (1)

- December 2013 (1)

- January 2014 (1)

- April 2014 (1)

- May 2014 (1)

- November 2022 (1)

- February 2023 (1)

- August 2023 (1)

- September 2023 (1)

- March 2024 (1)

- April 2024 (1)

- Mark O'Keefe (183)

- USDEC Staff (139)

- Alan Levitt (119)

- Tom Suber (41)

- Margaret Speich (22)

- Marc A.H. Beck (15)

- Vikki Nicholson-West (11)

- Angélique Hollister (11)

- Tom Vilsack (8)

- Jaime Castaneda (7)

- Matt McKnight (7)

- Véronique Lagrange (7)

- Margaret Speich and Mark O'Keefe (7)

- Ross Christieson (7)

- Paul Rogers (6)

- Shawna Morris (5)

- William Loux (5)

- Alan Levitt and Marc Beck (5)

- Krysta Harden (4)

- USDEC Communications (3)

- Kristi Saitama (3)

- Marilyn Hershey (3)

- Brad Gehrke (3)

- Tom Quaife (2)

- Jim Mulhern (2)

- Alan Levitt and William Loux (2)

- Kara McDonald (2)

- Luke Waring (2)

- Merle McNeil (2)

- Andrei Mikhalevsky (1)

- Rodrigo Fernandez (1)

- Nick Gardner (1)

- Dermot Carey (1)

- Jeremy Travis (1)

- Annie Bienvenue (1)

- Ross Christieson and Shawna Morris (1)

- Paul Rogers and Tom Quaife (1)

- Rick Ortman (1)

- Tony Rice (1)

- Barbara O’Brien (1)

- Paul Rogers and Mark O'Keefe (1)

- Dalilah Ghazalay (1)

- Amy Wagner (1)

- Mitchell Bowling (1)

- Brad Scott (1)

- Amy Foor (1)

- Scott Lantz (1)

- Sandra Benson (1)

- Errico Auricchio (1)

- Jaclyn Krymowski (1)

.png)